Vladimirs_Gorelovs

Yesterday, Danone (OTCQX:DANOY) reported its second-quarter results that beat analysts’ expectations on top-line sales, volume/mix and operating profit margin. Here at Mare Evidence Lab, it is not the first time that we looked at the French company and after the Q1 sales data analysis, we decided to move our rating from buy to neutral. Our downgrade was based on the following key takeaways i) a clientele more careful on price points rather than brand name, ii) supply chain constraints with higher cost in logistics, iii) elasticities/volumes trade-off and iv) ongoing raw material inflationary pressure.

Following our neutral rating, Danone’s stock price barely moved and we are confident that the company has reached a status quo at around this price level.

Danone stock price 6m evolution

Q2 Results

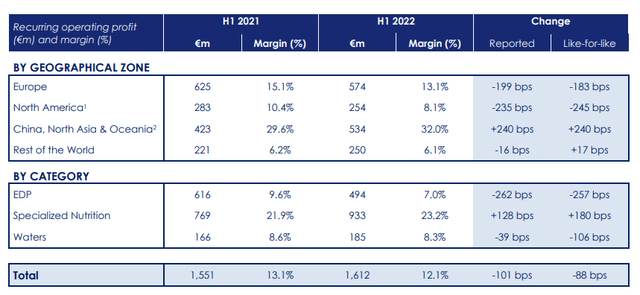

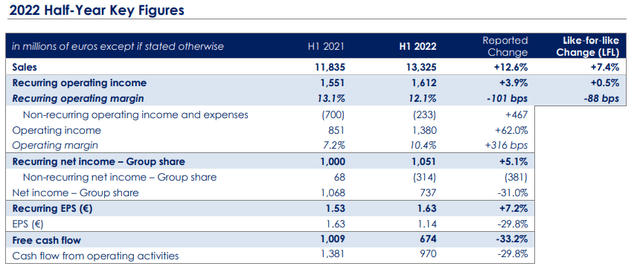

The group’s sales rose 7.4% like-for-like in Q2, against an average growth of 5.5% expected by Wall Street consensus expectations. While the rise in prices boosted its turnover, it also weighed on costs and the current operating margin fell to 12.1% in the first half compared to the 13.1% achieved in the first semester of 2021. The lower marginality was due to cost inflation pressure and was partially mitigated by volume/price/mix. In addition to the raw material price increase, the performance was impacted by the currency effect.

At the geographical level, like-for-like growth was more pronounced in North America and Europe. At the category level, the specialized nutrition division delivered a solid performance – this was supported by the infant formula shortage in the US and Canada. In our initiation of coverage, special nutrition sum-of-parts valuation coupled with activist’s involvement was the reason behind our outperforming rate.

Operating profit margin at GEO/category level

Conclusion and Valuation

The Danone group has announced that it is revising its annual sales forecast upwards after sales exceeded expectations in the Q2 performance. The agri-food group now expects like-for-like revenue growth between 5% and 6% in 2022 compared to a previous range of 3% to 5%. And also it is maintaining its objective of a current operating margin above 12%.

Thanks to the pass-through initiative, the company was able to mitigate COGS pressure. Danone should raise the bar and step up from the “Local First” strategy. Here at the Lab, we are still worried about the four points in the first paragraph and we reiterate our valuation at €56 per share based on a 16x P/E on the 2023 forecast number. We know that this valuation represents a 10% discount from the historical valuation, however, this reflects the current uncertainty in macroeconomics, negative consumer sentiment and a higher input cost environment.

Be the first to comment