Luke Chan

Summary

I recommend a BUY rating on First Watch (NASDAQ:FWRG). It has a brand that is well loved by its customer base and rides on the trend of increasing demand for daypart meals. Management has committed to continue growing with more than 2 thousand locations identified. The current valuation is cheap, in my opinion, which could generate a long-term 17% IRR for investors.

Company overview

FWRG has brought excellent and freshly made food to the tables of various people living in the United States since 1983. Putting “You First”, the whole idea is to present to you a fresh, innovative, and high-quality menu. Years of excellence and the evidence of good and freshly made food have made FWRG the fastest and largest growing concept in daytime dining. As of 2FQ22, FWRG only focuses on the US market.

Increased Trend of Daypart Meals

More people are moving from the hustle and bustle of urban areas to the peace and quiet that suburban areas have to offer. This is good for FWRG as most of their restaurants are located in suburban areas. This new trend, I must say, should lead to increased brand awareness. A study conducted by Technomic projects a 7.3% CAGR from 2021 all the way to 2024 (according to FWRG S-1). This clearly shows the consistent growth that has occurred over the last several years. Research has shown that about 78% of breakfast is still prepared at home (according to FWRG S-1). With these numbers, you can tell that the brand should continue to thrive as the years pass.

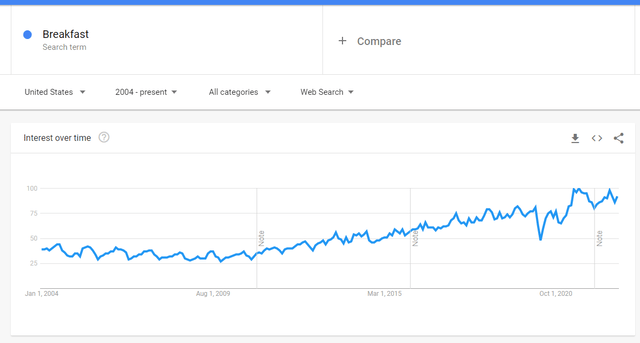

Furthermore, COVID-19 has increased the number of people working from home. One of the things these people are looking for is the ability to order food without leaving the comfort of their homes. A quick Google search trend index for breakfast reveals a significant increase in searches over the years. Traditional rigid breakfast and lunch do not offer an all-day menu that is convenient, fast, flexible, and reliable. By contrast, FWRG offers this and more.

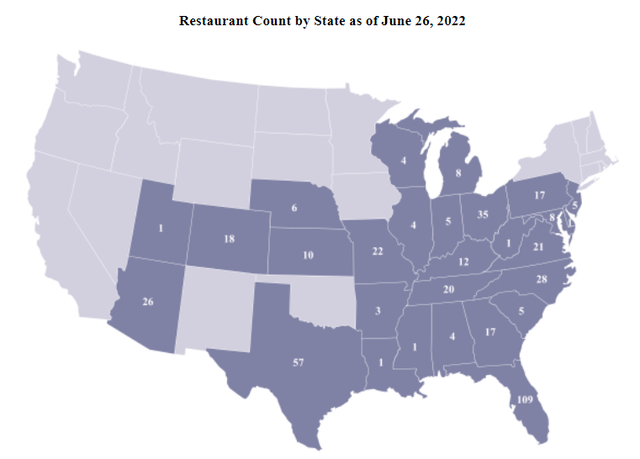

Tons Of Room Available To Grow In The US

A highly experienced restaurant development team and a third-party real estate analytics company carried out a detailed study that concluded that FWRG has the potential to expand to more than 2,200 locations in the United States (according to FWRG S-1). FWRG has remained committed to opening new restaurants. Its new restaurants have a flexible box size of approximately 3,000-6,600 square feet, which allows it to grow its footprint in several different locations. All of these have clearly shown us that they have a high potential to expand their presence within the states that they currently operate in as well as the new ones.

A comprehensive and data-driven real estate approach is employed to pick out new sites and also see to their development. New locations are selected through rigorous data on specific market characteristics, demographics, and growth. Their aim is to drive brand awareness through every new restaurant that is opened. The best part is that they intend to open 130 restaurants from 2022 to 2024. However, this does not mean that the current restaurants will be neglected because of the creation of new ones.

In-Store Operations Increase Employee Retention Rate

“One Shift, One Menu, One Focus” is what FWRG’s business model is built around. This model ensures that there are “No Night Shifts Ever.” This model ensures that FWRG is able to hire the best and most creative minds to work for them, retain workers for a longer period of time, and create a unifying organizational culture because they are an employer of choice. Their single menu throughout the day across all of their restaurants gives them the clarity of purpose to always satisfy their customers.

Early Investment In Data Collection Technology Yields Long-Term Positive Benefits

As we all expect, customer satisfaction should be at the top of the list of every business. FWRG is no different. Because of the large increase in remote digital orders, they have incorporated remote waitlist, remote orders, tokenized credit card transactions, and WiFi into a single system so as to enable them to understand trial, frequency, and customer lifetime value. Millions of pieces of customer information have been gathered since the establishment of these systems. Their aim is to make sure that the advancement of these systems will increase customer frequency.

Strong Execution History

One thing that anyone would look at when looking to invest in a company is how productive the company has been over the years. A whole lot of things point to the fact that FWRG has been breaking ground. To start with, they have nearly four decades of sales and unit growth. This is because their brand has a broad brand appeal, a strong economic proposition, and a hard to copy business model. Their growth has spanned from having over 277 restaurants as of 2015 to having 449 restaurants in 2022. Even FSR Magazine identified FWRG as the fastest-growing full-service restaurant chain based on unit growth. Even COVID-19 could not stop the rate at which the company was growing.

Alcohol Might Be A New Market Opportunity

Not only does FWRG offer foods made with fresh ingredients, but they also invent their own unique drinks by combining fresh juices and ingredients with a variety of liquors. The fiscal 2019 shows that these drinks contributed highly to the increment of sales. The alcohol menu is offered in 341 system-wide restaurants as of June 26, 2022. They are looking to increase customer awareness and excitement through their new items that are centered around alcohol to further increase sales.

Valuation

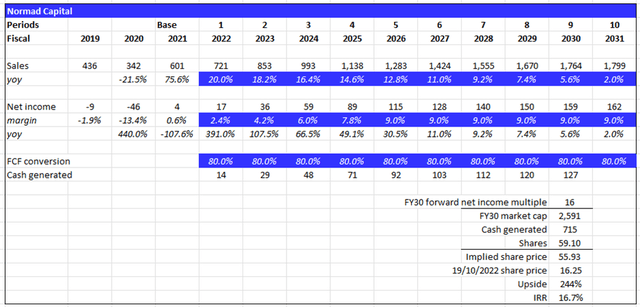

At the current stock price of $14.97 and 59.1 million shares, the market cap is ~$884 million. I believe the current market price presents a decent entry point for investors to decent 18% IRR. I believe FWRG will make $1.8 billion in sales and $162 million in net income in FY31. This will be driven by declining sales growth from 20% in FY22 to long-term inflationary rate of 2% in FY31. Net margin should expand also to industry level, giving it a market cap of $3.2 billion inclusive cash generated and a stock price of $55.93 in FY30 assuming it trades at 16x in FY30.

Assumptions:

- Sales: to follow management’s guidance in FY22 and start a gradual decline over a 10-year period as growth slows down from market saturation.

- Net income: to expand to industry level of 9% over a 5-year period, and remains flat from the fifth to tenth year. The reason for gradual improve in the first 5 years is because it takes time to new stores to reach mature unit economics.

- Valuation: to be valued using earnings multiple of 16x in FY30. Unlike fast growing franchise F&B business like McDonald’s (MCD) or Starbucks (SBUX), FWRG unit economics are not as good, hence I do not expect it to trade at similar levels. Instead, I expect FWRG to trade at a slight discount to the S&P500 average multiple.

Risk

F&B Is A Very Competitive Industry With Little Barriers To Entry

Although FWRG is constantly trying to be a better brand as the days pass, it is nevertheless saddening that it does not take some competitors a huge effort to replicate their menu. Worst still, there is little to nothing that can be done because the company is unlikely to receive patent protection.

Food Trend Is Hard To Predict

As time passes, it is often hard to predict the future of food trends. Although the day-part meal trend is still in vogue presently, it is hard to tell whether or not the coming generations will subscribe to the trend. In the case where they do not, FWRG could face some issues unless it is willing to shift ground.

FWRG’s Food Offerings Might Not Suit The Taste Of New Markets

Different people from different places might have tastes and preferences that differ. This might pose as a threat to the expansion that I suggested earlier, because the locals might not welcome the type of food FWRG is offering.

Recession

The macroeconomy has a direct impact on FWRG, as consumers are likely to spend less on dining out. Because of the high fixed costs of this business, the decremental margin is high, causing profit margins to fall as revenue declines. This risk is heightened by FWRG’s high debt level on its balance sheet.

Conclusion

FWRG is a fast-growing beloved brand that should continue to grow as the trend for daypart meals continues to grow. Investors can gain comfort that there is remaining room to grow as FWRG’s store count is still small, and they have already identified more than 2 thousand potential locations. The current valuation is a decent entry point that should yield investors a long-term IRR of ~17%.

Be the first to comment