Eric Broder Van Dyke

Earnings of First Hawaiian, Inc. (NASDAQ:FHB) will likely dip this year mostly because of provisioning normalization in the latter part of 2022. On the other hand, the margin will likely significantly expand this year thanks to the moderately-high sensitivity of net interest income to interest rate hikes. Further, strength in the Hawaiian economy will drive loan growth, which will, in turn, support the bottom line. Overall, I’m expecting First Hawaiian to report earnings of $1.85 per share for 2022, down 10% year-over-year. Compared to my last report on the company, I’ve tweaked upwards my earnings estimate mostly because of an upward revision in my margin estimate. The year-end target price suggests a small upside from the current market price. Therefore, I’m maintaining a hold rating on First Hawaiian, Inc.

Tourism Industry Recovery Bodes Well for Loan Growth

First Hawaiian disappointed me by reporting a decline of 0.5% in its loan balance for the first quarter of 2022. The loan trend will likely reverse in the year ahead partly because the loan pipeline was quite strong at the end of March 2022, as mentioned in the conference call.

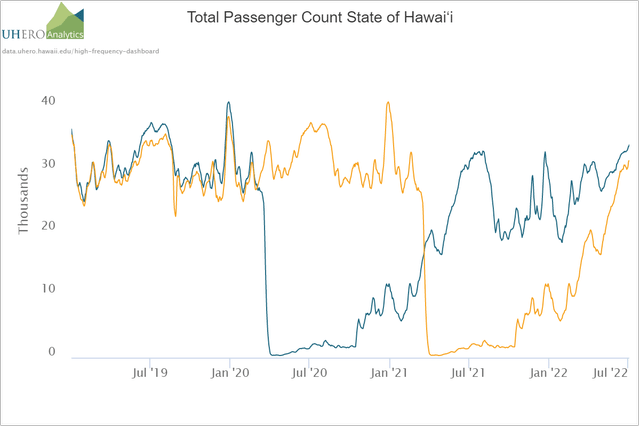

Further, the outlook for Hawaii’s economy is rosy, which bodes well for loan growth. As all Covid-related requirements for international and domestic travel ended by June 12, 2022, the outlook on tourism is quite robust. The total passenger count is back to the pre-pandemic level, according to official sources (see blue line in the chart below). In my opinion, the number of visitors to Hawaii should cross the historical norm soon because of the pent-up demand for travel.

University of Hawaii (UHERO)

However, high interest rates are likely to act as the biggest headwind to loan growth. The Federal Reserve projects the target Fed Funds rate to almost double from the current level to around 3.5% later this year. High rates will naturally dampen the demand for mortgage loans.

The management mentioned in the conference call that it expects loan growth to be in the mid-to-high single-digit range, which I believe is too optimistic given the headwinds. Overall, I’m expecting the loan balance to increase by 3.3% by the end of 2022 from the end of 2021. In my last report on First Hawaiian, I estimated loan growth of 5.1% for this year. I’ve revised downwards my loan growth estimate due to the first quarter’s performance as well as the emerging headwinds.

Meanwhile, deposits will likely grow mostly in line with loans for the last three quarters of 2022. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Financial Position | |||||||||

| Net Loans | 12,140 | 12,934 | 13,081 | 13,071 | 12,805 | 13,225 | |||

| Growth of Net Loans | 6.6% | 6.5% | 1.1% | (0.1)% | (2.0)% | 3.3% | |||

| Other Earning Assets | 5,903 | 5,106 | 4,410 | 6,821 | 9,440 | 9,772 | |||

| Deposits | 17,612 | 17,150 | 16,445 | 19,228 | 21,816 | 23,116 | |||

| Borrowings and Sub-Debt | 0 | 600 | 600 | 200 | – | – | |||

| Common equity | 2,533 | 2,525 | 2,640 | 2,744 | 2,657 | 2,365 | |||

| Book Value Per Share ($) | 18.1 | 18.4 | 19.8 | 21.1 | 20.7 | 18.5 | |||

| Tangible BVPS ($) | 11.0 | 11.2 | 12.3 | 13.4 | 12.9 | 10.7 | |||

| Source: SEC Filings, Author’s Estimates | |||||||||

| (In USD million unless otherwise specified) | |||||||||

Loan and Deposit Mixes are Well-positioned for Rate Hikes

Floating rate loans totaled $5 billion at the end of March 2022, representing 39% of the total loan portfolio, according to details given in the conference call. These loans will enable the average earning-asset yield to quickly respond to interest rate hikes. Further, a sizable 44% of total deposits were non-interest bearing at the end of March 2022. Therefore, the average deposit cost will be largely upward sticky amid a rising interest-rate environment. Due to the combination of the loan and deposit mixes, the net interest margin is quite sensitive to interest rate hikes.

The management’s interest-rate sensitivity analysis given in the 10-Q filing shows that a 100-basis points increase in interest rates can boost the net interest income by 5.0% over twelve months. The Federal Reserve projects the Fed Funds rate to increase by 325 basis points this year to around 3.5%. Considering the factors given above and the interest rate outlook, I’m expecting the net interest margin to increase by 25 basis points in the last three quarters of 2022 from 2.42% in the first quarter of the year. In my last report on First Hawaiian, I was expecting a much lower margin expansion of around 12 basis points. I have revised upwards my margin estimate because my outlook on interest rates is more hawkish now.

Provision Normalization Likely Amid Heightened Interest Rates

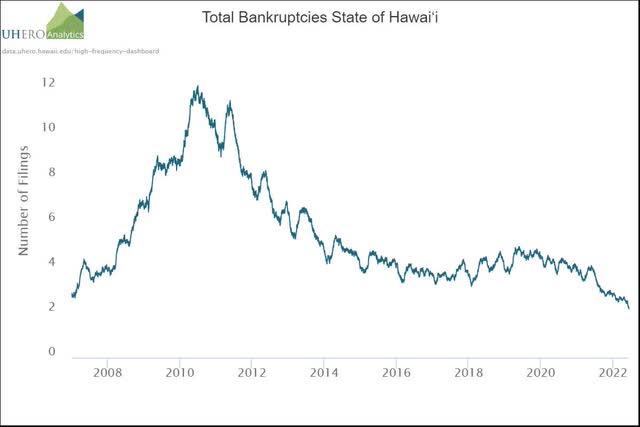

First Hawaiian surprised me by reporting a large net provision reversal for the first quarter of 2022. The portfolio’s better credit quality allowed this provision reversal. The company’s asset quality has steadily improved over the last year thanks to the overall macroeconomic improvement. Bankruptcies in Hawaii are at multiyear lows, as shown below.

University of Hawaii (UHERO)

Although the assets are performing well currently, the outlook on the continued future performance is not too bright. The biggest headwind is the higher interest-rate environment, which can push some already-stretched borrowers into default.

Overall, I’m expecting provisioning to return to a normal level for the last three quarters of 2022. However, due to the first quarter’s performance, the full year’s provisioning will be below normal. I’m expecting the net provision expense to make up 0.07% of total loans in 2022. In comparison, the net provision expense averaged 0.14% of total loans from 2017 to 2019.

In my last report on First Hawaiian, I estimated a net provision expense of $16 million for 2022. I’ve now slashed my provision expense estimate to $9 million because of the first quarter’s surprisingly good performance.

Expecting Earnings to Dip by 10%

Provision normalization for the last three quarters of 2022 will likely be the chief contributor to an earnings decline this year. On the other hand, mid-single-digit loan growth and significant margin expansion will likely support the bottom line. Overall, I’m expecting First Hawaiian to report earnings of $1.85 per share for 2022, down 10% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Income Statement | |||||||||

| Net interest income | 529 | 566 | 573 | 536 | 531 | 576 | |||

| Provision for loan losses | 19 | 22 | 14 | 122 | (39) | 9 | |||

| Non-interest income | 206 | 179 | 193 | 197 | 185 | 172 | |||

| Non-interest expense | 348 | 365 | 370 | 368 | 405 | 422 | |||

| Net income – Common Sh. | 184 | 264 | 284 | 186 | 266 | 238 | |||

| EPS – Diluted ($) | 1.32 | 1.93 | 2.13 | 1.43 | 2.05 | 1.85 | |||

| Source: SEC Filings, Author’s Estimates | |||||||||

| (In USD million unless otherwise specified) | |||||||||

In my last report on First Hawaiian, I estimated earnings of $1.73 per share for 2022. I have revised upwards my earnings estimate mostly because of the upward revision in my net interest margin estimate and slashing of the provision expense estimate.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation.

Target Price is Quite Close to the Current Market Price

First Hawaiian is offering a dividend yield of 4.5% at the current quarterly dividend rate of $0.26 per share. The earnings and dividend estimates suggest a payout ratio of 56% for 2022, which is in line with the five-year average of 58%. Therefore, I don’t believe there is any threat to the level of dividend payout.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value First Hawaiian. The stock has traded at an average P/TB ratio of 2.06 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 11.2 | 12.3 | 13.4 | 12.9 | ||

| Average Market Price ($) | 27.8 | 26.6 | 19.6 | 27.7 | ||

| Historical P/TB | 2.50x | 2.16x | 1.46x | 2.14x | 2.06x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $10.7 gives a target price of $22.1 for the end of 2022. This price target implies a 3.5% downside from the July 6 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.86x | 1.96x | 2.06x | 2.16x | 2.26x |

| TBVPS – Dec 2022 ($) | 10.7 | 10.7 | 10.7 | 10.7 | 10.7 |

| Target Price ($) | 19.9 | 21.0 | 22.1 | 23.1 | 24.2 |

| Market Price ($) | 22.9 | 22.9 | 22.9 | 22.9 | 22.9 |

| Upside/(Downside) | (12.9)% | (8.2)% | (3.5)% | 1.1% | 5.8% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 13.5x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 1.93 | 2.13 | 1.43 | 2.05 | ||

| Average Market Price ($) | 27.8 | 26.6 | 19.6 | 27.7 | ||

| Historical P/E | 14.4x | 12.5x | 13.7x | 13.5x | 13.5x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $1.85 gives a target price of $25.1 for the end of 2022. This price target implies a 9.7% upside from the July 6 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 11.5x | 12.5x | 13.5x | 14.5x | 15.5x |

| EPS 2022 ($) | 1.85 | 1.85 | 1.85 | 1.85 | 1.85 |

| Target Price ($) | 21.4 | 23.2 | 25.1 | 26.9 | 28.8 |

| Market Price ($) | 22.9 | 22.9 | 22.9 | 22.9 | 22.9 |

| Upside/(Downside) | (6.6)% | 1.6% | 9.7% | 17.8% | 25.9% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $23.6, which implies a 3.1% upside from the current market price. Adding the forward dividend yield gives a total expected return of 7.6%. Hence, I’m maintaining a hold rating on First Hawaiian, Inc.

Be the first to comment