RichVintage

With Calumet Specialty Products (NASDAQ:CLMT) just a few short weeks from its major shutdown and conversion at Great Falls, the landscape has changed prompting a MISSION update. In our view, it all remains positive, so let’s go watch the launch and listen.

A Preliminary Quarterly Update

In June, Calumet offered investors a rare quarterly update. The EBITDA forecast shown in the next slide is a significant improvement over the past few quarters.

Management noted that EBITDA is approaching $100 million-plus with all the businesses beginning to fire on all cylinders. Shreveport volumes, quarter-over-quarter are reported as being similar despite an April turnaround. Asphalt margins improved quarter over quarter and the WCS spread widened.

How realistic is the $100 million + forecasted EBITDA for the second quarter? Are the expectations going forward reasonable and achievable? These are two very important investor questions.

In looking to validate management’s forecasted EBITDA, we need to review the important leverage points of the business, namely crack spreads, movements in crude pricing, past performance and seasonality. We begin with a table below containing month and quarter averaged crack spreads. The spreads were self generated.

| Monthly Spreads | April | May | June | Ave | Prior Quarter |

| GC 2-1-1 | $38 | $52 | $59 | $50 | <$27 |

| WTI/WCS | $15 | $16 | $14 | $15 | $14 |

In our previous article, It’s the Final Countdown for Calumet Specialty Products, we noted that every $10 increase in GC 2-1-1 spreads adds approximately $30 million of EBITDA per quarter. Also, changes in crack spreads exclude the seasonal markets for asphalt, and the referenced 1st quarter contained little positive effects from the asphalt business. Finally, the company also noted that it had hedged 20% of its Shreveport production at $27 during March.

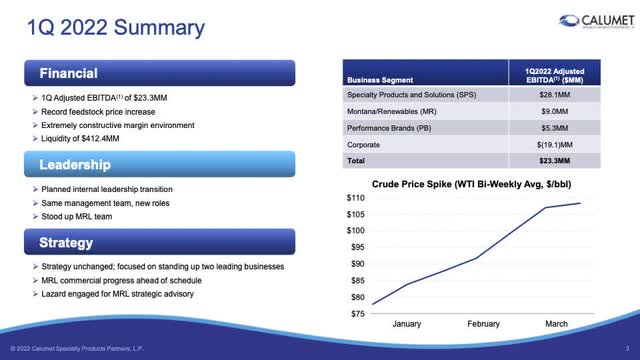

The next slide summarizes the last quarter result.

Calumet Results

The net EBITDA in the 1st quarter equaled $25 million.

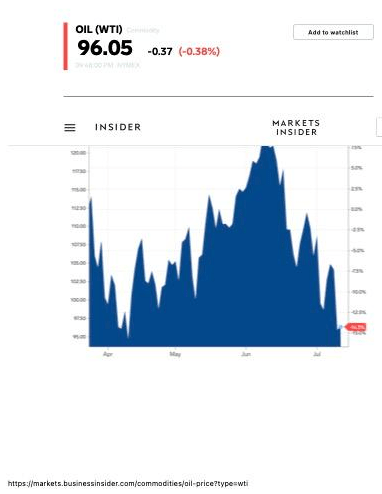

A slide including price changes in crude during the quarter follows.

Investing

Crude peaked in early June and then fell off 20% plus into July.

Next is a bullet list of the pros and cons affecting the 2nd quarter and in some cases spilling into the 3rd. Bullets summarizing change quarter over quarter follow:

- GC 2-1-1 spreads increases of $20 add up to $60 million maximum.

- With June being the highest, most of the significant June increase is likely delayed until the September quarter.

- Asphalt margins returned adding millions especially from Great Falls.

- 1st Quarter EBITDA equaled $25 million.

- The retreating crude oil pricing removes the steep cost penalty for the balance of Specialty business.

- The steep change in crude effectively hid Specialty’s performance.

- During June quarter 2019, Specialty produced almost $50 million in EBITDA.

Summing these general indications from the bullets, we start with $25 million from Q1 and add $60 million for changes in crack spreads. When you add an estimated 10 million for asphalt and recognizing that Specialty EBITDA has done 50 million in the past, it is clear that Calumet likely generated at or slightly above that $100 million. Our view estimates the EBITDA in the $100-$115 range.

3rd Quarter Possibilities

With management already updating a preliminary number for June, it seems most beneficial to review and estimate the 3rd quarter. Again, we created a bullet list of possible effects, pros and cons:

- In July, the GC 2-1-1 spread is trending downward thus far in the middle $45’s or adding in $50 million when comparing 3rd quarter over 1st quarter.

- It is important to note that delayed timing from July into August likely puts most of the effect into the 3rd quarter.

- During September quarter 2019, Specialty produced $50 million in EBITDA.

- Great Falls is being shut down for a month in August for the MRL conversion.

- Stored asphalt sales continue through the quarter.

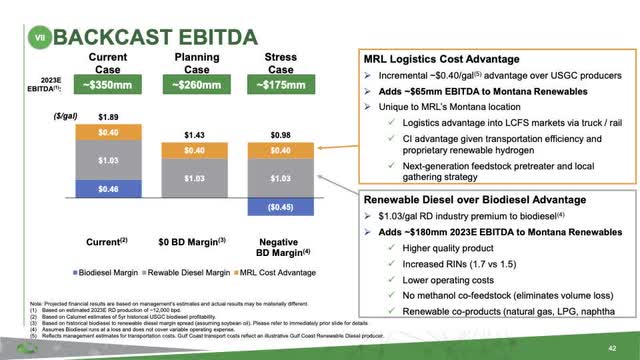

- Greats Fall will operate for two months at 5000 barrels per day of waste feeds for its renewable diesel business. At $1.75 per gallon margin, the EBITDA could be $20 million (Numbers from the June 17th Cowen slides).

Although, we aren’t sure how the final accounting will be done, it is clear that on the whole, a 3rd quarter might range in the $120-$150 EBITDA range ($20 million for MRL, plus $25 million based on Q1, plus $50 million for crack spreads, and $50 million historically earned in Q3). We have yet to truly understand the full impact of the Specialty business with it having been hidden for so long from nature and market events. But, Calumet at least for the next few quarters, appears on fire.

Long-Term Direction (Does It Matter?)

After the 3rd quarter, MRL at Great Falls will startup the digester unit giving operation the ability to cost effectively ramp in economical feeds. At that point, the following slide summarizes the early capabilities of MRL.

At $300 million yearly EBITDA from this business, Calumet might in total generate $500-$700 million a year. Back in 2019, management offered investors a view of both the fuels and specialty business claiming EBITDA of $250 million and $50 million respectively was possible.

We see two investment thesis now that MRL is set to launch and contribute meaningful EBITDA. The first view would be to monetize MRL in the short term and use funds from a transaction to reduce debt. We prefer the second view, which is to run both businesses and use the higher EBITDA to reduce debt organically and invest in the businesses. With the kind of growth possible within each, we view owning both for their lucrative growth. We fully respect those ascribing to the other.

With interest rates on the rise, an economy heading south, it may behoove management to delay in some fashion the sale of MRL. But again in our view, we can’t argue against more optimal conditions.

Risks & Investment

Risks exist from the volatile crude oil pricing and crack spreads. The stock price has been as high as $17 having recently fallen into the high $9s. In our view, a $9 price represents a buying opportunity gift. And while another world economic episode would damage Calumet’s businesses , particularly in its specialty business, we see this investment as a gift at its current price. Let the countdown continue. The final destination of the mission is in our view, immaterial.

Be the first to comment