RiverNorthPhotography

Fifth Third Bancorp (NASDAQ:FITB) missed analysts’ expectations for its third quarter earnings as the worsening economic outlook dragged on private equity income and commercial banking revenues. Additionally, the slowing housing market dragged on mortgage origination fees, which fell by 20% from a year ago.

Q3 2022 Results

The third quarter has been a mixed bag for other regional banks, as although the likes of Citizens Financial (CFG) and Huntington Bancshares (HBAN) managed to beat their consensus forecasts, regional peers such as KeyCorp (KEY) and Regions Financial (RF) delivered earnings misses too.

There were a number of common themes for most banks, however, including most significantly, the positive impact to net interest income as a result of the Federal Reserve’s rate-hiking campaign. Against this tailwind, the earnings lift was partially offset by fee revenue headwinds and rising loan loss provisions, which reflected the deterioration in the macroeconomic environment.

Fifth Third, with its greater exposure to corporate bond, M&A, syndication and private equity markets, was particularly hard hit as higher interest rates curbed activity in those areas. Adjusted non-interest income was 1% lower from Q2 2022, and down 8% on the prior year quarter. Overall, FITB reported Q3 adjusted EPS of $0.93, which was 5 cents lower than the consensus forecast of $0.98 per share.

Sluggish loan growth is another area of concern. Total loans were just 2% higher on the prior quarter – a slower pace of growth compared to the competition. With the rising rate environment, loan demand is set to slow further in the fourth quarter, with management expecting “average total loan balances to be stable to up 1% sequentially.” Yet, some of this slowdown will also be because of a conscious decision by the bank to prioritize asset quality and returns over volumes, as FITB scales back auto lending.

On credit quality, there was a positive surprise from this quarter’s results. Against the rising trend of loan loss provisions, FITB’s net provision for Q3 2022 was $158 million – 12% lower than the provision booked for its second quarter. This reflected continued resilience in its credit performance, with the non-performing loan ratio down by 1 basis point on a sequential quarterly basis, to 0.44%, and its conservative approach to provisioning.

Net charge offs were flat against the prior quarter, at 0.21%, while the allowance for credit losses covered 440% of non-performing loans.

Rising Net Interest Income

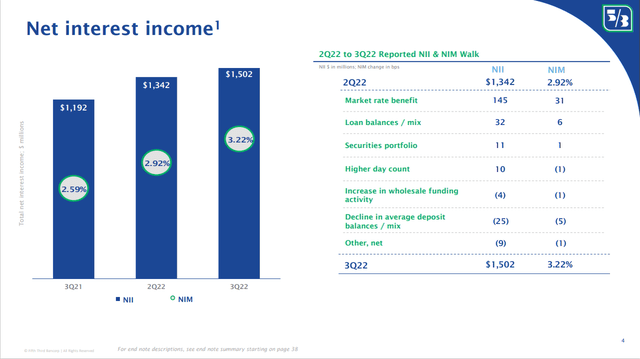

In spite of the headwinds, the regional bank achieved record adjusted revenue in Q3 2022 as rising net interest margins helped to drive a 24% increase in pre-provision net revenue from Q3 2021. Net interest income increased by 12% on the previous quarter, following a 30 basis points improvement in net interest margins.

Fifth Third Bancorp Q3 Earnings Presentation

Its low loans-to-deposits ratio – now at 75% – has meant that the bank has been able to sacrifice yield-sensitive deposits to deliver strong margin expansion. As such, FITB has managed to achieve “a cycle to date deposit beta of 16% thus far on the first 225 basis points of rate hikes.”

“We expect NII to be up approximately 5% sequentially, assuming a 75 basis point hike in November and another 50 basis points in December.

We expect a cumulative deposit beta of around 30% by year-end. This should result in interest-bearing core deposit costs rising from 41 basis points in the third quarter to the mid-to-high 90 basis point area for the fourth quarter.”

Chief Financial Officer Jamie Leonard, Fifth Third Bancorp’s Q3 Earnings Call

Outlook

The Fed funds rate could have further to climb in 2023, after recent disappointing inflation data. September’s consumer price index report showed core consumer price inflation, which excludes volatile items such as food and energy, rose to a 40-year high of 6.6%. This has sparked fears that price growth may have become more widespread and embedded than initially feared. Investors now expect rates to rise as high as 5% by May 2023.

This means there is scope for further improvement in net interest margins and net interest income, although the marginal benefit will likely be smaller going forwards. This is because deposit betas are expected to rise to over 50% for the next 100-125 basis points of incremental rate hikes, as competition for deposits will likely intensify.

Elsewhere, a recovery in fee revenues is expected by the fourth quarter of 2022, due to the expected contribution from its M&A pipeline. This will offset further weakness from mortgage originations and earnings credit rates on service charges. Adjusted non-interest income should be up 6% to 7% compared to the third quarter or stable, excluding the impacts of the TRA.

It’s not easy to look much further ahead. There is a great deal of uncertainty over whether interest rate tailwinds will be enough to outweigh the impact of the deteriorating macroeconomic environment on the medium-term earnings outlook.

FITB’s ability to grow in the medium-term is constrained, as the bank’s loan growth will likely lag behind its peers. However, in a more challenging operating environment, Fifth Third has the potential to outperform. With strong credit quality and conservative underwriting standards, the bank should benefit from a greater degree of resilience in a downturn. Meanwhile, revenue diversification, including sizable wealth management and card processing franchises, could enable it to generate steadier revenues across the cycle.

Final Thoughts

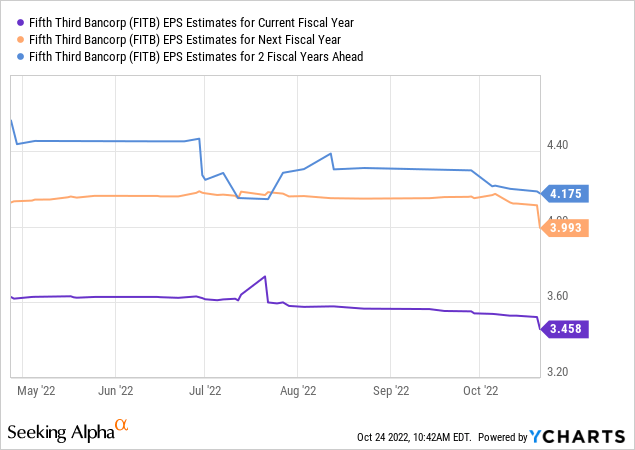

Analysts’ expectations for FITB’s earnings have come down sharply over the past six months, with particularly big downward revisions since its Q3 results. The 2022 EPS estimate has fallen by 4.7% over the past 180 days to $3.46, while adjusted earnings for 2023 and 2024 have been reduced by 3.3% and 8.4%, respectively, to $3.99 and $4.18.

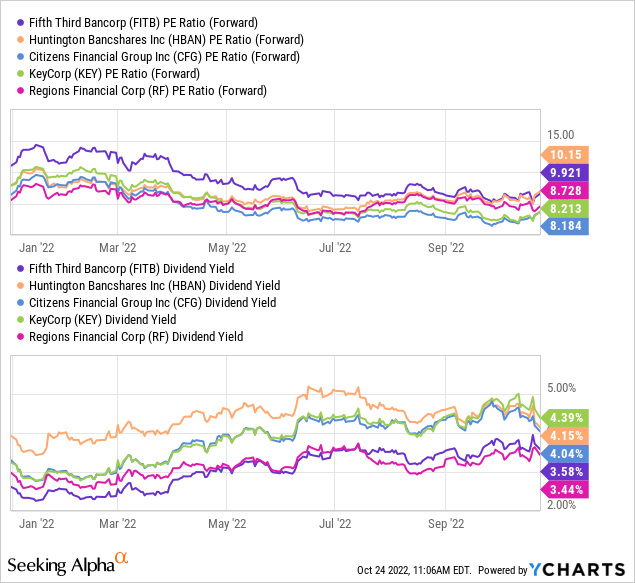

Fifth Third’s valuations, although not too demanding, are trading at a modest premium when compared to regional banks which have a similar geography. The stock is currently valued at 9.9 times its expected earnings for the current fiscal year, and has a dividend yield of 3.58%.

Be the first to comment