Grand Warszawski

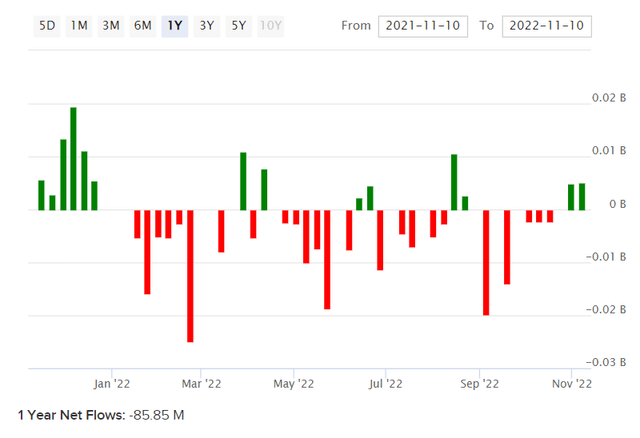

Fidelity MSCI Industrials Index ETF (NYSEARCA:FIDU) is an exchange-traded fund that provides investors with direct exposure to small-, mid- and large-cap stocks in the U.S. industrials sector. The net expense ratio is cheap at just 0.08%, while net assets under management were $657 million as of October 31, 2022. FIDU’s net fund flows over the past year have been negative by circa -$86 million, which is unsurprising as companies in the industrials sector are generally considered cyclical on the stock market.

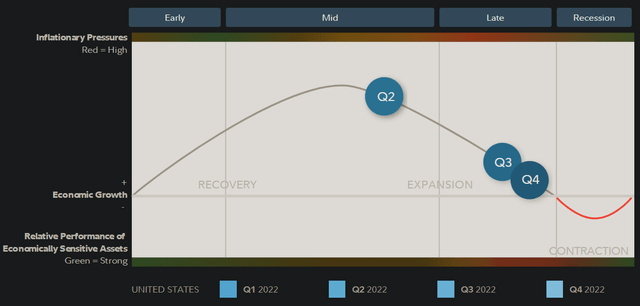

In recent times, the United States has been enduring higher inflation (which may now be abating) and lower growth. This is consistent with the latter phases of the business cycle, which Fidelity research confirms as of Q4 2022.

The FIDU fund tracks its chosen benchmark index, the MSCI US IMI Industrials 25/50 Index, although this is a capped version of the regular USA IMI Industrials Index. The uncapped, regular version is not currently materially different to the capped version in composition. Therefore, I will make reference to the regular version, as more granular financial data is available.

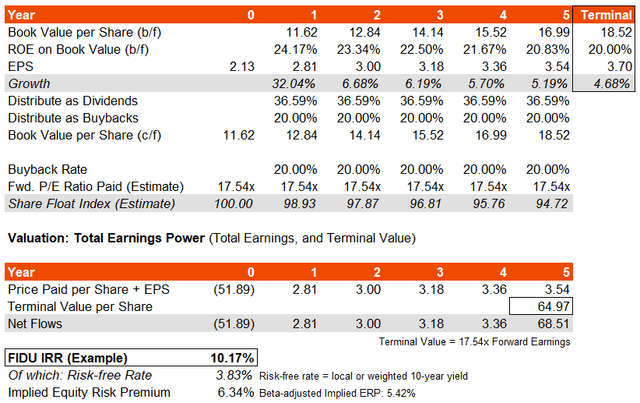

The most recent factsheet for FIDU’s uncapped benchmark offers trailing and forward price/earnings ratios of 23.16x and 17.54x, respectively, with a price/book ratio of 4.24x. That implies a forward return on equity of 24.17%, and a forward earnings yield of 5.7%. That is a modest forward earnings yield, but a decent underlying return on equity. The trailing dividend yield of 1.58% would imply a dividend distribution rate on earnings of about 37%. All these figures are as of October 31, 2022.

Assuming a gradually falling return on equity to about 20%, and otherwise steady returns on equity and dividend distribution rates, and no buybacks for the moment, my forward three- to five-year average earnings growth estimate comes to 14-18%, which is considerably higher than the estimated 9.51% as of November 10, 2022 from Morningstar.

If I assume buybacks of at least 20% of average net income across the portfolio (in addition to dividends), and a constant earnings multiple throughout, the average earnings growth potential drops back down to around 10-15%. Bear in mind given the discrepancy in trailing and forward price/earnings ratios, the market is implying a significant boost in forward one-year earnings growth, so much of this growth is front-loaded in any case.

My basic inputs and assumptions as above take me to an implied IRR of just over 10%. On a beta-adjusted basis, that implies an underlying equity risk premium of 5.42%, or 6.34% without an adjustment for historical volatility.

Bear in mind that slightly more aggressive (on average) buyback programs, a near-term recession that generates under-whelming earnings (as compared to forecasts), and a weaker forward earnings multiple all could put pressure on this IRR potential. Industrials companies usually operate in developed, mature and competitive markets, although plenty also have high barriers to entry. With the cyclical boost, FIDU could out-perform, but I think the valuation at present does not make industrials the best “cyclical bet” even if this rebound occurs some time in the next 9-12 months (for example). While markets lead the real economy in general, a short and/or soft recession would be required for FIDU to represent an attractive bet at present.

As of October 31, 2022, Fidelity reports 374 holdings, making the fund well diversified (the top 10 holdings are all 2-4% of the portfolio at most). While the fund is exposed only to U.S.-listed stocks, this makes the fund generally lower risk, as the United States is the most developed equity market in the world and thus enjoys some of the lowest equity risk premiums on average. Nevertheless, I have already factored all of this in, and if you imagine a 2% perpetual growth rate, and a 4.2-5.5% equity risk premium in the long run, the long-term multiple (with a risk-free rate of say, 4%) would justify a forward price/earnings multiple of around 13.33-16.13x. Even at the top of the range there, that would imply downside of -8% on pricing of the fund alone.

That is all speculation: it is possible that long-term equity risk premiums will converge to much lower rates. The global long-term ERP is closer to 3.2% per work from Professor Damodaran (globally, accounting for survivorship bias). Still, I think FIDU will probably continue to be a bit more volatile than the broader equity indices, and offer some opportunity for out-performance, but the risks are there equally for under-performance should a cyclical downturn last longer than expected. In summary, FIDU is not expensive, but stronger cyclical bets probably exist outside of the industrials sector.

Be the first to comment