shaunl/E+ via Getty Images

FIDI strategy and portfolio

The Fidelity International High Dividend ETF (NYSEARCA:FIDI) has been tracking the Fidelity International High Dividend Index since 01/16/2018. It has 103 holdings, a 12-month distribution yield of 6.01% and a total expense ratio of 0.39%. It pays quarterly distributions.

As described by Fidelity, the index “is designed to reflect the performance of large and mid-capitalization developed international high dividend-paying stocks that are expected to continue to pay and grow their dividends.”

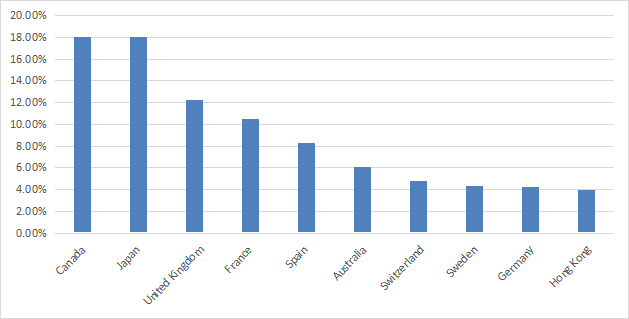

Over 87% of asset value is in large and mega-cap companies. The fund is currently invested about 18% in Canada and 18% in Japan. Other countries are below 13%. European countries have an aggregate weight of 54%. The next chart plots the top 10 countries, weighing about 90% of the portfolio. Hong Kong, which may represent a geopolitical and regulatory risk related to China, only has a 4% weight.

Country weights (Chart: author; data: Fidelity)

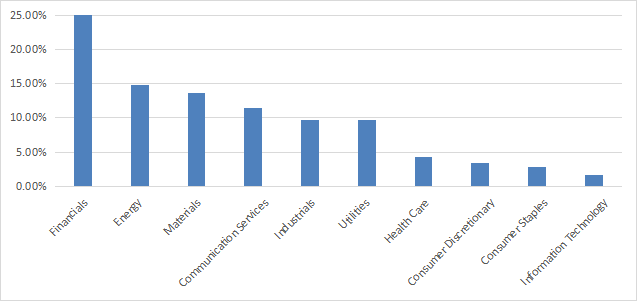

Financials are by far the heaviest sector in FIDI’s portfolio (25.4%), followed by energy (14.8%), materials (13.6%) and communication (11.5%). Other sectors are below 10% individually and 32% in aggregate.

Sector breakdown (Chart: author; data: Fidelity)

The next table compares FIDI’s aggregate valuation ratios with two of its closest competitors, both high-yield international equity ETFs: the Xtrackers MSCI EAFE High Dividend Yield Equity ETF (HDEF) and the iShares International Select Dividend ETF (IDV).

|

FIDI |

HDEF |

IDV |

|

|

Price/earnings TTM |

9.53 |

8.97 |

5.34 |

|

Price/book |

1.25 |

1.38 |

0.97 |

|

Price/sales |

0.83 |

0.9 |

0.89 |

|

Price/cash flow |

5.97 |

6.04 |

4.71 |

FIDI and HDEF look similar in valuation, while IDV is significantly cheaper regarding these metrics.

The top 10 holdings, listed below, represent 25.7% of asset value. The heaviest ones weigh about 3%, so risks related to individual companies are quite low.

|

Name |

Weight % |

Primary listing ticker |

|

BP PLC |

3.04 |

BP |

|

TotalEnergies SE |

3.02 |

TTE |

|

Endesa SA |

2.77 |

ELE |

|

Orange SA |

2.54 |

ORA |

|

Enbridge Inc |

2.48 |

ENB |

|

Repsol SA |

2.46 |

REP |

|

Nintendo Co Ltd |

2.39 |

7974 |

|

Power Assets Holdings Ltd |

2.38 |

6 |

|

Enel SpA |

2.32 |

ENEL |

|

Telefonica SA |

2.31 |

TEF |

Historical performance

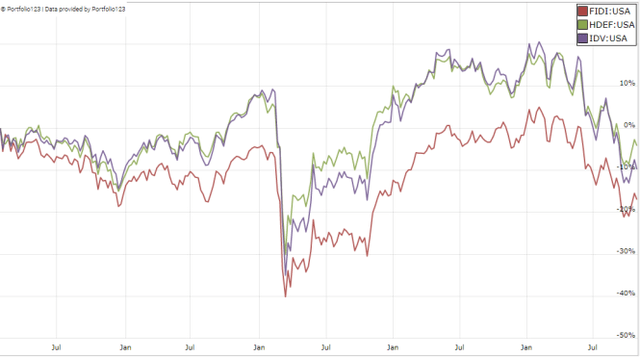

Since February 2018, FIDI, HDEF and IDV are in loss by 6% to 20% in total return (dividends included and reinvested). FIDI is the worst performer by a significant margin, and it also has the deepest drawdown. In the same period, the S&P 500 (SPY) has returned 43%.

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

FIDI |

-19.68% |

-4.50% |

-43.95% |

-0.12 |

20.04% |

|

HDEF |

-6.20% |

-1.34% |

-36.87% |

-0.01 |

17.29% |

|

IDV |

-11.36% |

-2.50% |

-41.64% |

-0.02 |

20.47% |

|

SPY |

43.11% |

7.83% |

-32.05% |

0.52 |

18.12% |

FIDI vs. 2 competitors since inception (Portfolio123)

In 2022, FIDI is almost on par with HDEF and beats IDV by 5 percentage points.

FIDI vs. 2 competitors in 2022 (Portfolio123)

Takeaway

FIDI is an international high-yield equity ETF holding about 100 stocks of large companies, mostly in Europe, Canada and Japan. Financials are the heaviest sector with 25% of asset value. Since its inception in 2018, FDI has underperformed two of its close competitors in the same asset category, HDEF and IDV. It also shows a deeper maximum drawdown. I don’t expect it will perform better in a more complicated economic environment. For transparency, a dividend-oriented part of my equity investments is split between a passive ETF allocation (FIDI is not part of it) and my actively managed Stability portfolio (14 stocks), disclosed and updated in Quantitative Risk & Value.

Be the first to comment