ablokhin/iStock Editorial via Getty Images

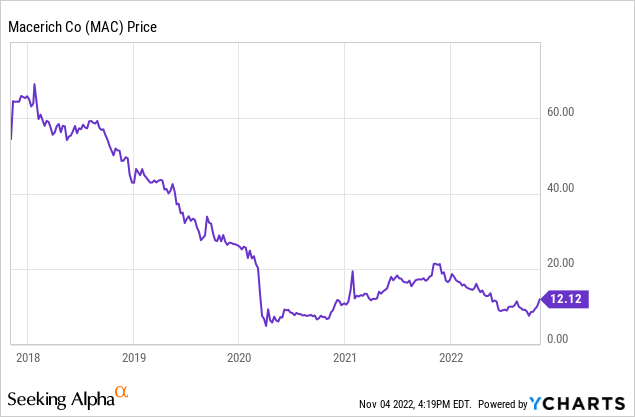

Three years ago, Macerich (NYSE:MAC) offered shareholders a double-digit dividend yield, as the mall owner’s share price had plummeted due to investor fears about the impact of changing shopping habits on its business. However, the REIT was plagued by speculation that its dividend was unsustainable.

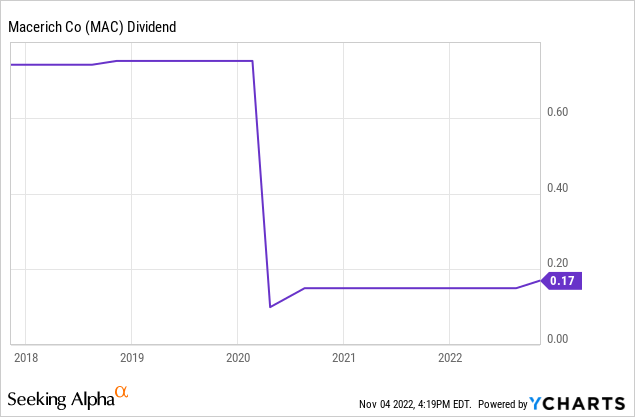

Sure enough, Macerich had to dramatically reduce its dividend when the COVID-19 pandemic hit. For the past two years or so, Macerich’s quarterly payout has stood at $0.15 per share: down by 80% from its pre-pandemic quarterly dividend of $0.75 per share.

Fortunately, tenant sales have surpassed pre-pandemic levels in 2022. The strong sales trends have driven a resurgence in demand for space at Macerich’s malls. As a result, Macerich announced its first dividend increase since 2018 in late October. The company set its dividend at $0.17 per share for Q4: up 13.3% from its previous level. And despite facing a substantial headwind from soaring interest rates, Macerich has room to continue increasing its dividend in the years ahead.

From dividend cuts to dividend growth

As Macerich stock plunged from over $60 in early 2018 to under $30 in late 2019, the REIT’s dividend yield jumped from around 4.5% to over 11%. As the share price fell, the company faced repeated questions from analysts about cutting the dividend.

However, management consistently rebuffed these questions, noting that FFO was sufficient to cover the dividend. They also said that while the company’s required distributions under REIT rules averaged around $2/share, Macerich was marketing several assets and JV stakes for sale, which could lead to sizable capital gains. These transactions would have reduced Macerich’s leverage while pushing its required distributions closer to $3/share.

While there was some merit to these points, Macerich never completed the asset sales it was contemplating in 2019. Meanwhile, paying around $3/share of dividends annually (over $450 million) meant that the company wasn’t retaining nearly enough cash to cover its CapEx, which averaged more than $400 million a year from 2017 to 2019. This caused Macerich’s debt (including its share of JVs) to rise from $7.53 billion in early 2017 to $8.07 billion by the end of 2019.

Combined with a downturn in adjusted EBITDA over this period, Macerich’s rising debt load drove its leverage ratio to an unacceptably high level. That made it especially vulnerable when the pandemic hit. Macerich had to reduce its dividend to $0.50/share in Q2 2020, with only 20% of that being paid in cash. A quarter later, it cut the dividend to $0.15/share (all paid in cash).

Furthermore, Macerich was forced to issue over 60 million shares through a dilutive at-the-market offering during 2021 in order to refinance its credit line and strengthen its balance sheet. As a result, its diluted share count has swelled by nearly 50% since 2019, permanently reducing its dividend potential on a per-share basis.

That said, Macerich’s deep dividend cuts during the pandemic left it with a very conservative payout ratio. Even after last week’s dividend increase, Macerich will be paying just over $150 million in dividends annually: down from over $450 million in 2019. While EBITDA is lower than it was in 2019 due to various asset sales and the lingering impact of the pandemic, Macerich now has room to raise its dividend gradually while still retaining enough capital to cover CapEx and reduce its debt modestly.

Business fundamentals look good

On Thursday, Macerich reported solid results for Q3 2022. While adjusted FFO per share missed the analyst consensus by $0.01 and the company reduced the midpoint of its full-year FFO guidance, Macerich raised its forecast for full-year growth in cash same-center NOI (net operating income) to a range of 7%-7.5%. A quarter earlier, it expected 5.5%-6.75% growth on that basis. Entering the year, Macerich projected growth of just 4%-5.5% in cash same-center NOI.

Importantly, occupancy rates for Macerich’s malls are trending back towards pre-pandemic levels. The company ended Q3 with occupancy of 92.1%: up 30 basis points sequentially and 180 basis points year over year. Just six quarters ago, occupancy bottomed out at 88.5%.

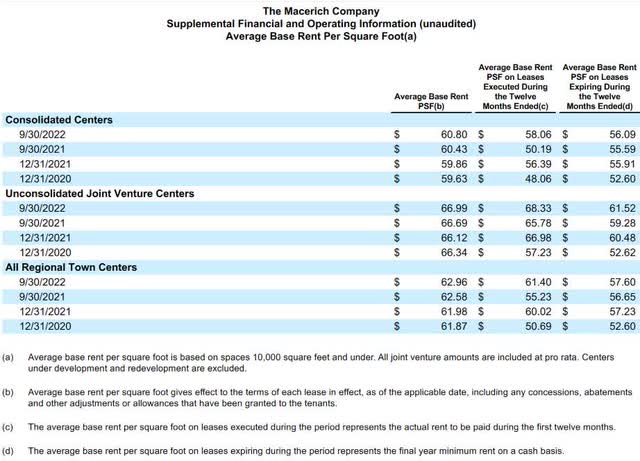

With fewer vacancies at its malls (particularly its more successful properties), Macerich’s pricing power is beginning to improve. Leasing spreads reached 6.6% for the trailing 12 months, with new small shop leases having an average base rent of $61.40 per square foot, compared to $57.60 for expiring leases.

Source: Macerich Q3 2022 Supplemental, p. 21.

This figure actually underestimates the improvement in leasing spreads, though. For the 12 months ending June 30, 2022, new small shop leases had an average base rent of $57.58 per square foot: a spread of just 0.6%. Clearly, Macerich achieved extremely strong pricing on the new leases it signed during Q3 to drive such a big improvement in the trailing-12-month figures in a single quarter. Leasing volumes also remain near multiyear highs.

Rising interest rates are a real problem

While Macerich’s underlying business is improving rapidly, the company faces one major external headwind: soaring interest rates. During 2022, the Federal Reserve has raised interest rates at a pace not seen in decades to combat high inflation. Making matters worse, recession fears and uncertainty about how high the Fed will push interest rates have caused lenders to demand higher spreads over Treasuries to refinance or extend loans.

Macerich ended Q3 with $6 billion of fixed-rate debt, compared to just $771 million of floating-rate debt. Still, the jump in short-term rates could potentially be a $20 million year-over-year headwind to interest expense on Macerich’s existing floating-rate debt in 2023.

Moreover, Macerich has several major maturities in the coming months. That includes a $312 million loan (at share) on Washington Square Mall that matures later this month. At present, the loan has a fixed rate of 3.65%, but Macerich is negotiating an extension at a floating rate of SOFR+4.0%. That will likely put the effective rate north of 8% by year-end, driving a roughly $15 million headwind in 2023 for that one property. (The loan will have an interest rate cap in place, but Macerich has not disclosed the level of the cap.)

Several more fixed-rate mortgages with a combined balance over $500 million are set to mature between early February and early April of 2023. Even if Macerich can negotiate more favorable spreads to the SOFR, extending or refinancing these loans will likely increase annualized interest expense by $15 million as of Q2 2023.

In short, interest expense could jump by around $50 million next year. And so while Macerich is on pace for another year of solid NOI growth in 2023 due to its large book of signed new leases, adjusted FFO per share will likely dip compared to the 2022 figure (currently guided at $1.93-$1.99).

Fortunately, the pace of Macerich’s fixed-rate debt maturities slows after next April. Thus, even if interest rates remain high by recent standards, the year-over-year headwind from rising interest costs will moderate beyond 2023. Indeed, just over half of Macerich’s debt consists of fixed-rate mortgages that are locked in until at least 2026.

|

Period |

Fixed-Rate Maturities |

|

Nov. 2022-April 2023 |

$840 million |

|

May 2023-Dec. 2023 |

$242 million |

|

2024 |

$758 million |

|

2025 |

$720 million |

|

2026 |

$988 million |

|

Thereafter |

$2.4 billion |

Table by author. Data source: Macerich Q3 2022 supplemental.

Macerich remains deeply undervalued

Over the past five weeks, Macerich stock has rallied more than 50% from below $8 at the end of September to a Friday closing price of $12.11. Even after that rapid recovery, Macerich shares have fallen 44% from a year ago and trade at a bargain price of just 6 times the company’s projected 2022 FFO. And following the recent dividend increase, Macerich stock yields a healthy 5.6%.

Assuming NOI growth only offsets half of the projected $50 million increase in Macerich’s interest expense next year, FFO should still come in comfortably above $1.80. So even on a forward-looking basis, Macerich stock trades for less than 7 times FFO, and its dividend payout ratio would be less than 40%.

Interest rates will probably start to moderate within a year or two, mitigating the headwind to interest expense. Meanwhile, Macerich should be able to continue growing NOI at a robust pace beyond 2023 as occupancy returns to historical highs, rents continue increasing, and the company completes several high-potential redevelopments and anchor replacements.

This sets the stage for a return to FFO growth, most likely in 2024. That in turn will enable Macerich to gradually increase its dividend in the years ahead.

In the long run, high inflation coupled with higher interest rates should actually benefit Macerich. Real estate typically maintains its real value during periods of inflation. Practically speaking, inflation is one of the factors contributing to rising sales per square foot at Macerich’s malls, which will support higher rents (and thus higher property values) in the future.

Considering the excellent quality of Macerich’s real estate, its improved balance sheet, and the REIT’s strong NOI momentum, I believe Macerich stock should trade for at least 10 times forward FFO (i.e., $18-plus), despite the rising rate environment. As interest rates moderate and FFO returns to growth, the company’s valuation should improve further. This gives Macerich stock excellent capital appreciation potential on top of its attractive yield.

Be the first to comment