xp3rt5/iStock via Getty Images

Investment Thesis

The Fed signaled a half-percentage-point rate hike and rapid balance sheet reduction, mirroring the start of the most aggressive tightening cycle since 1994. More to come if inflation remains rogue. Mortgages are up, and prices are up. The Fed is going nuclear, destroying wealth to address inflation. Markets are down this year, and recession has become the base case scenario for many, including Deutsche Bank (DB). What do we do, us retail investors?

My advice is to make a plan and be disciplined. Invest, don’t speculate. A high conviction will help you control your emotions as we face these turbulent markets. Like everyone else, my positions are in the red. My strategy is to accumulate shares, dollar-averaging my investments gradually.

Second, buy industries that stand to profit from rising interest rates. These include names in Insurance, Banking, and Investment Funds, whose business model fundamentally rests on interest rate spreads to make a profit. This is where the smart money is going now, including Blackstone (BX), who bought a 9.9% stake in AIG’s (AIG) Life & Retirement Business last July, and Berkshire Hathaway (BRK.A) (BRK.B), which bought Alleghany Corp (Y) last month, among others who recently made mega deals in the insurance industry.

Today, we shed light on Fidelity National Finance, Inc. (NYSE:FNF), the largest title insurance company in the US. It has excellent quant scores and multiple revenue drivers, augmenting its stable, investment-grade, 4% dividend yield.

FNF Quant Scores (Seeking Alpha)

Favorable Trends

Fidelity is the largest title insurance company in the U.S., giving it excellent exposure to the booming U.S. real estate market. Lenders require property buyers to have title insurance to protect themselves from unexpected claims over the property, often used as collateral for the loan amount.

Despite rising interest rates, the U.S. real estate market remains strong. I think people put too much emphasis on interest, while, in my view, the purchasing property purchase decision is more influenced by the buyer’s ability to pay the monthly repayments.

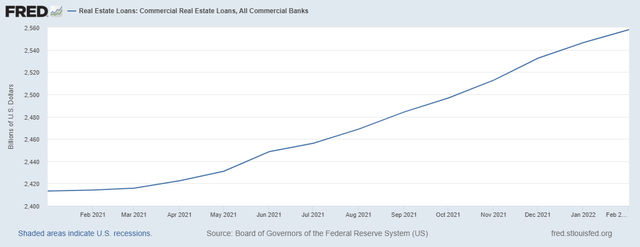

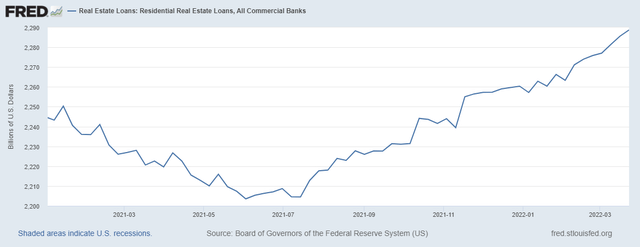

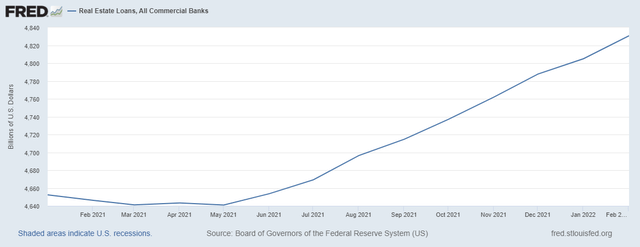

All economic indicators show that average wages in the U.S. are rising, at least partially offsetting the increase in housing prices and inflation. Look at monthly housing data from the Federal Reserve Bank of St Louis. These monthly charts show data as recently as March, showing a resilient property market and suggesting that investors should expect excellent quarterly results for FNF, an attractive proposition, especially given the ticker’s slump.

Commercial Real Estate Loans (FRED) Residential Real Estate Loans (FRED) Real Estate Loans, All (FRED)

It wouldn’t be prudent to bet that the real estate market won’t cool off at some point. However, current data indicate a lucrative Q1, which I believe is a catalyst for a stock correction. Historically, FNF reported Q1 results in late April or early May of each year. Moreover, the company has weathered multiple recessions, including the 2007 mortgage crisis, distributing dividends throughout.

In 2020, FNF purchased F&G, adding a second business line besides the title insurance, a strategic move praised by rating agencies for diversification benefits. F&G annuity business isn’t susceptible to the property market and allows FNF to profit from changing demographic trends by offering retirement solutions to pensioners.

Financial Position

Title insurance constitutes the majority of FNF’s revenue, exposing investors to economic cyclicality in the real estate market, GDP, inflation, and interest rates. In the past, sales fluctuated with changing economic conditions, but also due to multiple M&As, splits, and spin-offs. Nonetheless, management successfully maintained strong financials, helping FNF secure a credit rating upgrade in 2018.

I believe that the risks of a recession are fully incorporated into the current price. The company’s $400 million dividend distribution constitutes a mere 19% payout ratio. It has been paying dividends for at least 16 years and maintained its distribution during the 2009 mortgage crisis, a sign of a solid balance sheet and prudent financial management. Last year marked the 7th year of dividend growth. Share buybacks and dividend distribution amounted to a mere $900 million in 2021, weighted against $4 billion in operating cash flow. The low payout ratio leaves ample room to grow its yield, which stands at 4%.

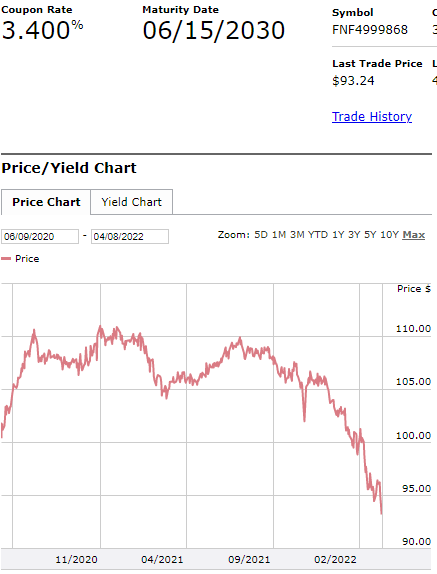

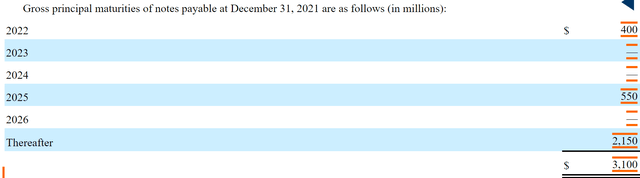

I am not sure whether the company will start repaying the debt it incurred for the F&G acquisition. Until now, it hasn’t, preferring to retain capital. The debt incurred for F&G costs between 2.25% and 3.5% annually, with maturities extending to 2031. The cost of financing has been increasing, along with the broader shift in the rate curve, as investors factor in rising interest rates. Nonetheless, FNF doesn’t have to worry about this now because most of its borrowing has long-term maturities. Below is the historical price of one of FNF’s debts ( 650 million, 3.4% 2030 bond) and the maturity schedule of aggregate FNF borrowing.

FNF 2030, 3.4% bond (Morningstar)

FNF debt maturity schedule (SEC Filings)

Summary

FNF has excellent exposure to a booming real estate market. Unlike many think, the US property market is still strong, fueled by rising wages and lower unemployment, counterbalancing rising mortgage rates. Strong monthly data show a resilient property market in the face of rising mortgage rates, suggesting a solid Q1 this year, offering a catalyst for an upside stock correction.

The insurance giant’s business model rests on its ability to generate investment income to fund insurance claims and annuity expenses. A significant portion of FNF funds is fixed income securities, allowing the company to roll over its assets at higher rates as the Fed tightens monetary policy.

The firm’s relatively safe 4% dividend augments the favorable trends listed above. A low payout ratio will allow the insurance giant to continue its dividend growth strategy.

Be the first to comment