Solskin

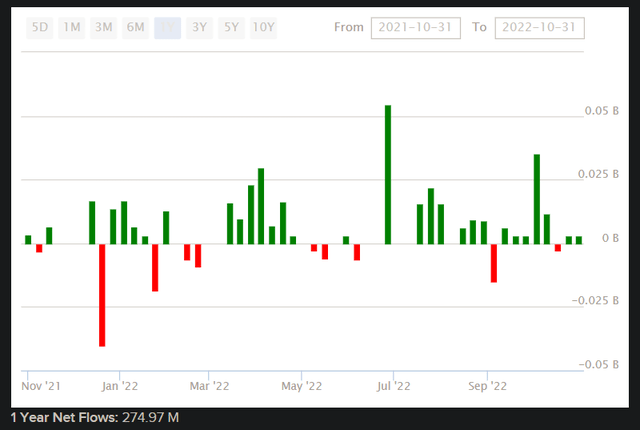

Fidelity MSCI Health Care Index ETF (NYSEARCA:FHLC) is an exchange-traded fund that provides investors with direct exposure to health care stocks, designed to track the performance of the fund’s chosen benchmark index, the MSCI USA IMI Health Care Index. FHLC is cheaply run, with a net expense ratio as reported of only 0.08%. Net assets under management were $2.7 billion as of September 30, 2022, and that follows positive net fund flows over the past year or so of approximately $275 million (see below).

ETFDB.com

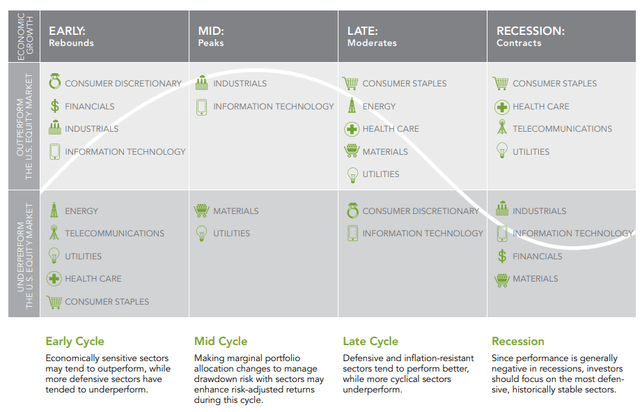

Equities have sold off generally through 2022, however FHLC has performed relatively well. The fund has fallen by approximately -8% year to date, but that compares to the S&P 500 U.S. equity index (a popular U.S. equity benchmark) of about -20% over the same time frame. Health care stocks tend to do relatively well during the later and recessionary phases of the business cycle, as depicted in the graphic below from Fidelity.

Fidelity.com

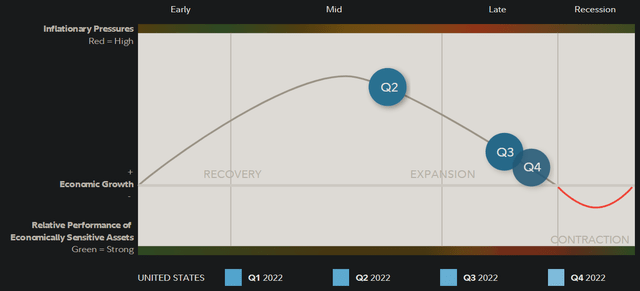

Fidelity also carries out regular business cycle positioning analysis. As of Q4 2022, the United States is thought to be in the late stage of its current business cycle, which has admittedly moved very quickly to date.

Fidelity.com

That is based on moderating economic growth, tighter credit availability, earnings pressure, “contradictory” (tighter) policy (i.e., fiscal, monetary), and higher inventory/sales ratios. In my last article on FHLC, posted June 7, 2021, I commented saying that “I would be unsurprised to see FHLC outperform SPY materially on a forward, twelve-month basis”, with similar reasoning. Since then, the price-only positive out-performance has been just over 10% vs. the S&P 500 per Seeking Alpha data at the time of writing.

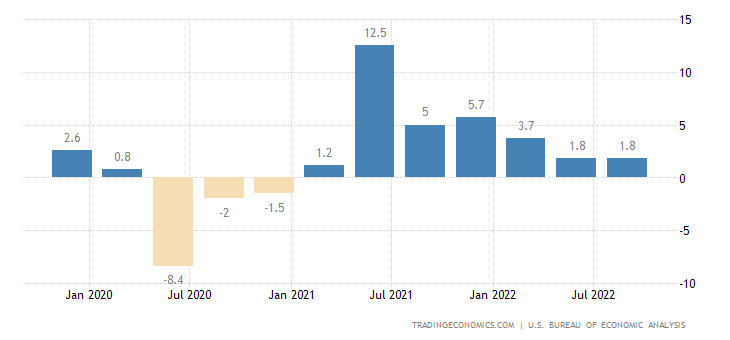

The United States is not yet recognized as being in a recession, helped in part by low unemployment, as well as modest but still positive GDP growth. GDP expanded 1.8% in Q3 2022, year-over-year.

TradingEconomics.com

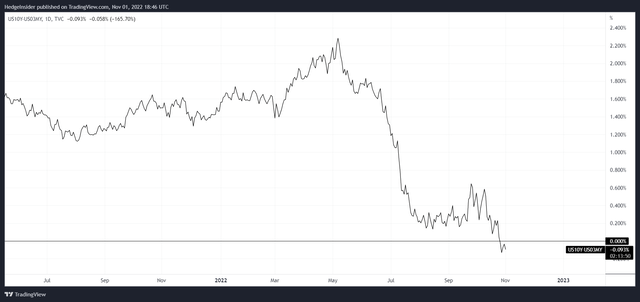

What comes next is almost certainly recession, especially given that an extremely reliable indicator has just signaled as much. That is an inversion in the 10-year, 3-month U.S. bond yield spread.

TradingView.com

Nevertheless, that recession is not necessarily destined to be soon, nor harsh. Still, we should probably consider that the risk is high that a recessionary stance comes next. That means that FHLC is still likely to be cyclically well positioned in the near term. However, markets are also forward-looking, and so once a recession becomes the consensus and understood belief, it will become more likely that FHLC will start to under-perform relative to riskier (cyclical and economically sensitive) sectors (e.g., tech, or even financials).

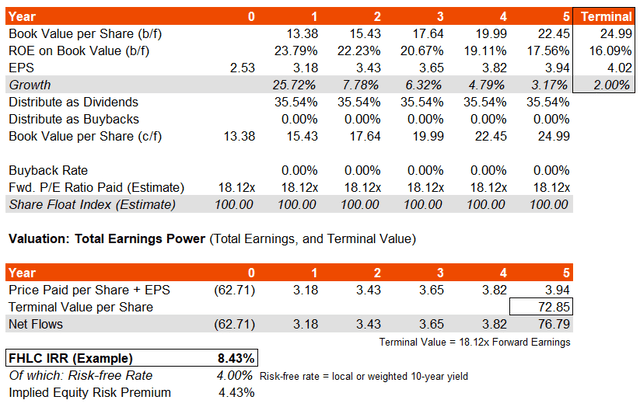

Morningstar currently has a consensus three- to five-year earnings growth estimate of about 9.33%. Using the earlier referenced MSCI report (for FHLC’s benchmark) as a basis, I have constructed the basic DCF model below keeping the earnings multiple constant over the time frame, and assuming a risk-free rate of 4% (close to the present U.S. 10-year yield). I have also built in an assumption that forward return on equity of 23.8% drops to about 16% by year six. It is unlikely that FHLC’s underlying earnings would ride out a recession in such a smooth way, but this takes my three- to five-year earnings growth average to about 9.3-12.9% (9.3% over five years, roughly in line with the Morningstar consensus). I also assume a constant dividend distribution rate, and no buybacks.

Author’s Calculations

The implied IRR of 8.43% is fair, and implies an underlying equity risk premium of 4.43%, which is good considering the fund’s low historical beta of circa 0.72. You could argue a beta-adjusted ERP of well over 6%, which is high and would typically indicate under-valuation. However, either my estimate or the consensus analyst estimates are optimistic. A hit to earnings during a recession of -10%, followed a bounce back, could easily take the forward equity risk premium negative.

Health care stocks are generally considered safer and recession-proof in some ways, hence why demand can pick up late-cycle given their “safe-haven” characteristics (within the equity world, at least). So, a large hit to earnings might be unlucky (and unlikely). But we are also assuming a constant price/earnings ratio. Arguably a mature sector with a 2-3% nominal earnings growth rate to perpetuity, with a relatively modest equity risk premium of 4.2%, and a risk-free rate of 4%, should command a forward price/earnings ratio of no more than 19.23x, and arguably as low as 16.13x. The current forward multiple of about 18x per MSCI (although Morningstar estimate 15.3x as of October 28, 2022) would suggest that FHLC possibly has little room to grow on the valuation side.

As Morningstar’s numbers often seem somewhat optimistic, I would better trust FHLC’s benchmark data from MSCI. On balance though, FHLC’s valuation looks within the bounds of normality, and a relatively smooth next few years (even if a recession indeed occurs in the next 1-2 years) would seem to suggest that FHLC is fairly valued. If U.S. rates were to fall post-recession, this could also support the valuation multiple post-recession, helping to provide a buffer against any medium-term drop in earnings.

I think FHLC is therefore probably fairly valued and positioned to offer returns of circa 8% per annum (including dividends reinvested) over the next few years. Any significant deviation from this line of return would probably warrant revisiting the fund. From a cyclical perspective, FHLC does still look attractive, as a recession does not appear imminent, but once a recognized recession does occur, investors would probably be sensible to start thinking about rotating. A recession would likely result in a Fed pivot, as monetary policy changes can take up to 18 months to take effect in the real growth and earnings (even longer for inflation), and this would likely enable riskier sectors to outperform health care.

Be the first to comment