bjdlzx

Investment thesis

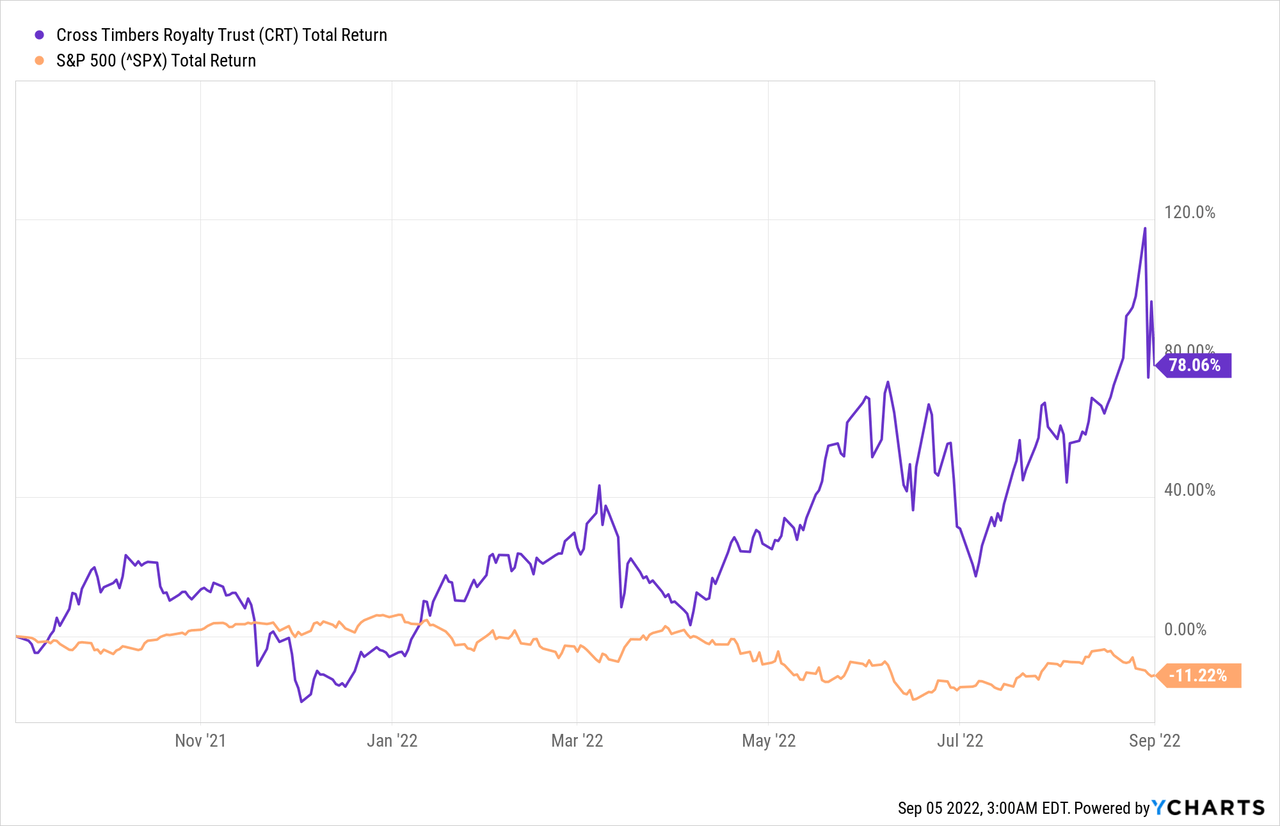

Cross Timbers Royalty Trust (NYSE:CRT) is a small-cap royalty trust with a market capitalization of $122 million, which is considered minuscule in the industry but has a very high dividend yield. They have performed well against the market in the previous year, with a positive change in total returns at 78.06%, compared to a loss of 11.22% by the S&P 500. The company operations and structure were discussed in detail in our previous article.

We will focus more on the future of the oil and gas sector, where CRT operates, observing macroeconomic and systemic effects and issues that are likely to affect its stock price and dividend yield.

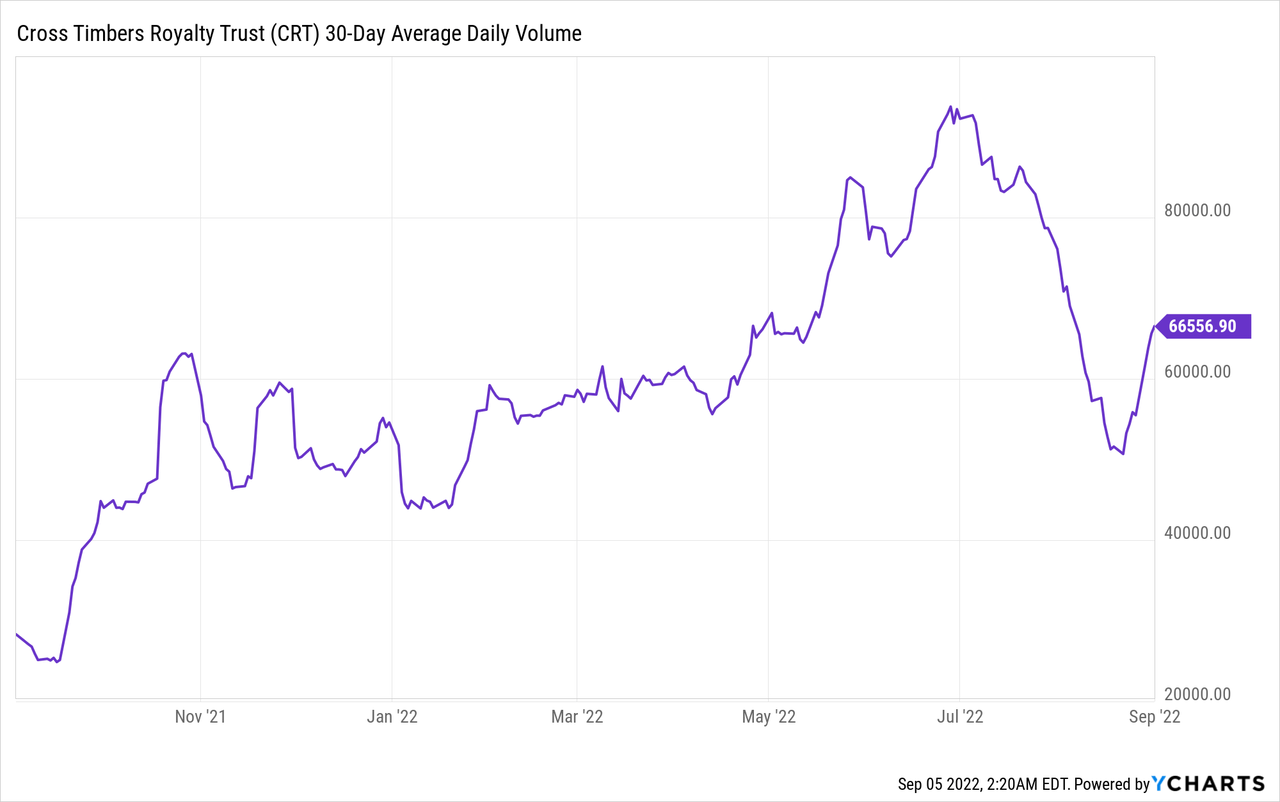

The sentiment regarding CRT has been bullish as of late, after its latest announcement of an increase of 20.3% on the monthly dividend to $0.2306/share from a prior dividend of $0.1917/share. This is evident by its higher recent trading volumes, which almost doubled on some days relative to its normal levels.

Distributions

Distributions steadily recovered in 2021 as oil and gas prices rebounded after the pandemic. This directly affected total distribution, which almost doubled as CRT declared $0.87 per unit in distributions in the first two quarters of 2022, compared to $0.45 per unit in H1 2021.

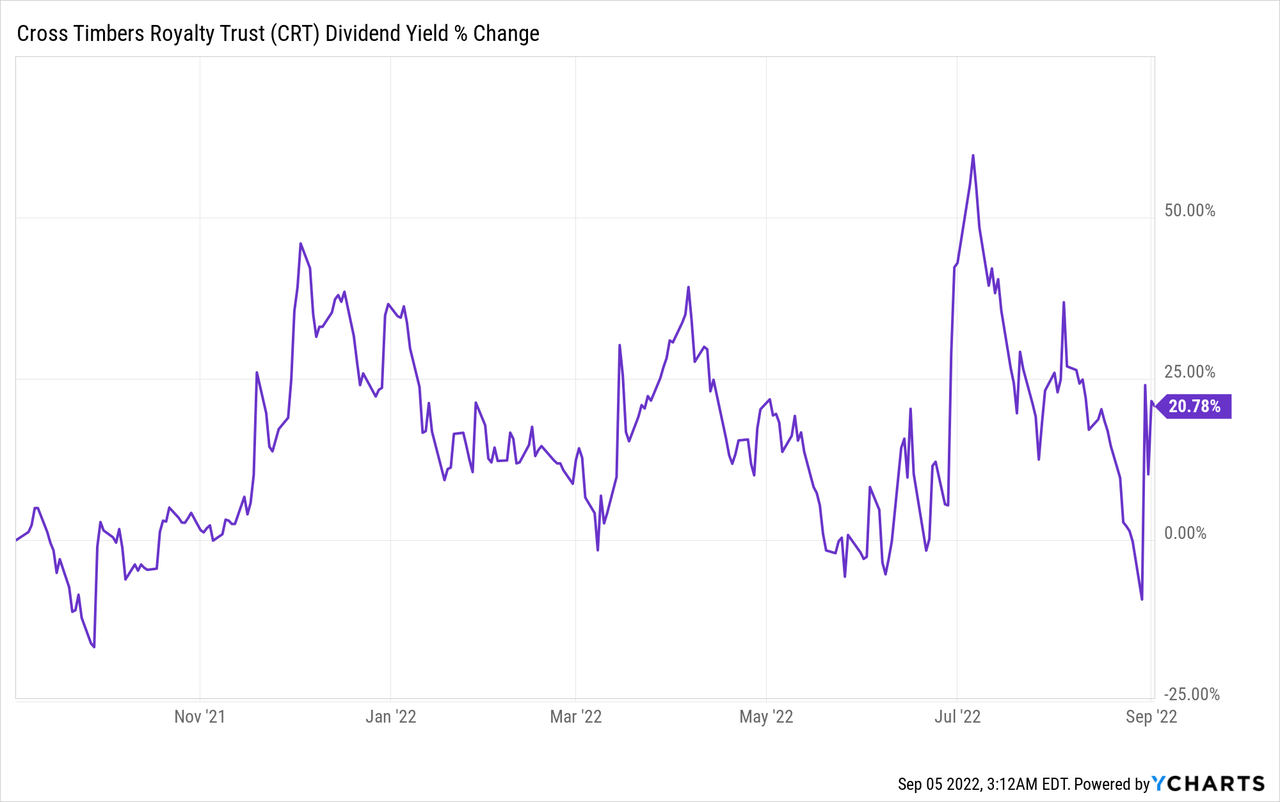

The company saw a rise of 20.78% in the monthly dividend yield in August. Looking at the numbers, they have reported an average dividend yield of 10.82% over the previous decade, making it a valuable income play. They sustained a steady dividend yield despite the pandemic-related economic downturn and the geopolitical tensions which have engulfed the world in recent months.

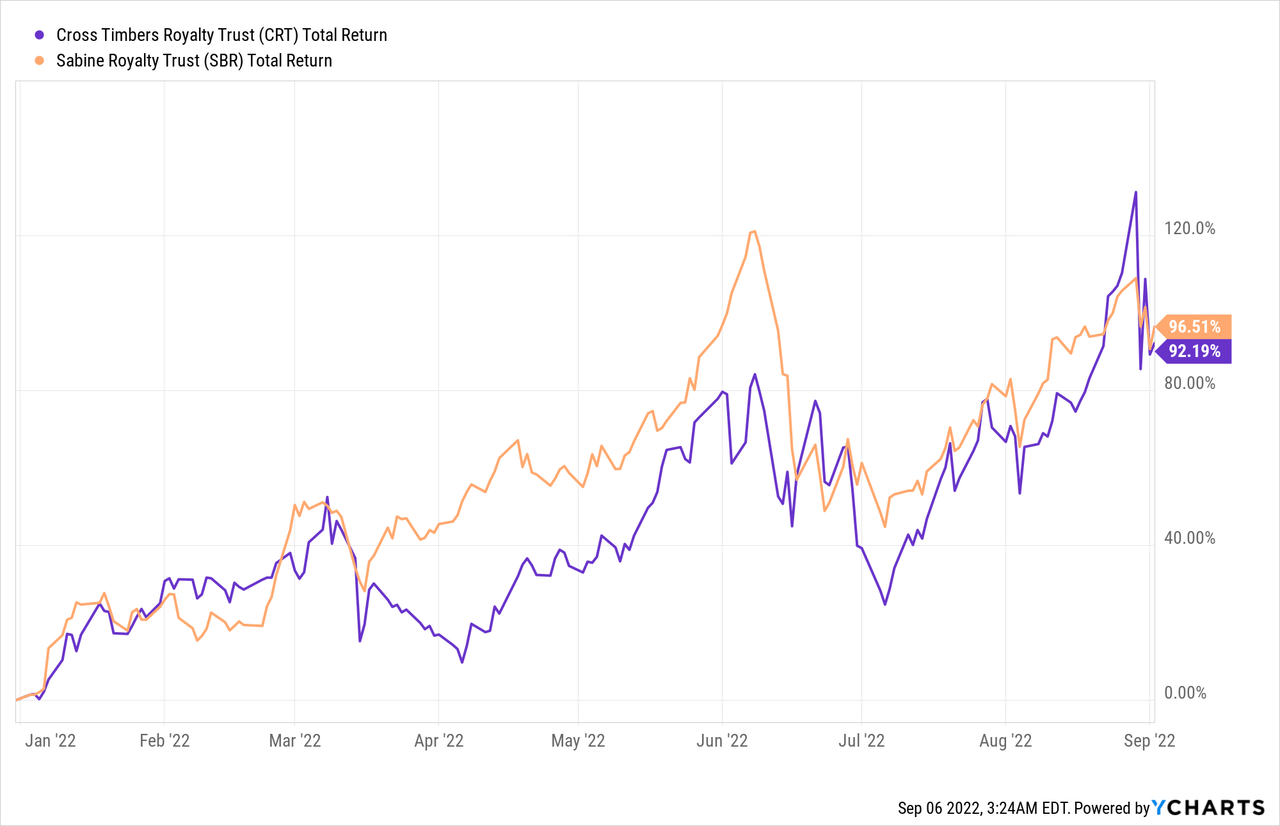

Even though a small-cap trust, CRT showed a 92.2% growth in total returns compared to the billion-dollar market-cap trust, Sabine Royalty Trust (SBR), which reported a 96.21% growth in total returns. This speaks volumes about CRT’s performance, which went toe-to-toe with a trust five times its size.

SBR also had a lower 4-year average dividend yield of 7.92% compared to CRT, which came in at 10.20%, showing its capabilities of dependability and growth. This is also highlighted by the fact that they have sustained dividend payments consecutively for 19 years, making theirs a trustworthy income stock for potential investors.

The company’s annual report reveals proven reserves of the underlying properties at 1.15 million barrels of oil and 12.6 billion cubic feet of natural gas as of December 2021. Both of these figures are lower than they were at the end of 2020, indicating the long-term decline of the reserves of the trust. CRT has repeatedly stated that it expects a natural production decline of 6-8% in the long run.

As oil and gas production decreases due to natural decline, investors should expect the distributable cash flow per share to decrease in the long run. But on a brighter note, even though the world has been moving toward clean energy sources recently, US oil companies are pumping up their output at a fast pace.

However, it should also be noted that the trust’s current reserves have an estimated lifespan of over 10 years, which has been extended for years now, considering that the estimated reserve lifespan in 2012 was about 12 years.

The company cannot do much at this point to impact growth; unit holders should be aware of this as Cross timbers is a passive play on accumulating royalty, largely dependent on rising demand and increasing prices of the underlying commodities.

Market Risks

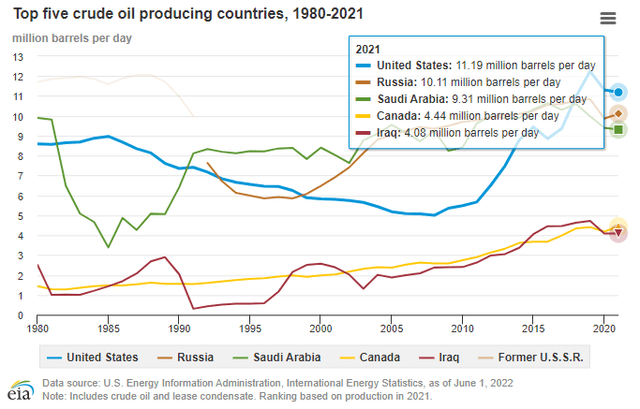

Global oil and gas consumption greatly bounced back after record lows during the pandemic. Then the Russian invasion of Ukraine resulted in even further tightening of the global supply. The subsequent sanctioning of Russia by the western countries further hindered the oil market since Russia exports over 13% of the global supply, following the United States, which supplies about 14.5%.

EIA

Europe is highly dependent on Russia because most of its electricity is generated from natural gas supplied by Russia. Still, now they are trying to move away from them and are buying LNG from the United States at steep prices, which has, in turn, affected the natural gas prices in the US and reached a 13-year high recently.

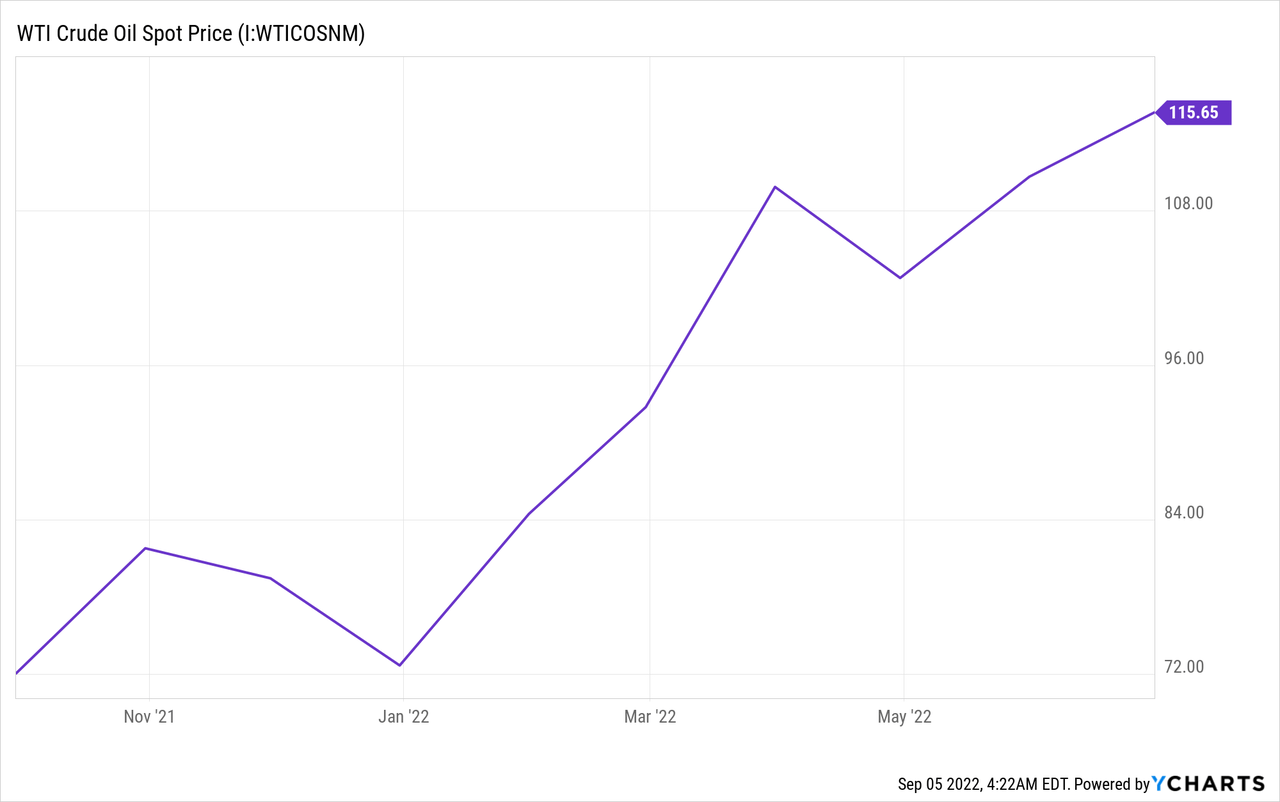

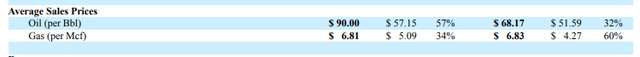

This situation is ideal for CRT as it has been historically sensitive to the rise in oil and gas prices and is directly proportionate to it. As can be seen, the table below clearly shows a rise in sales as a result of rising prices, and the prices are on an upward trajectory again (currently at $112.65/barrel) after a slight dip in May and June 2022.

Since Cross Timbers is a royalty trust, its operating costs are minimal. Since it generates most of its income through net profit interests, the operating leverage is very substantial when revenue rises.

The trust generates a gross profit margin of 100%, showing that it incurs midline costs, mostly management-related, with relatively low sensitivity, increasing its profitability spreads. This also signifies that increasing oil prices will significantly benefit CRT, making these prices critical for the trust’s distributable income. The growth almost entirely depends upon the commodity prices.

The table shows the difference in the MRQ and H1 figures relative to last year. The MRQ oil and gas prices rose 57% and 34% YoY, respectively.

CRT 10Q form

Conclusion

Cross Timbers Royalty Trust is a high dividend investment whose price can swing wildly now and then, depending on the oil and gas prices, indicating its cyclicity. Investors should consider it a viable income stock as the trust distributes all its income while retaining the share price.

Even though the stock showed tremendous price growth in the previous 52 weeks, it should not be considered a growth stock. Cross Timbers should be considered a long-term bet on the rising oil and gas market while collecting monthly income.

I recommend that investors looking for a healthy income while safely maintaining their capital investment should keep CRT on their radars while bearing in mind the risks associated with a stock so highly correlated with commodity prices, which may be affected by an impending recession.

Be the first to comment