Pcholik/iStock via Getty Images

Introduction

As it has been about four years since I last discussed Fevertree Drinks (OTCPK:FQVTF) (OTCPK:FQVTY) (also called ‘Fever-Tree’) here on Seeking Alpha, I think it’s perhaps time for an update. Even more so as I am slowly turning bullish on the stock. As you may remember, back in 2018, I was not convinced Fevertree was a good investment. Despite the strong balance sheet and robust margins, I wasn’t keen on paying 52 times EBITDA and 70 times the free cash flow and I called the stock ‘overvalued’.

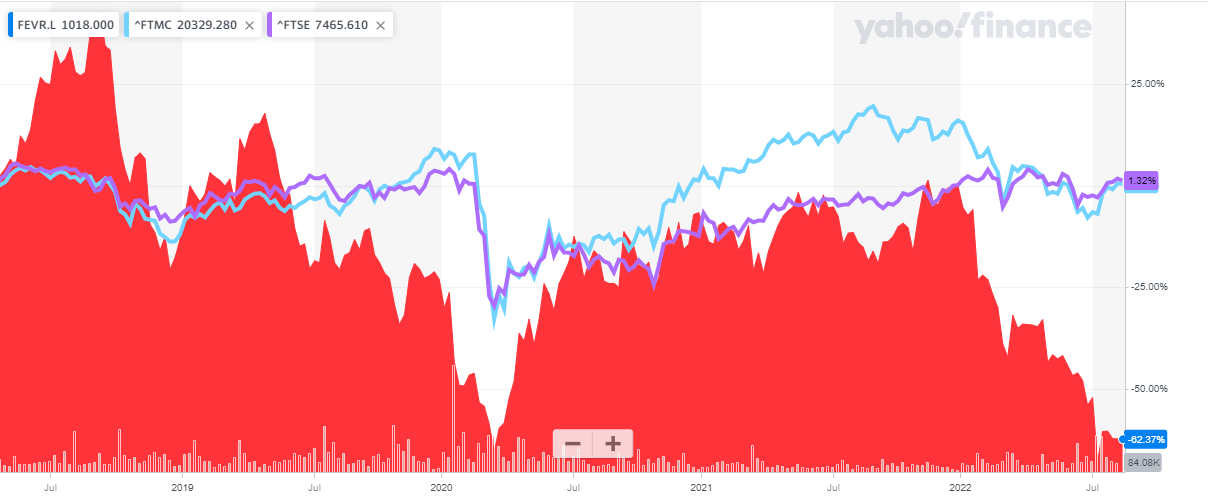

I did keep an eye on Fevertree as the management is doing the right things and the company has an excellent position and market share in the premium mixer segment. And now the stock is down over 60% since that 2018 article (while the FTSE 100 and FTSE 250 held their ground, as shown on the image below), with the Fevertree share price approaching levels we haven’t seen since the start of the pandemic, I wanted to look at Fevertree from a fresh perspective.

Yahoo Finance

Fevertree’s main listing is on the London Stock Exchange where it’s trading with FEVR as its ticker symbol. The average daily volume is approximately 700,000 shares, and considering the current share count is approximately 116.5M shares, the current market capitalization roughly 1.2B GBP. I will use the British Pound (‘GBP’) as base currency throughout this article.

The trading update for the first half of the year looks interesting

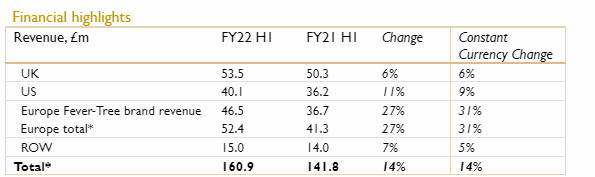

While Fevertree will report its financial results in September, the company did provide a trading update discussing the first half of the current financial year. The total revenue increased by approximately 14% to just over 160M GBP thanks to relatively strong growth across all geographies the company is active in.

Fevertree

The first half of the year is actually the weakest for Fevertree, and the company has maintained its full-year guidance of 355-365M GBP in revenue. This means the H2 revenue will likely be about 25% higher, at around 200M GBP.

That’s encouraging. But while Fevertree maintained its revenue guidance, it had to cut its margin guidance, which makes it look like the additional revenue will mainly be generated by passing on portions of the higher operating expenses to the consumers. Only a portion of those cost headwinds, indeed, as the company has reduced its gross margin guidance to 37% and an EBITDA margin of 14% in the first half of the year. This indicates Fevertree generated approximately 22.5M in EBITDA in the first semester.

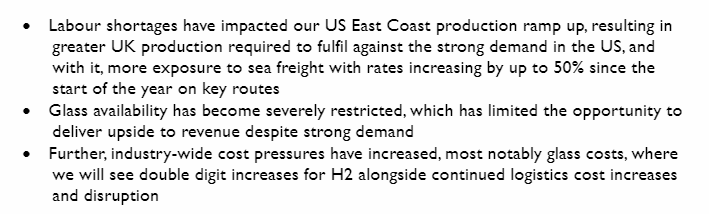

The full-year EBITDA guidance has now been set at 37.5M-45M GBP. So despite the expected 25% bump in revenue, not a single Pound of additional EBITDA will be generated. In the best case scenario, the 200M in revenue will generate about 22.5M GBP in EBITDA (a status quo compared to the first semester), while the lower end of the full-year EBITDA guidance indicates the H2 EBITDA could drop to 15M GBP for a margin of just 7.5%. Fevertree is pointing to three main causes for the rather disappointing EBITDA guidance.

Fevertree Investor Relations

We’ll perhaps get more details when the H1 results are published in September and hopefully Fevertree’s management can narrow down the guidance range sooner rather than later.

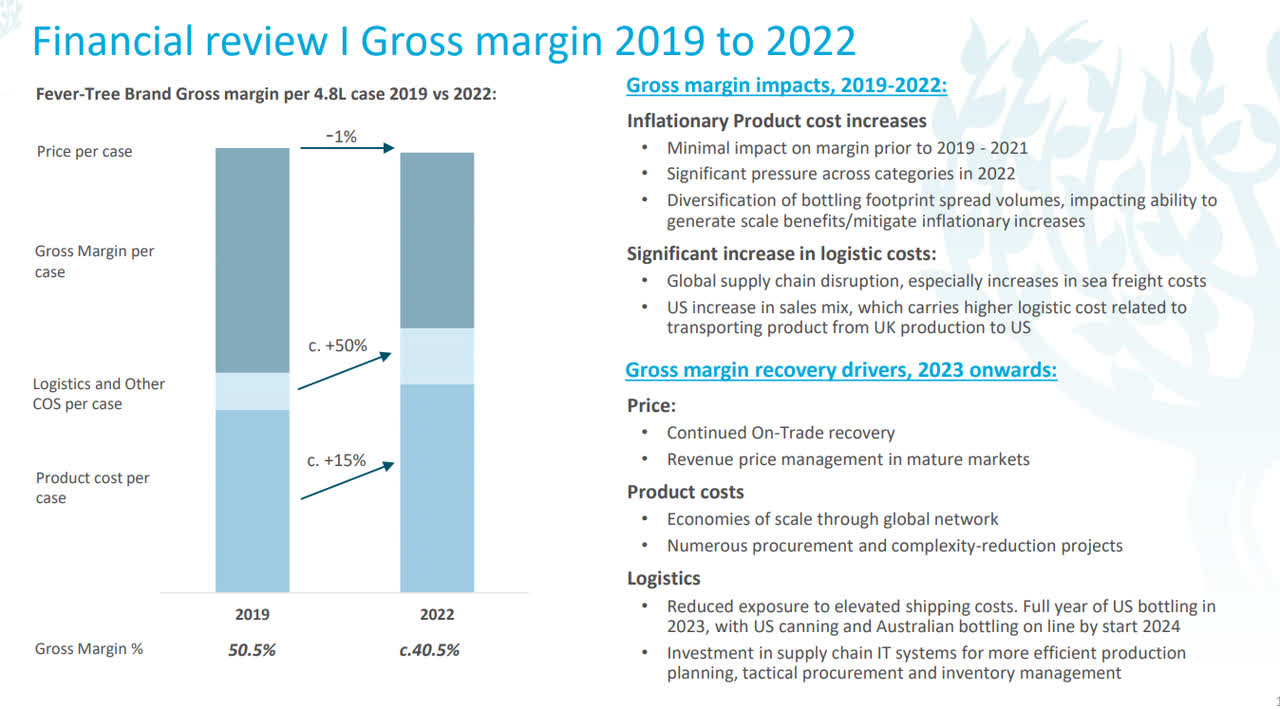

The margin pressures aren’t new as margins have been decreasing for a while but unfortunately there is no magical overnight solution. When it announced its FY 2021 results, Fevertree was hopeful to start turning the ship around in 2023 by focusing on price and cost measures while opening a bottling plant in 2023 and two new canning (USA) and bottling (Australia) plants coming online in 2024. Producing products closer to the customer base should have a positive impact on the supply chain and more importantly, the transportation expenses.

Fevertree Investor Relations

A look back at FY 2021 to see what we can expect

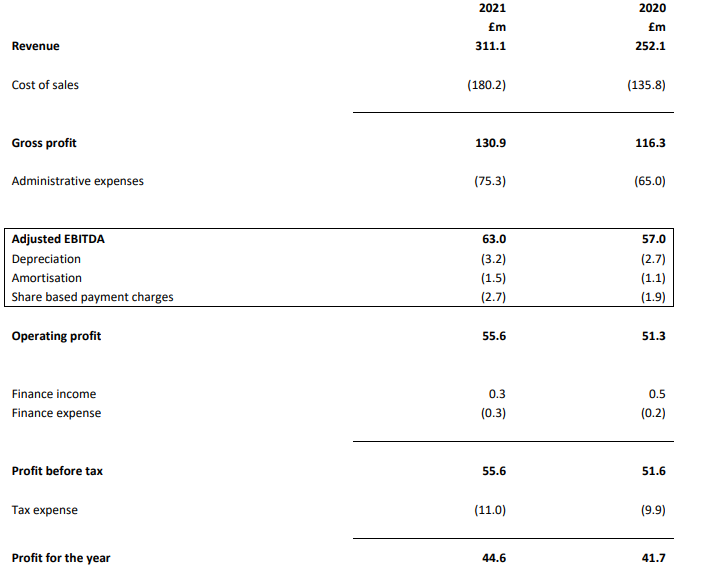

In 2021, the company generated total revenue of approximately 311M GBP resulting in an adjusted EBITDA of 63M GBP (up from 252M GBP and 57M GBP accordingly). The net income was approximately 44.6M GBP for an EPS of just over 38 pence per share.

Fevertree Investor Relations

As mentioned before, Fevertree now expects another year with a double-digit revenue increase, but the EBITDA will nosedive and come in about 30% lower.

Let’s assume the EBITDA will come in at 40M GBP and the depreciation and amortization expenses (4.7M GBP) remain unchanged while the share based payments fall back to 2M GBP again. That would result in an EBIT of 33.3M GBP and a likely net income of approximately 27M GBP for an EPS of 23 pence. Should Fevertree do a better job at protecting its margins, at a 45M GBP EBITDA, the net income will come in around 31M GBP or 26.5 pence per share. In any case, the stock is currently trading at about 40 times earnings for this year.

Fortunately the balance sheet remains in excellent shape. As of the end of 2021, Fevertree had a net cash position of approximately 166M GBP or approximately 142 pence per share. That’s great, but Fevertree also paid a final dividend (10.47 pence) and a special dividend (42.9 pence) in the first semester of this year, so the net cash position has likely fallen to around 100-110 pence per share depending on working capital elements.

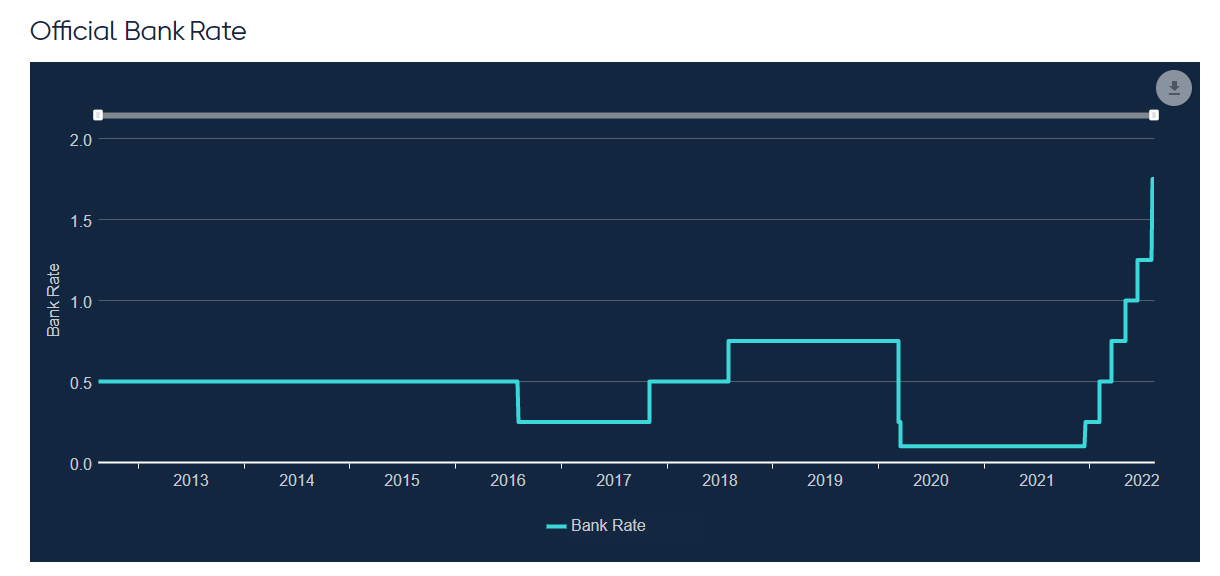

The net cash position could become an interesting factor as interest rates are increasing again. Should Fevertree end the year with 125M GBP in net cash on which it earns a 2% interest rate, the 2.5M GBP in interest income would result in about 2M GBP in after-tax cash flow and earnings. And that isn’t ‘wishful thinking’ as the current Bank of England interest rate has already been hiked to 1.75%.

Bank of England

Investment thesis

The share price decrease can easily be explained by the very disappointing guidance. When Fevertree released its FY 2021 results, the company was expecting a 16-17% EBITDA margin for an EBITDA result of 63-66M GBP. With a range of 37.5-45M GBP right now, about 30% of the expected EBITDA has gone up in smoke.

However, one could make the argument that Fevertree is gradually hiking prices and the only thing ‘lost’ is time: eventually the price increases will catch up with the opex increases. This will not happen overnight and I doubt that even in FY 2023 we will see Fevertree reach its 2021 EBITDA of approximately 63M GBP again. Fortunately the balance sheet is strong, so Fevertree does have the luxury to gradually deal with the opex increases.

I still don’t have a long position in Fevertree but I can see the value at the current levels. If we can get back to last year’s EBITDA result by 2024/2025, the current valuation of about 15 times EBITDA, the current valuation could be justified. Trading at 25 times earnings (using a 63M GBP EBITDA result), Fevertree still isn’t cheap so I’m in no rush to get in.

Be the first to comment