JBCarvalho Photography

Investment Thesis

Ferrari (NYSE:RACE) is one of the world’s most recognizable brands. Founded back in 1942 in Italy by Enzo Ferrari, the brand has grown to become one of the largest car manufacturers in the world. Despite the recent turbulence in the economy, Ferrari continues to show strong resilience. The company’s demographic is also one of, if not the strongest, as the ultra-rich are much less prone to inflationary pressure and economic downturns. Its latest earnings indicate strong demand and growth and the expansion of its catalog is likely to provide further growth opportunities moving forward. The company has also been actively returning cash to shareholders through buybacks and dividends.

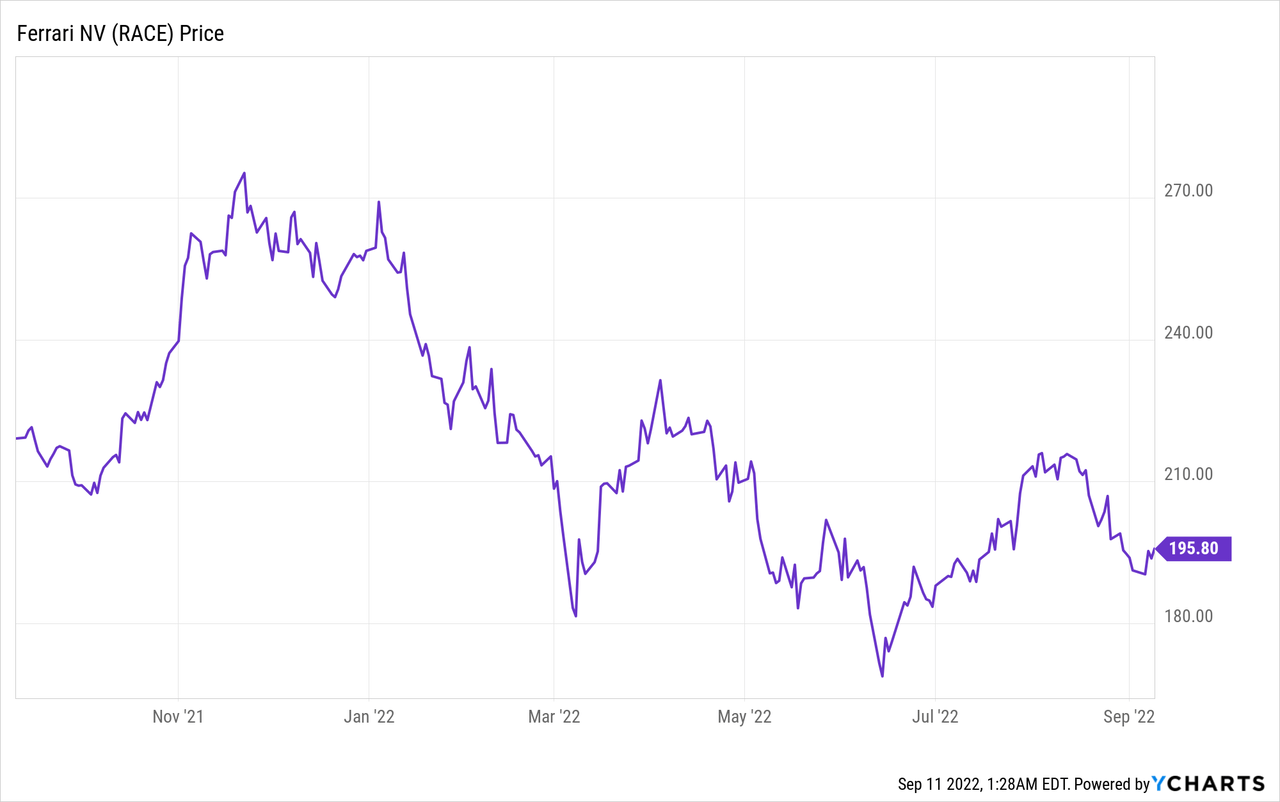

Amid the broad market sell-off, the company is now trading almost 30% below its all-time high last year. However, despite the large drop in share price, the forward P/E ratio of 40 remains very expensive. I like the company’s prospects but I believe investors should wait for a better price point before dipping in, as the current valuation offers very limited upside. Therefore I rate Ferrari as a hold at the current price.

Catalog Expansion

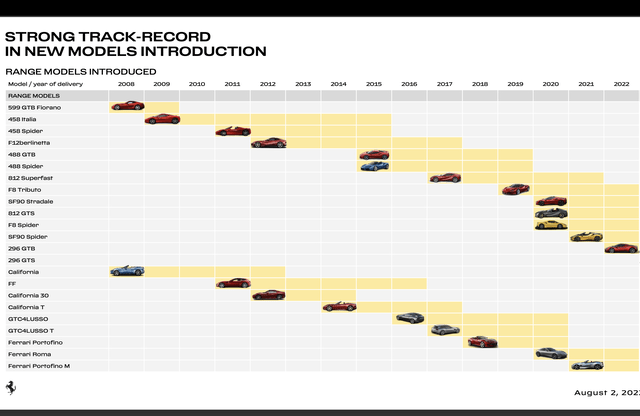

Ferrari’s main growth catalysts include the expansion of its product portfolio. From the chart below, you can see that the company usually introduce 1–2 new range model and 1–2 new limited/special edition model each year. During the latest capital market day, the management team announced that it is going to introduce 15 new vehicles from 2023 to 2026. This is a much faster launch pace compared to prior years. One of the notable launches includes the Purosangue, Ferrari’s first SUV, which is set to be unveiled later this month. It is likely to generate some buzz just like Lamborghini’s Urus.

The company is also going to unveil its first fully electric vehicle in 2025, and the long-awaited supercar within the plan period. The company now expects EVs to account for 40% of its catalog by 2030. These highly anticipated launches are likely to generate strong sales for the company moving forward. The increase in the number of launches should also drive up the total number of orders and shipments.

Ferrari

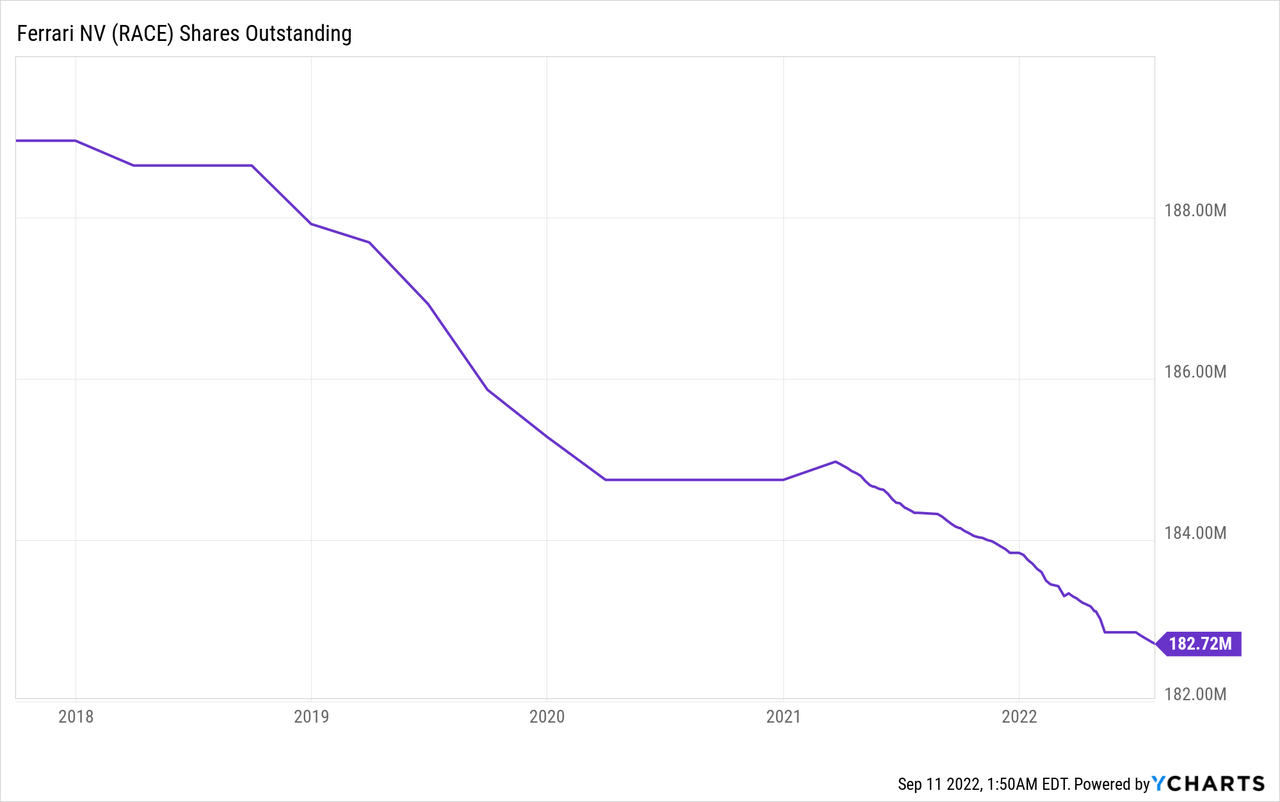

Dividends and Buybacks

Ferrari has very friendly shareholder policies. The company has been actively returning cash to investors through buybacks and dividends, with buybacks being the first priority and dividends being the second. In the past 5 years, the number of shares outstanding has been coming down consistently, as shown in the chart below. In June, management announced the commencement of a new share repurchase program of approximately €2 billion (to be executed by 2026), representing almost 6% of the current market cap. This will likely provide a boost for the EPS figure moving forward.

The company also started distributing annual dividends in 2017. Earlier this year, it increased its yearly dividend by 57% to $1.47 per share. While the current yield is only at around 0.75%, I expect the dividend will continue to grow rapidly. The current payout ratio is only 26.7% and management did signal the figure will be raised to 35% in the future.

Benedetto Vigna, CEO, on dividend and buybacks

Such solid financial profile allows us to keep investing for our future growth, while increasing the shareholders’ remuneration with a combination of dividends and share buyback. Dividend payout will be increased to 35% of adjusted net income and a €2 billion share repurchase program already started.

Financials

Ferrari’s latest quarterly earnings were superb. It beat both the top and bottom line and raised guidance on all metrics. The results are very impressive when considering how volatile the economy had been in the last year.

Benedetto Vigna, CEO, on second-quarter results

Ferrari continues a phase of strong growth, with quarterly record results in terms of revenues, EBITDA and EBIT. The quality of the first six months and the robustness of our business allows us to revise upward the 2022 guidance on all metrics. Also the net order intake reached a new record level in the quarter

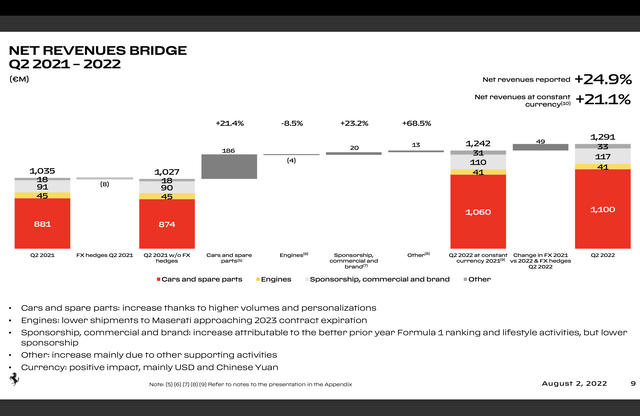

Just a quick note, all the figures mentioned below in this section will be in Euros. Ferrari reported revenue of €1.29 billion, up 24.9% YoY (year over year) from €1.04 billion. The growth is mostly driven by the strong shipment numbers, which were up 29% from 2,685 units to 3,455 units. The shipment for Mainland China, Hong Kong, and Taiwan was up over 110% during the quarter. The company is continuing to see strong demand across the catalog, especially for the Portofino convertible and F8 Tributo. Revenue for sponsorship, commercial, and the brand also saw a 29% increase due to better Formula 1 ranking and higher contribution from lifestyle activities.

Ferrari

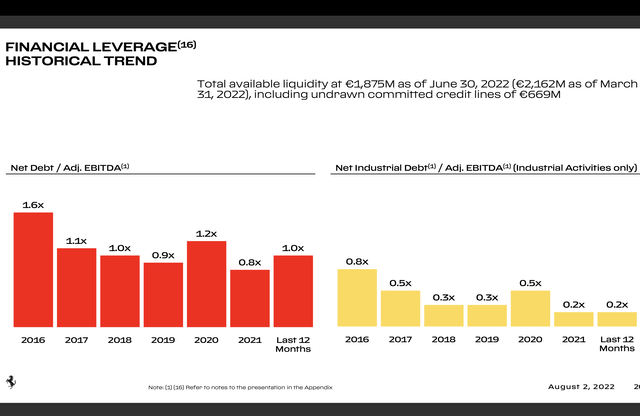

EBITDA for the quarter was €446 million compared to €386 million, up 15% YoY. EBITDA margin dipped slightly from 37.4% to 34.6%, in line with expectations. The drop is largely attributed to the increase in communication and marketing expenses. Net profit was €251 million, up 22% from €206 million. Diluted EPS was 1.36 compared to 1.11, up 23%. The company’s balance sheet remains very healthy.

It ended the quarter with €2.8 billion in debt and €1.2 billion in debt, representing a net debt / adjusted EBITDA ratio of 1, in line with the historical average. The company also repurchased €150 million worth of shares during the quarter.

Ferrari

Valuation

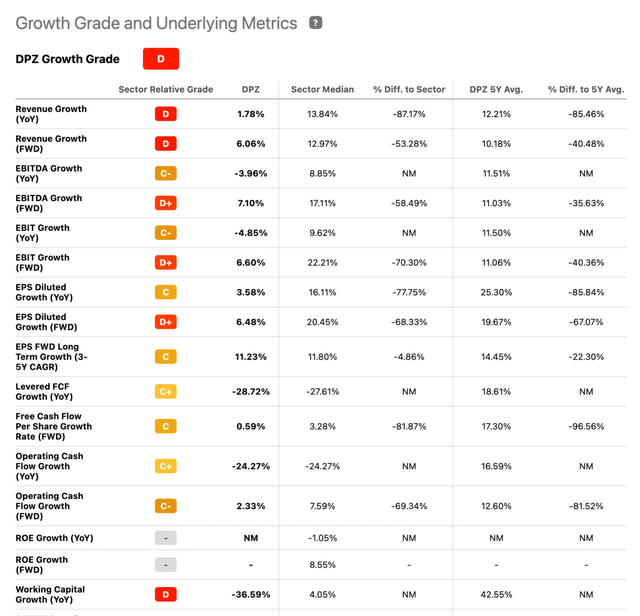

Despite the 30% drop in share price. Ferrari remains very expensive. The company is currently trading at an fwd P/E ratio of 40. There aren’t many brands out there similar to Ferrari so it is hard to find direct comparisons for valuation. The most alike company I can think of is LVMH (OTCPK:LVMHF), which is also one of the world’s most recognizable luxury brands with a resilient customer base. Currently, LVMH is trading at an fwd P/E ratio of 27.6. This is much lower and more reasonable compared to Ferrari’s. LVMH also reported 1H sales growth of 28.2%, even higher than Ferrari’s 24.9%. A 100% premium in multiple seems to be unjustified in my opinion. On a historical basis, the company is currently trading in line with its 5-year average fwd P/E ratio, as shown in the chart below. The current valuation appears to have already priced in a lot of the future growth and capped the near-term upside.

Seeking Alpha

Risks

I believe the two biggest risks in regard to Ferrari are manufacturing progress and foreign currency. Ferrari has a much longer assembly time compared to other car manufacturers. A range model typically takes about three weeks while special editions and supercars can take months. With the current supply chain situation being so volatile, it is possible that the production of its cars may be delayed. This as a result will reduce the supply of current models and even possibly push forward the launch date for new models, driving down the number of shipments in the near term. Foreign currency is another potential risk. Most of Ferrari’s revenue comes from foreign countries, with the US only accounting for approximately 30% of total shipments. With the dollar continuing to spike up, the company may see a negative currency impact on future earnings. While the company does place some currency hedges, it is hard to fully absorb all the impact.

Conclusion

In conclusion, I believe investors should be patient and wait for a better price point. Ferrari continues to report upbeat growth despite facing such a tough environment. Thanks to its resilient customer base, the demand for its cars remains very strong. The company is expected to expand its catalog by introducing 15 new vehicles in the coming 4 years, which include a lot of highly anticipated launches such as its first-ever SUV and EV. It is also continuing to return cash to investors through dividends and buybacks, which will provide additional support for its EPS as the share count decreases. However, the current valuation seems to be very stretched and offers little upside. There are also underlying risks in regard to supply chain stability and currency headwinds. Therefore I rate Ferrari as a hold.

Be the first to comment