onurdongel

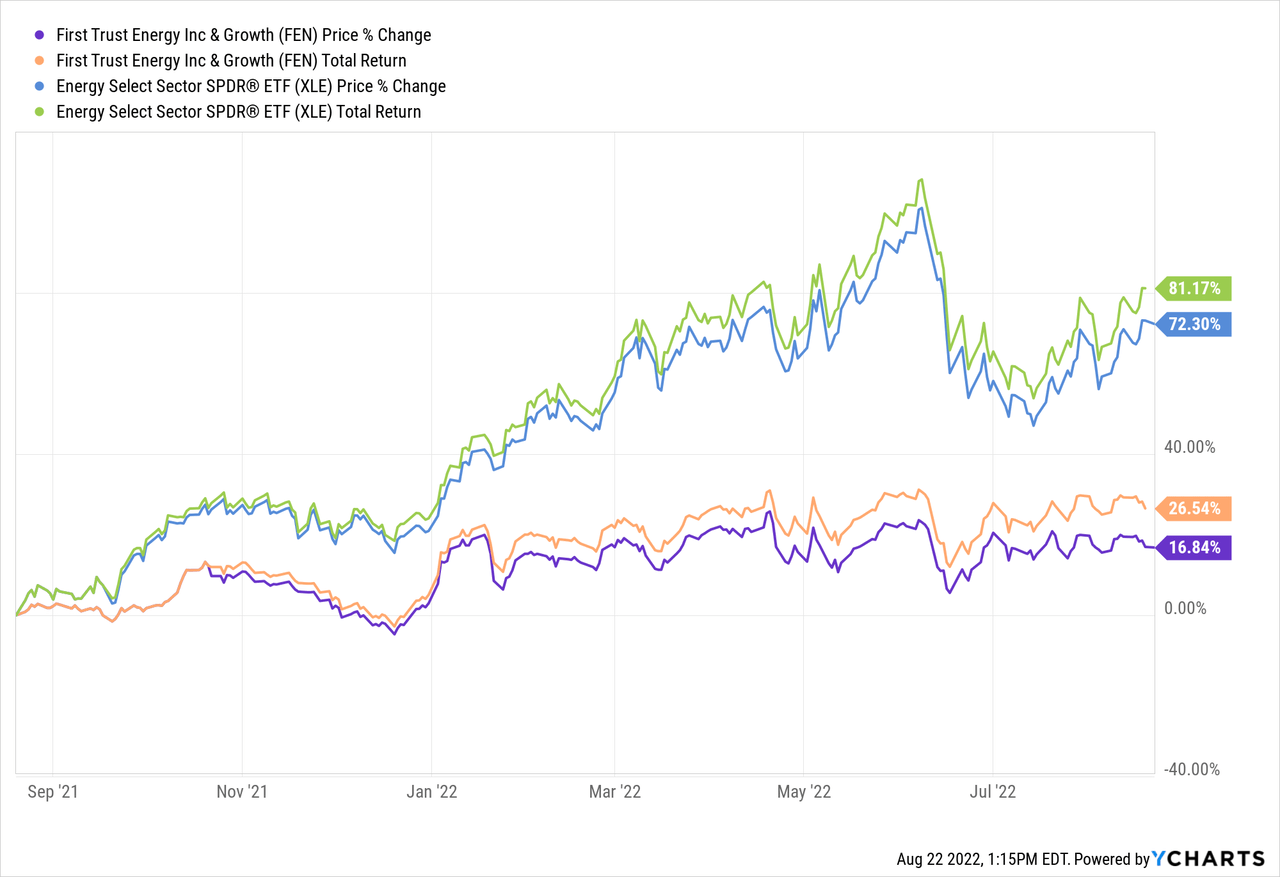

The First Trust Energy Income & Growth Fund (NYSE:FEN) currently has an attractive 7.6% yield considering – despite all the talk about rising interest rates – the yield on the U.S. 10-year Treasury is at pixel time is still only 3.03%. Meantime, the fund has ridden the energy sector rally to be up 17.7% over the past year. That equates to an estimated annual total return of 25.3%. That’s not bad, especially considering the performance of the S&P 500. However, considering the broad Energy Sector – as measured by the Energy Select Sector SPDR ETF (XLE) – has returned close to 70% over the past year, FEN has been a laggard. That being the case, and as I have advised my followers for many years, there is certainly more to investing than a laser focus on yield.

Investment Thesis

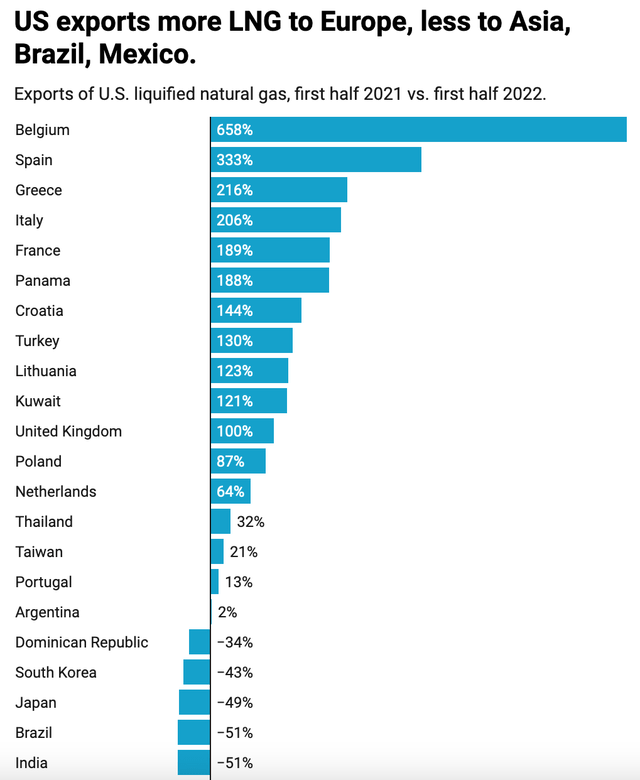

As you no doubt already know, Putin’s horrific war-of-choice on Ukraine, and the resulting sanctions placed on Russia by the United States and its Democratic & NATO allies, have effectively broken the global energy supply chain (and the global food supply-chain as well). That being the case, the planet has seen a surge in oil, natural gas, and LNG prices. That is especially the case in the EU, which had grown ever more dependent on O&G from Russia over the past decade. The EU will learn a hard lesson this winter, but in the meantime, it is ramping up LNG imports from the United States. That is generally bullish for the domestic LNG exporters, but also for the domestic midstream companies – many of which are held in the FEN fund.

Reuters

Source: Reuters – Analysis: U.S. LNG exports to Europe on Track to Surpass Biden Promise

Indeed, the U.S. is not only the #1 natural gas producer in the world, it was the top LNG exporter during the first-half of 2022. So, today I will take a closer look at the FEN fund to see how it has positioned investors for success going forward.

Top-10 Holdings

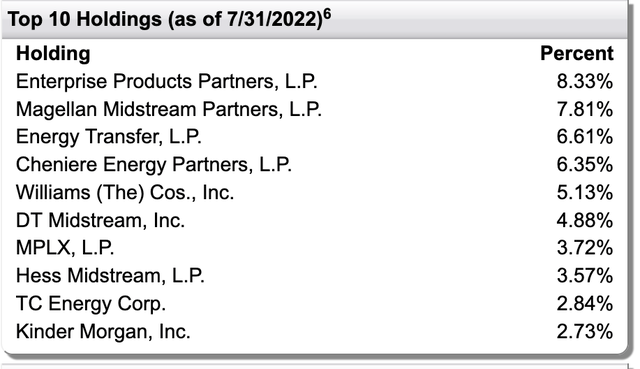

The top-10 holding in the FEN fund are shown below and equate to what I consider to be a relatively concentrated 52% of the entire portfolio:

First Trust

As can be seen, the top three holdings are leading midstream MLPs that, in aggregate, account for nearly 23% of the entire portfolio.

Enterprise Products Partners L.P. (EPD) is the #1 holding with an 8.3% weight. EPD is one of the biggest midstream companies in North America with a market-cap of $59 billion. It currently yields 6.9% and has a forward P/E of only 10.9x. EPD operates natural gas, NGLs, and oil pipelines and is also one of the largest natural gas processors.

The #3 holding with a 6.6% weight is Energy Transfer LP (ET). ET owns & operates five natural gas storage facilities in Texas and Oklahoma along with ~19,830 miles of interstate natural gas pipelines. Energy Transfer also supplies natural gas to electric utilities, independent power plants, and industrial end-users. ET currently yields 6.4% and has a forward P/E of only 7.3x.

Cheniere Energy Partners, LP (CQP) is the #4 holding in the fund with a 6.4% weight. CQP – the MLP of leading US LNG exporter Cheniere Energy (LNG) – through its subsidiaries, owns & operates the Sabine Pass LNG export terminal located in Cameron Parish, Louisiana. The company’s regasification facilities include five LNG storage tanks with an aggregate capacity of ~17 bcf. CQP yields 5.7%.

The Williams Companies (WMB) is another large ($42.6 billion) infrastructure company that owns & operates pipelines, nat gas gathering & processing assets, as well as crude oil and refined products terminal services. WMB currently yields 4.8% and trades at a relatively lofty valuation (at least for midstream companies…) of 21.5x forward earnings.

Canadian-based pipeline company TC Energy (TRP) is the #9 holding with a 2.8% weight. TRP owns & operates natural gas and crude oil pipelines (including Keystone) and distributes natural gas to power generation plants, industries, interconnecting pipelines, and to LNG export terminals. TRP currently yields 5.6%.

The top-10 is rounded out by Kinder Morgan (KMI), another large O&G infrastructure company that currently yields 5.9%. Kinder recently agreed to buy gas-to-power company North American Natural Resources and its seven landfill facilities in Michigan & Kentucky for $135 million.

Performance

As mentioned previously, while FEN throws off attractive income, its capital appreciation has significantly lagged (and so to its total returns …) that of the broad Energy Sector as measured by the XLE ETF:

Note that XLE is no slouch when it comes to income as it is currently yielding 3.5%.

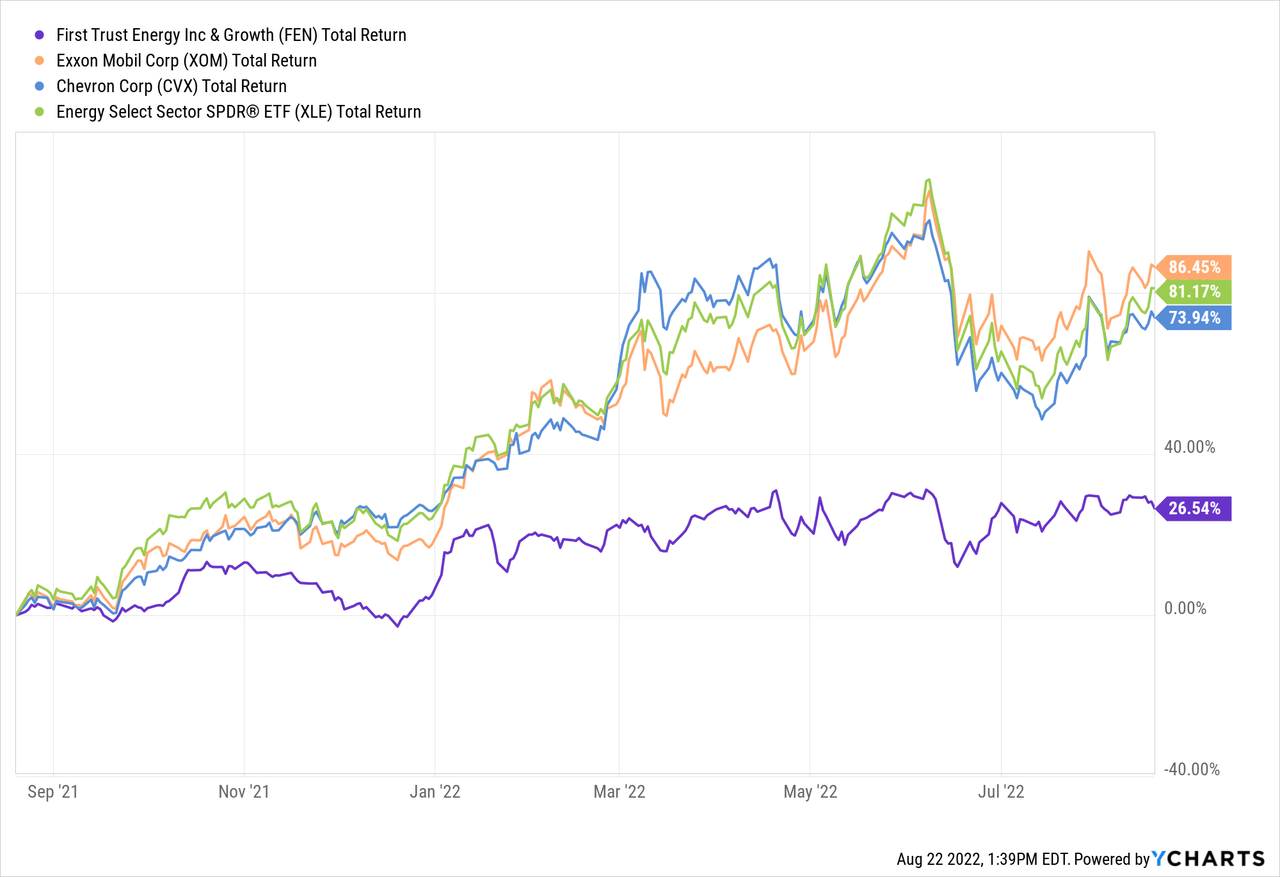

This is a prime example of what I described in one of my most popular Seeking Alpha articles: Retirees Beware: Dividend Investing Is Overrated. That is: over-emphasizing yield can lead to (severely) lagging total returns. However, I certainly allocate a portion of my own personal portfolio toward dividend income and dividend growth stocks – ironically enough, most of which are in the energy sector: Exxon (XOM), Chevron (CVX), and ConocoPhillips (COP), for example. All of these companies have significantly outperformed the FEN fund over the past year, yet still throw off strong yields. Meantime, FEN doesn’t have any of the relatively high-yield shale producers that have adopted variable-rate dividends. For instance, Diamondback Energy (FANG) and its LP Viper Energy Partners (VNOM) are returning tons of free-cash-flow to investors this year. Why those kinds of shale companies aren’t in FEN’s top-10 holdings is a mystery to me (VNOM is up 88% over the past year).

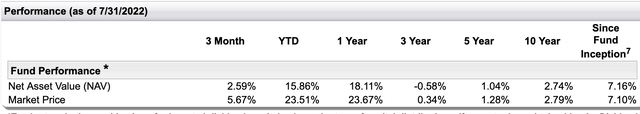

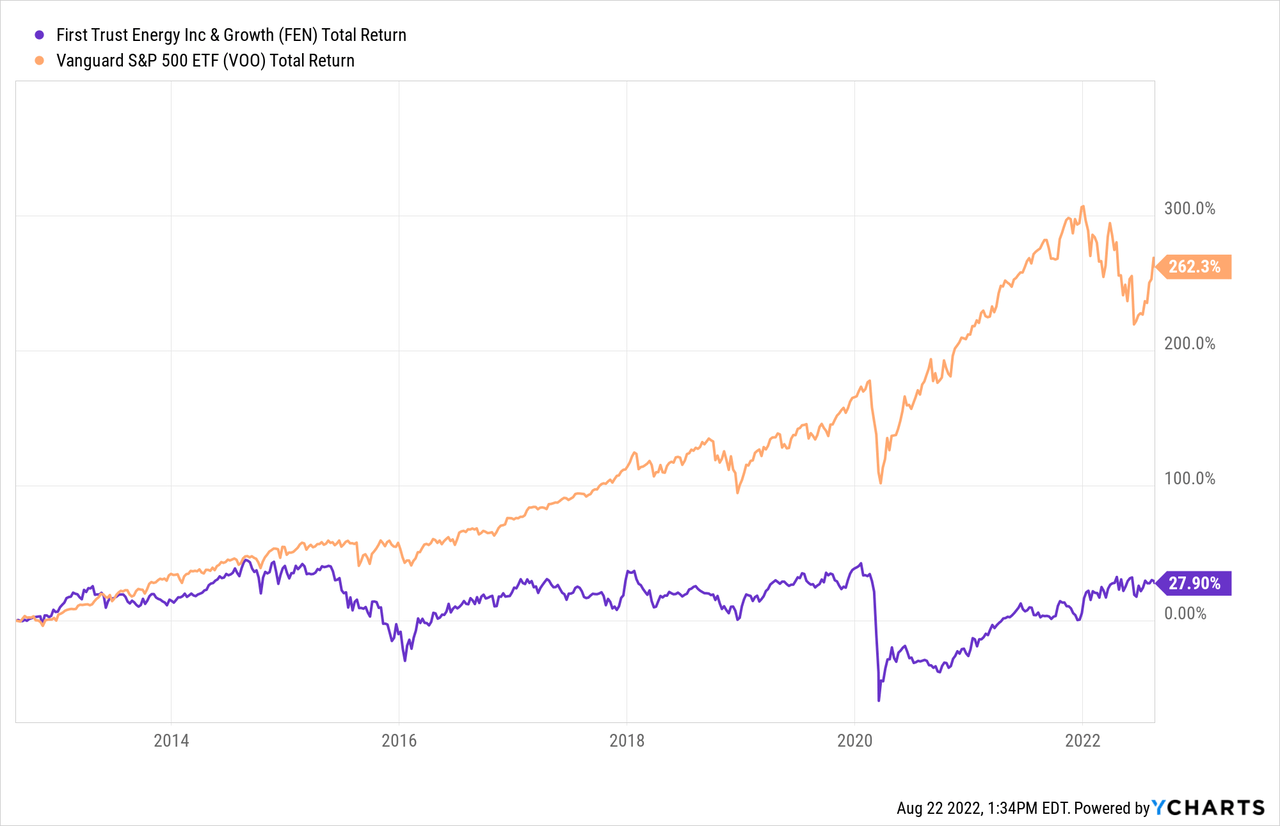

In the meantime, the long-term performance track-record of the FEN fund is, well, rather pathetic: its 10-year average return is only 2.8%.

First Trust

However, to be fair, FEN has outperformed the S&P 500 by 32% over the past year. But over a longer-term horizon, the S&P 500 – as represented by the Vanguard S&P 500 ETF (VOO) – has left FEN in its dust:

That being the case, I cannot advise an investor to allocate capital to the FEN fund unless he or she is considered to be a good timer of the O&G markets. But just remember, in order to be successful in timing the market you have to be right twice: once to get in, and once to get out. Research shows ordinary investors are terrible at timing the market.

Risks

Now, midstream companies generally have lower risks due to their relatively stable flow due to typically long-term fee-based and cost-of-service contracts. On the other hand, my followers know I believe the basic MLP business structure in the U.S. is essentially broken from the LP’s perspective because the partnerships are typically highly skewed in favor of the General Partners (GPs). I have covered numerous examples of how GPs manage the LPs in such a manner so that “take under” transactions (i.e. rolling up an LP into the GP at a valuation level that is less than fair for LP unitholders) is typically the norm rather than the exception. FEN’s heavy reliance on MLPs is likely one big reason why the fund’s 10-year return track-record is so anemic.

FEN is certainly not immune to the global energy market supply/demand fundamentals and the current high inflation rising interest rate macro-environment. Any substantial slow-down in the global economy could put downward pressure on energy prices and – as a result – FEN’s share price.

Meantime, FEN’s expense ratio is 1.43%. Such a high fee is likely due to managing all the associated issues of dealing with the complex K-1 forms most LP’s issue every year at tax-time. This high fee is obviously eating into FEN’s returns and should be considered by investors when they are looking google-eyed at that high-yield “opportunity.”

Summary & Conclusion

The FEN fund is a great example of how an investor can get snookered into a “high yield investment” which results in he or she significantly lagging what the market is more than willing to give them – in this case, the broad Energy Sector. In fact, I would suggest First Trust change the description from “Energy Income & Growth” to simply “Energy Income”. Investors looking for income from energy companies could have done much (much) better simply buying and holding dividend paying corporations like Exxon and Chevron, which currently yield 3.7% and 3.6%, but have blown away FEN over the past year via capital appreciation:

I’ll pass on the FEN fund. Investors looking for diversified income from energy companies should buy the XLE Energy SPDR ETF instead. XLE has delivered superior total returns as compared to FEN.

Be the first to comment