Stefonlinton

In August, I wrote a cautious article on FedEx Corporation (NYSE:FDX), arguing that the company’s FY2025 goals of $105-110 billion in revenues and 10% operating margins are likely not achievable, especially given rising wage and fuel costs.

Since my article, FedEx’s stock price has crashed over 30%, as the company warned on Q1/2023 results and withdrew full year guidance. As the dust has settled post the warning, are FedEx’s shares now worth a buy for long-term investors?

I think FedEx’s cost cutting plans are unrealistic, as most of the miss in Q1/F23 earnings was due to fuel expenses. However, I do think shares have fallen to attractive levels. At $160 / share, investors are now valuing the company assuming a terminal 4.5% operating margin, which appears too low. I would start accumulating shares at these levels, cognizant that shares can fall even lower in the coming quarters if the U.S. and global economies do fall into recession in 2023.

Q1/F23 Recap

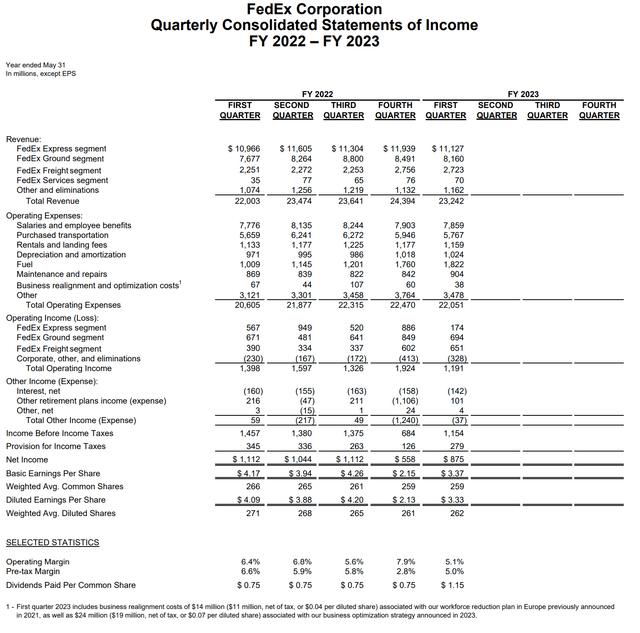

For Q1/F2023 (ended August 31, 2022), FDX reported $23.2 billion in revenues and $3.44 in non-GAAP EPS. Although the revenue figure was close to analyst estimates of $23.5 billion, the earnings number was far below estimates of $5.14 before FedEx pre-announced the warning.

According to management, the main culprit in the earnings miss was a sharp decline in package volumes towards the end of the quarter. In response, FedEx management immediately implemented cost measures to improve profitability.

FedEx expects to reduce total costs by $2.2 to 2.7 billion in F2023, including $1.5-1.7 billion in the Express segment, $350-500 million in the Ground segment, and $350-500 million at the corporate head office. $300 million of the cost cuts have been implemented as of Q1/F23, and another $700 million is expected in Q2/F23.

FedEx also expects to cut another $4 billion in incremental costs by F2025, as part of its ‘Global Transformation Program’.

Was The Miss Really Driven By Volumes?

Looking at FedEx’s financial statements for Q1/F23, although revenues were a miss to consensus, it still represented 5.6% growth YoY. The main issue, from my lens, is a sharp increase in operating expenses, growing 7.0% YoY to $22.1 billion. Even if revenue had met analyst estimates of $23.5 billion, it would still have grown slower than expenses, so earnings would have missed analyst estimates, which called for an unrealistic 23% YoY growth to $5.14 / share (Figure 1).

Figure 1 – FDX Q1/F23 Financial Summary (Fedex Stats Pack)

In fact, looking at management’s actions to immediately cut costs should tell you the headline ‘miss due to volumes’ was a misdirection.

Are Cost Cuts Realistic?

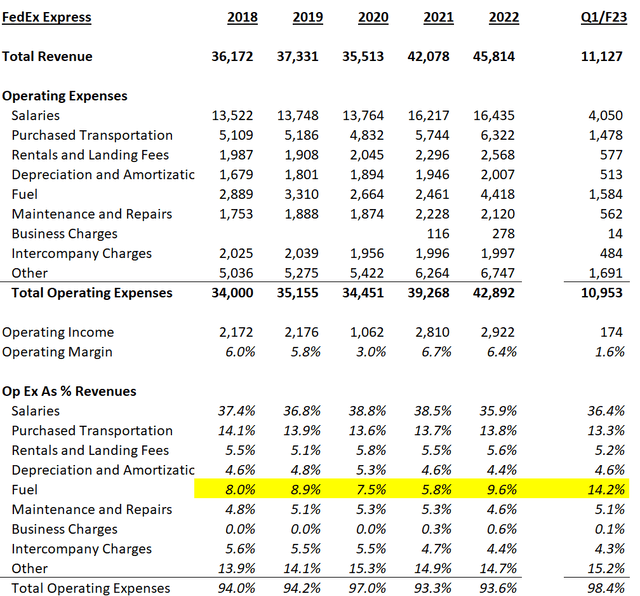

First, looking at the FedEx Express segment, management wants to cut expenses by $1.5 – 1.7 billion (3.7% of F2022 operating expenses at the midpoint) in F2023. However, if we look at the segmented financials as shown in the company’s stats book, Q1/F23 operating margin was a disaster at 1.6% primarily because of the jump in fuel expenses from 9.6% of revenues in F2022 to 14.2% in Q1/F23 (Figure 2).

Figure 2 – FedEx Express Financial Summary (Author created with data from Fedex Stats Book)

Unless FedEx has invented a new plane that can fly without jet fuel, it’s unclear how they can hope to cut $1.5-1.7 billion in operating expenses without impacting service levels. Note that salaries as a % of revenues is not elevated at only 36.4% in Q1/F23, below the 5-Yr average of 37.5%. Fuel as a % of revenues at 14.2% vs. 9.6% in F2022 adds ~$2 billion in annual operating expenses.

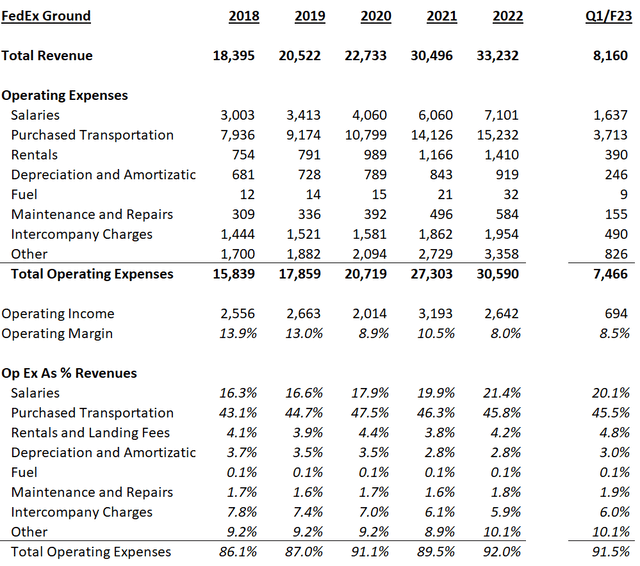

In the FedEx Ground segment, management wants to cut $350-500 million in expenses (1.4% of F2022 expenses at midpoint) in F2023. Here, the cuts seem more plausible, as salaries had been elevated at 20.1% of revenues vs. 18.4% 5-Yr average (Figure 3).

Figure 3 – FedEx Ground Financial Summary (Author created with data from Fedex Stats Book)

However, investors are reminded that FedEx Ground conducts its delivery operations through more than 100,000 vehicles owned and operated by “independent contractors.” I have written about this topic in my prior article, but FedEx contractors are already up in arms as their profitability have been severely squeezed in recent years due to rising wages and fuel costs. Can FedEx perform a miracle and ‘squeeze blood out of a stone’, extracting yet more value out of their contractors?

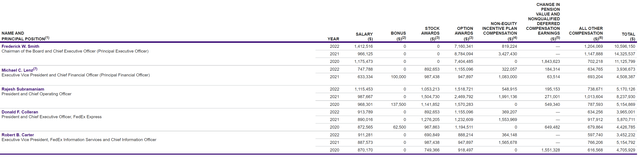

Finally, outside of the Express, Ground, and Freight segments, FedEx has approximately $6 billion in expenses at the corporate level. Is it reasonable to cut $350 – 500 million in expenses here as well? Perhaps management should start with their own salaries, since in Fiscal 2022, they were paid a collective $27.2 million in compensation but FedEx’s stock fell 29% from May 31, 2021 to May 31, 2022, underperforming the S&P 500 by 28% (Figure 4 and 5).

Figure 4 – FedEx Top 5 Executive Compensation (FDX Proxy Statement)

Figure 5 – FDX has underperformed S&P 500 in Fiscal 2022 (Seeking Alpha)

In my opinion, the cost cuts announced by the management team in response to the poor earnings results are not realistic, as most of the poor performance in Q1/F23 had been due to fuel costs. Cutting salaries and other operating expenses may actually be detrimental in terms of reduced service levels and customer satisfaction.

Valuation Getting Attractive

FedEx’s poor quarterly performance probably proves that management’s F2025 goals of 10% operating margin is not achievable, unless energy prices come down significantly in the next few years (in which case, management can claim victory on a job well done!).

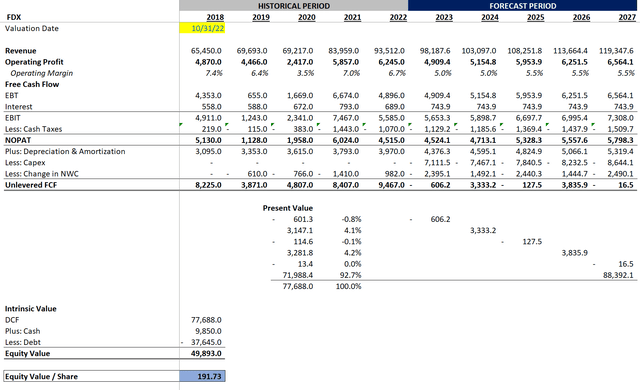

However, if we value the company on more conservative assumptions of 5.0% operating margins in F2023 and F2024, climbing to 5.5% thereafter, we can still come up with over $190 in DCF value for the shares, assuming a terminal 7.0x EV/EBITDA multiple.

Figure 6 – FDX DCF Valuation (Author created)

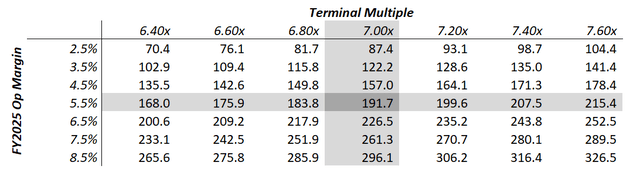

Alternatively, at $160 / share, the market seems to be implying the company will only generate 4.5% operating margins into perpetuity, which appears too low (Figure 7).

Figure 7 – FDX DCF Sensitivity To Op Margins and Terminal Multiple (Author created)

Risk

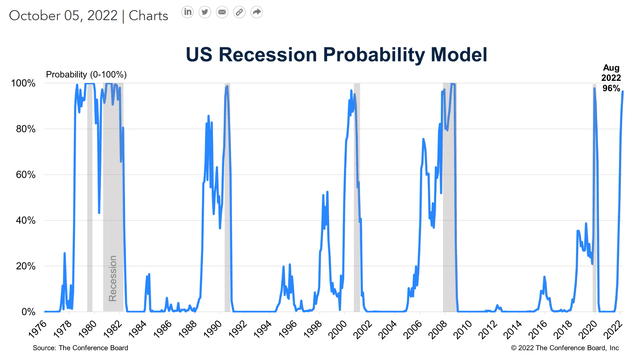

The biggest risk to stepping in and buying FedEx shares at current levels is that the U.S. economy is likely to enter a recession in calendar 2023, as predicted by the Conference Board (Figure 8).

Figure 8 – U.S. likely to enter recession in 2023 (Conference Board)

While shares may look cheap relative to normalized margin rates, they could certainly get cheaper during an actual recession. For example, during the 2008 recession, FedEx’s shares traded as low as 1.0x Price-to-Book (“P/B”) value (Figure 9). Currently, shares are trading at 1.6x P/B.

Figure 9 – FDX P/B (Seeking Alpha)

Conclusion

In conclusion, I think FedEx’s cost cutting plans are unrealistic, as most of the miss in Q1/F23 earnings was due to fuel expenses. However, I do think shares have fallen to attractive levels. At $160 / share, investors are now valuing the company assuming a terminal 4.5% operating margin, which appears too low. I would start accumulating shares at these levels, cognizant that shares can fall even further in the coming quarters if the U.S. and global economies fall into recession in 2023 as predicted by some leading economists.

Be the first to comment