edwardolive

Investment Thesis

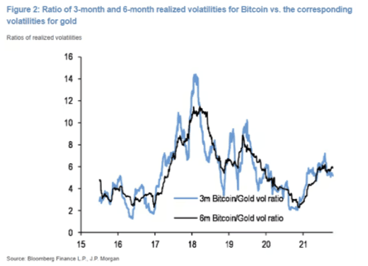

Over the past few weeks, store of value assets have been on a bullish trend once again, whether physical or digital. Precious metals have long beaten the market during inflation in the past. But now we see another prominent player with a trillion-dollar market cap competing against these shiny metals; Bitcoin.

While bitcoin has gained respect among millennials and young investors as a bet against inflation, older generations like the boomers are mostly still cynical about its intrinsic value. But does that mean assets like precious metals will not be able to perform well in the future as an inflation hedge? No, this alludes that those companies which will accept the presence of another store of value asset, and improvise with time, shall remain in the industry and thrive.

With its focus on retail investors, A-Mark Precious Metals (NASDAQ:AMRK) will likely be a major player in the precious metals industry in the long run.

JP Morgan

Source: Fortune

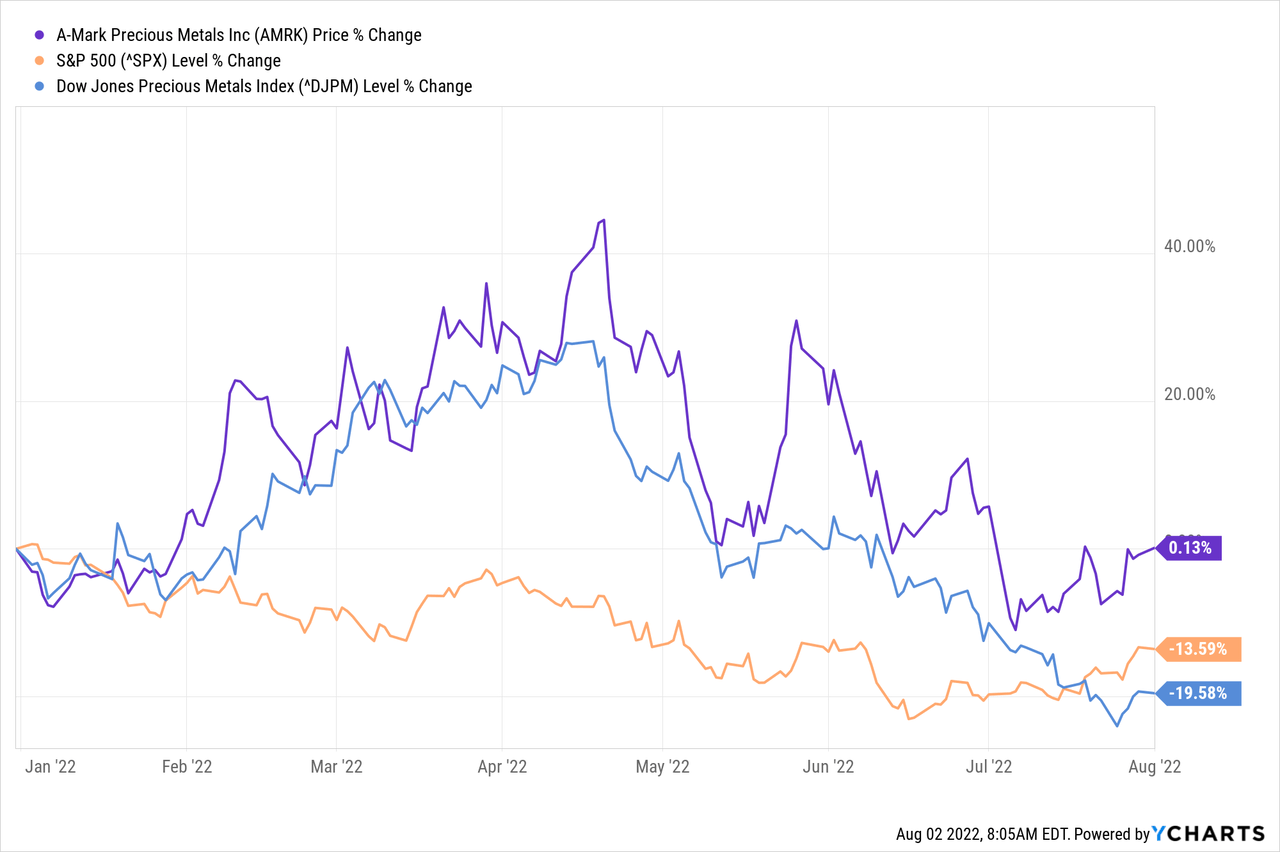

A-Mark Precious Metals, a NASDAQ-listed company, has shown great performance in the past three years, outpacing the S&P 500’s price return by 14% and the Dow Jones Precious metal index (DJGSP) by a phenomenal 20% YTD.

The company’s exceptional financial performance is a front-seat driver of this gain as it generated a record revenue of $8.2 billion in the TTM that ended in March 2022.

With a forward P/E ratio of 3.83x, compared to its sector median of 10.15x, I rate A-Mark Precious Metals as a buy due to its inherent nature of being a value stock with immense growth prospects.

Company Overview

A-Mark precious metals Inc. is engaged in bullion trading of precious metals such as gold, silver, platinum, copper, and numerous coins and other products via a portfolio of channels.

The company has a well-diversified customer base, including dealers, financial institutions, sovereign mints, refiners, brokers, investors, and retail customers. It has been in the precious metal business since 1965, with a portfolio of over 200 products to offer.

The company generates revenue through the following three segments:

E-Commerce (Direct to Consumer): AMRK’s two major subsidiaries, JM Bullion and Goldline, operate in this segment to provide precious metal products to direct consumers. In the past three years, the retail sector has been the company’s core focus with the intent of digitization of precious metal bars and expanding its retail customer base via e-commerce acquisitions.

Wholesale: A-Mark operates in this segment to purchase and distribute precious metals from sovereign and private mints, mostly in the US. However, it “has long-standing distributorships with other sovereign mints, including Australia, Austria, Canada, China, Mexico, South Africa, and the United Kingdom.”

Secured Lending: A-Mark has two subsidiaries working in this category for originating and securing loans by bullion and numismatic coins. Revenue generation from this segment is mostly through interest income.

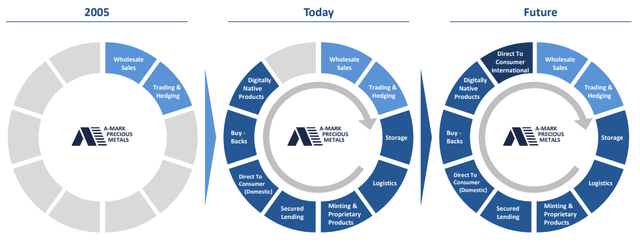

Transition Towards Direct to Consumer (D2C)

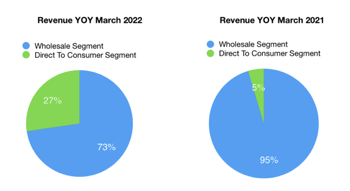

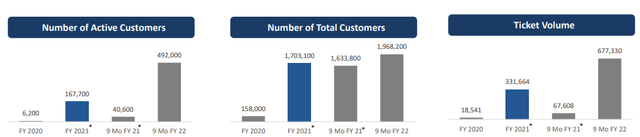

During the previous 5 years, A-Mark has made over three acquisitions, Silver Gold Bull, JM Bullion, and Goldline. AMRK’s business decisions have yielded fruitful outcomes with the strategy to expand its retail operations and build a vertically integrated precious metal platform. The company has expanded its customer base exponentially with an over 11 times YoY growth, predominantly dictated by the JM Bullion acquisition in March 2021.

AMRK Investors’ Presentation

JM Bullion is an e-commerce retailer of precious metals, operating five separately branded, company-owned websites targeting specific niches within the precious metals market. Its success has been one of the many reasons for AMRK’s recent uphill ride as the company absorbs many achievements in its portfolio, including being ranked 40th in the Inc magazine’s 2016 list of the fastest-growing privately held companies in the United States.

This aggressive move has grown the D2C segment’s contribution to total revenue from about 5% in Q1 2021 to over 27% in Q1 2022. The surge in inflation and gold prices since the pandemic have also positively impacted its ascent.

Author

Latest E-Commerce Move: Silver Gold Bull

More recently, A-Mark has entered into an agreement to acquire an equity interest in Calgary-based Silver Gold Bull Inc. for approximately $44.0 million, owning 40% of outstanding shares in SGB. The proposed investment will bring A-Mark’s ownership in SGB to 47.4%, as the company previously owned 7.4% shares back in 2014. The agreement also grants AMRK the right to increase its interest in the company up to 75% in the next 18 to 27 months.

Silver Gold Bull generated a revenue of $650 million in 2021 with a gross and net margin of 6.5% and 4.2%, increasing its YoY sales volume by 47.5% for silver and 29% for gold, indicating a bullishly trending market demand. Its customer base also grew significantly during the year with a 48% YoY customer increase, totaling over 270 thousand customers. With this acquisition, A-Mark expects to further expand its D2C footprint in the international markets.

Cyber Metals – Digitizing Gold

There has been a revolution in financial markets, with innovative products and industries gaining momentum in the past few years. The young generation has been more receptive to the concept of fractionalization and digital ownership of assets. AMRK has also recently announced a digital platform that digitizes large gold, silver, and platinum bars and allows consumers to buy and sell fractional shares of these bars in various denominations.

Upon unveiling this new project, CEO A-Mark Greg Roberts said,

We are excited to unveil CyberMetals as we believe it is an innovative product offering that will attract new precious metals customers from previously untapped sources while reducing friction for precious metals ownership.”

It’s not hard to bridge together that AMRK has been making bold decisions like introducing cyber metals and shifting its target market from boomers to millennials and Gen Z. The company has also invested in digital assets (cryptocurrencies), which had a carrying value of $0.2 million as of the MRQ.

Financial Status

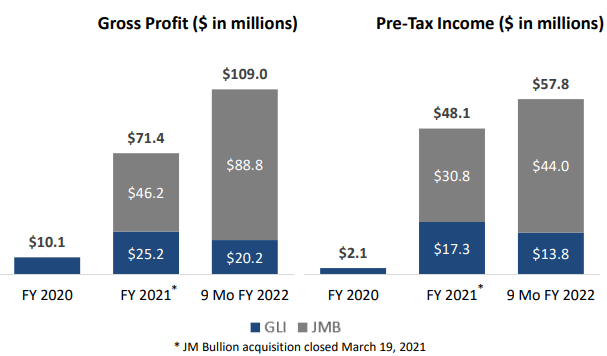

The company’s financial performance is healthy with prospects of sustainable growth. It demonstrated an over 33% YoY growth in the MRQ, primarily driven by its strategic focus on the e-commerce platforms, specifically the JM Bullion and Goldline transactions.

The EBIT margins are significantly lower than its peer average of 21.92%, which is attributable to JM Bullion’s consolidation in AMRK’s books. It appears that AMRK aims to generate profit through a large number of transactions per customer rather than a high margin per transaction, as is apparent from the significant increase in its ticketing volume.

The company could significantly improve its profitability by improving its margins, considering the volume growth it has achieved. A detailed transaction price sensitivity analysis could help the company find a sweet spot between increasing its margins while avoiding losing its volume growth.

Observing its EPS trend, AMRK has impressively beaten 7 out of the 8 previous analyst estimates. The diluted EPS significantly slipped from $8.84 to $3.06 YoY in the MRQ because of a two-for-one split of A-Mark’s common stock in the form of a stock dividend, to make ownership more accessible to employees and investors. The normalized EPS also slid from $5.55 to $4.74, due to a higher D&A charge from $0.4 million to $7.5 million and a higher effective tax rate from 11.3% to 18.2%.

Valuation

The stock is showing signs of serious undervaluation with its revenue metrics, like the P/S ratio of 0.09x and the EV-to-Sales ratio of 0.16x, compared to the sector medians of 2.96x and 2.62x.

Overall, the company appears significantly undervalued using individual relative valuation metrics, except through the P/CF ratio of 26.40, which is almost 2.5 times higher than its peer group. Given the expected FCF per share growth of 28.25% and an OCF growth of 28.74% during the year, the valuation numbers are also likely to improve and shouldn’t be considered in isolation as a deterrent.

Averaging out the company’s metrics to sector median outputs a price tag of around $50, exposing an upside potential of about 65%. I have excluded the forward and TTM-based sales figures from my calculations due to the outlier effect attached to those numbers, which results in unrealistic estimates. The $50 price per share is lower than analyst expectations of around $60 but appears more realistic given the overall market conditions.

The Future

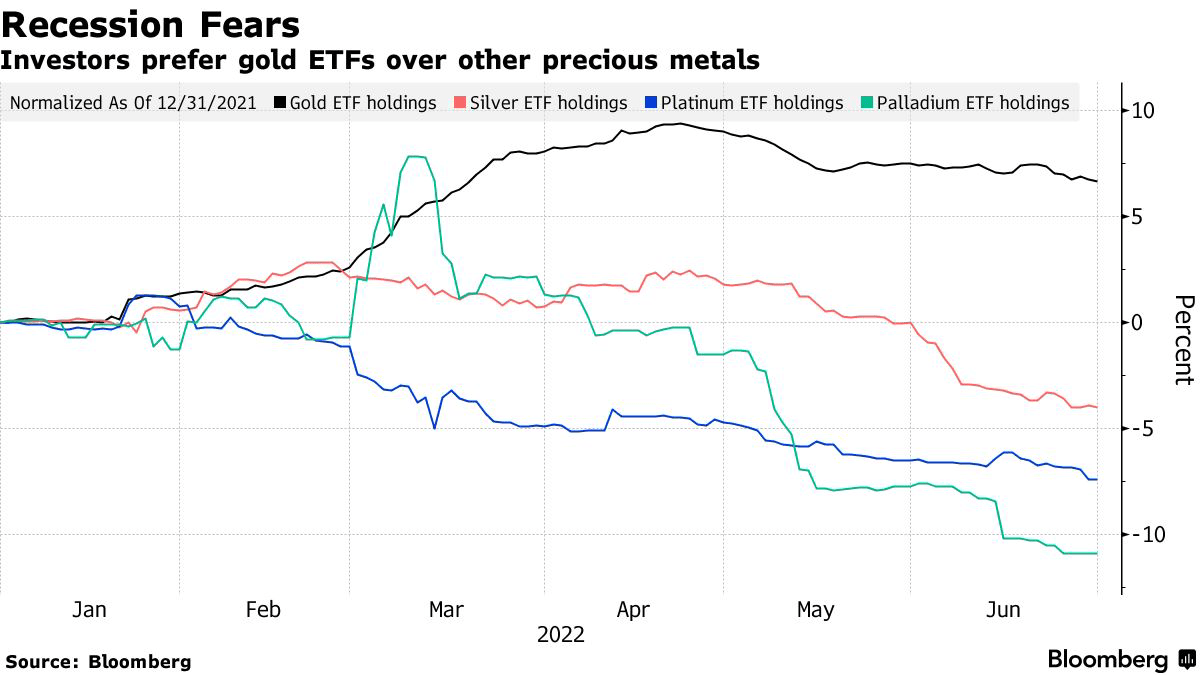

Recently, Gold bulls have been active again, as US GDP contracted by 0.9% this quarter and 1.6% in the first quarter. It seems like the US has entered a ‘technical’ recession, even though some economists are still quibbling over the true definition of a recession. Accordingly, A-Mark has sold over 21 million ounces of silver, up 120% YoY, and over 500,000 ounces of gold, up 170% YoY, in the MRQ.

Bloomberg

Source: Bloomberg

On the other hand, the Fed has been the center of attention for many analysts in the last week of July as the Fed chair raised interest rates by 75 bps for the second consecutive month. Suppose the dollar starts weakening again, the case for the commodities to see a more upward trend might get stronger.

Bullion markets have always been a safe haven for investors to hedge inflation amid economic uncertainties and right now, there is too much uncertainty in the market for risky investments. The precious metals market has a proven track record as a safe investment under these conditions and A-Mark stands to benefit from this scenario, especially as it likely appeals to a lot of the younger generation at a higher level than conventional investments.

Nevertheless, investors need to be aware that a recession impacts almost every industry in the market, and the statement “Past performance is no guarantee of future results,” seems more relevant than ever.

Conclusion

The company’s expansion in bullion exchanges and more emphasis on retailer investors indicate that AMRK is here to stay if it successfully caters to young investors. The new generation has been very receptive to innovations such as digital assets, NFTs, and cryptocurrencies.

The interest and resilience shown by millennials and Gen Z investors by investing in volatile investments that are easy to access and available in fractional denominations could be a major catalyst for AMRK to shift its focus to its new demographic.

Be the first to comment