Chalabala/iStock via Getty Images

Investment Thesis

FedEx (NYSE:FDX) has had a tough couple of years. However, smart capex and a new focus on efficiency should allow the company to remain profitable into the future.

A solid economic moat combined with a flexible workforce allow the company to tailor supply to meet demand. Furthermore, strategic debt management has allowed FedEx to remain immune to the inflationary macroeconomic environment.

Short-term volatilities due to market conditions may lead to a further depreciation in the stock price. This would place shares at a price-point which would make going long on the stock a truly attractive proposition.

Company Background

FedEx is one the major global players in the less-than-truckload delivery marketplace specializing in for-hire, small-parcel deliveries. Its major competitors are United Parcel Service (UPS) in the United States and DHL Express in Europe.

FedEx were the pioneers for overnight deliveries with the creation of FedEx Express and still lead the industry in haste-oriented delivery services for both consumers and corporations. While their total market share and on-the-ground presence is still trumped by United Parcel Service, it is undeniable that their speed advantage and investments into increased capacity have allowed the company to create a unique competitive advantage.

By delivering to over 220 countries using an extensive and flexible network of air and land-based logistics solutions, FedEx has managed to create a unique and robust method to extracting the most out of any given macroeconomic market condition.

The strategy shift from a growth orientated mindset to efficiency maximization by the new management should help provide stable, predictable profits into the future and ensure they remain competitive against a host of competitive solutions from the likes of Amazon (AMZN) and UPS.

Economic Moat – In Depth Analysis

The primary driver for FedEx’s economic moat lies in its innovative Express services and FedEx Ground delivery solutions. FedEx’s Home Delivery Service boasts a 100% coverage within the United States, and they remain the number one solution for consumers and corporations in the US with regards to overnight parcel shipments.

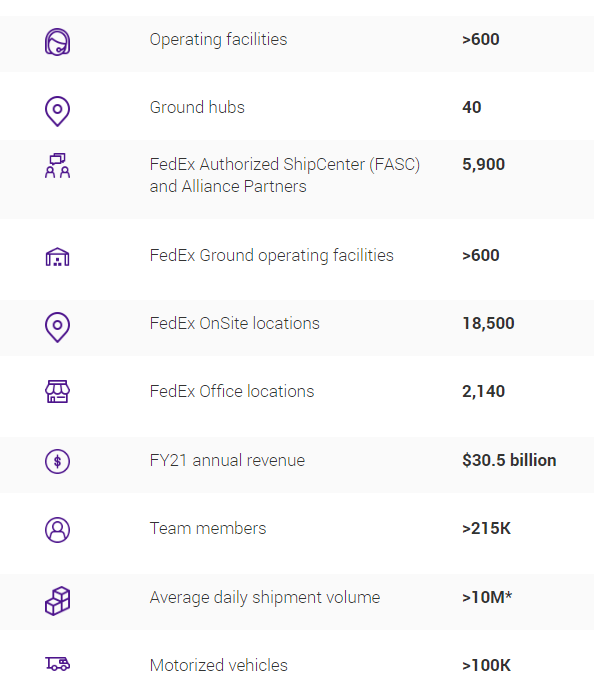

FedEx – About Us

FedEx’s advantage in this segment is largely due to their cost advantage which is derived from the economies of scale the company is able to exploit. FedEx Express operates over 690 cargo aircraft while FedEx Ground is capable of mobilizing over 100,000 motorized delivery vehicles. This demonstrates the significant capital costs associated with the business which creates large barriers to entry for incumbent firms.

However, their 5Y-average ROIC remains at only 7.28% illustrating that their ability to outpace their cost of capital is quite slim.

On a global scale, FedEx dominates the logistics environments alongside UPS and DHL Express. Once more, the significant barriers to entry in the form of capital costs (aircraft, trucks, sorting facilities, depots etc.) and infrastructural limitations (such as airport capacities) make it almost impossible for incumbent firms to enter the market.

The only potential threat towards FedEx comes from innovations from DHL Express in Europe and UPS’ continued expansions globally, along with the slowly developing global network being created by Amazon.

The sheer scale for package processing and high delivery drop-density boasted by FedEx allows the firm to enjoy significant cost-effectiveness in comparison to their competitors.

The significant of this advantage cannot be overstated, and the 2009 withdrawal of DHL from the US domestic package delivery landscape highlights the truly momentous challenge that faces would-be firms from entering the market.

Financial Situation

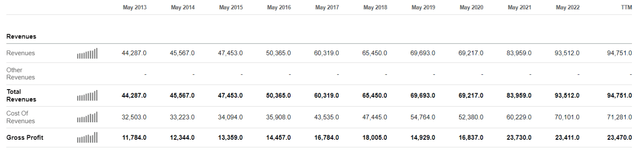

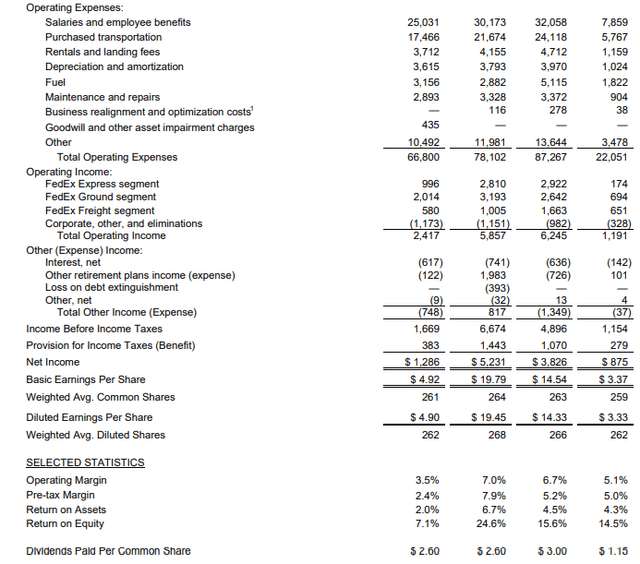

FedEx continues to exhibit a healthy income statement and quite simply, remains a money-making machine. For FY2022 FedEx boasted revenues of $93.5B with a gross profit of $23.4B. These figures represent increases of 35% and 39% respectively when compared to 2020 figures.

While total operating expenses also grew at a rate of 33% between FY2020 to FY2022, this is largely attributable to the labor shortages and thus, the increased revenues spent on salaries in this time period. Increasing fuel costs between 2021-2022 also contributed significantly to the increased operating expenses.

Because of these operational headwinds, operating margins decreased from 7.0% in FY2021 to 6.7% in FY2022. A further decrease in revenues from the Express and Ground segments in Q1 2023 as compared to Q4 2022 suggest the general marketplace for packages and deliveries is softening into the new year.

However, the new shift towards a more efficiency-oriented business model is already starting to be realized with 2023 Q1 operating expenses decreasing compared to Q4. This was primarily thanks to reductions in salaries (-0.6%) and excess capacity purchased transport costs (3%) which offset the 3.6% rise in fuel costs.

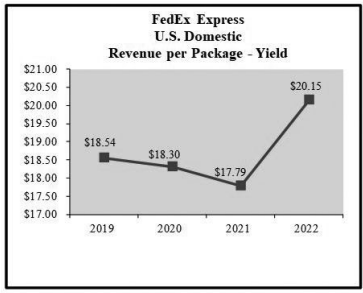

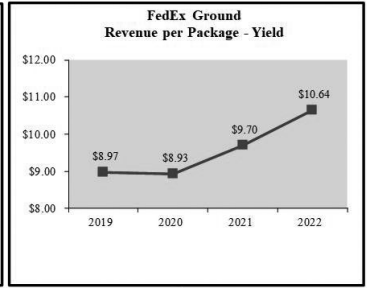

FedEx Annual Report FY2022 FedEx Annual Report FY2022

This increase in efficiency has also been realized in their dollars of revenues per package metrics. Both FedEx Express and Ground have seen significant increases of 13.2% and 9.69% respectively.

From a balance sheet perspective, FedEx is also in good shape. Their total current assets in 2022 amounted to $20,4B with current liabilities only totaling $14.3B. FedEx has no liquidity issues.

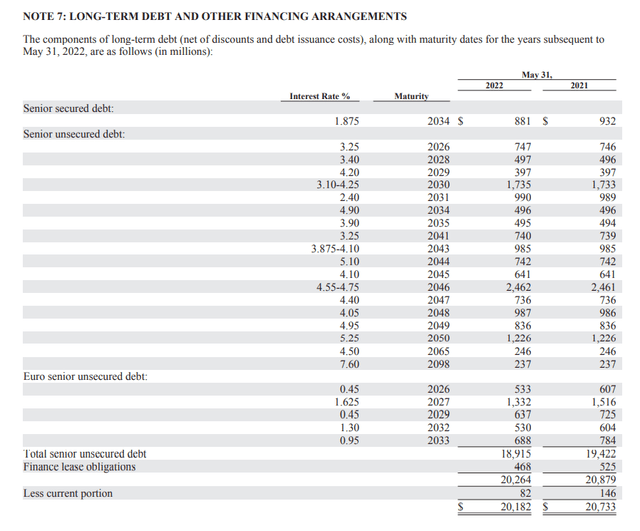

Most of their long-term liabilities exist as senior unsecured debts set at fixed rates with a majority only beginning to mature from 2034 onwards. This illustrates the previous management executed their growth stage with significant forward planning with regards to their debt repayment schedules.

In turn, this should allow FedEx to reap the rewards of their new drive for lower operating costs and efficiency in the form of boosted operational margins and thus, value generation for shareholders.

The securing of fixed rates for a majority of their debts (at a weighted average rate of 3.5%) allows FedEx to avoid the headwinds being experienced by some corporations due to the inflationary macroeconomic environment prevailing globally.

From a cash flow perspective, FedEx is once again in a relatively strong position. Seeking Alpha’s Quant assigns FedEx with a profitability grade of A+ which I believe is representative of the cash flow situation at the company.

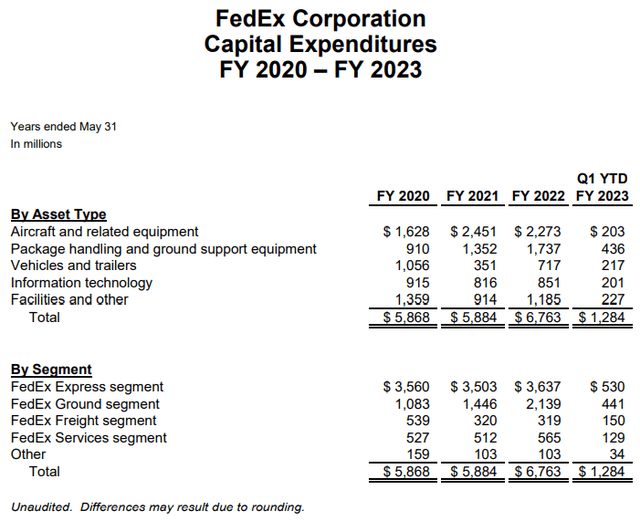

Cash flows from operations amounted to $9.8B in 2022. FedEx spent over $6B in capital expenditures. This is consistent with their 5Y average capex of over $5.3B. Their 2023 capital expenditures are expected to be consistent with 2022 at approximately $6.8 billion.

The primary driver for these capital expenditures is the electrification of their Ground fleet and the modernization of the aircraft operating for Express. This is being done with a focus on decreasing long-term operating and maintenance costs for their machinery.

Nonetheless, while FedEx continues to invest in their business, the capital intensity relative to revenue is expected by management to remain below historical levels

Seeking Alpha’s Quant system has also assigned their dividend payments an A rating with regards to safety which illustrates the sustainability of these payments. While the growth in dividends has been a little slow (5Y growth rate of 16.15%), this is largely attributable to the significant historical expenditure on capital.

As the company transitions fully into their efficiency-oriented operations model, I fully expect their dividends payments to grow while remaining at a sustainable level.

Valuation

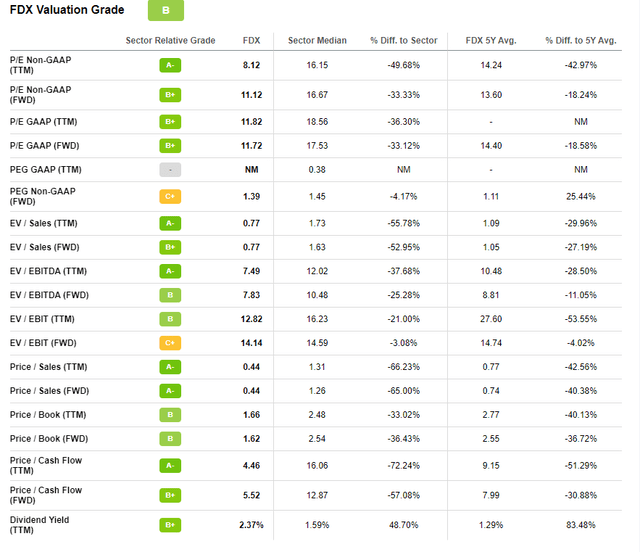

Seeking Alpha’s quant system has assigned a B Valuation rating for FedEx, which I am largely inclined to agree with. Their FWD P/E GAAP of 11.72 is low enough, especially considering a sector median of 17.53 and a 5Y average of 14.40. This is supported by a FWD EV/EBITDA of 7.49 compared to a historical 5Y average of 8.81 and a sector median of 10.48. Equally, their Price/Cash Flow FWD multiple is only 4.46 compared to 16.06 as a sector median.

I believe these metrics illustrate that FedEx is currently trading at prices below its intrinsic market value.

In the short term (6-9 months) I believe the stock price may still exhibit some bearish tendencies due to the difficult macroeconomic environment, softening demand for packages and delivers along with ever rising fuel costs.

However, in the long-term (2-4 years) their strong position as a market leader combined with a efficiency-focused operations model will allow this blue-chip stock to rise back towards a price-point which better reflects its intrinsic value.

Furthermore, it is crucial to consider the price of FedEx in relation to its historical average. The stock peaked in mid-2021 at around $310 per share. While this absolutely represented an overvaluation of the company, the current price of just $158 makes it (when combined with their fundamentally strong and unique operations model and competitive advantage) an absolute steal.

Risks Facing FedEx

The primary risks for FedEx arise primarily from ESG factors and industry competition. Their environmental risk arises from heavy reliance of carbon-based fuels which form the backbone of their delivery network. However, the significant drive for electrification and decarbonization of their supply infrastructure is, in my opinion, tackling environmental concerns to a satisfactory degree.

The main ESG threat for FedEx lies in workers unionizing and becoming classified as “employees” rather than contractors. Currently, only the pilots flying aircraft for Express are unionized along with FedEx’s global workers.

One factor preventing increased unionization is the Railway Labor Act which covers all Express drivers. This means they must vote to organize on a national basis rather than on a local one, thus significantly increasing the threshold for unionization.

The primary risk from unionization lies in FedEx no longer being able to tailor their workforce as dictated by market demand for packages and delivers which would hurt operating margins through significantly increase capital expenditures.

The other potential source of risk arises from Amazon expanding their insourcing of express delivery services. The possibility for Amazon to begin marketing their in-house express network to third-party customers presents a potential threat to FedEx as the Prime concept encroaches directly on the marketspace FedEx Express resides in. However, Amazon lacks the capacity and infrastructural mobility to match FedEx on even a US market level.

Therefore, due to the significant infrastructural investments required from Amazon to achieve this, I believe FedEx will benefit from at least another 10 years of relatively uninterrupted operations.

Summary

FedEx has had a tough couple of years leading-up to 2022. However, solid business fundamentals, smart capital expenditure and a new focus on efficiency have allowed the company to grow significantly while remaining profitable throughout. In my opinion, share prices are yet to reflect the value generated by the firm.

As a short-term investment, I believe there is still too much potential volatility for the stock as uncertainty surrounds fuel prices and demand-side headwinds due to inflationary market pressures. However, in the long-term I believe their strategic debt management and robust business model will ensure profitability and shareholder value generation.

It’s not often you can pick-up a blue-chip stock like FedEx at a truly attractive price, and I believe the time has finally come to go long. If share prices drop another $20-$30, the stock will be an absolute no brainer for value investors.

Be the first to comment