Mario Tama

FedEx Corporation (NYSE:FDX) preannounced Q1 ’23 earnings the week of September 16th, and the results were not good, and then the scheduled earnings release supporting financials were released last Thursday, September 22 ’23.

All the damage was done in the stock on September 16th, 2022 when shares of FDX fell 21% on the negative preannouncement.

Clients saw some tax-loss selling of FDX in taxable accounts following the earnings pre-announcement, but the majority of the position is still owned since the majority of the damage is now is now in the price.

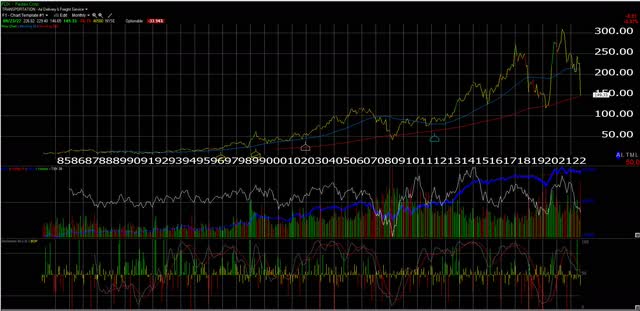

Looking at the chart:

FedEx Monthly Chart (Worden Telechart )

It surprised me pulling up this chart seeing the stock of FedEx testing it’s 200-month moving average. That’s a 16.66 year moving average.

It could be saying as much about the stock as it is about the current market we are facing today.

The March, 2020, Covid low for FDX was $88 per share so if you don’t think FedEx could get much worse in terms of stock price depreciation, trust me it can, but the 200-month moving average could be more meaningful today than it was in March ’20.

The fact is FedEx may be the worst kind of stock for this type of market today since the company is a:

1.) capital-intensive, global brand

2.) with a high degree of operating leverage

3). Revenue and EPS that are very sensitive to economic conditions

4.) Capex as % of cash-flow-from-operations is historically higher than 50%, and that’s not good.

5.) From the conference call notes, the US and Asia geographies saw volume shortfalls that were predominantly economic, while Europe was both economic and service-related per Raj Subramaniam.

FedEx’s conference call notes (found here on Seeking Alpha) are a great read on what’s happening to global freight rates in China, Southeast Asia and Europe.

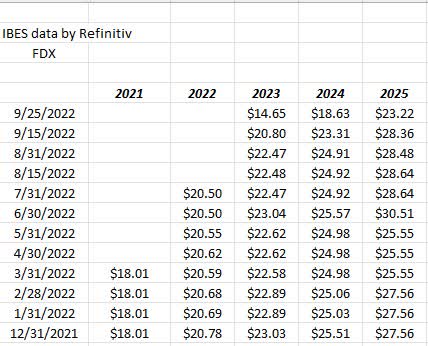

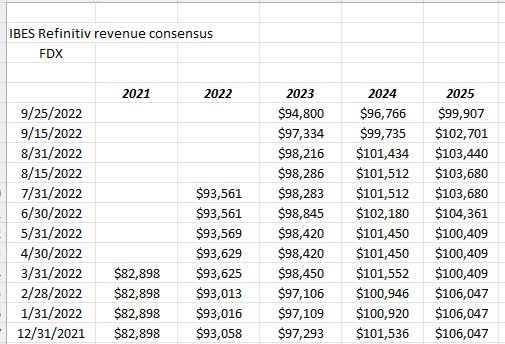

Trends in FDX EPS and revenue estimates:

FDX EPS revisions (IBES data by Refinitiv ) FDX Revenue revisions (IBES data by Refinitiv )

Readers can see the sharp decline in fiscal ’23’s EPS estimate with the stock trading at roughly 10x the fiscal ’23 EPS estimate as of this weekend, however, we can probably assume both revenue and EPS revisions will continue to decline until the central bank rate increases stop or international economies start to grow once again.

FedEx valuation:

| Valuation metric | FDX price on 9/23 at $150 p/s |

| Avg exp 3-yr EPS gro | 8% |

| Avg exp 3-yr rev gro | 2% |

| Price to sales (revenue) | 0.41x |

| Price-to-book | 1.5x ($95 per sh) |

| Price-to-cash-flow | 4x |

| Price-to-free-cash-flow | 14x |

| Free-cash-flow yield | 7% |

| M-star fair value | $225 |

| Dividend yield | 3% |

Source: valuation spreadsheet based on trailing-twelve-month metrics and Morningstar data

Valuation metrics are always a snapshot in time, with the stock at a certain price and the valuation metrics based on historical or projected financial data so take all these metrics with a substantial dose of skepticism. These can and will change in the next 30 – 60 days depending on the Fed and the US economy.

The big news to come out of Thursday night’s conference call is that FedEx is expected to take annualized cost savings of $2.45 billion (midpoint of $2.2 bl – $2.7 bl. projected) out of the cost structure in fiscal ’23.

FedEx’s total operating expenses average about $22 billion per quarter so the freight giant is looking to remove a little more than 10% of operating expenses in the next year.

Just looking at the math over the last 2 years, FedEx Express will likely see the most of the cost savings given its global nature and the state of Europe and China, while Ground has seemingly worked through its operational issues around the surge and then collapse of ecommerce around Covid-19 in 2020 and 2021 and FedEx Freight has actually been putting up solid results.

Summary / conclusion: FedEx is probably the poster child of the kind of stock you don’t want to own in a global recession, for the reasons noted in the 1 – 5 bullet points above.

The long-term issue for FedEx is the capex required of the business. At over 50% of cash-flow, capex like that makes for a very tough existence for companies in that position and makes a company very sensitive to changes in the economy and their revenue.

What’s puzzled me over the years is FedEx Express and the fact that the segment is consistently between 40% – 50% of total revenue but has had a hard time leveraging Express revenue for similar operating income growth. It’s not that Express doesn’t grow operating income – it does – it doesn’t grow it consistently along with revenue growth at the same rate. Again, that’s the consummate drag of operating leverage.

I’ve often wondered just from looking at the math (and FedEx’s disclosure of their financial state is excellent) whether there is a way to permanently downsize FedEx Express and improve their profit margins.

Nirvana for FedEx is 10% operating margins, but with this latest pre-announcement, FDX’s operating margins will likely be between 5% -6% until the Fed starts cutting rates and global growth returns.

The last time FedEx saw a 10% operating margin was fiscal Q4 ’17.

The cost savings initiatives for FDX are helpful but much of these savings should be made permanent, to boost that operating margin permanently and reduce the capex-heavy dependence of the company.

In the title I noted that it is “too late to sell” but that is an individual decision for readers. In fiscal ’19 when the Powell and the Fed were last raising the fed funds rate and FedEx warned, the stock took well over a year to recover while the SP 500 returned 31.8% in 2019.

In June ’21 this article was published on FedEx, which was poorly-timed on my part with the stock trading close to an all-time-high. With the latest drop in the stock (Sept ’22), FDX’s price-to-sales revenue now matches the price-to-sales metric last seen between late 2008 and mid-2009 or the depths of the last global recession. (On the valuation spreadsheet, sometime between late ’08 and early ’09, FDX’s price-to-sales hit 0.33x. ) Even if readers assume that fiscal ’23 revenue falls to $90 billion, down from $94.8 billion estimate currently, the $38 – $39 billion market cap at $150 per share, heavily discounts $90 billion in annual revenue or lower than that.

FDX is down more than 50% from its early June ’21 high of $319 per share. It depends on how bad you think the recession will be and how long you think it lasts.

The current shares are being kept for now but that may change too. The goal will be to scale in and lower the cost-basis for clients over time.

Be the first to comment