FedEx Ground Justin Sullivan/Getty Images News

FedEx (NYSE:FDX) plunged more than 16.5% after today’s close after-market trading after it withdrew its FY 2023 earnings guidance and missed 2023Q1. It was a significant step back from what FedEx had predicted at the end of June.

The company said,

First quarter results were adversely impacted by global volume softness that accelerated in the final weeks of the quarter. FedEx Express results were particularly impacted by macroeconomic weakness in Asia and service challenges in Europe, leading to a revenue shortfall in this segment of approximately $500 million relative to company forecasts. FedEx Ground revenue was approximately $300 million below company forecasts.

But it added,

…macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S. [My emphasis].

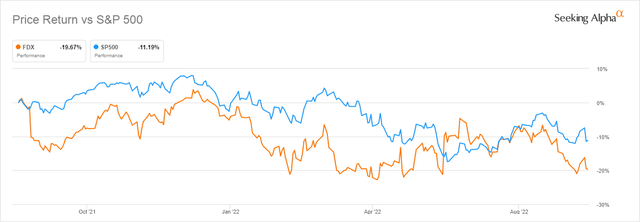

FedEx has a somewhat close correlation to the S&P 500 (SP500), with a 24-month Beta of .80 and a 60-month Beta of 1.20. The Beta of some peers in the industry peers are similarly — and even more closely — correlated. The price-return comparison of FDX and the S&P 500 for the last year is shown below.

Upon first hearing the FedEx news, and that so much of it was tied to Asia and Europe, I had presumed — hoped, actually — that much of it was attributable to translation risk as the USD is, for the moment, the “tallest pygmy” among G7 currencies. The EUR, JPY, and GBP have all plunged slumped badly relative to the USD. But FDX press release doesn’t speak of the currency pairs. It speaks of volume and negative trends overseas and in the USA.

And that should concern the broader market.

Thesis

Companies like FedEx service the larger economy. Its CEO, Raj Subramaniam, just said a few hours ago what was my thesis for this article: That FedEx’s precipitous decline in volumes signals that we’re “going into a worldwide recession.” That’s because FedEx’s old tag line, “When it absolutely has to be there overnight” is less urgent in a slowing economy.

When you think about it, FDX is caught in Asia, where China’s GDP was recently cut to just 2.7% by Nomura; Japan, where the Bank of Japan has cut its growth estimate to 2.0%; Europe, where the European Commission estimates a 2.7% growth rate; Great Britain, 2.3%; and the USA, where the Conference Board estimates GDP growth of just 1.4%. And all those estimates are from earlier, not later, in the quarter when FedEx saw its operations fall off.

Inflation in consumer necessities like food, transportation, and shelter will squeeze out consumer spending and force demand destruction and tighter margins, as will rising rates. Producer prices, while down in August, were still up absent food and energy. It should be noted, too, that as a US company, FedEx will have foreign currency translation pressures that European and Asian competitors will not have to face locally. To remain competitive in Europe and Asia, FedEx will have to lower “in-country” prices, causing additional margin pressure.

Conclusion

FDX is planning to cut costs and has other challenges ahead, including its defined benefit pension liability and reduction-in-force costs that it plans as part of its cost-cutting. Heading into a deep, wide, global recession, FDX will likely face disinflationary pricing as companies accept longer delivery times and use other, cheaper, alternative. We expect FDX stock will decline by as much as an additional 20% by this time next year and, for that reason, it should wait for signs of an upturn before doing its planned stock repurchases. Sell or short.___________________________________________________ *With apologies and a tip-of-the-hat to the producers of the 1976 Walter Matthau/Tatum O’Neal film, “The Bad News Bears” ___________________________________________________

Note: Our commentaries most often tend to be event-driven. They are mostly written from a public policy, economic, or political/geopolitical perspective. Some are written from a management consulting perspective for companies that we believe to be under-performing and include strategies that we would recommend were the companies our clients. Others discuss new management strategies we believe will fail. This approach lends special value to contrarian investors to uncover potential opportunities in companies that are otherwise in a downturn. (Opinions with respect to such companies here, however, assume the company will not change).

Be the first to comment