Spencer Platt/Getty Images News

Introduction

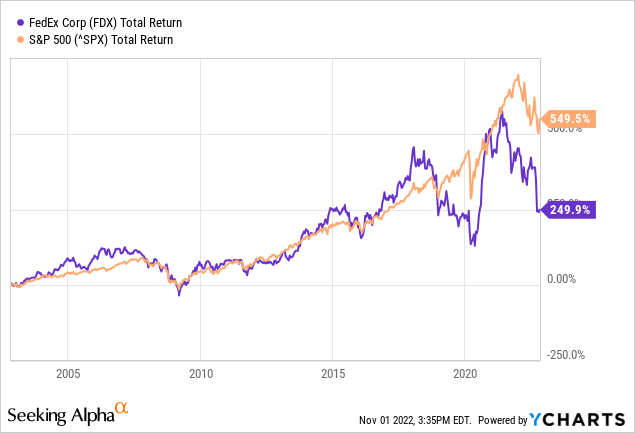

FedEx (NYSE:FDX) experienced strong growth over the past 20 years, but since the corona crisis, its strength has weakened and it continues to lag behind the S&P500. The low price might look like a potential buying opportunity, but there are some risks lurking for FedEx.

Quarterly results came in lower than expected and FedEx lowered volume expectations. The treasury yield spread quoted below 0, and from a historical perspective this indicates an emerging recession. The accelerated share buyback is a temporary catalyst for upwards movement of the share price, but there are many risks to the stock price. Therefore, I believe the stock is a sell.

Quarterly Results Fell Short Of Expectations

During the first quarter of the current fiscal year, revenue grew 5.6%, but earnings per share fell 21% year over year. Earnings per share was well below analysts’ expectations, they expected an increase of more than 18%. FedEx also lowered its forecasts for ground volume due to a decline in customers shipping packages with FedEx.

Quoted from the earnings report:

First quarter consolidated operating results were adversely impacted by global volume softness that accelerated in the final weeks of the quarter due to weakening economic conditions. In addition, results were negatively affected by service challenges at FedEx Express. Yield improvements, including fuel surcharge increases, more than offset the decline in volume, resulting in an increase in revenue for the quarter.

In response, the company implemented cost actions and continued its focus on yield management and revenue quality to mitigate the effect of volume declines. However, the impact of cost actions lagged volume declines and operating expenses remained high relative to demand.

Over the past two quarters, U.S. GDP has declined, pushing the United States into recession. A drop in GDP affects FedEx because consumers are spending less. Still, I expect an emerging recession within a year because the spread between the 10-year and 3-month interest rates is currently below 0. Historically, this means that the U.S. could enter a recession within now and a year. A recession could mean earnings expectations for FedEx are in jeopardy. Still, analysts expect earnings per share of $18.25 on average in fiscal 2024. Because the yield spread has become inverse, I expect future earnings to be less rosy than analysts predict.

Accelerated Share Buyback Program Is A Temporary Catalyst

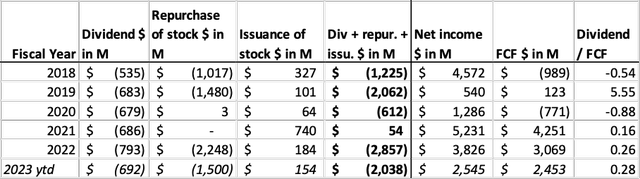

FedEx has always been shareholder-friendly, yet this has not led to a sharp rise in its share price from 2020. FedEx pays dividends and buys back its own shares. Currently the dividend is listed at $4.60. At the current share price of $158, this means a dividend yield of 2.9%.

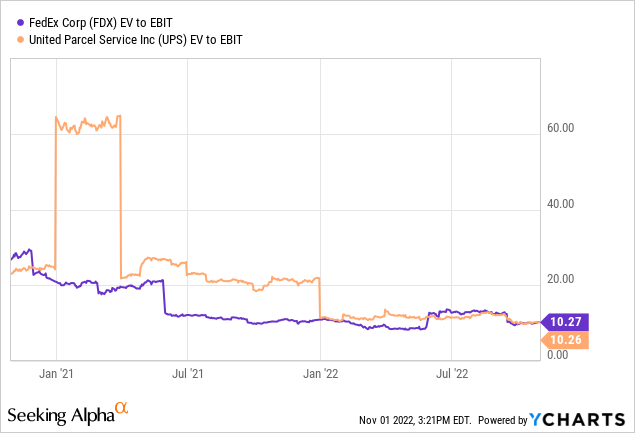

Repurchasing shares is a tax-friendly way to return cash to shareholders. When the US enters an economic recession, FedEx’ profit could decline fast. FedEx operating profit margin is very low compared to UPS’s, so the drop in profits may be sharp (FedEx operating margin = 5%, UPS operating margin = 13%).

FedEx is accelerating share repurchases totaling $1.5B worth of shares. On the current market capitalization, this provides a buyback return of 3.7%. The share repurchases are expected to be completed before the end of FedEx’s fiscal year, which will take place on May 2023. The rapid repurchase will limit a further share price decline until next fiscal year. In the short term, a rise in share price can be expected, but I expect it to be temporary given the economic risks.

In recent years, FedEx has been shareholder-friendly by introducing a sizable share buyback package in addition to a small dividend. In total, FedEx paid out more to shareholders than free cash flow generated from 2018 to date. The cash returned to shareholders was financed by their free cash flow, but also by taking on debt.

FDX’ Cash Flow Highlights (SEC and Author’s Own Calculations)

As a result, their long- and short-term debt rose sharply to $20B, more than 50% of their market capitalization. Fiscal year 2022 free cash flow was only $3B, making debt a factor of 7 of their free cash flow. That’s a lot if free cash flow declines in a coming recession.

Valuation In Line With Competitor, But Take A Look At Competitor UPS

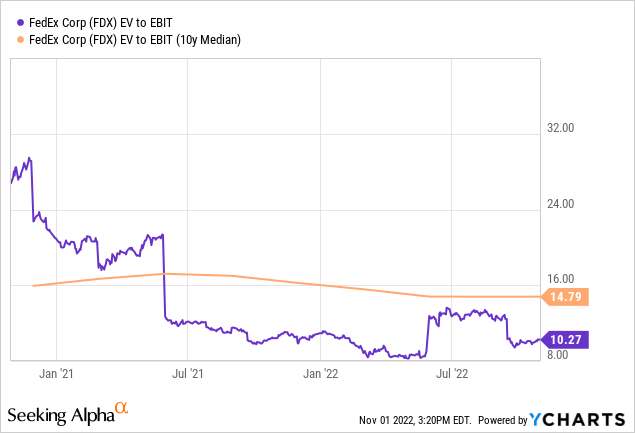

The recent stock price decline provides favorable valuation metrics. In the following chart, I show enterprise value to EBIT because this compares both market capitalization, debt and cash to EBIT. Cash and debt are an important part of the valuation metrics because FedEx has distributed more cash to its shareholders over the past four years than it has received in free cash flow.

Due to the coronavirus crisis, EBIT has fallen sharply, causing the EV/EBIT chart to quote at infinity. Therefore, I have shown the chart from October 2020 including the 10-year median. FedEx quotes attractively at a 20% discount to the historical EV/EBIT value. But valuation may fluctuate sharply if FedEx makes less profit. Low valuation is not a reason to buy the stock.

FedEx’s closest competitor is United Parcel Service (UPS). UPS also quotes in line with FedEx’s valuation. Therefore, UPS is also a stock to take a closer look at. In fact, UPS’s high profitability makes the stock very interesting.

Conclusion

The sharp decline in the share price might look like a good buying opportunity, but there are some risks lurking. FedEx is repurchasing $1.5B of its own shares on an accelerated basis, representing a buyback yield of 3.7%. The dividend has been growing steadily for years, averaging 19% a year over the past 10 years. The EV/EBIT ratio is below the 10-year median, so the stock’s valuation is attractive and in line with competitor UPS. FedEx came out with a quarterly report that fell well below analysts’ expectations. Earnings per share fell 21%, while analysts expecting an 18% increase in EPS. The lowering of their volume expectations creates further pressure in the near future. Still, the results were predictable as U.S. GDP has declined over the past two quarters. The yield spread has inverted and from a historical perspective this indicates a recession within now and a year. I see the inverse yield spread as a bleak prospect for FedEx. Consequently, I expect a deeper decline in FedEx’s stock price within a year.

Be the first to comment