ValeryEgorov/iStock Editorial via Getty Images

I set out earlier this year to answer the most common bear arguments against investing in SoFi Technologies, Inc. (NASDAQ:SOFI). So far I’ve covered stock-based compensation and dilution, dependency on student loans, and balance sheet, profitability, and free cash flow. All that is left is to answer the moaters – those who say that SoFi lacks a competitive advantage and that everything they do can be easily replicated (i.e., SoFi has no moat).

I quickly realized as I started writing that I had far too much material to fit into one single article. So I’m going to break this up into two parts. Today we will talk about the customer-facing products they offer. Next time I will delve into the most misunderstood part of SoFi’s business, which also happens to be the hardest to replicate: their technology segment.

Moats Are Built, Not Bestowed

In 1995, Warren Buffett said,

“The most important thing [is] trying to find a business with a wide and long-lasting moat around it … protecting a terrific economic castle with an honest lord in charge of the castle.”

The most successful companies have something unique that distinguishes them and makes them unrivaled in some way. Moats can take the form of brand, technology, patents, high barriers to entry, cost savings, or numerous other competitive advantages.

Apple (AAPL) has their brand and ecosystem. Google (GOOG, GOOGL) is far and away the most used search engine. Amazon (AMZN) is the first place you look to buy pretty much anything. Here is the thing though, it isn’t like some magical moat fairy came down, waved her magic wand, and granted these tech giants an unassailable position at the top of market cap mountain.

I’m old enough that I remember opening up multiple instances of Netscape to type the same search query into Lycos, Google, Excite, Infoseek, Yahoo, and (my personal favorite at the time) AltaVista to see which search engine turned up what I was looking for. I remember when Blackberry was the market leader in smartphones, and I remember buying books from Amazon when that was all they sold.

Google dug their moat by engineering a superior algorithm and caching results for commonly searched words and phrases. They became the de facto search engine because their results were consistently the most relevant and their response time was faster. At the turn of the millennium, 17% of web users visited AltaVista at least once a week and only 7% of web users visited Google once a week. Sometime around 2004, Google’s market share went above 50% and it only grew from there, They widened that moat by staying nimble and giving free or low-cost access to an ever-growing suite of products (Gmail, Drive, Photos, etc.) and making the greatest acquisition of all time (YouTube).

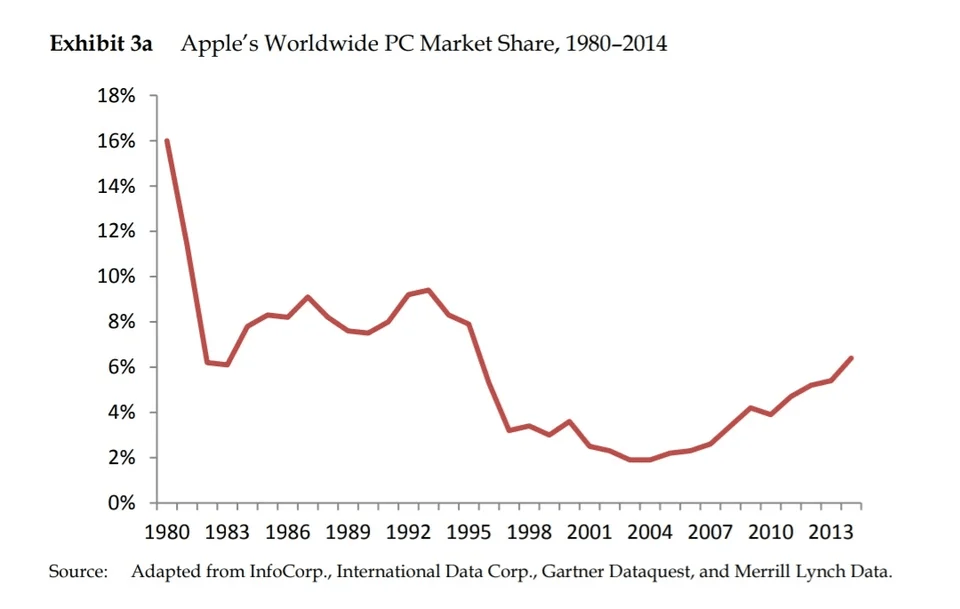

Apple went from failing at their current business to becoming the most valuable company in the world in less than a decade. Seriously, from the mid-90s to mid-2000s, their main revenue generator was computers, their niche market were designers, and they were getting crushed. Windows 95 cut their already single-digit market share in half and it stayed that low for a decade, hovering between 2-3%.

Apple’s Worldwide PC Market Share (Reddit)

Then they built a brand. In 2006, Apple created one of the best advertising campaigns of all time with their 4-year “Get a Mac” campaign. It featured a young casual actor introducing himself as “a Mac” compared to an older more formal actor in a suit and tie who played “a PC.” The ads were brilliant, firmly entrenching the idea that Macs were faster, more reliable, less prone to errors and crashes, and easier for building websites and working with movies, pictures, music, and other media. Between that and the success of their iPod, and iTunes becoming the program for creating and playing music libraries, they started taking market share back. Then they released the iPhone in 2007 and never looked back. Apple is now an entire ecosystem of hardware products that basically sell themselves because each device is excellent on its own, and, more importantly, because all of them work best together.

The point is that, with the rare exception of heavy patent protection, a moat takes time to dig and fill with water. As good companies grow, they make it deeper, wider, and fill it with sharks with laser beams attached to their heads. Anyone could have reasonably argued that Google was “just a search engine,” Amazon was “just a retailer,” and Apple was “just a failing computer manufacturer.” Moats are the result of creative vision, leveraging competitive advantages, and exceptional execution. A moat is built, not bestowed.

SoFi’s consumer business

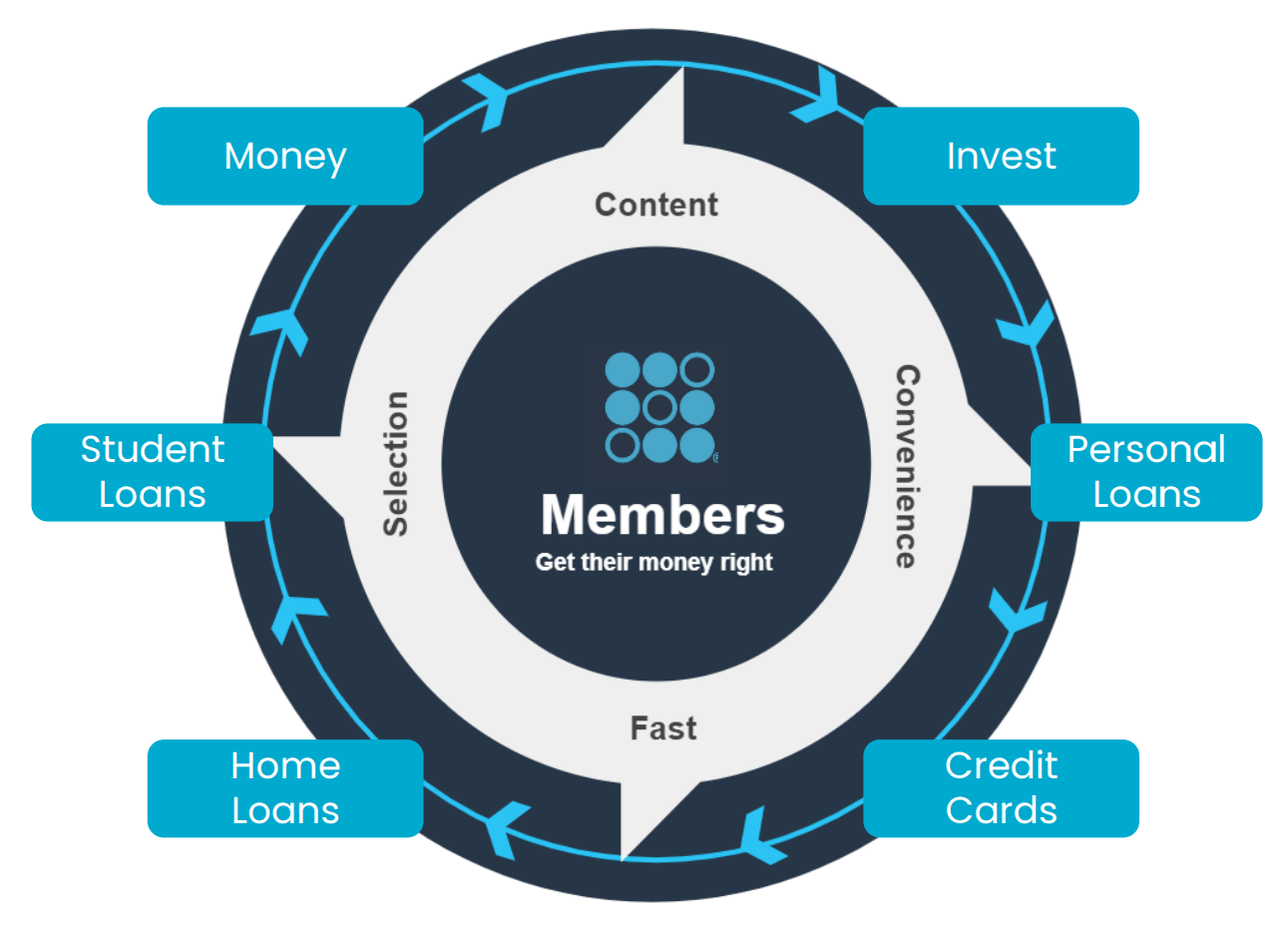

SoFi’s pitch is pretty simple, it’s a “One-stop shop for all your financial needs.” The products include checking and savings accounts, investment and crypto brokerage (including IRAs and robo-advisors), credit card, personal loans, student loans, mortgages, SoFi Relay (finance tracker, budgeting, and credit score tracking), insurance offerings, and other smaller products. They want to be there for and support their members (what they call their customers) through every part of their financial journey. The playbook they have is laid out by CFO Chris Lapointe (I’ve lightly edited his words for brevity and clarity):

SoFi Productivity Loop (SoFi)

“We have deployed a strategy that we call the Financial Services Productivity Loop, and that has three main components.”

-

“The first one is creating a comprehensive set of products that are each and individually best-of-breed […] in addition to that, we want each of those products to work better when they’re used together.”

-

“The second key element of our overall strategy is to have superior unit economics across each and every one of our products and vertical integration is a key component of that.”

-

“The third component is investing in our fintech platform in pursuit of becoming the AWS of fintech.”

I’ll cover the first two points today and discuss the AWS of fintech in my next SoFi article.

Best-of-breed products

SoFi wants each of their individual products to stand on its own against all competing products and come out on top. If customers have a great first experience, it builds trust and gives them confidence to use SoFi for their next financial need. The ability to cross sell is a core part of the SoFi thesis. Each time an existing member uses a new product, SoFi gets incremental revenue without having to pay a new customer acquisition cost (CAC). Additionally, it makes the product stickier, since now the member is more embedded into the SoFi financial ecosystem. Let’s look at each main product to determine how execution is going.

SoFi Checking & Savings

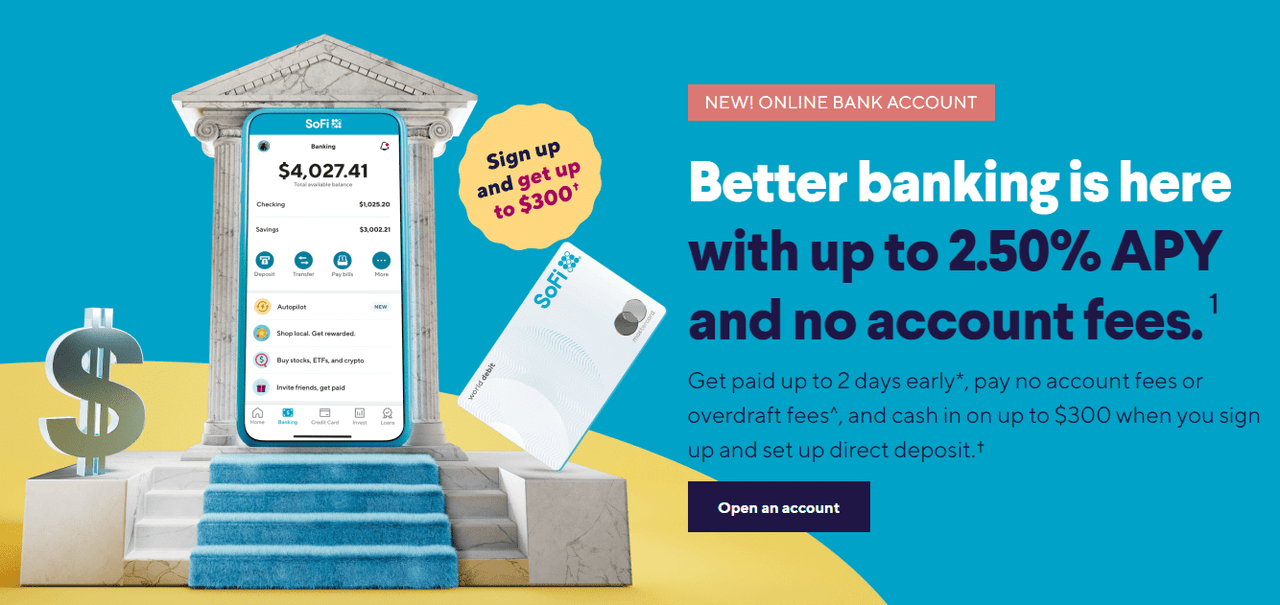

Checking & Savings is SoFi’s main “top of the funnel” product. It is meant to get members in for the lowest possible CAC. They do this by offering very high APY on both checking and savings accounts. Since becoming a bank, their APY has steadily risen as the Fed has raised rates, from 1% in February to 1.25% in April, 1.5% in June, 1.8% in July, 2% in August, and 2.5% at the end of September.

Checking & Savings also requires members to use SoFi as their direct deposit to access this higher APY (they get 1.2% without it). There is also a new account sign up bonus of up to $300 tied to, you guessed it, setting up direct deposit. SoFi understands that direct deposit is the key to modern banking. Your primary bank is where you send your direct deposit. SoFi Checking & Savings is elite in most other ways as well. No fees, 2-day early direct deposit, ability to set up automated savings, vaults so you can put your savings into different buckets, overdraft protection, mobile deposit, etc. They do not offer ATM fee reimbursement, but ATM withdrawals are free through the Allpoint network, the nation’s largest network, which has more than 3x the ATM locations of Chase. Cash deposits are the main drawback since they lack physical branches. Cash deposits can be made at Green Dot locations (Walgreens, 7-Eleven, Walmart, others), but there is a fee.

SoFi

APY is truly the differentiator here compared to legacy institutions and most neobanks. Chime offers 1.5%, Ally offers 2.1%, and LendingClub gives 2.65% as of the time of writing. All of those are for high-yield savings and do not include checking accounts. SoFi is the only option to have full liquidity and high interest at the same time. Investing apps Wealthfront and Robinhood also offer interest on cash balances in their account. Wealthfront offers 2.55% and Robinhood offers 1.5% for most users and 3% if you have Robinhood Gold. SoFi has been above most competitors most of the time through the last 6 months, although not always at the top (as with LendingClub right now).

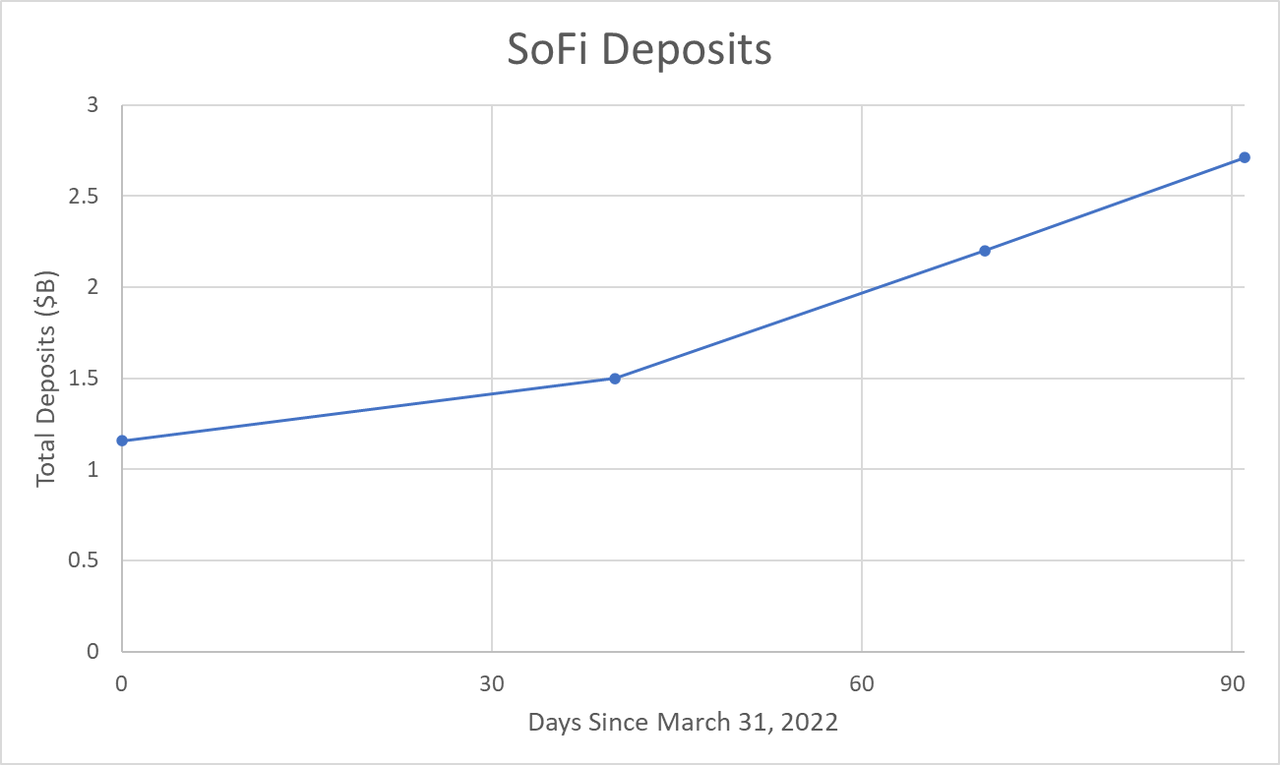

Verdict: SoFi Checking & Savings is best-of-breed or close to it. This can be seen by the growth in their deposits. SoFi has been offering a deposit account since releasing its SoFi Money product in February of 2019. It took them three years to get to $1.15B in deposits, which is what they had on March 31, 2022, as reported with their Q1 earnings. The bank charter unlocked their ability to compete by migrating Money to Checking & Savings and ramping APY. Three months later deposits had more than doubled to $2.71B.

SoFi Deposits (Author)

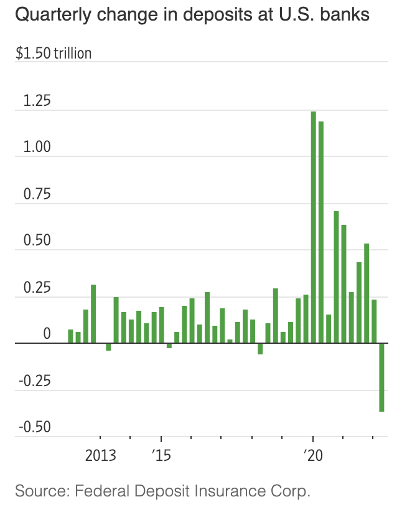

This took place in a macro backdrop where deposits in U.S. banks fell for the first time since 2018, and it wasn’t a small drop. Total deposits fell by $370B, the largest decrease ever recorded.

Quarterly Change in deposits at U.S. Banks (FDIC)

SoFi’s Checking & Savings product is best of breed or very close.

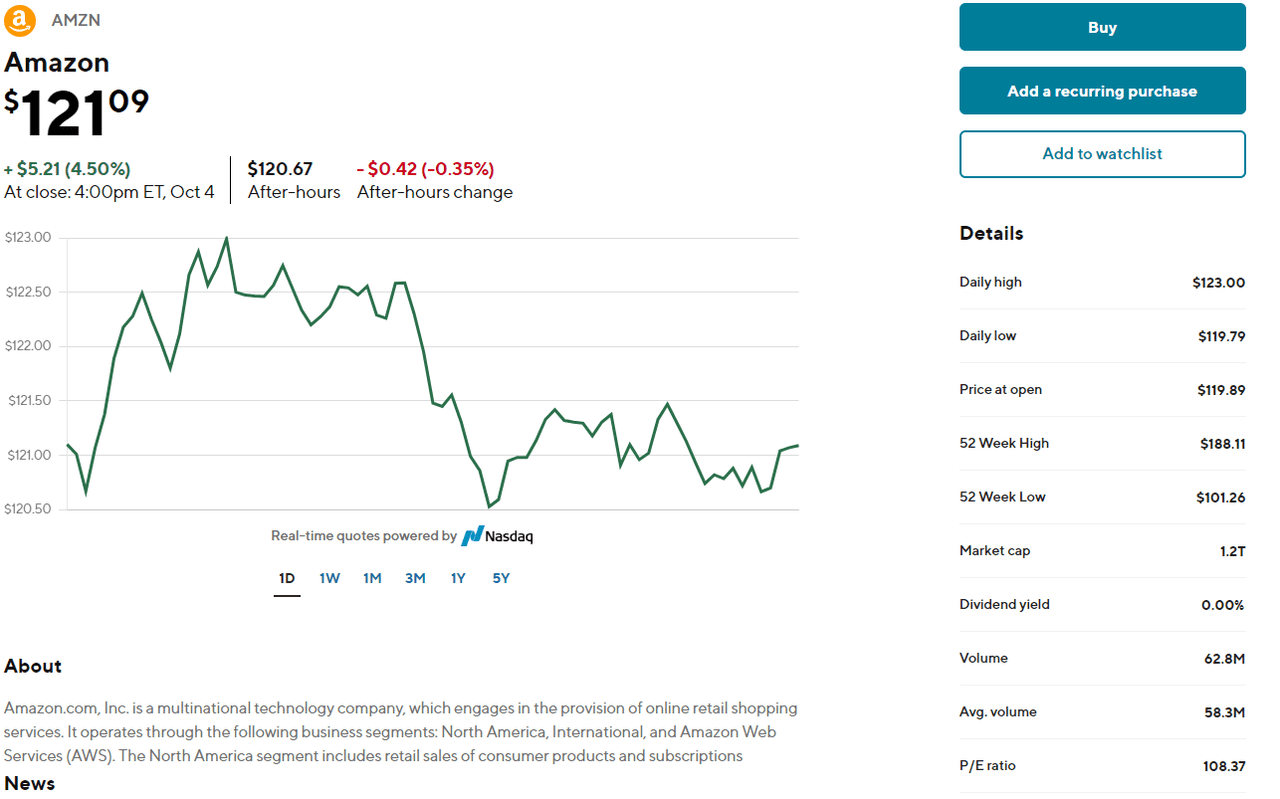

SoFi Invest

I’ll cut to the chase here. SoFi Invest is decidedly not best of breed for active investing. The UI is clumsy, the graphs are mediocre, charting is virtually nonexistent, there is no way to access Level 2 data, and they still have not released options trading, which is absurd and a big black eye in my book. Equity investing is fee-free, driven by payment for order flow. Their crypto offerings are very diverse, but crypto purchases do have fees attached (although this is waived for purchases that are set up as recurring purchases with each paycheck). SoFi Invest has its work cut out for it.

SoFi Invest UI (SoFi)

That being said, there are things that they have done very well. SoFi has not gotten the credit it deserves as an innovator in the brokerage space. SoFi pioneered trading in fractional shares. It seems odd to think about now that fractional shares are ubiquitous, but they didn’t exist before SoFi saw the need and met it. SoFi saw in their data that their users were not trading stocks like Google and Amazon. After pooling customers, they realized a single share was too expensive for some of their members. SoFi engineered a creative and elegant solution by offering fractional shares. Other brokerages quickly copied the practice.

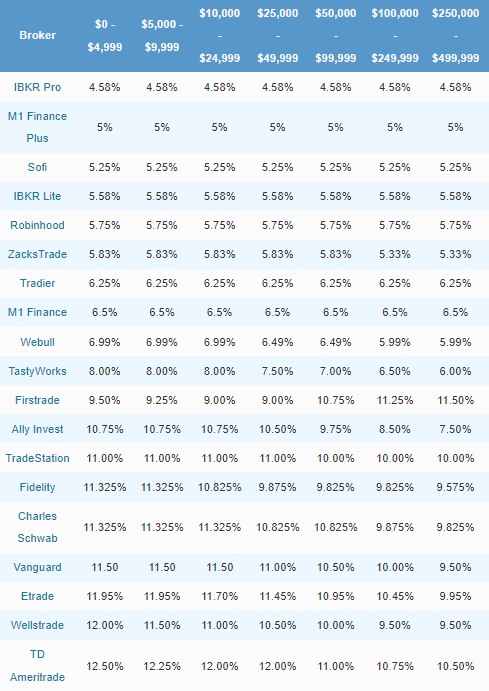

SoFi also was the very first to offer IPO investing for all users, a practice that was again immediately copied by others such as Robinhood. SoFi also has a bevy of their own branded ETFs. Their robo-advisor is excellent and has been ranked by Barron’s as the best overall robo-advisor for two years in a row. Margin rates are also best in class at 5.25%. This compares very favorably competitors, as seen in the table below.

Margin rates at various brokerages (Brokerage-Review.com)

Verdict: SoFi has said publicly that they are planning on rolling out options trading before the end of 2022. That alone won’t tip the scales in their favor, but it will be a big step forward. Another big problem is the UI/UX. It is way behind modern digital brokerages like Robinhood and WeBull. If the rollout of options comes with a wholesale redesign of their investing platform, it would be a large leap forward. Until then, other brokerages will remain ahead of them.

SoFi Credit Card

SoFi only has one credit card offering at this point. It offers 2% cash back on all purchases as long as the rewards are redeemed into a SoFi product. New members can get 3% cash back with SoFi Plus (discussed more below). The cash back is available as soon as the charge is processed and immediately posts to your account upon redemption. It is folded into SoFi’s larger rewards program which I’ll discuss more below.

Verdict: CEO Anthony Noto has talked about creating a wider set of credit card offerings in the future to build a credit card ecosystem, but that isn’t what is going on right now. Chase probably has the best ecosystem especially for higher end customers.

SoFi Relay

Relay is SoFi’s credit monitoring, budgeting, and financial tracking service. It is similar in scope to what is offered by Mint. Mint offers a better product overall, but there are aspects where Relay excels. In contrast to their Invest product, where the UI is lacking, I find Relay’s interface cleaner than Mint, though not as powerful.

Relay’s real value to investor the unparalleled access member financial data. This allows SoFi to tailor offerings to individual needs. If a member with a lot of money in savings and no linked brokerage account, SoFi sends an offer to open a SoFi Invest account. If someone is carrying a lot of credit card debt, they can offer a personal loan, etc. They also use the data for their risk models, discussed below in the Lending section.

Verdict: Mint is still the best option here, but SoFi’s offering is no slouch and is constantly improving.

Lending

SoFi offers personal loans, student loan refinancing, in-school student loans, and mortgages. They own every piece of their lending business from the top to the bottom and enjoy very good unit economics as a result. The entire process from application to funding on personal loans often happens in the same day. They don’t really talk much about it, but they’ve been using AI risk models since before 2018.

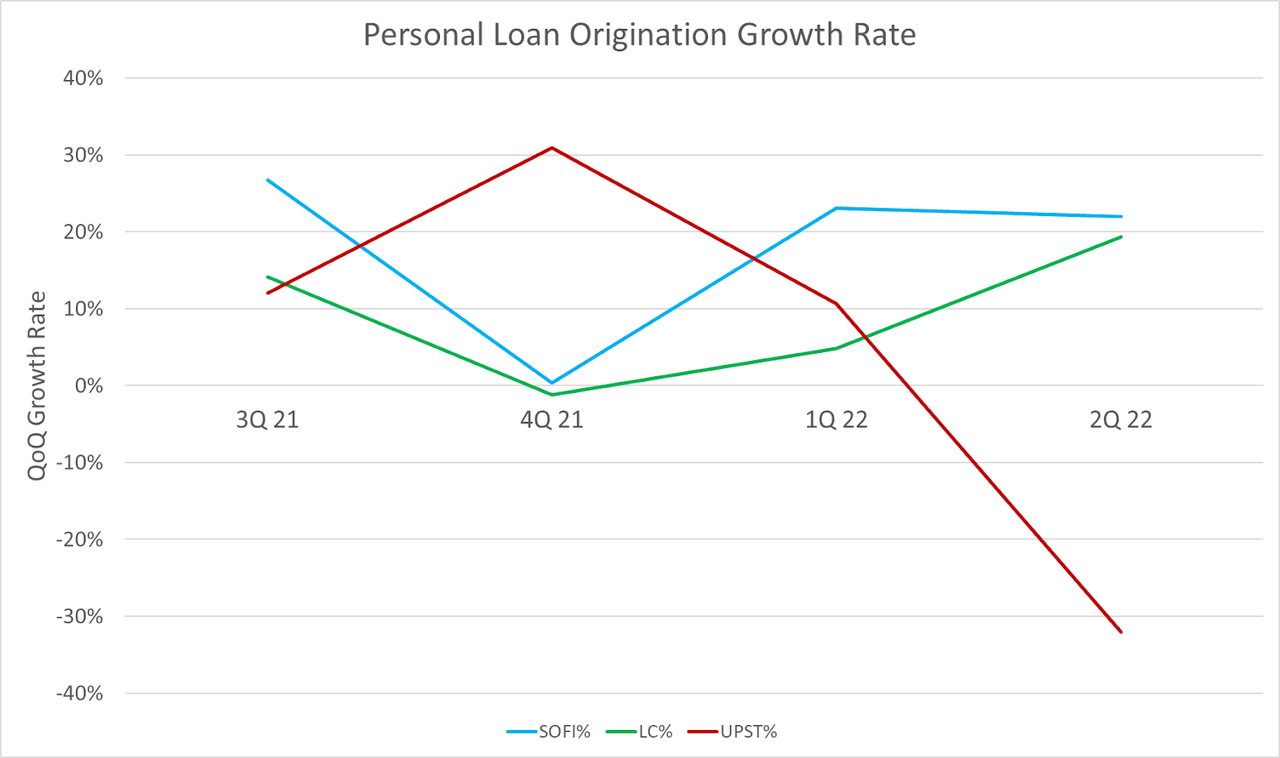

From a moat standpoint, what differentiates SoFi is the quality of their borrowers and their persistent origination growth. Even with rising rates, SoFi’s origination growth rate is accelerating faster than competitors. In their most recent quarterly earnings report, they stated that:

“Our personal loans borrowers’ weighted average income is $160,000 with a weighted average FICO score of 748. Our student loan borrowers weighted average income is $170,000 with a weighted average FICO of 773.”

Their loans are of the highest quality. Anything under that quality gets referred to other lending partners, and SoFi gets a referral fee.

Personal loan origination quarterly growth rates of Fintechs (Author)

Verdict: Their lending segment is best of breed and continues to outperform competitors. Upstart’s (UPST) funding has dried up because they target lower quality borrowers. LendingClub (LC) warned in their Q2 earnings report about possible weakness in funding in the second half of 2022. SoFi has not seen any weakness in demand for their paper and is growing originations faster than Upstart and LendingClub while maintaining the highest quality borrower of all three companies. And despite the rising rate environment, delinquencies on their loans are lower than they were before COVID.

Best of Breed Conclusion

Checking & Savings and Lending products are best of breed. Relay is doing well, brokerage is a mixed bag but not best in class and their credit card offering is nothing to write home about. Where they truly excel, though, is the next two sections.

Better Together

Everything up until now can be found as a standalone offering by another financial institution. No other fintech offers everything in one place, meaning that SoFi has greater room to leverage their existing members than anyone in the business. No other neobank has checking, brokerage, credit card, and lending. Many have three of those four, but none have all four, and that doesn’t include Relay, free access to financial planners, and strategic partnerships to offer insurance and estate planning. That alone separates SoFi, but what truly makes SoFi “Better Together” is their rewards system and the newly launched SoFi Plus.

Rewards

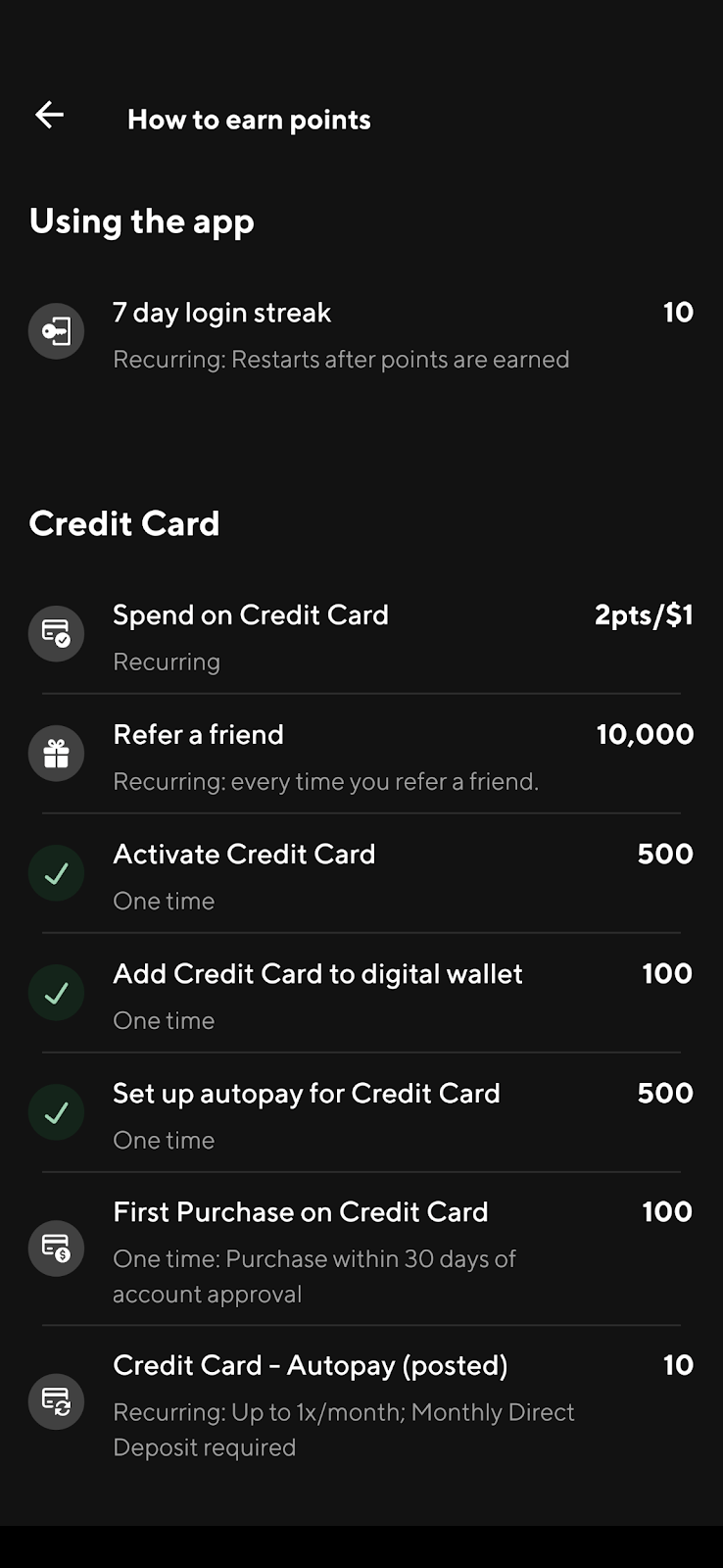

SoFi gives rewards points that are essentially worth 1 penny each and can be gained in a variety of ways. Each dollar spent on your credit card is worth 2 points. Login for 7 days straight to the app, 10 points. Increase your credit score, link a new account to Relay, activate your credit card, send a recurring deposit to Invest, 10, 25, 500, and 50 points. You get the picture. It keeps members coming back and gamifies banking in a non intrusive but unique way, making the product stickier.

SoFi Rewards (SoFi)

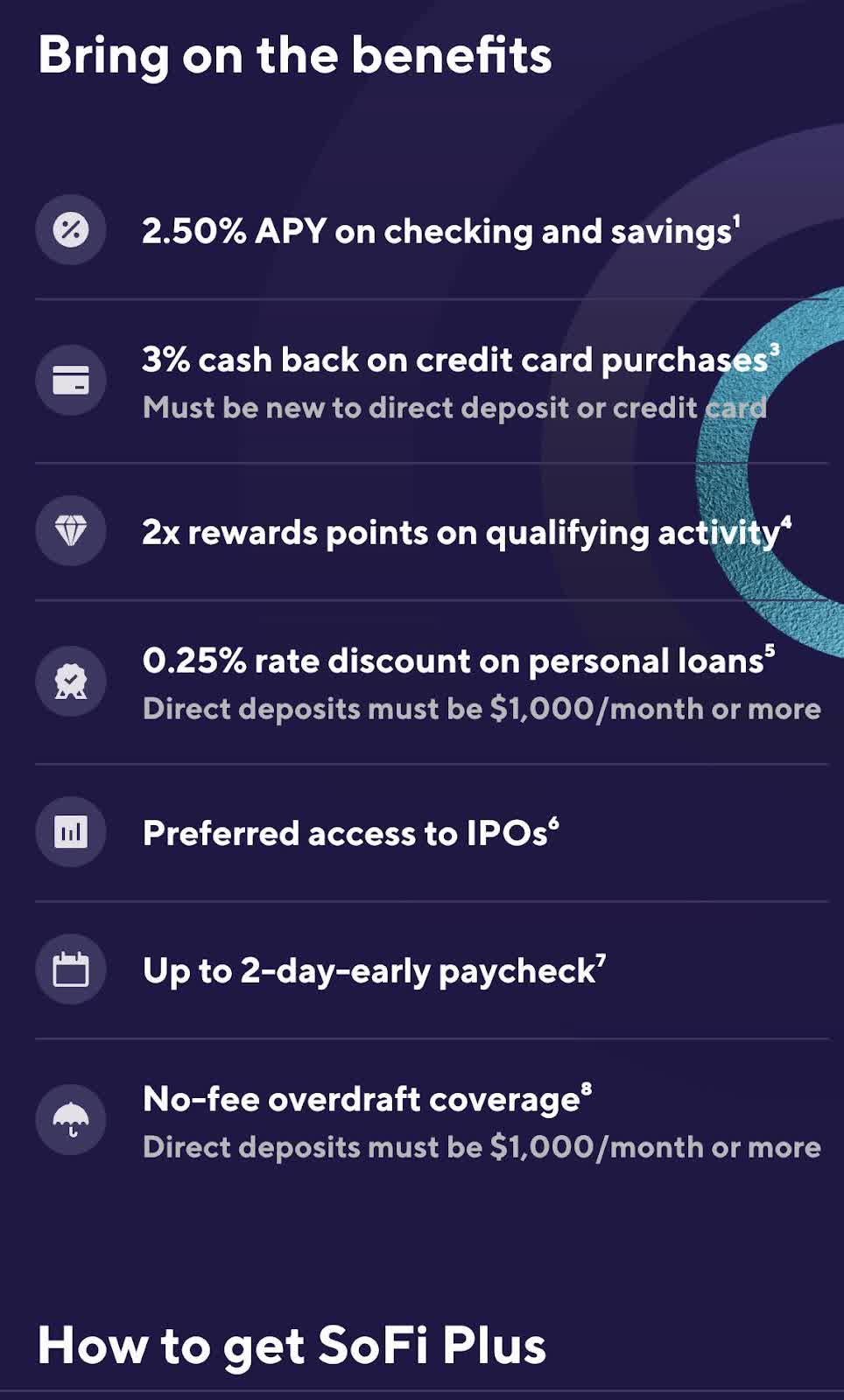

SoFi Plus

SoFi Plus is currently rolling out to all users. It is essentially the umbrella under which you get additional perks, rewards, and discounts. To qualify all you need is, you guessed it, to send your direct deposits to SoFi (at least $1000/month). Benefits include 3% cash back on your credit card for the first $12k spent (with unlimited 2% cash back thereafter), the aforementioned 2.5% APY in checking & savings, and preferred access to IPOs, among other things.

SoFi Plus Benefits (SoFi)

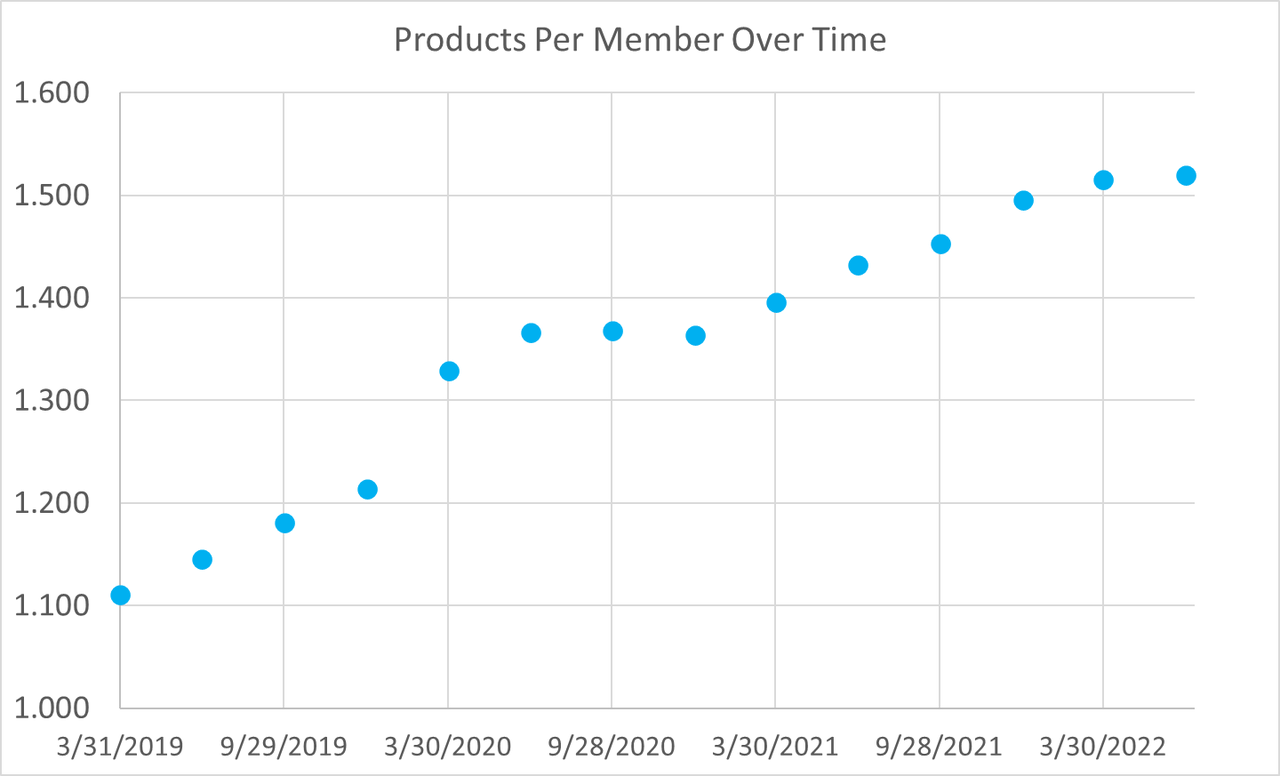

This helps cross sell existing customers into new products to access the full slate of benefits offered. The more products each member has, the more revenue SoFi generates and the less likely they are to switch to a competing financial institution. Cross sell numbers show that they are succeeding and the number of products per member has steadily increased from 1.11 to 1.52.

Products per member over time (Author)

Superior Unit Economics

A core part of my bullish thesis on SoFi is that they have built a web of differentiated operations that give them systematic cost advantages over competitors. The most obvious one is that they are a digital bank with no physical branches. This allows them to save significantly on overhead, maintenance, salaries, and other operating costs that come with brick-and-mortar branches. This gives them a leg up on traditional banks.

Vertical Integration

That’s great, but there are tons of digital-only neobanks who enjoy that same advantage. How does SoFi outcompete these institutions? A less obvious and more important source of cost savings is SoFi’s vertical integration. Before 2018, SoFi was just a lender, but they realized how vital it was to be able to control every step of the process from application to risk profiling to funding to loan servicing. They seek to replicate that vertical integration in all their businesses and do it through being a chartered bank and through their Galileo and Technisys businesses.

Bank Charter

SoFi was granted their banking charter in January 2022. This allows them to use deposits as collateral for loans. The cost of capital on their deposits is just the APY they pay, which is a lower cost than other methods such as warehouse lines of credit. Getting a bank charter is a costly multi-year process and only a handful of Fintechs have one (LendingClub, Varo, Green Dot and Block (SQ)). This is a big differentiator compared to other Fintechs and neobanks because it gives SoFi access to lower cost capital to find their business, resulting in better net interest margin.

Galileo

Galileo will be a major focus of my AWS of Fintech article, but it’s also important in this context to realize that it gives SoFi structural cost advantages. Galileo offers payment processing, fraud detection, card issuing, ACH transfers, disputes, and other products. SoFi needs those same tools and products, but because they own the underlying technology, they get to access these products at cost. Every time a Robinhood, Chime, Dave, MoneyLion, or Revolut (among many others) customer swipes their debit card or transfers money to another account, they have to pay Galileo a fee that SoFi avoids.

Technisys

Financial institutions need one or more banking cores to run their ledgers and backend systems. Technisys’ main business is in providing single and multicore solutions. SoFi is slowly moving all their products from their previous core providers to Technisys. This will save them between $75M-$85M annually once they’ve fully transitioned. This is another structural cost savings achieved by vertical integration that is extremely difficult to replicate for SoFi competitors, both traditional and Fintech.

Galileo

Prudent Management

I won’t spend a lot of time here, but something that often gets overlooked is that SoFi’s management makes prudent and wise strategic decisions, which leads to superior maintainable economics throughout the entire business cycle. I’ll give two quick examples.

First, their long-term policy has been and continues to be to reinvest 70 cents of every dollar earned back into the company, dropping the other 30 cents to the bottom line. This strategic decision was strictly adhered to in the low interest and easy money fiscal policy environment of 2020 and 2021 and the course remains the same as rates are being hiked and as the Fed is tightening. They never mortgaged their balance sheet or their future to chase growth at all costs in the past. Maintaining a steady and sustainable course is a big reason why they’ve continued to perform at and above expectations quarter after quarter while others have missed expectations and lowered guidance.

A second example is their loan strategy. As they originate a loan, they invest in hedges to guarantee their gain on sale margin. Usually, rates going up devalues a loan portfolio, but their hedges means that they maintain margins as rates continue to rise. Whereas some other Fintechs have seen the value of their loan book deteriorate and hurt their business (I’m looking at you Upstart), SoFi’s business and margins have remained robust. Management showing prudence and foresight is part of SoFi’s moat.

Areas of Concern

User Interface and User Experience

No company is flawless, and SoFi is no exception. There are areas of concern that need to be addressed or where execution is lacking. The UI and UX of the app could use some work. The app is fine and it is very functional, but those aren’t exactly the type of adjectives that quicken the pulse. It’s better than legacy banking apps, but that’s a very low bar.

This should be a strength for a digital-only bank, but the app can be difficult to navigate, cluttered, and unpolished. Nowhere is this more obvious than the poorly-implemented dark mode beta that works in some parts of the app and not in others. As a user and investor, I’m hoping that an interface overhaul will accompany the rollout of options trading, but I’m not expecting it.

Customer Service

My personal experience with customer service has been excellent. However, I’ve never had to deal with their fraud department, which is probably the most important part and the one that seems to be lacking. Reddit and other sites often have posts with stories of locked accounts and fraudulent charges that take weeks to resolve or even longer. It appears their fraud department is separate from their normal customer service team and often does not answer calls and fails to return messages. While these types of problems occur at every financial institution, it is something that must be resolved. A customer that is trusting you with their money needs to know that their trust is not misplaced.

SoFi Plus without Direct Deposit

The direct deposit prerequisite for higher APY and other SoFi Plus perks is a one-size-fits-all solution that leaves some of their target demographic out in the cold. Entrepreneurs, gig workers, retirees, and others cannot enjoy these benefits. SoFi needs to extend their top member benefits to these cohorts. Whether a minimum account balance, monthly spending requirement, or some other method, they are losing business if they cannot find other ways to let members qualify.

How durable is the B2C moat?

SoFi strives to be best of breed in each of their segments, but Checking & Savings and Lending are the only ones where they are close. Invest and credit card are below average to middling and Relay is good, but Mint is probably better. Where SoFi differentiates itself for consumers is in the quality of its complete package. SoFi Plus perks, their unique rewards system, and offering so many differentiated products under one umbrella are a compelling offering for members, and their increasing cross sell numbers prove it.

SoFi’s biggest moat in the B2C business is superior cost savings through their charter and vertically integrated technology stack. This is a huge advantage over legacy banks and their antiquated systems. It is also unique among Fintechs, as evidenced by the fact that so many neobanks and Fintechs pay SoFi to use this tech rather than develop it on their own. The bank charter grants lower costs of funding for their loans. This unique combination of low-cost capital and modern, scalable, and agile technology is completely unmatched by any other financial institution. This results in their ability to offer higher rates to members on deposits, lower rates to members on loans, and still have higher margin profits for the business and investors.

The most important thing to me is that the execution is improving and the moat has been consistently growing. It is durable and expanding. While there are lots of things I can point to as areas that can be improved, SoFi is undoubtedly a better company today than it ever has been before. There could easily be more macro headwinds on the horizon, but if you have a long-term investment horizon, SoFi is an exceptional value as a secular growth story trading under book value. It is among the names of companies I buy every week as part of my dollar-cost averaging strategy.

Be the first to comment