Teka77/iStock Editorial via Getty Images

Investment Thesis

FedEx (NYSE:FDX) is targeting new geographies by the method of acquisition and integration of new businesses and strategies. Integration of TNT Express into FedEx and the company’s new Asia-Europe trade route are highlights of my thesis, as these moves would benefit FedEx exponentially in near future. I think the stock has factored in all the negative sentiment and has already reached the bottom. After considering all these factors and the growth fundamentals of the company, the stock price looks attractive for long-term investments. Given the company’s current valuation, I believe the company is undervalued, and I maintain a Buy rating on the stock.

Company Overview

FedEx Corporation is a holding company based in Memphis, Tennessee. The company manages a portfolio of transportation, e-commerce, and business services companies. The company’s portfolio is classified under four business segments: FedEx Express, FedEx Ground, FedEx Freight, and FedEx Services. Federal Express Corporation is an express transportation service that delivers goods in 220 countries. At the same time, FedEx Ground is a small package, low-weight and low-cost service which delivers only in North America and Canada currently. FedEx Freight is an LTL (less-than-truckload) freight services provider to all types of businesses. FedEx Services offers sales, marketing, information technology, customer service, communications, and technical support services to all portfolio businesses of the company. The company always looks for acquisition opportunities that synergize with the current business model. One of such acquisitions which my thesis primarily focuses on is TNT integration into FedEx Express.

Integration of TNT and New Trade Routes

TNT Express is a Europe-based company that FedEx acquired for $4.8 billion in 2016. Initially, the company was planning to integrate TNT Express into its European air network by 2017, but after the acquisition, TNT Express was paralyzed by the NotPetya cyberattack and COVID-19, which has caused massive shipment dislocation. FedEx spent a total of $1.5 billion to complete this integration last year. This integration of TNT into FedEx Express will give access to air and ground coverage of all the countries of Europe. Before this integration, FedEx had minimal presence in the road delivery segment of the European countries, and TNT Express’ extensive European ground-delivery network will prove to be the solution to this problem. TNT Express has created an opportunity for FedEx to expand its intercontinental services. Now when the TNT express is fully integrated into FedEx Express, it will result in significant cost reduction and low service prices, which can create prices between all the competitors. Currently in Europe, FedEx has gained 3rd largest market share, but I believe the company will surpass UPS, which is in the second position. Also, I think this integration will significantly increase the company’s earnings as TNT Express is 6% of the sales of the FedEx Express and this segment is 50% of the total revenue of FedEx Corporation. According to my analysis, this complete integration will result in strong growth and margin expansion of the FedEx Express and will translate into share price gain in the future.

On June 16th, 2022, the company announced a new Asia-Europe Route, which will connect Asian countries with European countries. This service will be a part of the FedEx Express, and this route will improve the connectivity between customers of China, Singapore, and Japan. The new route is designed to offer one day a week direct connection between the Paris hub, FedEx Charles de Gaulle, to Singapore. This route is vital for both countries as Europe’s second-largest commercial partner is Singapore. In 2021, the trade between China and Europe had grown to $800 billion, which is considered the commerce of half of the world’s merchandise, and this commerce is showing a 12% YoY growth trend. The business from Japan is considered as time-sensitive and rigorous temperature control, mainly because the large chunk of shipments are for the Healthcare sector. This route will directly connect Kansai International Airport, FedEx North Pacific Regional Hub, and the CDG Hub in Paris, France. This route is a gateway to a lot of new opportunities for FedEx to expand the business into many countries and it will help increase the revenue growth with robust demand from untapped geographies.

Additional Catalysts

Margin Expansion in FedEx Ground

According to GroupM, retail sales may rise to $7 trillion worth sales or 25% of the total market by 2024. FedEx will be a beneficiary of this as FedEx ground which contributes 37% of the total revenue, will get an exponential demand growth. The COVID-19 pandemic has increased the dependency of everyone on e-commerce websites which has accelerated the e-commerce penetration worldwide. The demand of the segment during the pandemic has risen by 23%. FedEx Ground is involved in delivering small packages, low-weight, and low-cost services within North America and Canada. I believe as the number of orders increases, the fixed delivery cost will decrease, which will expand the operational margin of the segment. I am estimating margin expansions because currently, the company is experiencing the same in the B2B Ground delivery. These deliveries have higher margins as the company ships multiple packages together in B2B, which saves a lot of delivery costs. I believe if the company maintains an affordable price, which will appeal to the customer sentiment can result in robust volume growth in the next 2-3 years.

Growing Dividend

The quarterly dividend has reached $1.15 per share, which is a 2.03% annualized dividend yield on the current share price. It is not considered very high, but in the last five years, the company has increased its dividend by 13.4%, which is very impressive. Recently, FedEx has decided to cut its capital and enhance stockholder value by increasing the dividend by 53%. This news was very positive for the market, and the share price of the company has jumped by more than 10% after the news. The board of directors wants to show their confidence and growth trajectory by increasing dividend payments to their shareholders. I believe the dividend payout will continue to rise in coming quarters and this will strengthen my thesis of high upside potential for FedEx.

Michael C. Lenz, FedEx Corp. Executive Vice President and Chief Financial Officer added:

The increased dividend we announced today is the culmination of our Board’s thoughtful efforts over many months to ensure that our capital allocation strategy reflects our confidence in the trajectory of the business and increases returns for our stockholders. We look forward to sharing more detail on our strategy and long-term objectives at our investor day later this month.

Financials

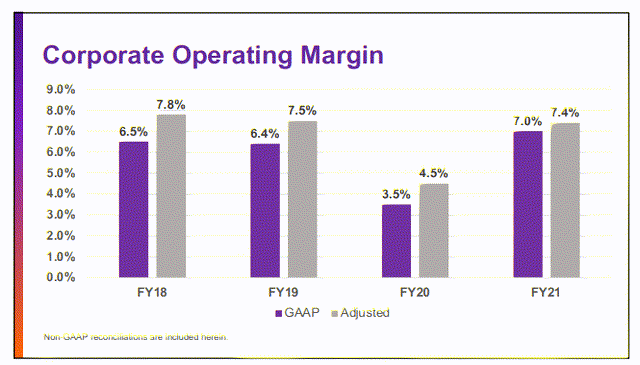

The financial reporting of the fiscal year 2021 is enough to tell us that the company is recovering from the impact from COVID-19, rising transportation costs, and expenses incurred in the integration of TNT Express, as the company’s operating margins are now again coming to the healthy pre-pandemic levels. In 2018, the operating margins were at 7.8% of the net sales, which has declined by 330 bps in the last two years. Now, 7.4% operational margins show that the company is recovering and working with high efficiency.

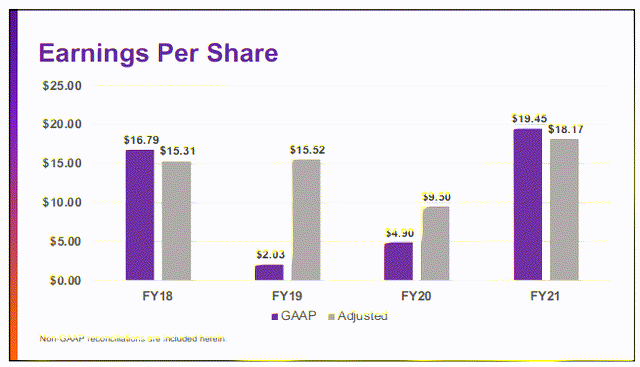

In the case of EPS, the company has already surpassed the pre-pandemic levels and has reported a record EPS of $18.17. After the integration of the TNT express and expansion in the European market, I believe the results of the coming fiscal years will easily exceed the record earnings of FY2021.

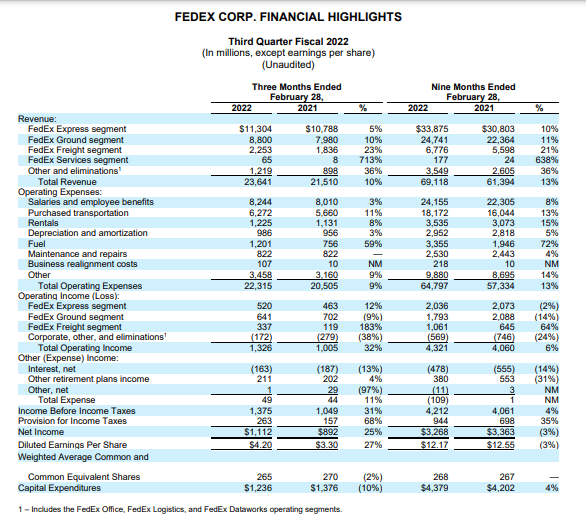

SEC: FedEx 10Q

On March 17th, 2022, the company reported its third quarter financials. The company reported 9.7% topline growth or $23.6 billion in revenue as compared to the $21.5 billion of the same quarter of the last year. The operating profit has increased by 37.7%, and operating margins have improved by 130 bps. The improvement in operating margins was driven by the higher revenue per shipment saved a lot of fuel expenses, and the omicron effects partially offset it. Net profit for the Q3, 2022 is $1.22 billion, which is a growth of 30% as compared to the $939 million of the Q3, 2021. Reported EPS for the third quarter is $4.59, which is significant growth from the $3.30 of the same period of last year. FedEx Express results benefited from higher margins, low fuel, and low variable compensation. The near-term constraints for this segment are economic slowdown, availability of labor, and shipping demand.

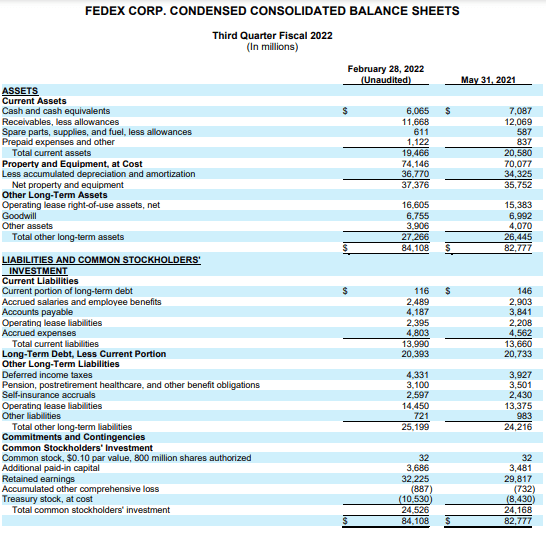

SEC: FedEx 10Q

The company ended this quarter with $6.06 million in cash and huge long-term debt. The company has a long-term debt of $20 billion, mostly because of the capital-intensive nature of the business and the consecutive acquisition for the past many years to expand its business. I know if we check the balance sheet, we will find the $25 billion in debt but all of it is made up of deferred income taxes, pension, post-retirement healthcare, and operating lease liabilities and I don’t think all of this as a long term debt because they are not going to have any significant effect on the earnings or the capital structure of the company. That’s why I have excluded these line items while calculating the cash-to-debt ratio. The cash-to-debt ratio of the business is 0.3x, which is very low and concerning.

With the third quarter results, the company has also published its fiscal year outlook. The company estimates EPS to be in the range of $18.60 to $19.60 after deducting year-end MTM retirement plans accounting adjustment, TNT integration expenditure, and cost required for the business realignment activities. The total expenses required for all these line items will be $1.60 to $1.90 per share. The company is estimating a total of $7 billion as capital expenditure which is lower as compared to prior estimates. The company has increased its outlook after experiencing margin expansion in almost all business segments. These expanding margins and revised outlook supports my investment thesis.

FedEx vs UPS

FedEx and UPS are two leading delivery service providers. If I compare the services and market share of all the companies in delivery services, then UPS and FedEx will turnout into main competitors to each other. UPS is best known for its domestic ground delivery, while FedEx is considered as best in global air express freight. UPS delivers more than 24 million packages every day. On the other hand, FedEx transports 18 million packages every day. UPS has built a network dependent on the one pickup and delivery concept, while FedEx has created hub networks specializing in time-sensitive deliveries. FedEx tries to run its business by charging high fees on FedEx Express delivery which works well for corporate clients because of time efficiency. At the same time, UPS generally focuses on delivering small packages at a regular time and regular cost. The structure of both of the companies is very different from each other. Currently, UPS is ahead of FedEx if we compare the market share of both the companies, but I believe with the integration of TNT express and expansion of margins due to cost efficiency, in the next 2-3 years, FedEx will grow faster than UPS.

Now let’s compare the current valuations of FedEx and UPS. Currently, UPS is trading at a 14.04x P/E ratio and FedEx is trading at a P/E multiple of 11.75x which is a discount of 2.29x. The average P/E of the delivery services industry is 13.95x. If we compare the P/E of both of the companies with the industry average, then FedEx is undervalued and UPS is overvalued according to comparative analysis. FedEx is trading at a discount of 2.2x as compared to industry P/E.

Risks Faced by FedEx

High Oil Prices

FedEx being a logistics company is greatly affected by the fuel costs. In the one year, we have seen a meteoric rise in oil prices. A great part of it can be attributed to the lack of oil supply due to the Russia-Ukraine war and OPEC’s supply cut to raise the oil price further. FedEx’s profit margins are highly dependent on the vehicle and jet fuel prices, and with oil at record high prices, the firm will surely feel the heat. FedEx generally charges a fuel surcharge to cope up with the high fuel costs, but given the current slowdown in the economy and demand stagnation, it’s difficult to predict to what extent FedEx can raise the fuel surcharge. The question remains to be answered and poses a great risk for the firm to tackle.

Increased sanctions on Trade

In recent times, we have seen many governments around the world, including the US, China, Russia, and India, make changes to their trade policies and impose sanctions and tariffs on the import of various goods. Such actions by these governments lead to weak global trade and it is a big negative factor for FedEx. These sanctions and increased tariffs are a disincentive for countries to engage in trade and less the flow of goods in the economy is a cause of worry for logistics and transportation companies like FedEx.

Cyberspace vulnerabilities

FedEx has experienced various cyber-attacks and data breaches that adversely affected the firm’s working. Cyberattacks can cause the collapse of the whole delivery infrastructure and lead firms into a state of paralysis, where the company is unable to track its shipments. Such attacks are not a fantasy but a very probable scenario if cyber security is not monitored effectively. Some of the instances of past attacks encountered by FedEx are the 2017 NotPetya virus infiltration that drastically affected the worldwide operations of TNT Express and the 2017 WannaCry virus that exploited the loopholes in third-party cloud services and infested FedEx system with viruses. FedEx has to be very careful with cyber security management and be prepared for any such attacks in the future.

Valuation

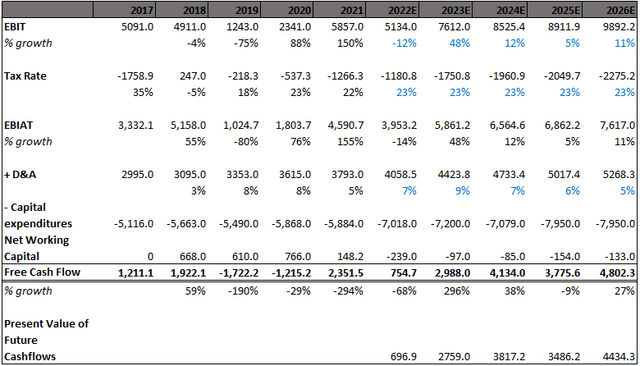

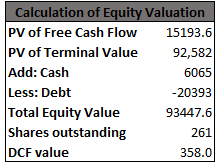

FedEx has a market cap of $58.4 billion and is trading at a P/E multiple of 11.75x. The stock is currently trading at $225.31. I have calculated the discounted cash flow for FedEx and as per my analysis the intrinsic value of stock comes out to be $358. As per the DCF model the stock is trading at a discount of 37.06% from its intrinsic value. This reflects an upside potential of 58.8% from current price levels. For calculating the DCF we have taken the Weighted Average Cost of Capital (WACC) rate of 8.3% and growth of free cash flow at 57% on an average for next 5 years. The reason for explosive growth projections is integration of TNT with FedEx, ease of trade restrictions and lifting of Covid-19 curbs. These factors clearly indicate positive signs for FedEx and reflect my investment thesis of a Buy on FedEx.

DCF model by Author DCF model by Author

Conclusion

I am enthused about the FedEx Corporation after analyzing all the catalysts and current financials. After considering all the growth factors and limited risk of the company, I believe the company is a growth investment opportunity. The company is currently focusing on expanding its business in different geographies with the integration of old acquisitions and new strategies. The company is also focusing on new acquisition opportunities which will synergize with all of the current portfolios of the company.

According to my DCF valuation and comparative analysis, FedEx is currently trading at a cheap valuation. With the upcoming expansion plans and robust margins, I think the company is a good growth investment opportunity. After considering all these factors, I assign a buy rating for FedEx.

Be the first to comment