Spencer Platt

FedEx Corporation (NYSE:FDX) recently announced some lofty FY2025 goals of $105 to 110 billion in revenues and 10% operating margins. The market is currently giving management zero credit for these goals, due to a number of headwinds such as surging wage and energy pressures. FedEx is a classic “show me” story, and I remain on the sidelines until the company shows signs of being able to close the operating margin gap or if the mentioned margin headwinds abate.

FedEx Announces Lofty FY2025 Goals

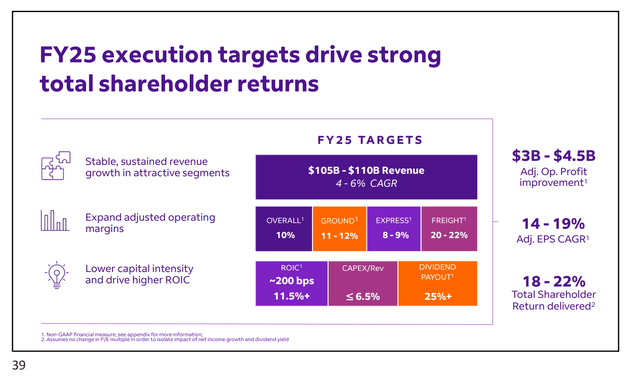

In its recent investor day on June 29th, FedEx management unveiled some lofty FY2025 goals (Figure 1). By FY25, FedEx wants to achieve $105 to $110 billion in revenues and improve profitability to 10% operating margin overall, targeting $3 to 4.5 billion in operating profit improvement.

Figure 1 – FedEx FY2025 goals (FedEx investor presentation)

Revenue Goals Achievable

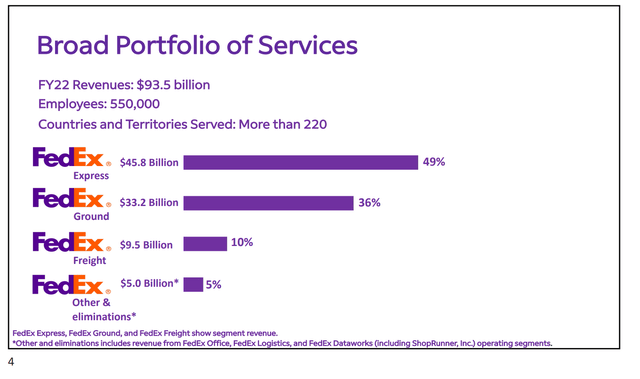

From FY22’s $93.5 billion base (Figure 2), using the midpoint of management’s revenue growth target of 4-6% will generate FY2025 revenues of $108.3 billion.

Figure 2 – FedEx FY2022 revenue breakdown (FedEx investor presentation)

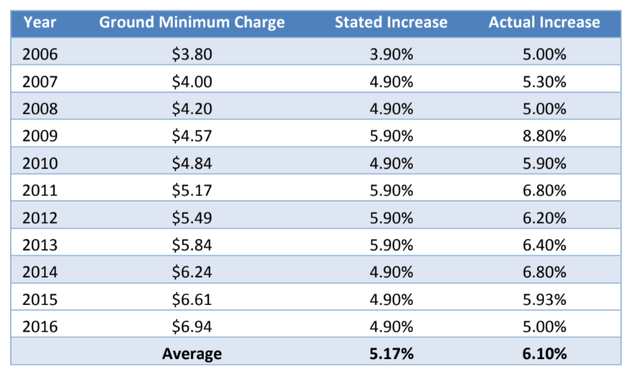

For context, from 2012 to 2022, revenues grew at a 8.1% CAGR. From 2017 to 2022 (post the large TNT acquisition in 2016), revenues grew at 9.2% CAGR. So management’s target of 4-6% revenue CAGR is certainly achievable, particularly if high inflation is sticky and FedEx is able to pass through costs to customers. Historically, FedEx has increased rates by approximately 5% a year (Figure 3).

Figure 3 – Historical Fedex rate increases (shipware.com)

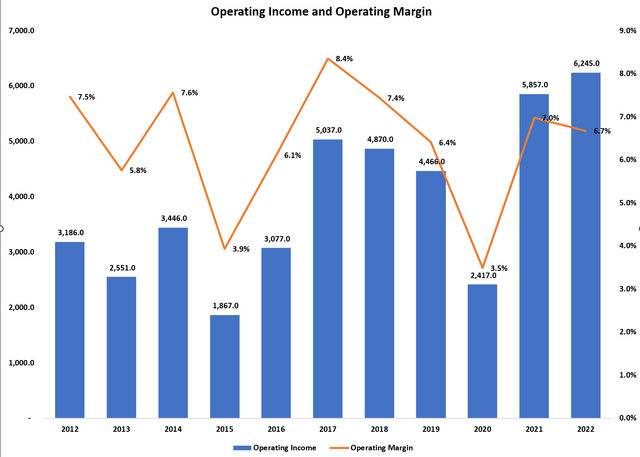

Operating Margin Goals Harder To Achieve

Over the past decade, FedEx has generated operating margin from 3.5% to 8.4% (Figure 4), with an average of 6.4%. In fact, the highest operating margin FedEx achieved in the past 20 years were in 2006 and 2007 when operating margin achieved 9.3%. To find a year when operating margin exceeded 10%, we have to go back 35 years to 1987, when FedEx delivered 11.5% operating margin on $3.2 billion in revenues. Is it possible to get operating margin > 10% in FY2025? Sure. Is it probable? Not likely.

Figure 4 – Historical operating margin (Author created with data from roic.ai)

Express Key To Achieving Margin Goals

FedEx Express, with 49% of revenues, is FedEx’s biggest segment so it’s profitability is the most important to FedEx achieving its overall profability goals. For Express, management wants to boost operating margins to 8-9% by FY2025, from 6.4% in FY2022 (Figure 5)

Figure 5 – Express FY25 goals (FedEx investor presentation)

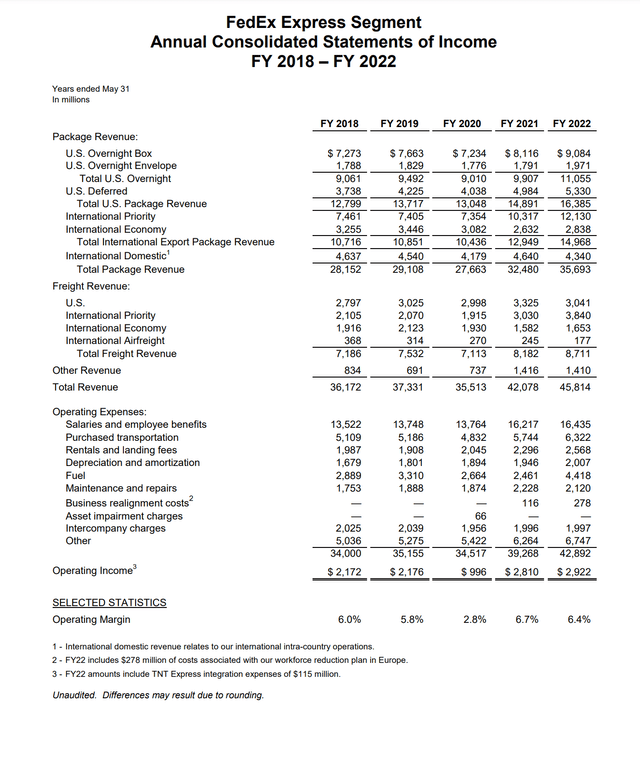

From the reams of operating data FedEx provides, we can see that FedEx Express generated operating margin of 2.8% to 6.4% from FY2018 to FY2022, so 8-9% operating margin seems a bit of a stretch (Figure 6).

Figure 6 – FedEx Express segment operating results 2018 to 2022 (Fedex Investor Releations)

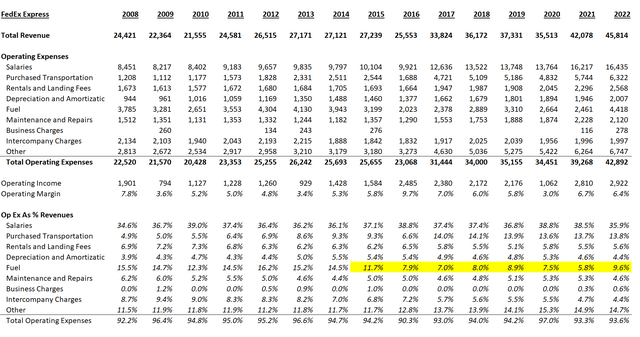

If we go back further, we can see that FedEx Express did achieve the targeted operating margin once, in 2016, when it achieved 9.7% (Figure 7).

Figure 7 – Express segment results 2008 to 2022 (Author created with data from FedEx IR)

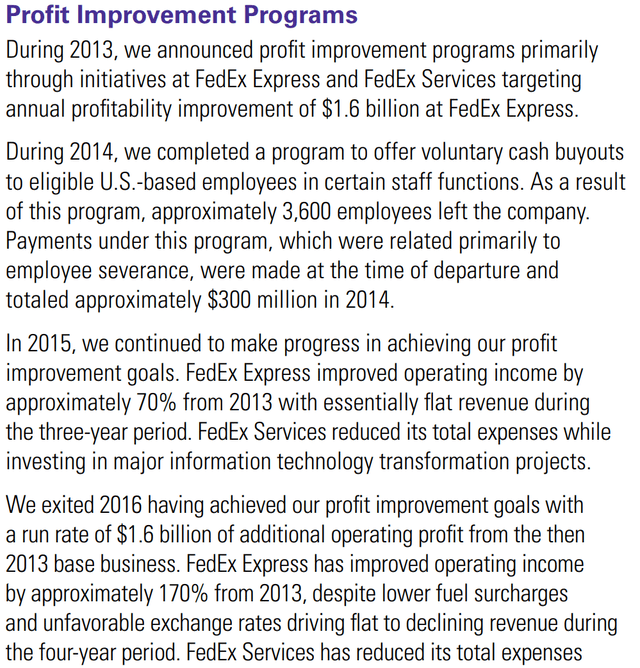

FedEx management cited in its 2016 annual report that it achieved $1.6 billion run-rate improvement in operating expenses from it’s “Profit Improvement Programs” (Figure 8).

Figure 8 – Profit Improvement Program (FedEx 2016 Annual Report)

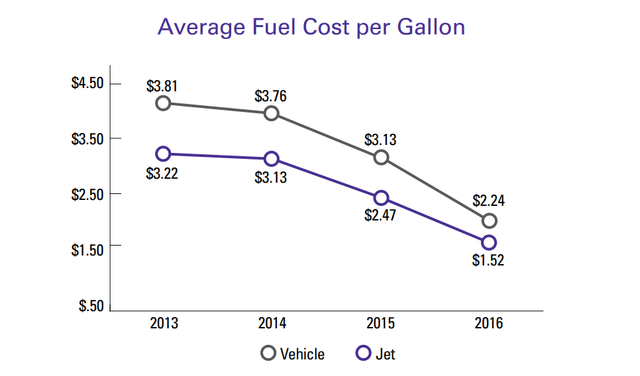

What was left unsaid is that much, if not all, of the profit improvement came on the back of a precipitous drop in fuel prices between 2013 and 2016 (Figure 9). As a % of revenues, fuel expenses fell from 15.2% in 2013 to 7.9% in 2016 or a delta of $2.1 billion in actual fuel expenses, while revenues declined only $1 billion. No doubt a big part of the lower revenues is due to lower fuel surcharges, but the impact of lower fuel costs to operations cannot be understated.

Figure 9 – Drop in fuel expenses (FedEx 2016 Annual Report)

Interestingly, post-2016, we see Purchased Transportation take a step jump from less than 10% of revenues to 13 to 14% of revenues. Perhaps this is FedEx’s way to manage expenses, by outsourcing a big part of the transportation and let 3rd parties take on the volatility, similar to how the FedEx Ground business is run.

In any event, we can see that fuel is a big swing factor for FedEx Express profitability. From 2021 to 2022, fuel went from 5.8% to 9.6% of revenues, although fuel surcharges likely softened the blow. On a multi-year basis, assuming fuel does not continue to shoot higher like it did in FY2022, it is possible for FedEx to raise pricing and reduce fuel’s contribution to expenses (i.e. raise base prices to offset higher fuel expenses and phase out the fuel surcharge, keeping price increases permanent).

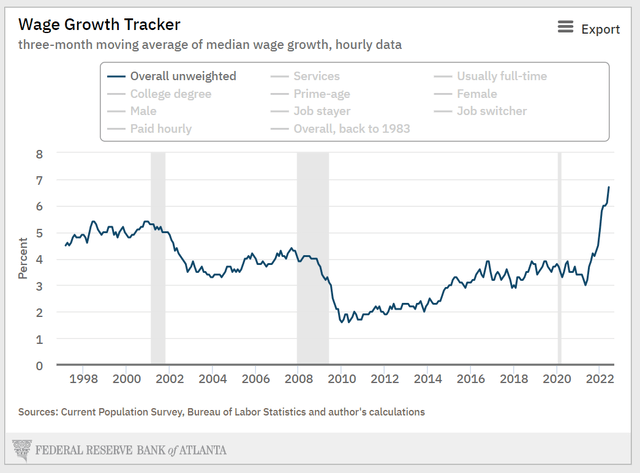

On the other hand, we can see that salaries as a % of revenues fell YoY from 38.5% in 2021 to 35.9%. Granted, part of this is probably because the denominator was inflated by fuel surcharges (2022 weighted average fuel surcharge of 13.1%, 23.0% and 10.1% in U.S. Domestic, International Export, and International Domestic business lines). However, salaries expense rose by only 1.3% YoY while revenues rose by 8.9%, helping offset fuel costs. We do not believe this low level of salary increase is sustainable.

For example, according to the Atlanta Fed, wage inflation is currently running at a 6.7% rate (Figure 10). So while we may see moderation in fuel expenses as % of revenue, we are likely to see salaries expense climb back up. From 2008 to 2022, salary expenses averaged 37.1% of revenues. From 2017 onwards (post TNT acquisition, bringing on European cost structures), this figure averaged 37.5%.

Figure 10 – Wage inflation at 6.7% (Atlanta Fed)

Overall, FedEx Express’ operating margin averaged 5.7% from 2008 to 2022. To expect operating margin expansion of 160 to 260 bps from FY2022’s 6.4% with rising wage and fuel pressures is a bit of a stretch.

FedEx Ground Is Also Important For Margins

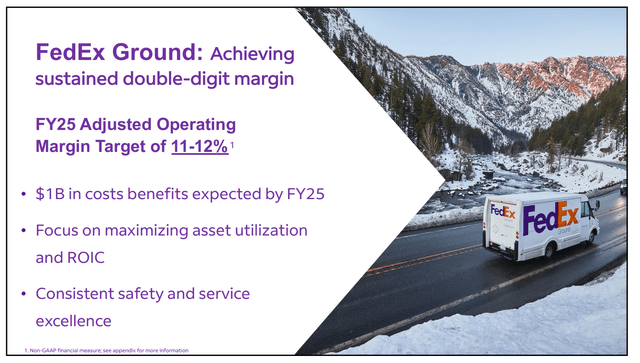

For FedEx Ground which accounts for 36% of revenues, the target is for operating margins of 11-12% by FY2025.

Figure 11 – FedEx Ground FY25 Goals (FedEx investor presentation)

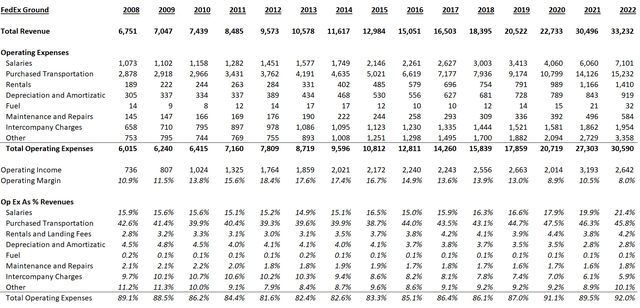

This target appears more achievable, as FedEx Ground achieved that level of profitability as recently as 2019 (Figure 12). Historically, FedEx Ground had been a very profitable business, with operating margins hitting a high of 18.4% in 2012. What caused the deterioration in the last decade and can it be reversed?

Figure 12 – FedEx Ground segment operations (Author created with data from FedEx IR)

The two biggest drivers of cost increase in the last decade were salaries, which rose from 15.2% of segment revenues in 2012 to 21.4% in 2022, and Purchased Transportation, which rose from 39.3% to 45.8%.

First, salaries expense rose from 17.9% of revenues in FY2020 to 21.4% of revenues in FY2022 or 74.9% dollar growth over two years, mostly because COVID-19 created a surge in demand for online shopping and home delivery services while the pandemic also created a shortage of workers, putting upward pressure on wages. As of May 31, 2020, FedEx Ground employed 40,000 full-time, and 114,000 permanent part-time employees. This figure jumped to 66,000 full-time and 134,000 permanent part-time employees as of May 31, 2022 or 65% increase in full-time staff and 18% increase in part-time staff. Given the wage pressures cited by the Atlanta Fed, salaries as % of revenues may stay elevated.

On Purchased Transportation, we must understand that FedEx Ground conducts its delivery operations through more than 100,000 vehicles owned and operated by “independent contractors.” Although FedEx has outsourced the delivery operations (staffing, fuel, vehicle maintenance, etc.), the same cost pressure that affect in-sourced businesses would show up in this line item. It is actually surprising transportation as % of revenues decreased from 47.5% in FY2020 to 45.8% in FY2022, meaning the profitability of FedEx contractors have actually decreased during COVID-19.

In fact, contractors appear to be up in arms over their decreased profitability, as judging from recent news articles. Will FedEx be able to squeeze more profitability out of contractors?

Are Contractors Really Contractors?

A secondary consideration is that FedEx is currently embroiled in a messy legal battle on whether “FedEx Ground should be treated as an employer or joint employer of drivers employed by service providers engaged by FedEx Ground.” If ‘independent contractors’ wear FedEx uniforms and drive routes set by FedEx, are they really independent?

The courts certainly didn’t think so, as the Ninth Circuit Court of Appeals in San Francisco concluded in 2014 that FedEx had misclassified FedEx Ground drivers as independent contractors. Interestingly, if we look at FedEx Ground’s Purchased Transportation expenses as % of revenues, it took a step jump higher from under 40% to 44% in 2016, right after the Company decided to settle the misclassification lawsuit in California. Perhaps FedEx Ground’s extraordinary profitability earlier in the decade was simply due to the Company not properly compensating route drivers?

Looking forward, it appears management has a lot of work to do in order to achieve its stated 11-12% operating margin in the Ground business. Wage pressures are surging, which could keep salaries as % of revenues high. Also, cost pressures at independent contractors could force that line item to increase as a % of revenues.

Assuming FedEx does achieve its goals, what are shares worth?

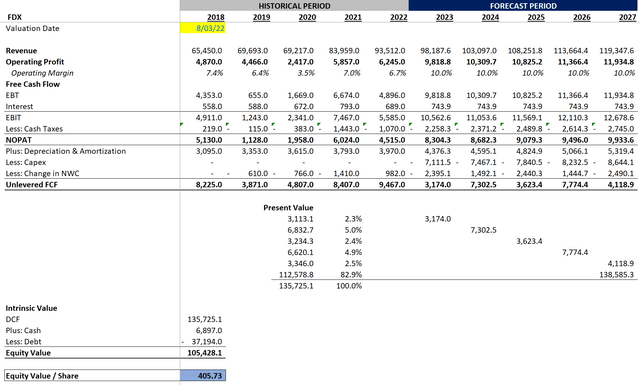

If management can indeed grow revenues to $105 to 110 billion by FY2025 while improving operating margin to 10%, a discounted cash flow (“DCF”) analysis shows shares could be worth $400, or 70%+ upside (Figure 13).

Figure 13 – DCF valuation given management goals (Author created)

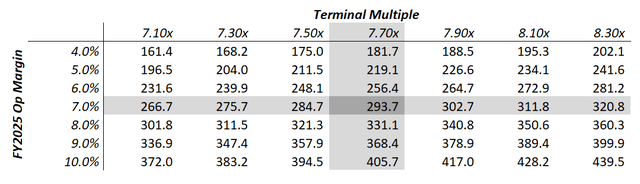

However, given the challenges mentioned above regarding the Express and Ground segments, what operating margin is the market actually pricing in? At current share price of $233, it appears the market is pricing in operating margins between 5 to 6%, slightly less than the 6.4% average operating margin mentioned at the beginning of the article.

Figure 14 – Sensitivity analysis (Author created)

Risks To My Analysis

An upside risk to FedEx is obviously if energy and wage inflation abates, in which case management has an easier job in achieving the 10% FY2025 operating margin goal. However, given western sanctions on Russian energy exports, the only plausible way energy prices decrease would be if the global economy enters a recession.

This then becomes a downside risk, as FedEx’s business is cyclical and sensitive to general business volumes. In fact, FY2019 (which encompassed the 2018 Fed tightening and global slowdown) saw operating margins fall 1.0% YoY to 6.4% and EPS fall 88% from $16.79 to $2.03. FY2009, the Great Financial Crisis year, saw operating margins of 2.1% and EPS of $0.31. So, there appears to be a large downside risk to FedEx from economic slowdowns.

Conclusion

In conclusion, while management has unveiled lofty FY2025 goals of $105-110 billion in revenues and 10% operating margins, it appears the market is currently not giving FedEx any credit for these goals. As management executes and delivers against those goals, we may see the stock appreciate towards the 75%+ potential upside. However, given the headwinds in margins that I mentioned, I am currently on the sidelines regarding the stock. I believe this is a classic “show me” story.

Be the first to comment