uschools/E+ via Getty Images

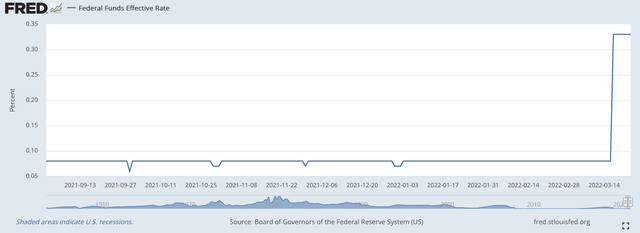

On Wednesday, March 16, the Federal Reserve raised its target range for the policy rate of interest, the Federal Funds rate by 25 basis points to 0.25 percent to 0.50 percent.

The Federal Reserve also saw the effective Federal Funds rate rise to 0.33 percent for the whole banking week.

Thus, the Fed has kept the effective Federal Funds rate at 0.08 percent from September 1, 2021, to March 16, 2022.

Now, it appears that the Fed will keep the effective Federal Funds rate at 0.33 percent for the time being.

Here is the chart.

Effective Federal Funds rate (Federal Reserve)

Federal Reserve officials have signaled that they will raise this policy rate up to five more times this year.

If the Fed sticks to just 25 basis point increases, the range for the Federal Funds rate would rise to 1.50 percent to 1.75 percent.

Some officials, however, are talking about the need to move the range by 50 basis points, at least a couple of times, to get the effective Federal Funds rate up to a level that would be more effective in fighting inflation,.

Federal Reserve Tapering

As has been noted, the Federal Reserve has been tapering its outright purchases of securities for its portfolio this year.

Since December 29, 2021, the Fed has only purchased, outright, $230.0 billion. Last year, it had been purchasing $120.0 billion per month.

So, the Fed did exactly what it signaled the financial markets that it would do.

And, as promised, the Fed raised the target range for the Federal Funds rate at its March meeting of the Federal Open Market Committee.

But, while the Federal Reserve was still buying $230.0 billion in securities, it was also selling, under an agreement to repurchase, $134.0 billion of securities.

Furthermore, the Federal government was removing $315.0 billion in reserves as it moved money from its accounts at the Federal Reserve to accounts in the private sector.

Net, from December 29, 2021, through March 23, 2022, the Federal Reserve oversaw a decline in reserve balances at commercial banks.

In other words, the Federal Reserve oversaw a decline in reserve balances at commercial banks of just over $270.0 billion.

In other words, while the Fed was still buying securities in the open market, it was overseeing the selling of securities in order to keep the Federal Funds rate, up at 0.08 percent until March 16 and “goose” the Federal Funds rate up to 0.33 percent ever since the rise in the target range.

Note that over the past two weeks, reserve balances of commercial banks fell in both weeks.

Reserve balances fell by just over $60.0 billion in the banking week ending March 16 and fell again by a little more than $124.0 billion in the banking week ending March 23.

The Future

This behavior, on the part of the Fed, raises questions about how the Fed is going to handle the battle against inflation.

The commercial banking system has close to $3.8 trillion sitting in Federal Reserve accounts.

This $3.8 trillion represents something like “excess reserves” to the commercial banking system.

The Federal Reserve, protecting the U.S. banking system and the U.S. economy, put all this money into bank accounts over the past two years as it strove to keep the economy and financial system healthy.

All this liquidity in the banking system puts downward pressure on the Fed’s policy rate of interest.

And, as we have seen over the past year or so, the Federal Reserve has had to rely on the Federal government and the market for repurchase agreements to remove sufficient liquidity from the banking system to keep the Federal Funds rate from falling below 0.08 percent and, now, falling below 0.33 percent.

It would seem that the Federal Reserve cannot keep selling securities into the “repo” market in order to keep the effective Federal Funds rate rising to support, maybe, up to five more changes in the Fed’s target range for the Federal Funds rate.

In other words, the Federal Reserve, at some time this year, is going to have to begin to reduce the size of its securities portfolio.

Fed officials have suggested that they can reduce the size of the Fed’s securities portfolio by letting securities mature and not replace them.

The question here is, will just the maturing securities provide enough balances to reduce the portfolio to the size it will need to be reduced?

My guess on this is that maturing securities will not be able to do the job.

Thus, sometime during this year, the Fed is going to have to start selling securities from its portfolio.

This will be a major move.

Federal Reserve Quandary

More and more, people in the investment community are starting to realize that the Federal Reserve has created a situation that it is going to have a hard time solving.

Since early 2020, the Federal Reserve has pumped an excessive amount of funds into the banking system. Mr. Powell, in all that he has done, has continually tried to err on the side of monetary ease so as to avoid a situation where the financial system got a shock that would collapse the system.

So far, Mr. Powell and the Fed have avoided this kind of calamity.

But, it now faces the problem of having to deal with the “over cautiousness.”

In other words, the Federal Reserve has created this situation and now the Federal Reserve must get us out of this situation.

This is not going to be easy.

And, in my estimate, it is not going to be painless.

But, this is where we are. And, we know so little about all the other factors that are going to be impacting our future.

In my view, the Federal Reserve is going to have to start reducing the size of its securities portfolio. This is the only way that it is going to be able to raise its policy rate of interest.

I await Mr. Powell’s suggestion on how this is all going to be done.

Be the first to comment