mihailomilovanovic

Thesis

Leading premium shopping centers REIT Federal Realty Investment Trust (NYSE:FRT) stock has faced massive headwinds sustaining its upward momentum in 2022, despite the underlying recovery in its operating metrics.

Consequently, FRT has underperformed the broad market significantly in 2022, down nearly 25% on a total return basis. As a result, we believe the market has de-rated FRT, even though its FFO per share growth cadence is expected to return to its pre-pandemic momentum.

Our analysis indicates that FRT’s valuation seems reasonable, despite the de-rating. While Federal Realty is not expected to be immune to a broad slowdown in consumer discretionary spending, its target customers are still likely to be resilient.

Therefore, we deduce that potential downside risks in its operating metrics are reflected in its current valuation, despite worsening macro headwinds coupled with a hawkish Fed and elevated inflation.

As a result, despite the near-term downside volatility, we believe the recent pullback from its summer rally could be an opportunity for investors to add more exposure.

Accordingly, we rate FRT as a Buy.

Federal Realty’s Recovery Remains Robust

Federal Realty’s underlying metrics have continued to improve through Q2 as occupancy rates improve. The REIT reported an occupancy rate of 92%, with 94.1% leased in Q2. It also raised its FY22 guidance for FFO per share growth, as it expects a more robust recovery, despite the worsening macro headwinds. Furthermore, management anticipates that its occupancy rates could improve further to between 92.5% and 93% by the end of 2022.

Therefore, we believe it accentuates management’s confidence in its target consumers, which are likely less immune to the cyclical challenges posed by the gamut of macro headwinds we highlighted earlier. Management articulated:

Percentage rent, an indicator of tenant sales strength, was up over 90% on a comparable basis and up 18% sequentially on a rolling 12-month average. These data points all serve as a testament to the relative strength of the consumer in our high-income, highly educated, densely populated high-barrier markets. Again, [these] markets have demonstrated resilience over cycles and the ability to outperform during cyclical downturns. (Federal Realty FQ2’22 earnings call)

Federal Realty’s Recovery Is Still Expected To Normalize

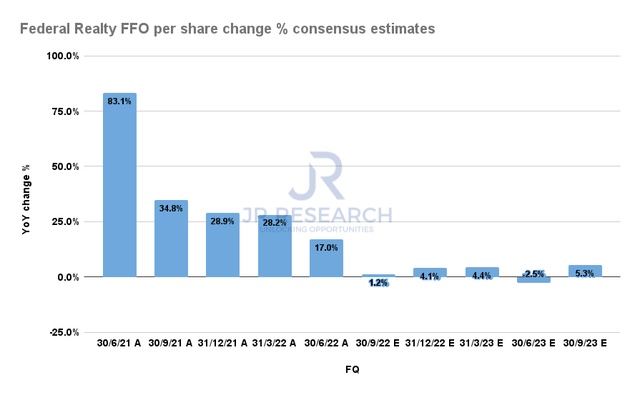

Federal Realty FFO per share change % consensus estimates (S&P Cap IQ)

Notwithstanding, we believe the market likely anticipated normalization in its post-pandemic recovery. Despite management’s raised FFO per share guidance for FY22, it still suggests that H2’s growth cadence should moderate.

Accordingly, the consensus estimates (bullish) indicate that Federal Realty’s FFO per share growth could slow to 1.2% in Q3 before recovering to 4.1% in Q4.

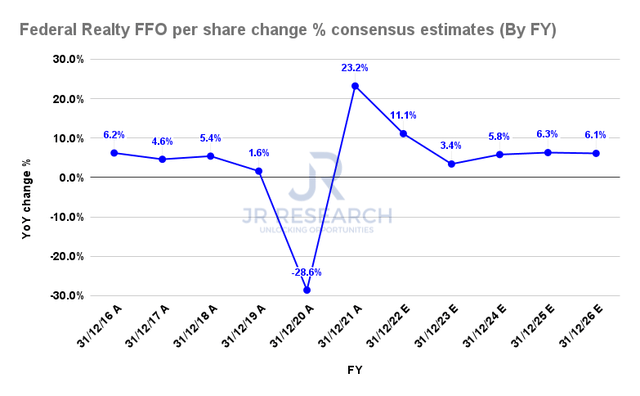

Federal Realty FFO per share change % consensus estimates (By FY) (S&P Cap IQ)

As a result, Federal Realty’s FFO per share growth is expected to slow to its near-term nadir in FY23 before recovering its pre-pandemic cadence through FY26. However, given the current macro headwinds, we believe the trajectory is reasonable.

Therefore, we believe the de-rating in FRT in 2022 is justified to reflect its post-pandemic growth normalization. The market also needs to de-risk FRT’s valuations to account for potential macro headwinds that could further squeeze its higher-end consumer wallet if the recession is worse than expected.

Federal Realty’s Dividends Look Secure

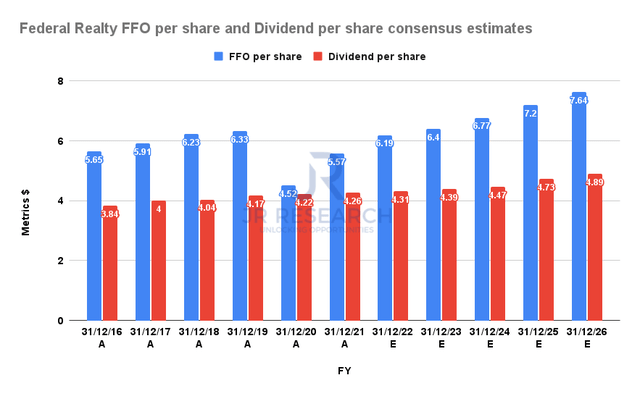

FRT FFO per share and Dividend per share consensus estimates (S&P Cap IQ)

Income investors can still rest assured of Federal Realty’s robust FFO metrics in sustaining its dividend strategy over the medium-term. Management remains prudent in its payout ratios, which we believe is conservative but is necessary for telegraphing confidence to the market in its ability to sustain its strong dividend-paying record.

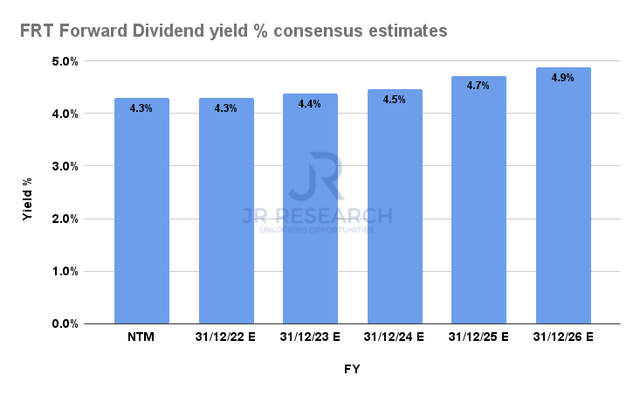

FRT Forward Dividend yields % consensus estimates (S&P Cap IQ)

On an NTM basis, its dividend yield has improved to 4.3%, given the recent pullback. Furthermore, investors can continue to expect stronger payouts through FY26, which we believe should help undergird its current valuations.

Is FRT Stock A Buy, Sell, Or Hold?

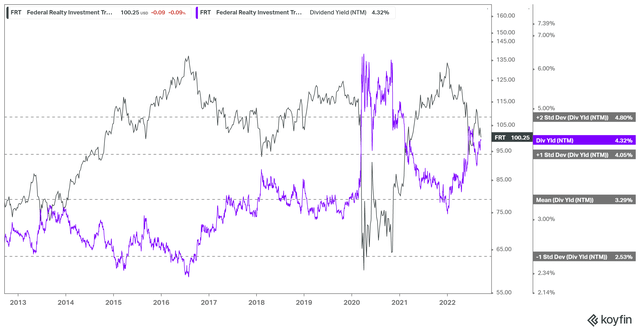

FRT NTM Dividend yields % valuation trend (koyfin)

FRT’s NTM dividend yields last traded above the one standard deviation zone above its 10Y mean of 3.29%. Therefore, we are confident that its valuation is attractive, as the losses seen in 2020, driven by the COVID pandemic, are unlikely to recur despite the looming recession.

Furthermore, management’s confidence in raising its FFO per share for FY22 is a testament to the confidence in its execution through the cycle. Therefore, we don’t expect its NTM dividend yields to reach the above two standard deviation zones above its 10Y mean last seen in the pandemic lows.

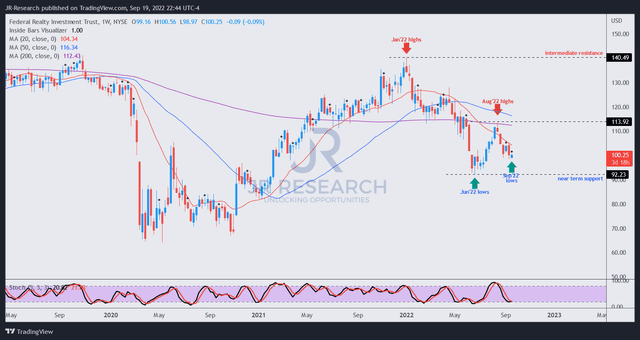

FRT price chart (weekly) (TradingView)

Furthermore, we gleaned constructive price action in FRT’s upward momentum. Despite the recent pullback from its August highs, FRT has moved into medium-term oversold zones, and its September lows look likely to be sustained above its June bottom.

Therefore, the price action appears to support the continued recovery of its medium-term bullish bias, even as macro headwinds are likely to worsen further.

We rate FRT as a Buy and urge income investors to use the recent pullback to add more positions.

Be the first to comment