Sean Gallup

Elevator Pitch

Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG), which investors also refer to as Google, continues to warrant a Buy investment rating in my opinion. In my previous July 7, 2022 update for Alphabet, I indicated that Google is “a Buy during the dip” in the short term.

My attention turns to Alphabet’s appeal as a long-term investment in the current article. Google’s recent uninspiring share price performance and a decrease in the average sell-side analyst rating for the stock might have come as a disappointment for some investors. But there are multiple signs and indicators, as detailed in this article, which suggest that Alphabet’s business and financial outlook in the long run is still excellent.

I think there are a number of growth drivers and value creation levers that will drive Google’s stock price up over time. Therefore, I keep my Buy rating on Alphabet unchanged, based on the belief that investors in Google with a long-term horizon will eventually be rewarded for their patience.

Has Google Stock Performed Well?

Google stock hasn’t performed well in recent times.

Alphabet’s stock price declined by -29% and –26% for the 2022 year-to-date and the one-year time periods, respectively. In comparison, the S&P 500 was down by -19% and -13% for this year thus far and the last year, respectively. In other words, Alphabet’s shares have underperformed the broader market recently.

However, investors who have bought into the company’s shares earlier are still sitting on huge gains.

In the past three years, Alphabet’s shares rose by +66%, which was more than double the +30% increase for the S&P 500 in the same period. Similarly, Google’s share price went up by +118% in the last five years as compared to a relatively more modest +56% rise for the S&P 500 during this period.

The above-mentioned numbers illustrate the importance of having a reasonably long term investment horizon when considering a potential investment in Alphabet or any other stock for that matter.

What Are Analyst Ratings On Alphabet Stock?

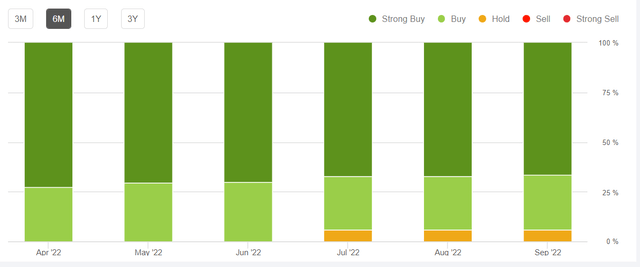

Wall Street continues to be very bullish on Alphabet’s stock, as evidenced by the fact that 48 of the 51 sell-side analysts covering the company’s shares have assigned either a Buy or Strong Buy rating to Google.

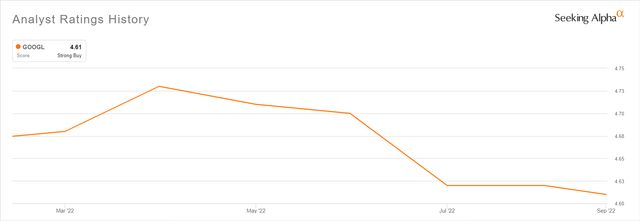

But it is the change in analyst ratings over time that really matters (instead of the absolute rating), as this is a key indicator of investor sentiment.

Analyst Ratings History For Alphabet In The Past Six Months

Seeking Alpha

The Sell Side’s Recommendations For Google Stock In The Last Six Months

Seeking Alpha

As per the charts presented above, the average analyst rating (5 for Strong Buy, 3 for Hold, 1 for Strong Sell) for Google has gone down from 4.73 as of end-April 2022 to 4.61 now. Another way to look at this is that there were no Hold or Sell ratings for Alphabet in the months of April, May and June 2022, but three analysts rated Google as a Hold since July this year.

In a nutshell, investor sentiment for Alphabet has weakened in recent months based on an analysis of the change in investment ratings for the stock.

Alphabet Stock Key Metrics

There are a number of positive takeaways from Alphabet stock’s key metrics disclosed as part of the company’s most recent quarterly financial results and management commentary from other sources as well. These metrics support the thesis that Google is an excellent investment candidate for the long run.

Firstly, Alphabet’s Google Search & Other business performed very well in Q2 2022 notwithstanding macroeconomic challenges, and this bodes well for the long-term outlook for the company and its core business.

According to its Q2 2022 10-Q filing, revenue for the Google Search & Other service grew by +13.5% YoY from $35.9 billion in Q2 2021 to $40.7 billion for Q2 2022. Alphabet’s actual Q2 2022 revenue for the Google Search & Other business also beat the market’s consensus forecast by approximately +1% as per S&P Capital IQ data.

Google Search & Other is the most important business for Alphabet, as it is the company’s largest revenue contributor accounting for 58% of its top line FY 2021. At its Q2 2022 earnings briefing, Alphabet stressed that the company’s strategy is to provide products and services that are “helpful to people and businesses during uncertain moments” and “for the long term” as well. Specifically, GOOG highlighted that Google Search serves the purpose of enabling people “to find anything from anywhere.”

The good Q2 2022 performance of the Google Search & Other business line even during difficult times like these is encouraging. This suggests that Google’s search ads will remain a very relevant tool for advertisers in their efforts to reach out to their target audience in the intermediate to long term. As an example of how Alphabet is optimizing Google Search to adapt to changes in users’ preferences and needs, the company is constantly tweaking its Search products to facilitate voice and visual searches which are becoming more popular.

Secondly, Alphabet is trying hard to achieve a balance between cost optimization in the short term and sustaining investments for the long run. I believe this cost optimization exercise in the near term will allow GOOGL to re-allocate cost savings and excess capital into projects that have the best chance of delivering the most upside in the long term.

Seeking Alpha News reported on September 7, 2022 that the CEO of Alphabet mentioned at a recent conference that he “is looking to make Google ‘20% more productive'”, which “may call for job reductions.” The CEO’s comments are consistent with what the company’s CFO noted at the recent quarterly results call. At its Q2 2022 earnings briefing, the CFO of Google emphasized that the company needs to ensure that it is “using resources effectively where we can to redeploy it and put it back into long-term investments.”

An August 16, 2022 BofA Securities research report (not publicly available) titled “More Layoff Speculation In Press” estimated that Alphabet has “roughly 50k employees (40% growth) added since the pandemic in 1Q’20.” This suggests that Google has substantial leeway to cut back on expenses and reinvest such savings in long term growth opportunities.

Thirdly, Google’s shareholder capital return metrics for the year-to-date period have been impressive, and this is an important investment criterion for investors. Allocating a meaningful amount of excess capital to share buybacks or dividends typically suggests that a company is shareholder-friendly and exercises prudence in the area of capital investments (which competes with the other key capital allocation alternative, shareholder capital return).

Alphabet spent approximately $15.2 billion on share buybacks in Q2 2022, and this means that it has allocated around $28.5 billion to share repurchases for the first half of this year. Assuming that Google maintains the same pace of share buybacks in 2H 2022, this will work out to be a decent annualized share buyback yield of 4%.

The company’s continued emphasis on shareholder capital return is critical for two key reasons.

One key reason is that a company with a track record of consistent shareholder capital returns will usually consider the expected investment returns of various capital allocation alternatives more carefully. In the case of Alphabet, it might be compelled to invest in more risky projects with uncertain payoffs in the absence of a share buyback program like the one it has now.

The other key reason is that share repurchases serve as a potential avenue of value creation in uncertain times. As the economy continues to weaken and the bear market is prolonged, Alphabet’s business growth will naturally be more muted and valuation multiples will compress across the board in the near term. In such a scenario, Google can create value for its shareholders by engaging in value-accretive share buybacks in an opportunistic manner as and when there is a substantial correction in its shares.

Is Google Stock A Good Long-Term Investment?

Google stock is a good long-term investment. In the preceding section, I touched on how Alphabet’s recent metrics send positive signals about its long-term growth outlook. In this section, I will highlight another three key points that investors should consider in evaluating the company’s growth prospects in the future.

One key point is that Alphabet’s long-term revenue growth might exceed market expectations, with Google Cloud being a major driver. As highlighted in the company’s September 2022 investor presentation, Google Cloud’s quarterly revenue has tripled from $2.1 billion to $6.3 billion in just two years between Q2 2019 and Q2 2021, but this business has yet to reach its full growth potential.

Alphabet stressed at the Goldman Sachs (GS) Communacopia + Technology Conference on September 13, 2022 that “new markets (in cloud) are opening, driven by growth in data, artificial intelligence, machine learning, cybersecurity and others.” The company’s bullish view about the cloud market and Google Cloud is reflected in IDC’s forecast (as cited in Alphabet’s September presentation) that public cloud services spending will almost double from $505 million in 2022 to $1.06 trillion by 2026.

Another key point is that Alphabet has significant room for operating profit margin expansion over time.

Based on the sell-side’s consensus financial projections sourced from S&P Capital IQ, the analysts are predicting that Google’s EBITDA margin will expand from 39.7% in fiscal 2022 to as high as 41.9% in fiscal 2026. If Wall Street is right, Alphabet’s FY 2026 EBITDA margin will mark a new 15-year peak for the company.

YouTube Ads and many of Alphabet’s businesses grouped under the Other Bets segments are sub-scale, which explain why they either boast low profit margins or are unprofitable. As these businesses expand their respective revenue bases in time to come, it is a matter of “when” rather than “if” that positive operating leverage kicks in and translates into improved profitability.

The final point is about capital allocation.

It is amazing that Alphabet has a strong financial position now, even though it just executed on the largest quarterly share buyback in the company’s history in Q2 2022. As per S&P Capital IQ’s financial data, Google has an estimated $125 billion in cash and short term investments on its books as of June 30, 2022. Considering the free cash flow generative nature of the company’s business, Alphabet’s cash pile is very likely to continue growing in the years ahead.

Many companies fret about the inability to generate positive cash flow, a weak balance sheet, and the lack of excess capital needed to support future growth or reward shareholders with capital return. This isn’t Google’s problem. Assuming that capital market conditions become more challenging going forward due to a weak economy and a bear market, Alphabet’s ability to fund its future long-term investments with internally generated cash flow will become even more important. Moreover, Alphabet is among a minority of companies that has the financial strength to support both capital investments and capital return. In fact, it is reasonable to assume that Google will allocate an increasing proportion of capital to share buybacks and other shareholder capital return initiatives over the coming years.

Is Alphabet Stock A Buy, Sell, or Hold?

Alphabet stock stays as a Buy-rated name in my view. There are many things that long-term investors will like about Alphabet. These include the potential for increased shareholder capital return, the positive expectations of operating profit margin expansion, and the long growth runway for Google Cloud.

Be the first to comment