Dilok Klaisataporn/iStock via Getty Images

The recent market rally has given investors hope, but only time will tell if it’s a repeat of the bear market rally from the summer that later fizzled. It’s important, however, to take advantage of opportunities that remain cheap and are able to withstand economic adversity.

This brings me to Federal Realty Investment Trust (NYSE:FRT), that, along with shopping center peer Regency Centers (REG) did not cut its dividend over the past 2 years (and never over the past 50+ years for that matter). This article highlights why FRT is currently too cheap for its quality and trophy properties.

Why FRT?

Federal Realty Trust is a shopping center REIT that was founded 60 years ago, in 1962. It has a portfolio of high-quality shopping centers that are mostly located in densely populated areas with high average household incomes. These properties include Pike & Rose in North Bethesda, Maryland, Santana Row in San Jose, California, and Assembly Row in Somerville, Massachusetts.

At present, FRT’s portfolio consists of 105 properties in 8 of America’s largest metropolitan areas, with around 3,100 tenants across 25 million square feet and ~3,400 residential units. Notably, FRT is also a Dividend King that’s weathered through countless economic cycles and raised its dividend for 55 consecutive years.

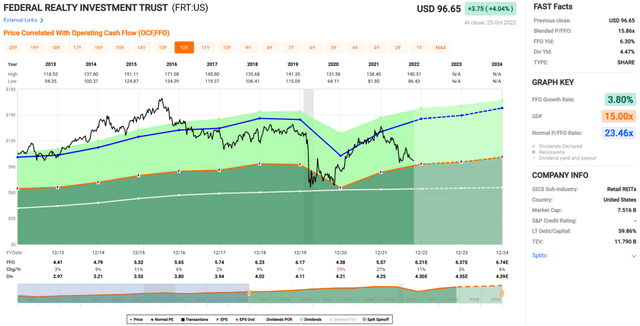

It appears the market is not appreciating FRT for its quality, as the stock is now trading well below its 52-week high of $140.51. Perhaps the market is spooked by the potential for an economic recession and higher interest rates.

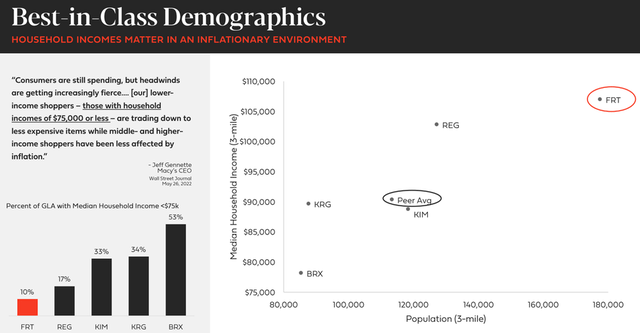

While those are legitimate concerns, I believe FRT is extremely well positioned to handle them. This is considering the very high quality nature of the portfolio with best in class-demographics. As shown below, FRT has the lowest exposure to areas with median household annual income less than $75,000, while having the highest population density and median household income among its peers.

FRT Portfolio Demographics (Investor Presentation)

This has translated into strong growth, with property operating income growing by 8.2% YoY during the second quarter, driven by strong lease spreads and improving leased rate at 94.1% (140 bps higher than the prior year period). Notably, FRT is just one of a handful of REITs with an A- credit rating with a net debt to EBITDA ratio of 5.8x and strong fixed charge coverage ratio of 4.3x.

Moreover, NAREIT noted last month that Q2 demand outstripped supply in the retail REIT segment, and FRT’s longtime CEO Don Wood recently went on CNBC this month to state that the company is a port in the storm, and that effectively, there hasn’t been much building of retail over the past 10 – 15 years, leading to the favorable supply and demand dynamics that the players are seeing now.

Perhaps counterintuitively, well-placed shopping center REITs such as FRT have actually benefited from COVID in the long-run, as people discovered the importance of socialization and omnichannel. This was exemplified by the CEO during last month’s Bank of America (BAC) Global Real Estate Conference:

We did extremely well during the global financial crisis. And then we have a run from 2011 to 2016 or so, that was just equally good. By ’17, ’18 and ’19 before COVID, the conversation in our industry about online shopping, bricks and mortar, is it necessary at all? What role does it perform, does it serve? And so there was a malaise of a period of time there in terms of stock performance certainly, as people figured out what was going to happen.

Coming out of COVID, I think COVID did the industry the best favor it could by saying, yeah, you know, maybe these things do live in tandem. Maybe there are distribution methods that can work together, but at the end of the day, we need bricks and mortar. And so, out we come from COVID. As we come out of COVID, our hours as along with most of the industries, incomes or leasing was extremely strong. It remains that strong today, and so leasing back up from the eighties into the mid-nineties was happened much faster frankly than we thought it would and it resulted in our outperforming significantly on an earning basis over the past eight quarters or so.

Meanwhile, FRT pays a very well-covered dividend with a low 65% payout ratio. I also find it to be attractively valued at present, with a forward P/FFO of 15, sitting well below its normal P/FFO of 23.5 over the past decade. Analysts have a consensus Buy rating and S&P Capital IQ has an average price target of $116.45, implying potential for strong double-digit total returns over the next 12 months.

Investor Takeaway

Income-oriented investors seeking a “sleep well at night”, well-covered dividend yield should consider Federal Realty Investment Trust. It carries very strong portfolio fundamentals, backed by industry-leading quality metrics. FRT is attractively valued at present and offers strong potential for strong total returns over the next 1-2 years.

Be the first to comment