Douglas Rissing

We think there is a huge risk that the Fed and some other central banks are overshooting with the monetary tightening, which is increasing the chances for a hard landing of the US economy, taking much of the world with it.

We think we are entering the territory where the remedy is worse than the disease, basically as most of the forces that produced inflation were one-offs, not structural developments even if the war in Ukraine and Chinese lockdowns have prolonged these. Inflation was the result of:

- Huge fiscal pandemic support, in combination with monetary accommodation.

- A series of supply shocks as a result of the pandemic which created bottlenecks in the labor market, critical components, and shifting demand from services to goods which exacerbated these.

Policies have already reversed and while supply chain problems got another flip with the invasion of Ukraine and Chinese lockdowns, these too are mostly on the wane on the back of softening economies and normalization of supply chains. There are multiple signs that inflation will come down fairly soon:

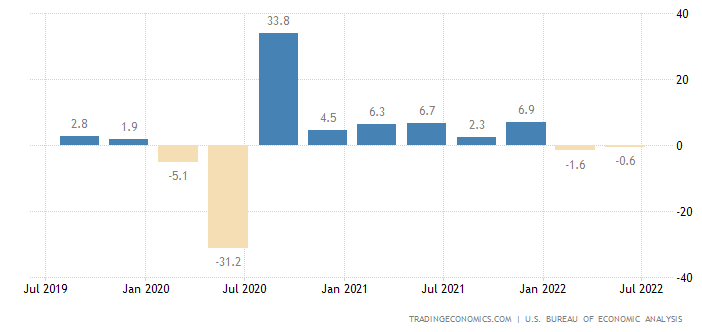

The economies of all three major growth centers (US, EU, China) are slowing down rapidly or already bordering on a recession. The US already had two quarters of negative growth:

Tradingeconomics

Commodity prices have come down, including oil, despite the war, here is the WTI:

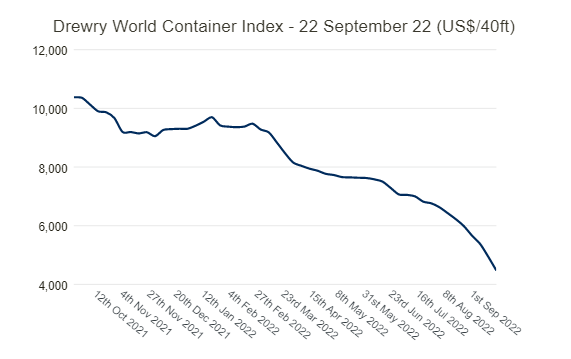

Transport costs like most freight rates (see our previous article on ZIM) have come down 50%+ from their peak:

Drewry

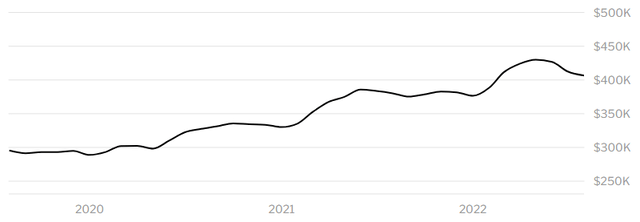

Mortgage rates have risen to decades high with those in the US topping 6%, cooling the housing market where prices are already coming down:

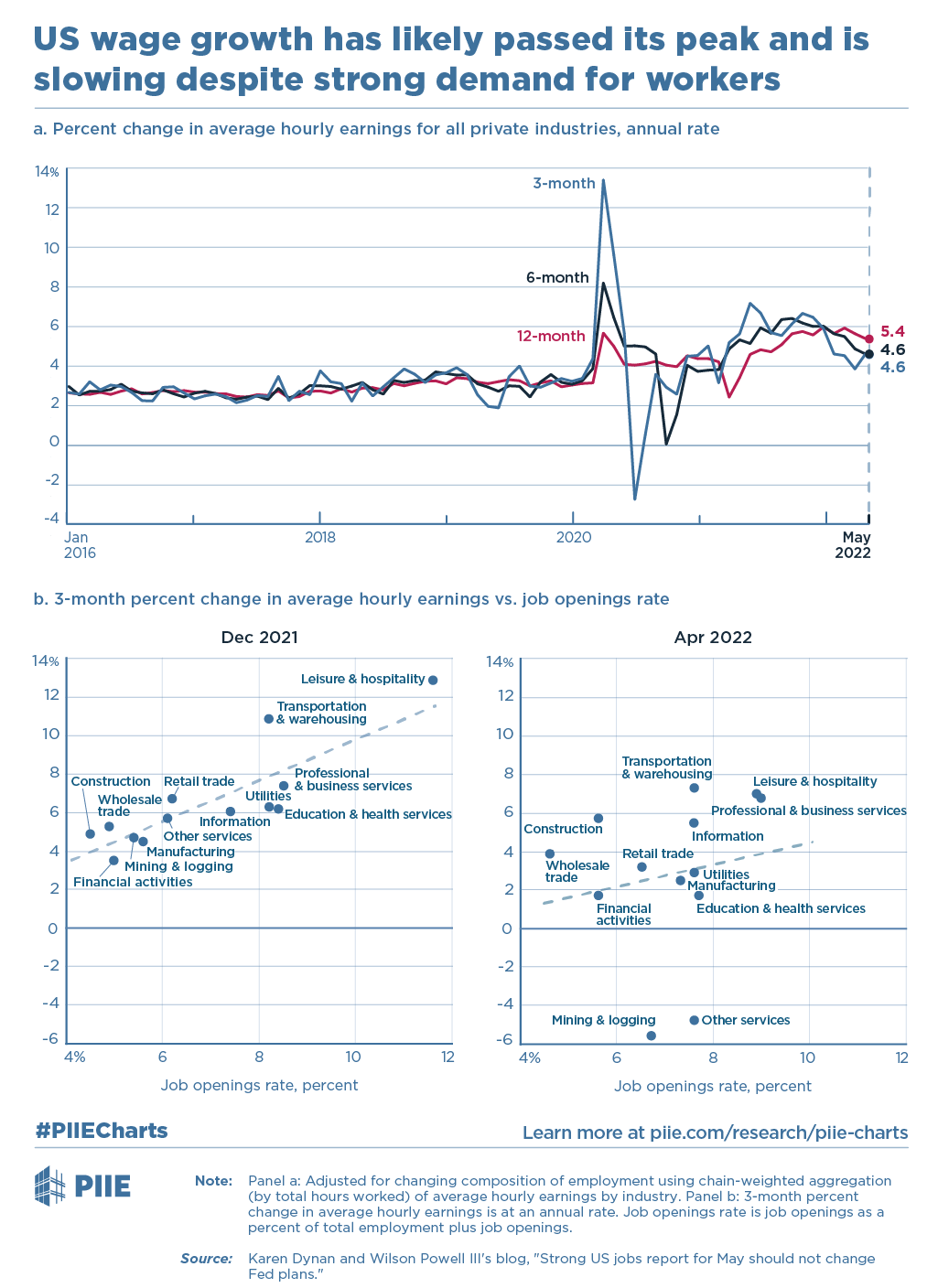

Despite still very high labor scarcity, wages haven’t exploded and are mostly growing below the inflation rate. This isn’t the 1970s with indexed wage contracts and radical unions ruling the roost, there has been a seminal shift in power away from labor in the past five decades.

PIIE

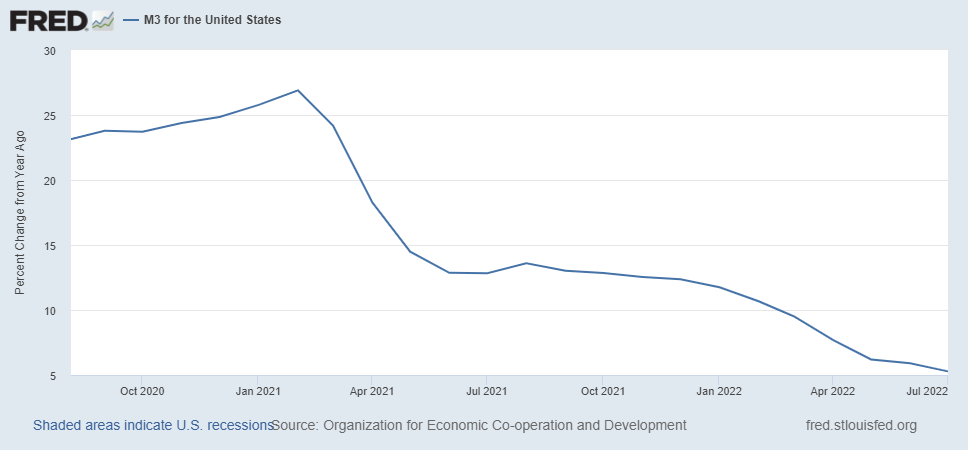

Monetary aggregates are coming down sharply almost everywhere and in real terms, they are already negative and the Fed is draining $95B a month in dollar liquidity through QT in addition to sharp interest rate rises.

FRED

The rise in the dollar squeezes world liquidity and higher US interest rates have a profound effect on balance sheets in a dollar debt-laden world.

CNBC

Stockmarkets have been in retreat almost everywhere

Economic areas

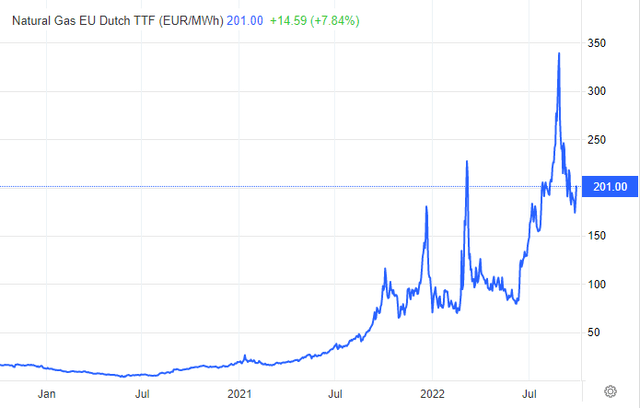

Much of the EU especially will face a deep recession as a result of sky-high natural gas prices (in the order of 10x those of Henry Hub) which (through heating and electricity prices) has a dramatic effect on the purchasing power of many consumers and a host of businesses are struggling as well.

Market reforms in the form of the introduction of marginal cost pricing have greatly magnified the negative effects as electricity rates are now based on the cost of the most expensive supply in daily and hourly auctions.

This is leading to perverse results, where electricity prices rise sharply even if natural gas (which obviously is the marginal supply) isn’t the main input of electricity generation.

Most governments have embarked on hugely expensive support programs that, in combination with rising interest rates and slowing economies, will further worsen public finances and could in time reignite the euro crisis.

Monetary tightening won’t deal with that but it will make the recession considerably worse. Deutsche Bank expects the eurozone to contract by 3% over the winter.

China, the motor of the world economy the last couple of decades is facing its own problems with the deflation of an epic real estate bubble which was good for 20%-30% of the economy.

While many big project developers and banks are likely to need a bailout we don’t expect this to develop into a financial crisis like the one we saw in the US in 2008-9 as the Chinese government has the tools for a more or less orderly restructuring.

However, coming on top of all these covid lockdowns, and worsening demographics this is likely to lead to years of slow growth and some spillover might yet happen via the currency markets.

The new government in the United Kingdom thought that now would be a good time to embark on supply-side policies like tax cuts for businesses and the wealthy (although most of these are scrapping of planned tax increases) in combination with energy price caps that are indiscriminate (and likely to be very expensive).

The markets didn’t rejoice, quite the contrary as the expansive fiscal policy is at loggerheads with tightening monetary policy and threatens to increase the inflationary problems.

A selloff ensued both in sterling as well as in the treasury market, threatening a bit of a doom loop here and forcing the BoE to intervene in the latter to stem rising mortgage rates, worsening the sterling crisis and this episode resembles a classic emerging market rout.

Speaking of which, many developing countries are in deep trouble, buffeted by the toxic combination of a rising dollar, rising food and energy prices, a slowing world economy, and rising interest rates.

Many are already on the brink, or over it with countries such as Sri Lanka, Lebanon, Turkey, Argentina, Pakistan, and probably a good many others to come experiencing serious problems.

The general picture is one of waning inflationary problems and increasing malaise in the world economy, we’re not sure this is the time for further aggressive monetary tightening. Then there is a quirk in the US inflation data.

US inflation

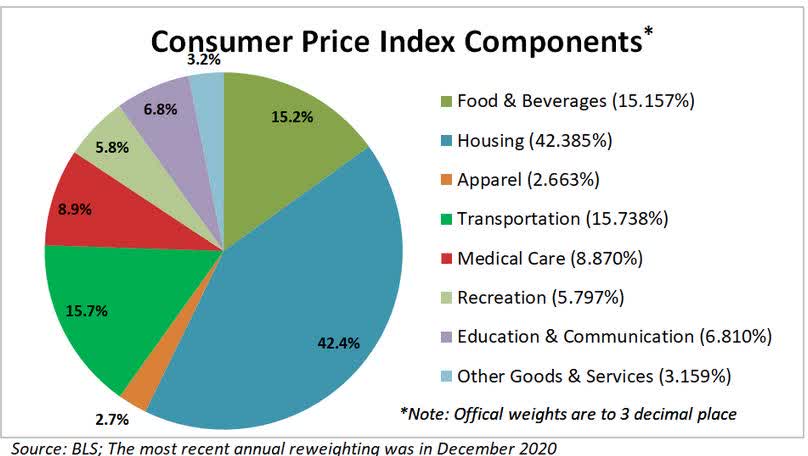

What about the US CPI or core CPI last week you might wonder. Yes, these disappointed and the core CPI is keeping stubbornly high. To a considerable extent, this is caused by its biggest component, housing, good for 42.4% of the CPI:

BLS

The most important component of housing is OER or owner’s equivalent rent, almost 25% of the CPI and an even larger part of core CPI (excluding food and energy).

But there is a substantial lag, up to 18 months between house prices and OER, it’s a pretty poor proxy for home prices (and even the Case-Shiller index has a lag as it is an average of the last three months, and it’s much more volatile). Even within central banks, there are some voices of stripping it out of the CPI.

Countries, where rent (or, as in the US, rent equivalents) rather than house prices are included in the CPI (like the US and EU), will see a slower fall in the CPI than those where house prices are in the CPI (like Australia, Canada, New Zealand, and Sweden) and will therefore likely tighten monetary policy longer.

Then there is the situation on the ground in Ukraine, which is cornering Putin and that’s a bit of a wild card to say the least. Much of that depends what’s going on in the head of one person and that happens to be one who has no compunction whatsoever for the lives of others, not even his fellow citizens.

Conclusion

We don’t need to tell you that the seas got considerably rougher, but we think that at some time it will become blatantly obvious that inflation is coming down and economies are sinking, and the Fed will stop tightening and could very well start reversing soon after.

But ultimately this depends on decisions by people and these people are not just concerned with reducing inflation, they’re also concerned with restoring their lost credibility so they are likely to overshoot and we’ll get a bigger economic slowdown than is warranted.

Bond market yields and the VIX are likely to provide early signs of a change in sentiment in the markets and give a buy sign for equities with a resurgence in oil price (which tends to move at least in part to its own dynamics) as the main risk to this thesis.

Be the first to comment