strickke/E+ via Getty Images

It’s all on you, Jay.

Friday’s pivotal speech by Chair Powell at the annual Jackson Hole Economic Policy Symposium is particularly fascinating this year. It was already two years ago when the Fed ushered in a new policy of “Flexible Average Inflation Targeting,” or FAIT. That policy would have worked wonders post-GFC, but this time around it’s generally seen as a blunder now that U.S. inflation has notched its highest marks since 1981.

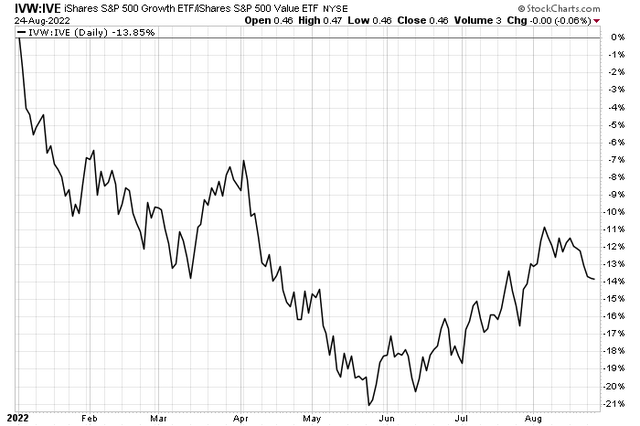

Homing in, the stock market’s summer rally has been led by growth shares. The iShares S&P 500 Growth ETF (NYSEARCA:IVW) bottomed on a relative basis back in late May, ahead of the S&P 500’s June 16 closing low. Since then, it has been a refrain of what worked in 2021 – mega cap tech and even speculative niches of the market like small tech/software names and even meme stocks earlier this month. Will the IVW’s relative strength persist? Or was that just a short-lived bounce within a broader bear market? That’s a key question for investors and portfolio managers ahead of Powell’s address on Friday.

S&P 500 Growth ETF Beating Value Over The Past Three Months

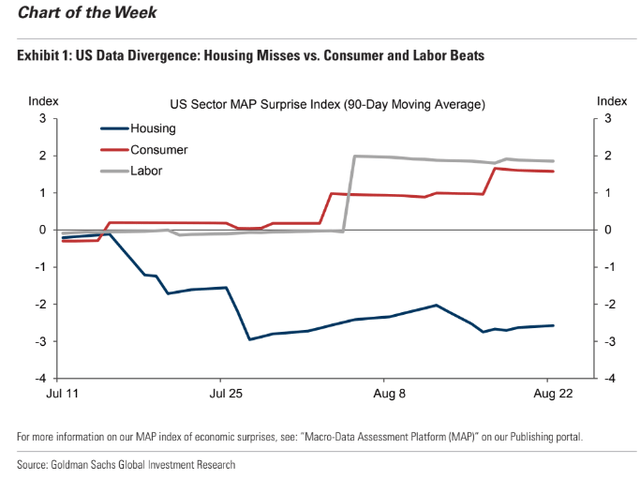

Turning to the economy, recent data have been mixed. Bifurcated might be the word. Housing stats have been downright awful vs. expectations while other parts of the economy, such as consumer spending and the jobs situation, appear better than most had expected by now. This creates an awkward situation for the FOMC – the housing market is cooling off, which helps their tightening cause, but people keep spending and wages keep rising at a high clip. Interest rate policy is perhaps more uncertain than ever amid this wacky economic backdrop.

Economic Surprises: A Mixed Bag

Goldman Sachs Investment Research

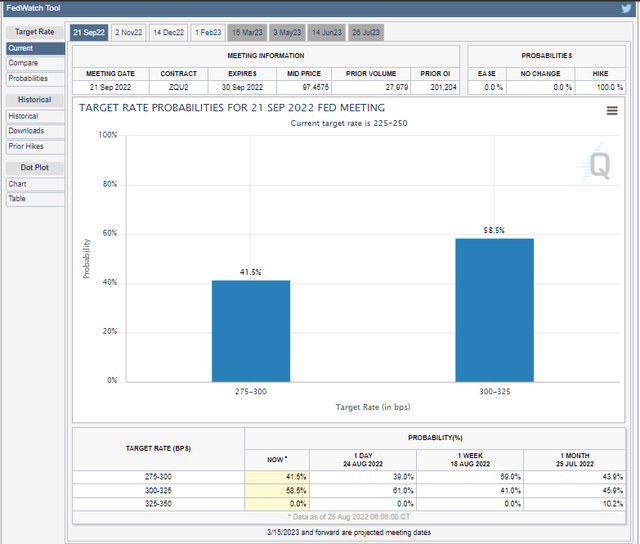

So what do traders expect when looking ahead to the next Fed gathering? It’s a toss-up, as the Atlanta Fed’s Raphael Bostic quipped earlier this week. As of Thursday morning, as Fed members gather in front of those beautiful Wyoming mountains, there’s a 41% chance of just a 0.5 percentage point hike and a 59% chance of a third consecutive 0.75 percentage point increase at the September meeting. Much ink has been spilled about the Fed’s so-called “pivot,” but in reality, the terminal Fed Funds rate has been somewhat stable in recent weeks in the 3.6% to 3.7% range by early next year.

September FOMC Meeting Expectations: A Toss-Up

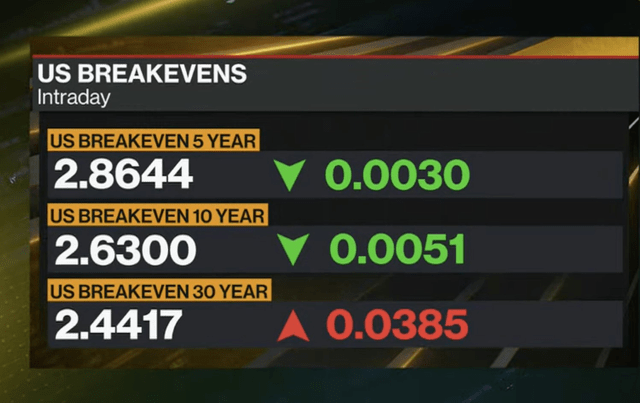

Working to the Fed’s benefit is the expected inflation situation. Breakeven rates, a measure of the yield difference between nominal Treasuries and inflation-protected Treasury securities, have not moved higher by a stunning amount. In fact, the year-ahead and two-year breakeven rates are slightly below 3.4% as of the middle of this week. While still high vs. history, the market seems to think the Fed will be on the ball with respect to future consumer price increases.

Breakeven Inflation Rates Are Well Off The Highs

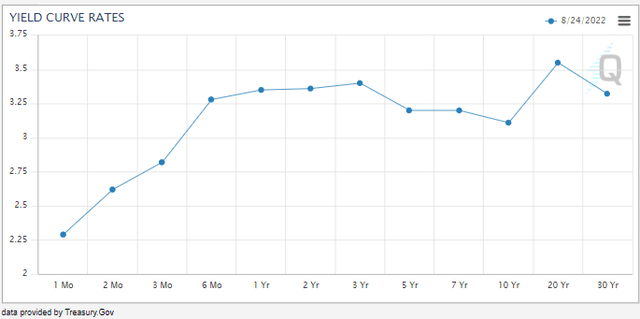

Something else I have noticed ahead of the Jackson Hole Fed event is what has been happening with the yield curve. There’s been plenty of chatter about how inverted the 2s10s has been, but it has steepened considerably in the last two weeks. After bottoming near -60bps earlier this month, that colloquial gauge of recession risk has steepened to just -28bps as of Thursday morning. Another good sign for the economy.

The Yield Curve Is Less Inverted

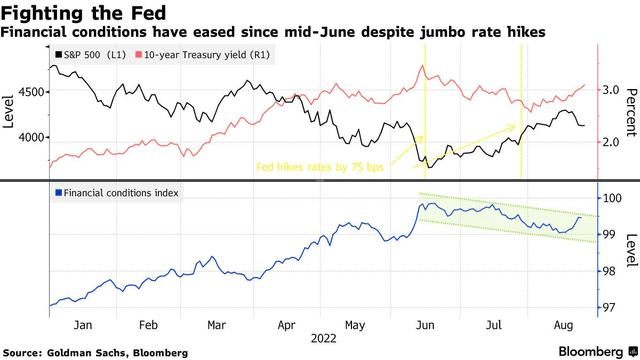

Good signs for the economy arguably make the Fed’s job tougher, though. They want demand to cool so that inflation comes down sooner rather than later. Economists look to the overall financial conditions barometer to get a sense of how easy the money situation is. This summer, as duration-sensitive growth stocks have staged a major absolute and relative comeback, financial conditions have eased. It’s been said by many talking heads that the market has priced in a Fed pivot. Yet nobody on TV wants to say they actually believe that themselves, so I question how much of that is in fact discounted into the price of rate-sensitive areas.

Financial Conditions Have Eased

The Technical Take

I would be remiss not to put some technical analysis into this Fed Preview. IVW, like so many index ETFs, rests at a critical juncture ahead of tomorrow’s speech. The S&P 500 Growth ETF is below its falling 200-day moving average after getting rejected there last week. However, IVW is above the key $67 price point – the February low and late May/early June peak. Also notice in the chart below that there is a small gap higher in late July that helped the bulls’ momentum. I will be watching this chart with a hot cup of coffee Friday morning as Jay takes the podium.

S&P 500 Growth ETF: Hovering Above $67 Support, Below The 200 DMA

The Bottom Line

The market expects a slower pace of rate hikes but a still restrictive policy to be reiterated by Chair Powell at Friday’s Jackson Hole Economic Policy Symposium. Don’t expect talk of 2023 rate cuts, but Jay will likely want to voice to the markets that the Fed is serious about taming inflation through a higher policy rate and more quantitative tightening. Traders should keep close tabs on how growth stocks perform to gauge how the market interprets the speech.

Be the first to comment