Epiximages

Investment Thesis

The First Trust Morningstar Dividend Leaders Index ETF (NYSEARCA:FDL) is estimated to yield over 4% after its latest annual reconstitution in June. With 20% exposure to the Energy sector, it’s an ideal investment for income investors looking to profit from high inflation and mitigate some of the risks of a possible recession. However, there are inherent risks in allocating so much to the volatile Energy sector, and as inflation subsides, I worry FDL’s total returns will, too. Therefore, I am downgrading FDL to a hold, and I look forward to explaining why in more detail now.

ETF Overview

FDL tracks the Morningstar Dividend Leaders Index, selecting 100 high-yielding U.S. securities (excluding REITs) Morningstar believes capable of sustaining its dividend payments. The play is on dividend safety, not growth, but Morningstar does exclude companies with negative five-year forward dividend growth rates. In addition, companies with dividend payout ratios exceeding 100% are not eligible. The Index rebalances quarterly and reconstitutes in June, meaning we have a relatively new set of holdings to analyze today.

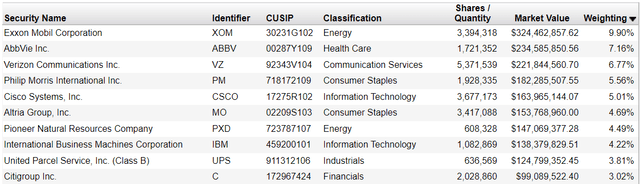

The June reconstitution saw enormous turnover. Eighty-seven companies were swapped, including five in the top ten holdings list: Exxon Mobil (XOM), Cisco Systems (CSCO), Pioneer Natural Resources (PXD), United Parcel Service (UPS), and Citigroup (C). The top ten holdings total 54.63%, so FDL is a highly concentrated portfolio.

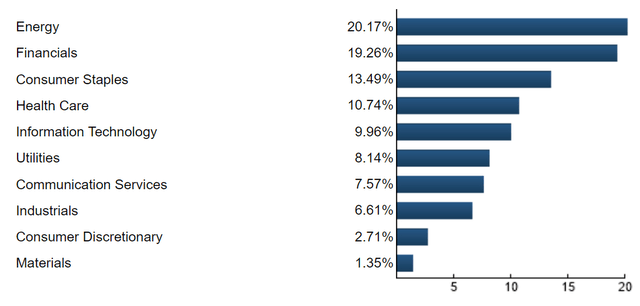

As mentioned, Energy is 20% of the ETF, followed by Financials (19.26%), Consumer Staples (13.49%), and Health Care (10.74%). This mixture of volatile and non-volatile stocks is excellent from a diversification standpoint. However, my concern is that the Energy exposure is too high.

We’ve already seen how quickly oil company gains can reverse this year. The Energy Select Sector SPDR ETF (XLE) was the third-worst-performing out of the 11 S&P 500 sector ETFs offered by State Street in the last three months. Crude oil is hovering around $90 per barrel today, down from the $120 highs set in June. In my view, Energy bulls should be concerned this trend could continue or, at minimum, produce moderate gains that don’t justify a high exposure to this risky sector.

FDL Historical Performance

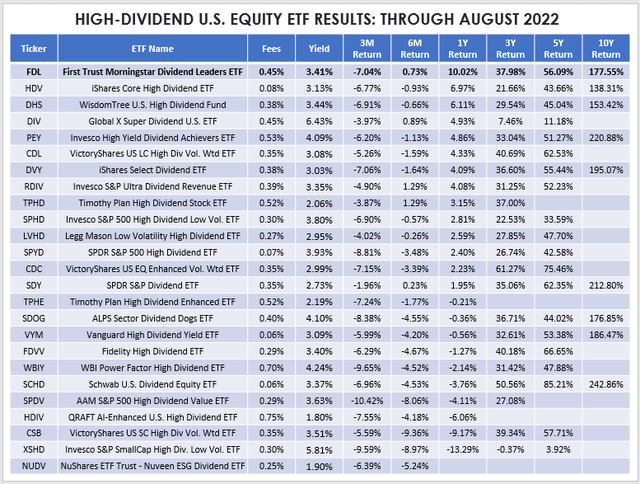

Over the last year, FDL was the best-performing U.S. high-dividend ETF. Here are its periodic returns compared to 24 peers, sorted by one-year returns.

The 177.55% gain over ten years is decent, considering S&P 500 Value Index ETFs like SPYV, VOOV, and IVE gained around 180% during this period. Still, it’s far from the best. The Invesco High Yield Dividend Achievers ETF (PEY) gained 220.88% and currently offers a 4.09% trailing yield.

To be clear, the yield shown in the table above may still be insufficient for income investors. For example, CEFs can provide double-digit yields in some instances. However, distributions are often funded by capital sources and enhanced by leverage, making it an apples-to-oranges comparison with these ETFs that primarily distribute net investment income.

Dividend Analysis

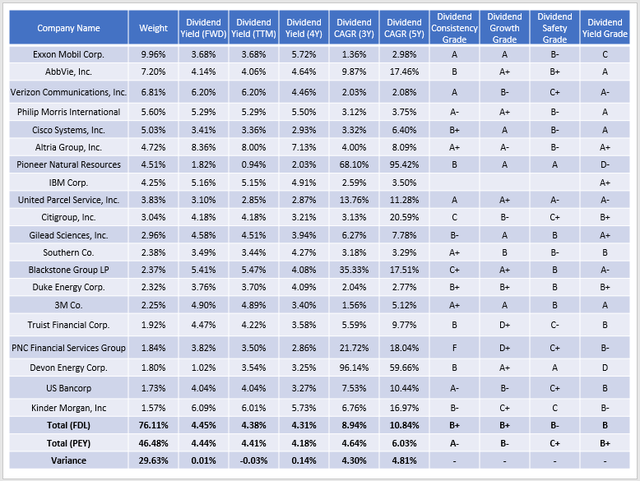

The table below presents yield-related metrics for FDL’s top holdings and compares them with PEY. FDL’s trailing dividend yield is 3.41%, but I expect distributions to increase closer to 4%. The reason is that FDL’s current constituents, due to the significant changes made in June, yield 4.45%. Annual fund expenses are 0.45%, so a net of 4% is a reasonable approximation.

The following table presents yield-related metrics for FDL’s top 20 holdings and compares them with PEY. FDL’s yield may even exceed 4% because some Energy companies like Pioneer Natural Resources are paying substantial special dividends lately.

I believe the two ETFs are similar from a yield perspective, but FDL wins on dividend growth, assuming Energy stocks continue their growth. FDL’s constituents have grown dividends at a weighted-average rate of 8.94% in the last three years and 10.84% in the previous five years. This growth is 4-5% better than PEY and higher than most other high-dividend ETFs.

Industry Fundamentals and Risks

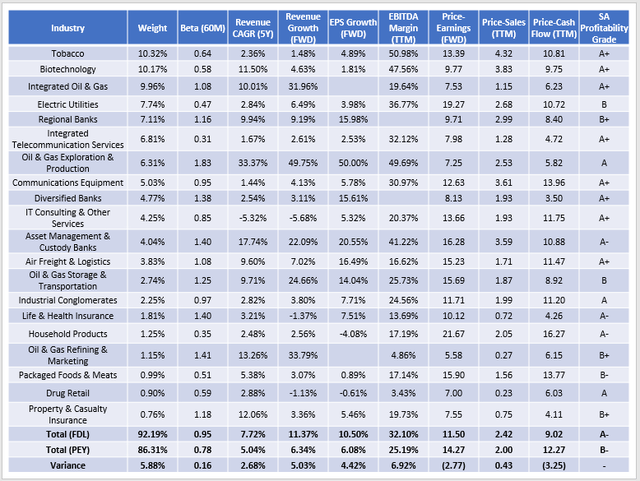

FDL’s dividend features look reasonably strong, but it’s also attractive from a fundamentals perspective. It has double-digit estimated sales and earnings growth (11.37% and 10.50%), which is 4-5% better than PEY. EBITDA margins are higher due to the overweighting of Tobacco and Biotechnology stocks, leading to a higher Seeking Alpha Profitability Grade (A- vs. B-). Finally, it’s a cheaper ETF on a forward price-earnings and trailing price-cash flow basis.

However, sometimes you have to look beyond the numbers and realize that the Energy sector is one of the most unpredictable sectors. Past swings in exposure haven’t been kind to FDL shareholders, either. FDL was over 20% Energy in July 2019, and the sector fell 43% that fiscal year. In response, the Index completely removed Energy stocks in June 2020, right before the sector rebounded 50%. The net result was FDL underperforming SPY by 32% between July 2019 and June 2021. In short, we shouldn’t understate the risks by looking only at volatility, valuation, and expected growth. FDL needs relatively high oil prices to succeed, and a lot can happen between now and when the Index reconstitutes in June 2023.

Investment Recommendation

Income investors have reason to hold or even add to FDL, given that its expected yield should be near 4% based on current prices. However, June’s reconstitution pushed its Energy exposure above 20%, which in my view, is too much. The cost of crude oil has fallen 25% since June, and FDL may repeat the errors of a few years ago when it added to the sector precisely at the wrong time. Whether it’s a critical design flaw or bad timing, either way, I’m uncomfortable.

FDL is currently a component of the Active Equity Model ETF Portfolio I manage at the Hoya Capital Income Builder. Based on this update, I doubt it will remain at next month’s review. Unless you’re using it to satisfy a high yield requirement or have little Energy exposure elsewhere in your portfolio, I believe there are better products. Therefore, I am downgrading FDL to a hold and am happy to discuss further in the comments below.

Be the first to comment