Marcus Lindstrom/E+ via Getty Images

I am confident that Europe can make it. – Ana Botín

In the “Leaders/Laggers” section of my paywalled research, I had highlighted how the international markets were holding up relatively well compared to the domestic markets; if elevated volatility is likely to remain a recurring feature for the foreseeable future, you could see interest remain with some of these overseas developed markets where central banks appear to be taking a less aggressive approach towards tightening, even as stock valuations there are a lot more appealing than the U.S.

If this is a terrain you’d like to explore, and you’re looking for a product that could offer you a solid and consistent income cushion, you may consider looking at the First Trust Dynamic Europe Equity Income Fund (NYSE:FDEU). This is a closed-end fund (“CEF”) that pursues a managed distribution policy of paying out monthly distributions over time. For the uninitiated, the primary goal of a product of this ilk is to meet its income objectives, and you may even find instances where a portion of any long-term capital gains are also distributed monthly. You’d be interested to know that at current levels, the fund’s distribution rate stands at a rather impressive figure of 6.53%, putting it at the highest point in over one and a half years.

Of course, getting access to these high distribution rates doesn’t come easy, as investors are faced with a rather elevated annual expense ratio that stands at a whopping 1.93%; the management fee alone accounts for 1.44%, whilst other expenses contribute 0.20%. FDEU also uses leverage to increase its yield, and these leverage-related costs account for another 0.29% of net assets.

European Macros

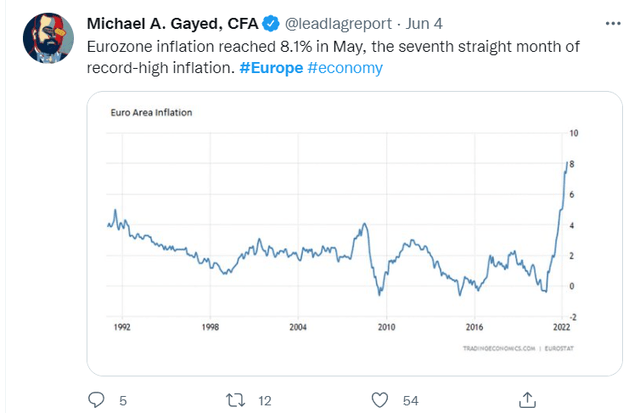

As flagged in The Lead-Lag Report, Europe is just yet another region that has been witnessing sky-high levels of inflation, with the number recently crossing the 8% mark. In FDEU’s top geographic region, the UK, the situation is even worse, with numbers of 9%.

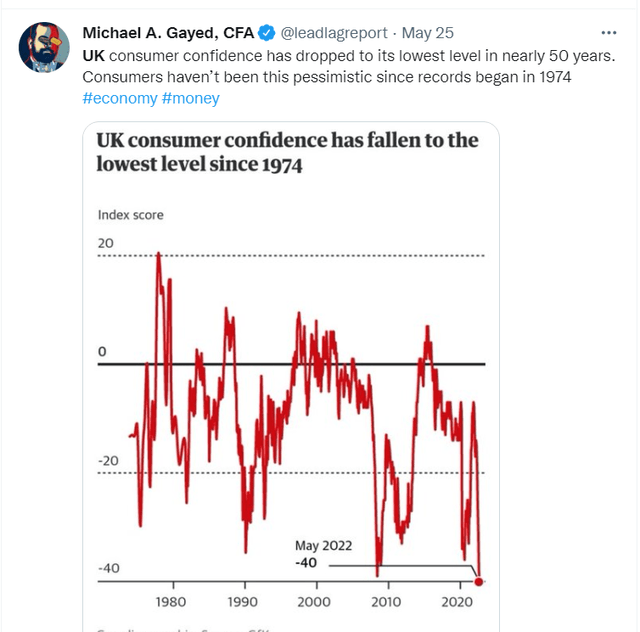

Under conditions such as this, it’s no surprise to discover that the British populace is feeling rather hard-done; incidentally, UK consumer confidence numbers haven’t seen such lowly levels since records were first maintained back in the 1970s!

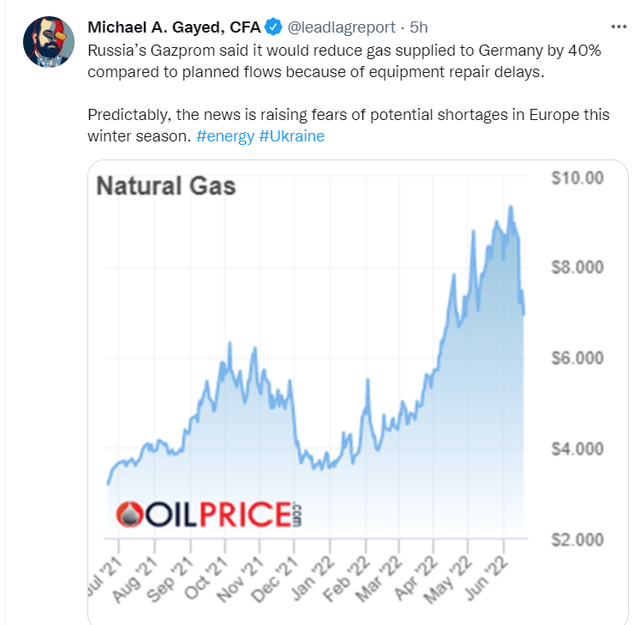

I can’t imagine a scenario where this situation will improve considerably, particularly on the energy front, which seems to have swamped not just the UK, but other important regions of Europe as well. As noted in a tweet put out earlier today, Gazprom’s supplies to Germany are expected to come off by 40%, and when demand could spike in the autumn and winter seasons, I do worry about the sort of levels prices could transition towards.

All in all, to counter the effects of this, the ECB is looking at two separate hikes of 25bps in the upcoming July and September meetings, but I remain doubtful if this will be sufficient to counter the inflation dragon. If you’ve been reading my commentary in The Lead-Lag Report, you’d note that I’ve been highlighting how timid central banks in that region appear to be; for instance, the Bank of England’s recent hike was only 25bps; this beggars belief when the bank itself expects inflation to trend higher and peak at 11%, sometime in H2.

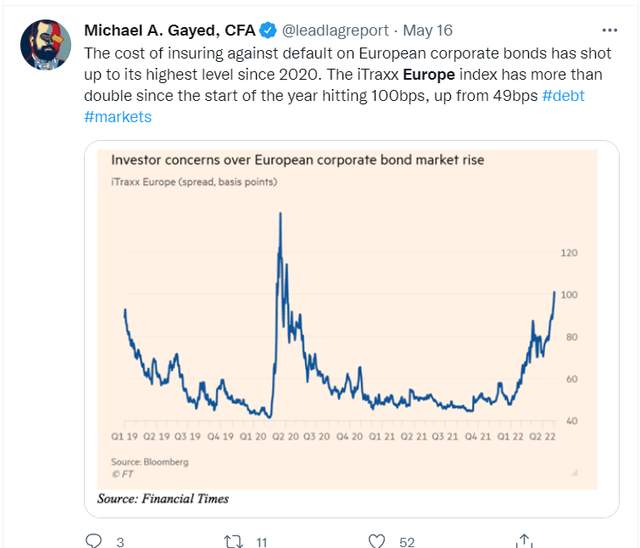

Leaving aside all that for a moment, what I found quite interesting was this recent intention to pivot towards what I would term as “selective QE,” where the most vulnerable economies in Europe will be supported by bond purchase initiatives. Measures of this sort could be rather useful in an environment where the iTraxx Europe index has been hitting some rather worrying levels.

Nonetheless, this quasi-hawk/quasi-dove narrative could potentially keep both sides happy, as one cohort would be content with the resumption of stimulus and the other cohort would be content with measures designed to quell inflation. Interestingly, I suspect this dynamic theme is something that could well catch on with other central banks across the globe in H2 2022.

Finally, I also think the Euro may well have made some sort of floor and could be due a bounce; note that it has recently formed something akin to the double bottom pattern at around the 1.04 levels. You may well also see the Fed take a leaf out of the ECB’s dynamic tightening approach, and this could dampen sentiment for the dollar, which has enjoyed its time in the sun.

Conclusion

As noted at the start of this article, some notable international-themed products are currently available at rather tasty valuations. FDEU is one of those names that stands out. Just for some perspective, investors can currently pick up this portfolio at a forward P/E of just 10.6x, a 15% discount to both the SPDR Portfolio Europe ETF (SPEU), and the Vanguard FTSE Europe ETF (VGK), both of whom trade at a corresponding multiple of 12.2x.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment