selvanegra/iStock via Getty Images

Some of my favorite biotech companies are the ones that are pushing the edge of science far enough that they are going to force publishing companies to update their biology textbooks. For me, Fate Therapeutics (NASDAQ:FATE) is one of those companies thanks to its revolutionary induced pluripotent stem cell “iPSC” technology. FATE was one of my favorite biotech investments back in 2017 and became one of my best trades over the next couple of years moving from $4 to over $40 per share. Sadly, my speculative investment strategy was not as sophisticated as Fate’s platform technology and I exited the position before FATE peaked in early 2021. I was forced to watch FATE climb above $100 per share as the market began to realize Fate’s potential… something I recognized years earlier. As a result, I altered the way I manage my speculative biotech investments and have enjoyed the benefits since.

Now, I am looking to return to Fate Therapeutics with my new strategy to take advantage of the cut in valuation and a more mature company. This time, I plan on sticking to my updated speculative strategy and will enjoy having a “house money” FATE position in my “Bio Boom” portfolio.

I intend to provide a brief background on Fate Therapeutics and the company’s progress thus far. In addition, I discuss my updated strategy and how I plan on managing a FATE 2.0 position in the coming quarters.

Fate Therapeutics Logo (Fate Therapeutics)

Background on Fate Therapeutics

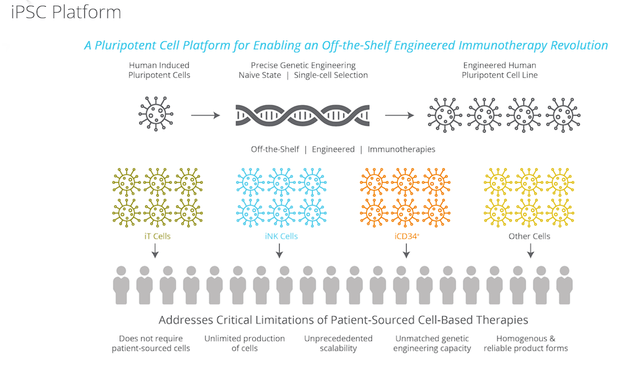

Fate Therapeutics is a clinical-stage biotech developing first-in-class cell immunotherapies for the treatment of cancer. Fate uses human induced pluripotent stem cells “iPSCs” spawned from their iPSC platform to generate clonal master iPSC lines, which are essentially blank canvas cells that are a renewable source with uniform properties. These iPSC lines are genetically engineered and indefinitely expanded in culture to be refined into off-the-shelf NK cell, T cell, and CD34+ treatments. Moreover, these cell therapies are projected to be more cost-effective compared to other cell I-O therapies and will target both liquid and solid tumors.

Fate Therapeutics iPSC Platform Overview (Fate Therapeutics)

Fate’s iPSC platform has over 300 issued patents and 150 pending patent applications that are owned or licensed by the company.

Fate has a couple of impressive collaborations with leading oncology outfits including one with Janssen Pharmaceuticals of Johnson & Johnson (JNJ) for off-the-shelf CAR NK cell and CAR T-cell therapies for hematological malignancies and solid tumors. According to the agreement, Fate is responsible for preclinical development up to IND submission. Janssen has options for worldwide development and commercialization, but Fate has the right to a 50/50 agreement in the United States. In terms of the financials, Fate has a $100M upfront along with $50M in equity for Janssen. Fate is also eligible for over $3B in milestones, as well as double-digit royalties. In addition, Janssen flips the bill for all development costs.

Fate’s second collaboration is with ONO Pharmaceutical for off-the-shelf CAR NK-cell and CAR T-cell therapies for the treatment of solid tumors. Ono will provide proprietary antigen binding domains to develop CAR-targeted therapies by integrating numerous mechanisms of action to be operative in the solid tumor microenvironment. Similar to the Janssen collaboration, Fate will be responsible for preclinical development and Ono has worldwide development and commercialization rights. In addition, Fate has the 50/50 option in both the United States and Europe. In return, Fate got a $10M upfront payment with 50/50 cost sharing to the pre-IND stage. In addition, Fate is eligible for up to $840M in milestones, along with mid-single to low double-digit royalties.

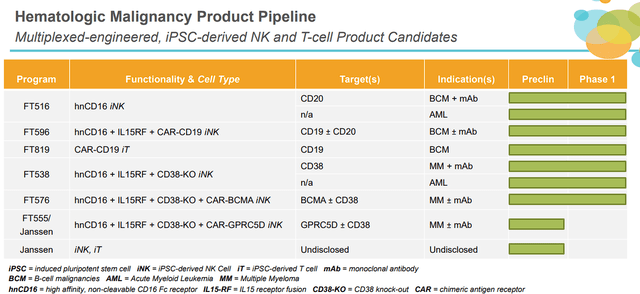

The company’s hematologic pipeline is extensive with both wholly-owned and partnered programs. Most of these programs are in Phase I of development targeting myelomas and leukemias. Fate is ready to launch a registration study under RMAT for relapsed/refractory aggressive BCL. In addition, they are looking to initiate a study for FT596 + R-CHOP in early-line aggressive BCL. Moreover, Fate is generating clinical datasets with FT516, FT596, FT538, FT576, and FT819.

Fate Therapeutics Hematologic Pipeline (Fate Therapeutics)

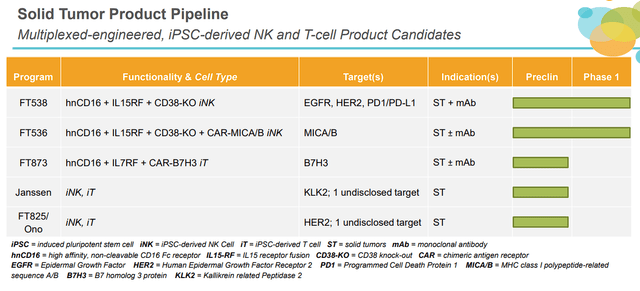

Fate’s solid tumor pipeline is significantly smaller than the hematologic pipeline, however, these solid tumor programs do cover a range of targets, which could be operative in numerous cancer types. Recently, Fate announced that they are generating dose-escalation datasets with FT538 with a monoclonal antibody therapy to boost ADCC. In addition, the company is looking to initiate FT536’s dose-escalation study as a novel pan-tumor targeting strategy. Furthermore, Fate is ready to complete IND-enabling studies of B7H3-targeted CAR programs.

Fate Therapeutics Solid Tumor Pipeline (Fate Therapeutics)

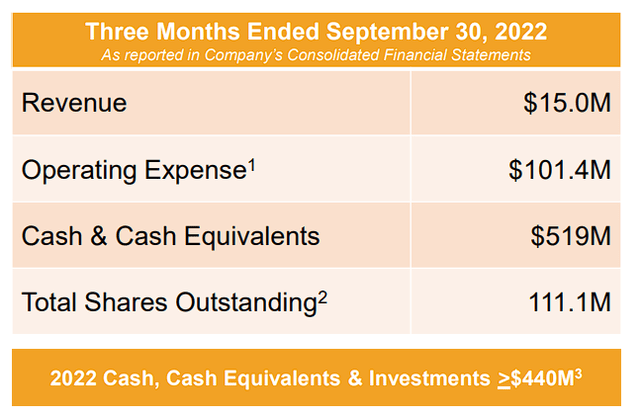

In Q3, the company pulled in $15M in revenue from their partnerships with Janssen and ONO Pharmaceutical. However, the company also reported about $101.4M in OpEx. The company finished the quarter with about $519M in cash and cash equivalents.

Fate Therapeutics Q3 Financials (Fate Therapeutics)

Why Return To FATE?

I originally got involved in Fate Therapeutics because I believed they are a leader in off-the-shelf cancer immunotherapies. Fate’s cutting-edge platform with over ten years of development has created an expansive pipeline of multiplexed NK and T-cell programs that have the potential to be effective in nearly all cancer types. In addition, the company has impressive partnerships for hematologic and solid tumors that can deliver significant revenue. Moreover, Fate has a dominant IP bank to help protect the company’s platform and pipeline accomplishments.

I am returning now because Fate is a more mature version of what I invested in years ago and has demonstrated clinical benefit in over 200 patients. In addition, Fate Therapeutics also has established scalable manufacturing capacity with in-house GMP operations with the capability to mass produce cell products. Last but not least, the share price has returned to a more tolerable valuation for a long-term investment.

Basically, a better company at a cheaper price.

Downside Risks to Consider

FATE has a few downside risks that investors should be aware of when initiating or managing a position. First, FATE is still trading at a premium valuation for current and near-term revenues. Indeed, the company’s market value has dropped 60% over the past twelve months, however, the ticker is still trading at a 38x forward price-to-sales for their 2022 revenue estimate and ~46x for their 2023 estimates. The industry’s average is around 5x price-to-sales, so FATE is trading at a massive premium for its near-term revenue.

FATE Revenue Estimates (Seeking Alpha)

In fact, FATE is estimated to drop below 5x forward price-to-sales in 2027 with roughly $800M in revenue. Going from $67M to $800M in four-to-five years is strong growth, but it is reliant on the company’s wholly owned products making it through the FDA and having a smooth commercial launch. A regulatory setback in one of the company’s leading pipeline programs could wreck these estimates and have a negative impact on the share price.

Another major concern is the company’s expenses and cash burn. The company’s Q3 R&D expenses hit $79.8M, up $53.1M in Q3 of 2021. G&A expenses were $21.6M compared to $15.7M in Q3 of last year. Admittedly, we have to expect the company’s expenses to swell in the coming quarters as their pipeline moves deeper into development and closer to commercialization. Yes, Fate had roughly $519M in cash at the end of Q3, so we shouldn’t expect the company to execute any dilutive financing in the near term. Still, investors should accept there is a strong likelihood the company will have to execute a secondary offering at some point in the future.

The stock’s premium valuation in conjunction with a premature pipeline, regulatory risks, and high cash burn makes FATE a speculative ticker at this time. As a result, FATE will be placed in the “Bio Boom” portfolio and will be assigned a conviction rating of 2 out of 5.

Discussing My Strategy for FATE 2.0

My previous FATE position was basically a disappointing victory, where I was too eager to rely on fundamentals and believed FATE was being absurdly overvalued. Indeed, FATE was quickly becoming overvalued for the company’s current state, and I convinced myself to exit the position because a sell-off had to be imminent. I simply disregarded the benefits of investing in cutting-edge biotech tickers… premium valuations and absurd momentum. Fate Therapeutics is attempting to change how we treat cancer, so the ticker’s prospects are almost limitless, yet I was willing to disregard the possibility that investors were willing to pay the premium price for that prospect. This blunder forced me to alter my position management strategy for speculative biotech tickers.

Now, my speculative strategy is to attempt to book profits with a series of designated sell targets in order to get to a “house money” status funded by the market. Having a de-risked position in a speculative ticker allows me to hold onto some shares to book profits on a blow-off top move or simply stick them in the sock drawer for a long-term investment.

Formulating a Plan

My plan is to return to FATE with a minuscule position in the near term to essentially “scratch the itch” and get my foot in the door. I will be using a fair value to determine my Buy Threshold over the remainder of 2022 and into 2023. Using the Street’s forward revenue estimates, breakeven estimate, discount for time, and discount for error, I believe FATE’s current fair value is around $20.50 per share. This will act as a Buy Threshold, where I will only add to my position unless the ticker is trading under $20.50 per share.

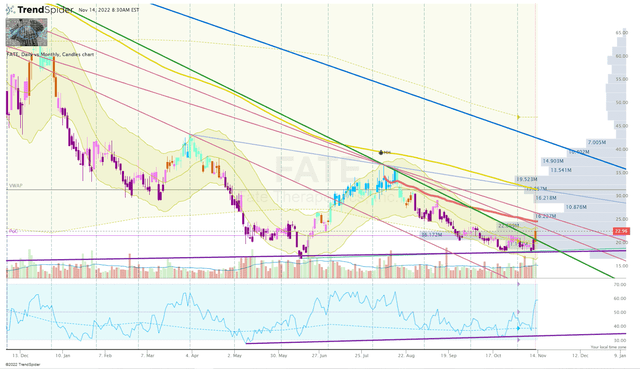

In addition to the Buy Threshold, I will be using technical analysis to identify potential reversals. Looking at the Daily Chart, we can see a potential double-bottom setup with the potential to break above the aVWAP from the formation’s high.

FATE Daily Chart (Trendspider)

What is more, we can see the go-no-go indicator has turned from bearish to neutral, so a break above the aVWAP could conjure a rally.

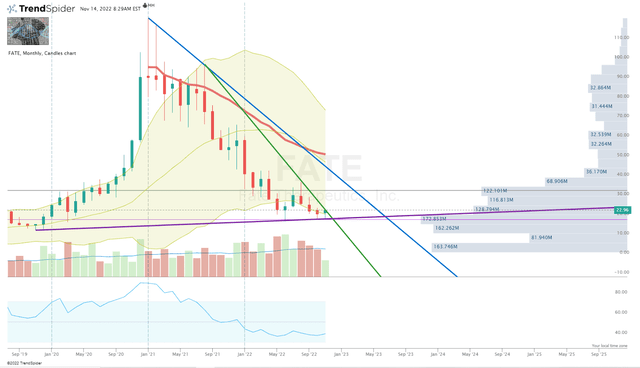

Looking at the Monthly Chart, we can see the share price has bounced off a support line that was established back at the end of 2019.

FATE Monthly Chart (Trendspider)

This tells me FATE could have found some solid support, so I will need to be ready to pull the trigger on a starter position above my Buy Threshold if the overall market wants to make a strong run into year-end. However, the Monthly Chart also shows that the share price is still under two strong downtrend rays, including the green downtrend ray coming from August of 2021 that could be strong enough to break the support and drive the share price below my Buy Threshold. After that, the blue downtrend from the all-time high is probably going to act as a trigger to set a few sell orders in order to book profits on a potential momentum change.

In summary, I am going to wait to see if the share price is able to break through the green downtrend ray on the Monthly Chart while above the support line. If it does, I will make a tiny starter position to ensure I have some exposure. If the downtrend ray pushes the share price below support, I will stick to my Buy Threshold of $20.50 and will look for a potential reversal setup before clicking the buy button. Following that, I will wait for the share price to break the blue downtrend from the all-time high before making another addition below my Buy Threshold. Once I have gotten my fill, I will set some sell orders that will get my FATE position to a “house money” state. This will allow me to hold FATE for a long-term investment that was funded by the market.

Long-term, I expect to be involved in FATE for the remainder of the decade in anticipation that the company will get one of their programs through the FDA and change the way we treat cancer.

Be the first to comment