John Moore/Getty Images News

Investment thesis

While the lithium boom story remains intact, mostly due to the continued transition of the car industry to EVs, lithium may not necessarily present a great investment opportunity, due to market overcrowding. Albermarle (NYSE:ALB) has been a star performer in lithium and within the overall mining sector in the past years. Its finances are solid, and growth prospects continue to be attractive, however, the stock price has gotten away from fundamentals, with years needed to grow into its current valuation, while there seems to be no lithium market risk priced in at all. In other words, the best-case scenario for lithium demand growth is taken for granted, with investors expecting only upside surprises and no potential pitfalls along the way.

Albemarle posts continued solid financial results in Q3 2022

For the latest quarter, there was much to be excited about in terms of Albemarle’s growing profits and revenues. Its lithium segment saw an increase in revenue of 318% compared with the third quarter of 2021. Net income increased to $897 million, compared with a loss of $392.8 million for the third quarter of 2021. Net sales came in at $2.1 billion, meaning that profit margins were a stellar 42%.

While the growth in revenues and profits has been stellar, it should be mentioned as well that interest costs came in at almost $30 million for the quarter, which is up six-fold compared with the same quarter from a year ago. The interest to revenues ratio is currently low, coming in at just 1.4%. I expect that Albemarle’s debt-servicing costs, which are already low, will improve in coming quarters as its profit margins and other financial performance metrics will continue to put it in solid financial shape.

Albemarle’s valuation is increasingly problematic, even for a solid growth company

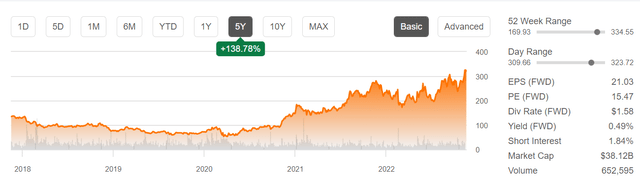

Albemarle stock & financial metrics (Seeking Alpha)

With a market cap of over $38 billion as I write this, Albemarle’s expected revenues for the year come in at roughly 5 times less than its market cap. Its forward P/E is at over 15 as we can see above, which is significantly higher compared with a ratio in the 3 to 5 range for most solid commodities mining companies. It is true that most mining companies are not perceived to be great growth stories like lithium miners, nevertheless, at this point, it seems that Albemarle’s best-case growth prospects for the next several years are already baked into the stock.

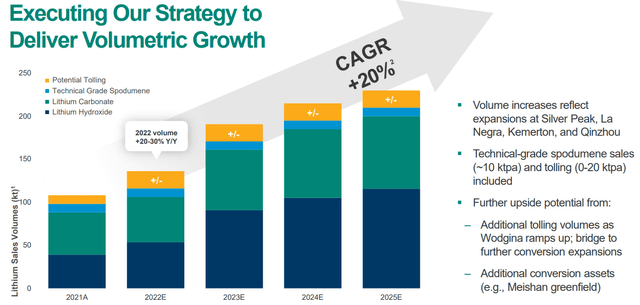

Albemarle lithium production growth forecast (Albemarle)

While its lithium production and sales volumes are forecast to more than double by 2025 compared with 2021 levels, most commodities mining companies trade at a level where yearly revenues are roughly equal to the market cap. We should not automatically assume that lithium prices will continue to trade at current levels or even go higher. There are many market factors that can potentially lead to lithium prices retreating from current levels.

Risks to the global lithium demand growth story abound

Given the continued march of the global EV boom story, any suggestion that global lithium demand growth expectations may leave investors betting on it disappointed may be considered to be borderline heresy. Nevertheless, sometimes the devil may be in the details of each story, and the EV boom story may be no different in this regard.

As I pointed out in a recent article, even though an ICE-powered vehicle sales ban by 2035 in the EU may seem like a bullish story for EVs, therefore for lithium producers, the net benefit may be overstated. Due to certain dynamics, such as the price/range relationship, that is not an issue with ICE-powered cars, the net effect of an ICE ban might be a dramatic shrinkage in the overall car ownership rate in the EU. Many consumers may decide that in the absence of their ability to buy an EV with enough range and other features that would provide them with the same utility that an ICE-powered car provides them currently, they may simply decide to give up on driving. In other words, we should not expect everyone who cannot afford a luxury-priced EV to settle for a city car. Such issues may start to come into play as carmakers seek to sell EV to the global middle class, even as it seems that to date very limited awareness exists of what is in effect a looming social problem, namely income-based range inequality. Even among those who are aware of this problem, the optimists among them take it for granted that continued technological improvement will take care of it, which may not be the case.

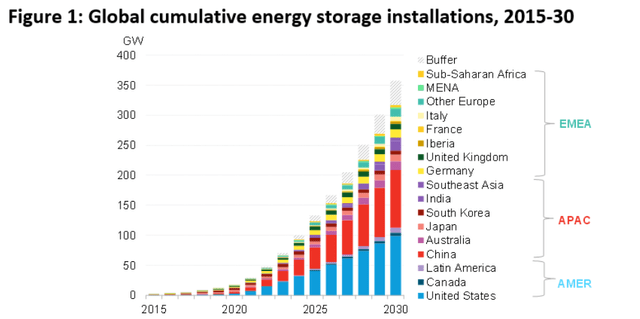

After EVs, the second most important emerging driver of lithium demand growth globally is thought to be as an electricity storage medium, within the context of the growing need to stabilize grids that are increasingly dependent on intermittent sources of energy such as wind & solar power generation.

Lithium batteries were supposed to play a major role in the many-fold increase in energy storage demand growth across the world. After the 2021 EU energy crisis that stemmed from a shortfall in wind power generation, it is increasingly clear that battery storage facilities that can only provide for stabilization of the grid for a few days will not suffice in solving the emerging problem. My guess is that a big bet will be made on green hydrogen conversion, which is why I invested recently in the green hydrogen startup Fusion Fuel (HTOO). Lithium-powered batteries for grid stabilization will fall out of grace as a result, given that once green hydrogen-powered backup electricity generation will start to be ramped up, those battery systems will be seen as redundant.

Investment implications

While Albemarle is performing greatly as a mining company, the market currently has it priced at levels where there is no room for any other market outcomes but the most bullish lithium demand forecasts coming through or even exceeding those most optimistic expectations. It needs that best-case scenario outcome to grow into its current valuation. As I pointed out, however, there are plenty of emerging factors that may throw a wrench into the lithium boom story. Demand may continue to grow, but any slowdown in that demand growth can easily cause global supply growth to overshoot that demand level, leaving lithium miners exposed, even as they continue to complete existing mining capacity expansion, which will turn out to be far less profitable than currently expected.

I sold my position in Albermarle stock a while ago, precisely based on these considerations. Its stock has gone up significantly since then, which goes to show that trading strictly based on fundamentals, weighing potential long-term risks, versus fundamentally justified upside potential can lead investors to miss out on the potentially significant upside that one might see far beyond what fundamentals might dictate. Having said that, the risk/reward odds ratio and the magnitude of the upside, in a best-case scenario, versus the downside potential in a worst-case lithium demand scenario leave investors in a position where they are taking significant risks for potentially limited gains.

Be the first to comment