Jian Fan

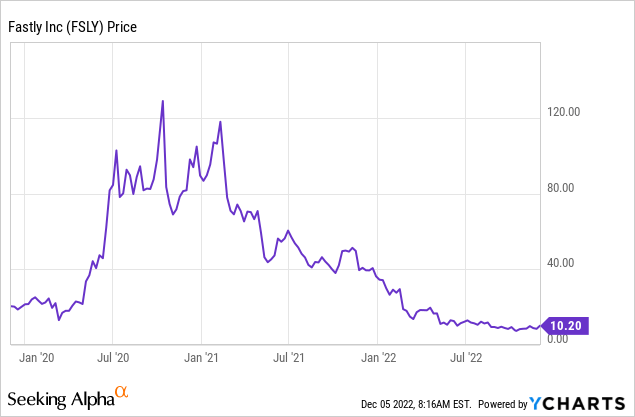

Fastly (NYSE:FSLY) owns a global content delivery network [CDN] which provides fast and secure access website access for over 2,900 companies globally. Its customers include a host of reputable organizations such as the New York Times, Stripe, Reddit, Epic Games, Boots and many more. The company has recently hired a new CEO (Todd Nightingale), a former Cisco executive who aims to help Fastly penetrate lucrative new markets such as Cybersecurity and Cloud Computing. So far, the business has reported solid start with both growth of the top and bottom line beating analyst estimates. In this post, I’m going to break down the company’s business model, financials and valuation. Let’s dive in.

Secure Business Model

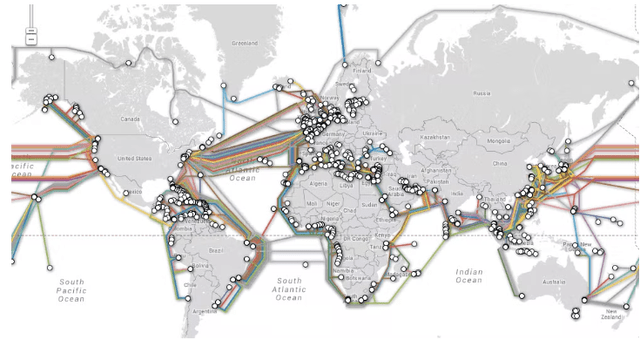

Fastly owns a vast content delivery network which utilizes a network of global data centers or points of presence [POP]. The idea is to “cache” or store local versions of websites in order to increase speed, performance and security. For example, let us say you live in Austin, Texas and want to access a U.K. based website in London. Then rather than sending you the web page directly from London, it will send you a local copy from your local data center or server in Austin, Texas, reducing latency.

Fastly POP Network (Fastly)

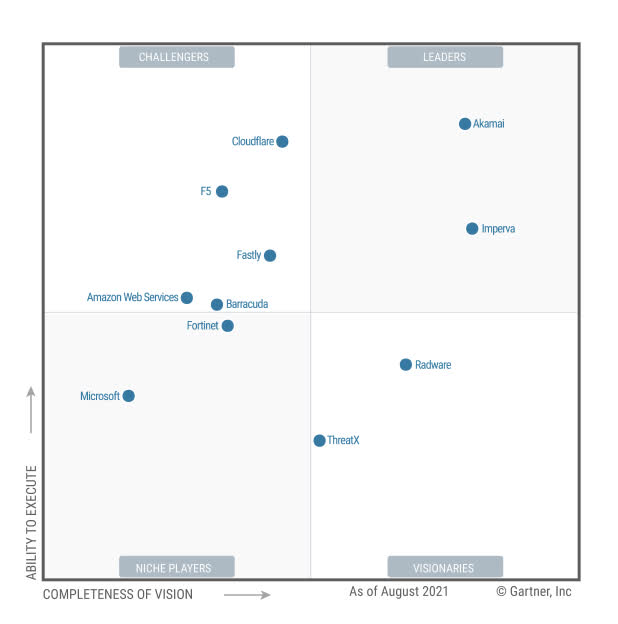

Fastly has gradually expanded its business model to attack two huge market opportunities: Cybersecurity, which McKinsey forecasts could be a $2 trillion market in the future, and cloud based “Compute” services, which is another fast growing market driven by the digital transformation of enterprises. Interestingly competitor CDN providers such as Cloudflare (NET) and Akamai (AKAM) are also expanding their business models into the same spaces and have gained strong transaction so far. For example, in the Web Application and API Protection (WAAP) market Fastly is a “Challenger” and Akamai is a leader. WAAP solutions are used to protect servers from DDoS (Distributed Denial of Service) attacks which basically involves overloading a server with requests. Fastly bolstered its WAAP solution through the acquisition of Signal Sciences for $775 million in cash and stock in 2020.

WAAP industry (Gartner)

Fastly was also selected by the world’s largest cloud infrastructure provider [AWS] as a VIP Marketing Accelerate partner. This should help to expand distribution of Fastly’s solution and boost sales.

Strong Financials

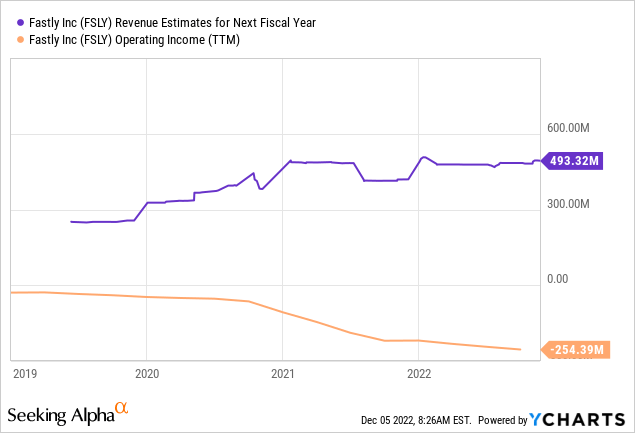

Fastly reported strong financial results for the third quarter of 2022. Revenue was $108.5 million, which increased by 25% year over year and beat analyst expectations by $4.84 million.

This was driven by strong growth in both the new Compute and Security services. Fastly has drove strong cross selling activity with Canada’s leading content creation company and with “marquee” accounts like New Relic. The company also signed up one of the largest pharmaceutical chains in Europe to its Next GEN WAF (Web Application Firewall). A Japanese video game company also became a customer and is using all of Fastly’s major services (WAF, Content Delivery and Compute). Fastly’s Signal Sciences Security product grew its revenue by a rapid 44% year over year, which is a strong start to the aforementioned merger.

Fastly Solutions (Fastly)

Fastly increased its total customer count in the third quarter of 2022 by 31 to 2,925. A large portion of these wins (11 new customers) were enterprise organizations and the company has a total of 482 of these major players.

The customers of Fastly are immensely “sticky” as the company reports a trailing 12 month net retention rate of 118%, with churn of less than 1% . This means customers are staying with the platform and spending more through account expansion. For example, the average spend for its enterprise customers has increased from $730,000 to $759,000, since the previous quarter which is a solid 4% expansion rate.

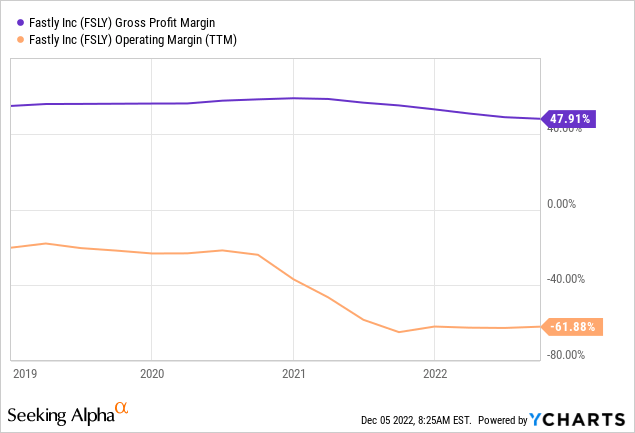

In terms of profitability Fastly reported a third quarter gross margin of 53.6% which increased by 320 basis points sequentially which was a positive sign. However, the company did report a 24% increase in Operating expenses which rose to $78 million. The good news is this was mainly driven by an increase in sales and marketing expenses as the company aims to grow its new products. Management is forecasting S&M costs to increase next quarter whiles its R&D and G&A expenses will remain flat.

The business’s R&D investments have continued to pay off. For example, the business rolled out new features such as compliance routing which aims to help customers with data sovereignty requirements which is a hot topic for organizations. Driving down infrastructure costs is an area management is also focusing on as it aims to optimize its network utilization, capacity planning and remove duplicate site costs.

Fastly reported earnings per share of negative $0.52 which beat analyst estimates by $0.01.

Free cash flow was negative $44 million which improved sequentially over the negative $61 million reported in the second quarter of 2022. This was mainly driven by a $27 million reduction in advanced payments for capital equipment. The business invested $15 million in capital expenditures in the third quarter of 2022, and moving forward this is expected to equate to between 10% and 12% of revenue.

Fastly has $719 million cash, cash equivalents, and marketable securities on its balance sheet. In addition, the business has $836.5 million in total debt of which the majority $704 million is long term debt.

Advanced Valuation

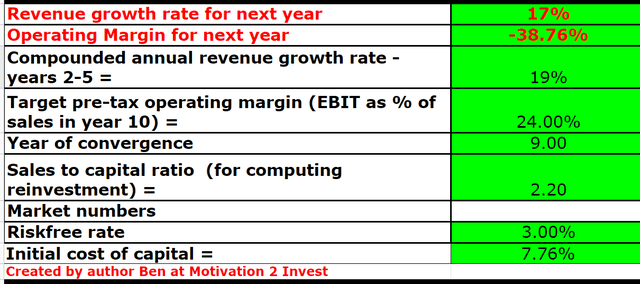

In order to value Fastly I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 17% revenue growth rate for next year based on management guidance at the midpoint. However, in years 2 to 5 I am forecasting revenue growth to accelerate to 19% per year which as Fastly’s new products gain increasing traction.

Fastly stock valuation 1 (created by author Ben at Motivation 2 Invest)

In order to increase the accuracy of the valuation I have capitalized R&D expenses, which has lifted net income and the operating margin. Profitability is an issue for Fastly but if they can continue to keep G&A expenses level while generating returns on its S&M expenses as it reaches scale the business should become profitable. For my forecast I have assumed an operating margin of 24% over the next 5 years, which is close to the average of the software industry.

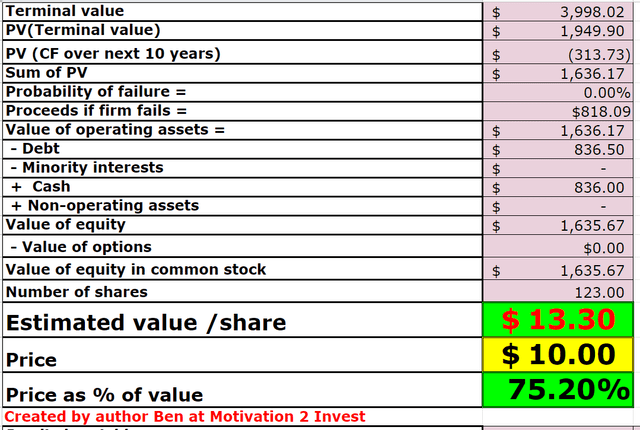

Fastly stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $13.30 per share, the stock is trading at $10 per share at the time of writing and is thus 25% undervalued. As an extra data point Fastly trades at a Price to Sales ratio =2, which is 79% cheaper than its 5 year average.

Risks

Focused Customer Base/Recession

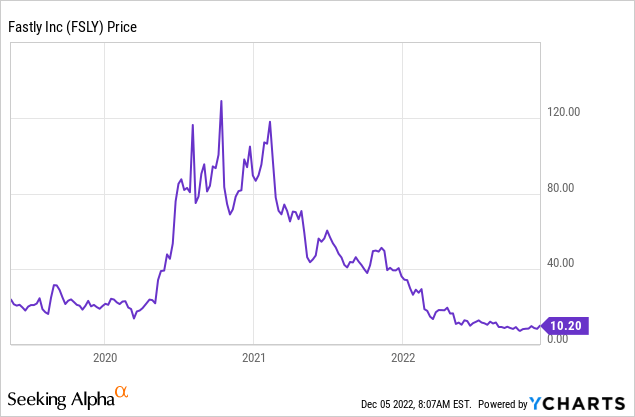

The company’s revenue is fairly focused with its top 10 customers making up 36% of total revenue which is a risk. In 2020, we saw this dynamic play out as TikTok removed the majority of its traffic from the Fastly network which decimated revenue and caused the stock price to plummet.

Another risk for Fastly is the macroeconomic environment (high inflation, rising interest rates) which has caused many analysts to forecast a recession. This will likely result in longer sales cycles and slower growth.

Final Thoughts

Fastly is an interesting company with a huge amount of growth potential. The business is growing revenue at a solid rate and is expanding into lucrative new markets. The stock is undervalued intrinsically at the time of writing and thus could be a great long-term investment.

Be the first to comment