jetcityimage

Investment Thesis

Fastenal Company’s (NASDAQ:FAST) near-term revenue growth should benefit from healthy demand in the commodity-related markets and capital goods markets. The long-term growth prospects for the company look solid with the opening of onsite locations and the installation of FMIs. The company has also started to see a moderation in certain operating expenses, such as incentive pay, profit sharing, and health care costs, which should benefit its margin. However, the stock is currently trading at a P/E of 27.24x FY22 consensus EPS estimate, which is higher than its peers, W.W. Grainger (GWW) at 20.26x and MSC Industrial (MSM) at 13.39x. Hence, I have a neutral rating on the stock.

Revenue Outlook

The growth drivers for Fastenal include the opening of onsite locations, FMI (Fastenal Managed Inventory), digital solutions, and national accounts. The company is targeting 375 to 400 onsite signings in FY22 and has reached midway of its target by signing 208 onsite locations in 1H FY22. It signed 106 onsite locations in Q1 FY22 and 102 signings in Q2 FY22. Fastenal’s customers benefited from the onsite model during the time of supply chain constraints, and it accelerated its adoption. On the FMI side, the company was able to sign 86 MEUs per day in Q2 FY22 and 83 in Q1 FY22, and is anticipating 21,000 to 23,000 MEUs (Machine Equivalent Units) Weighted-FMI device signings in FY22.

Last quarter, the daily sales in the company’s e-commerce channel grew 53% Y/Y with EDI (Electronic Data Interface) sales up 53.3% Y/Y and web sales up 51% Y/Y. EDI connects Fastenal’s system and its customer’s procurement system, providing a system-to-system exchange of electronic procurement documents such as purchase orders and invoices for direct and indirect spending. Together, EDI and web sales contributed 17.1% to the total sales, compared to 16.1% in Q1 FY22. Through a digital footprint, the company can manage the supply chain more efficiently for its customers. The digital footprint comprises sales from FMI and e-commerce sales that do not represent the billing of FMI services. The digital footprint represented 47.9% of the total sales in the last quarter.

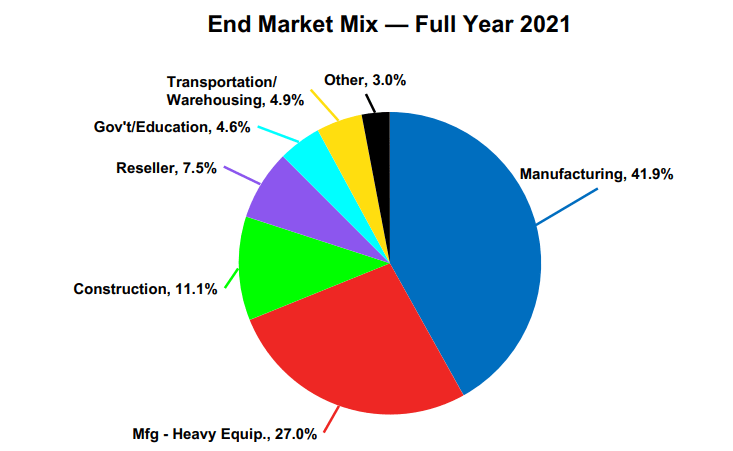

In the last quarter, pricing contributed 6.6% to 6.9% of the total sales growth, reflecting the carryover of broad pricing actions taken over the last 12 months to offset inflation. The company does not plan to take aggressive pricing actions going forward unless there’s a change in the inflationary environment. Percentage growth through pricing should moderate in the third quarter of FY22 as the company began aggressive pricing actions in Q3 FY21 and comparisons are getting difficult. The company has started to experience softening in demand since May 2022, primarily in the construction market and markets that directly touch customers, such as automotive and recreational vehicles. However, the demand in the core-capital goods and the commodity-related markets is still healthy as the backlogs across the manufacturers in these markets remain strong.

Company’s investor presentation

I believe that even if the market starts to slow down in the near term, Fastenal should be able to grow revenues as the backlog across a lot of industrial manufacturers remains healthy, supporting the company’s revenue growth in FY22. The long-term growth prospects for the company look solid with the opening of onsite locations and the installation of FMIs.

Margins

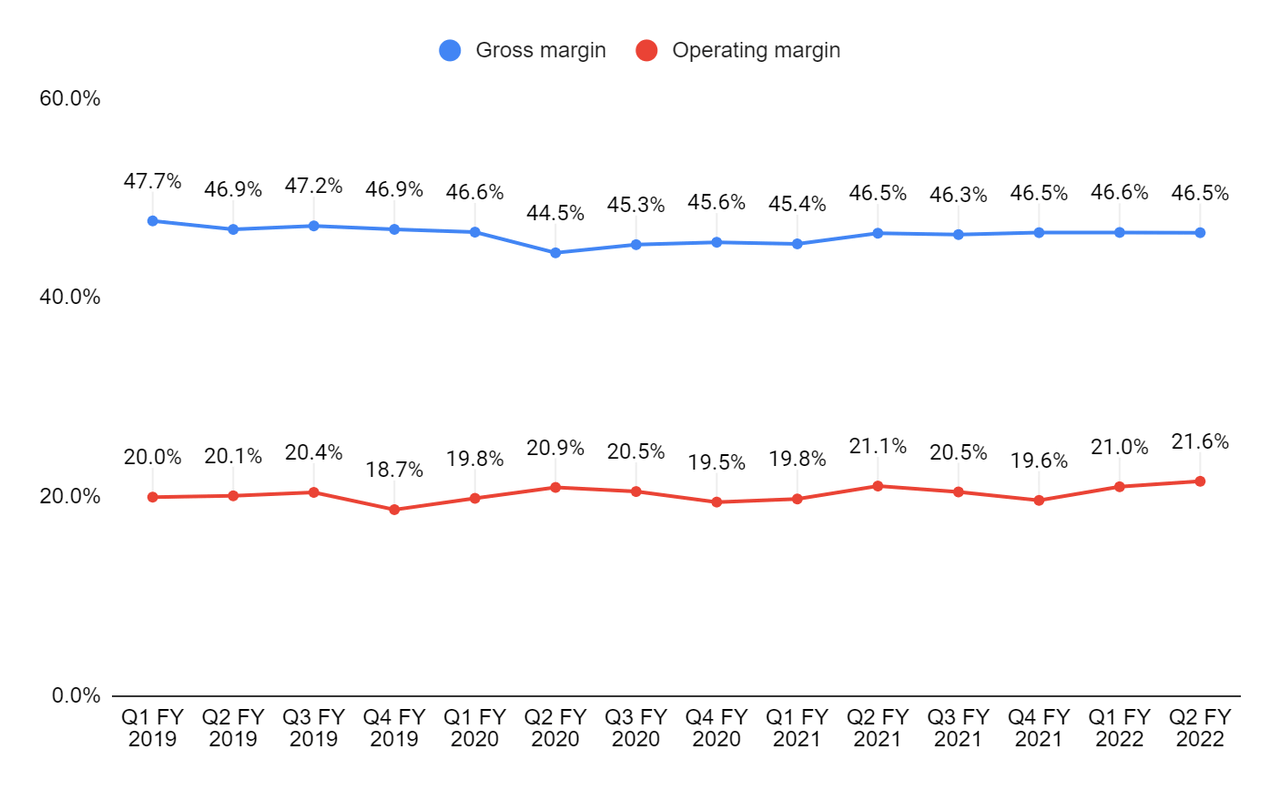

Due to the increased travel and higher inflation levels in Q2 FY22, the company’s travel expenses increased. Travel in the quarter rose 18% compared to that in Q2 FY19. However, the company is seeing a moderation in certain expenses, such as incentive pay, profit sharing, and health care costs. This benefited the company in the quarter as its operating expense leverage improved and led to an operating margin above pre-COVID levels. The pricing actions taken by the company are matching higher costs, yielding price/cost neutrality, and maintaining the gross margin over the last few quarters. The company is also benefiting from the shutdown of its traditional branches and was able to achieve 60 bps of occupancy related leverage from a 10% reduction in branches. Looking forward, I believe the company’s margin should benefit from the moderation of operating expenses and the stabilization of higher input costs.

FAST’s gross margin and operating margin (Company’s data, GS Analytics Research)

Valuation & Conclusion

The stock is currently trading at 27.24x FY22 consensus EPS estimate of $1.87 which is close to its five-year average forward P/E of 27.32x, and a significant premium versus its peers MSC Direct (trading at 13.39x FY22 EPS estimates) and Grainger Worldwide (trading at 20.26x FY22 EPS estimates). The company’s near term is supported by the healthy demand in the capital-goods and commodity-related markets, and its long term should benefit from the opening of onsite locations and FMI installations. However, the current valuation is not very attractive. Hence, I have a neutral rating on the stock.

Be the first to comment