latypova/iStock via Getty Images

There aren’t many bank stocks on the list of Dividend Aristocrats and Kings – those companies that have raised their dividend payouts for at least 25 and 50 straight years respectively. There used to be more, but the wave of dividend cuts that washed over the industry during the global financial crisis wiped many of their tallies out. So, when you do see a bank on those lists, it probably means that you’re looking at a special one.

Enter Farmers & Merchants Bancorp (OTCQX:FMCB), which started its dividend streak back in the early-to-mid 1960s. Long, unbroken histories of dividend raises might sound a little arbitrary, though it is a neat little proxy for ‘quality’ – something which this California-based lender has in spades. Indeed, there really isn’t a whole lot to grumble about here, with the bank ticking all the right boxes in terms of profitability, past shareholder returns, growth and, perhaps unsurprisingly given its dividend record, safety.

If I was to flag something it would be more on the ‘stock’ side of things. While I wouldn’t call this one expensive on a P/TBV or P/E basis, note that FMCB does trade over-the-counter where volume can be very thin, and without much investor interest OTC shares can get cheap and stay that way for a long time. With that, I’m opening here with a ‘buy’ rating, albeit with the caveat that this is perhaps one for ‘buy-and-hold’ folks rather than shorter-term investors.

An Agricultural Specialist

Farmers & Merchants Bancorp is the holding company for F&M Bank or, to give it its proper name, Farmers & Merchants Bank of Central California. The bank started life out in Lodi, San Joaquin County, in 1916, and has since expanded to a couple of dozen branches across the middle part of Central Valley, including Sacramento. More recently it has also moved into the Bay Area, with branches in Oakland and Napa among others.

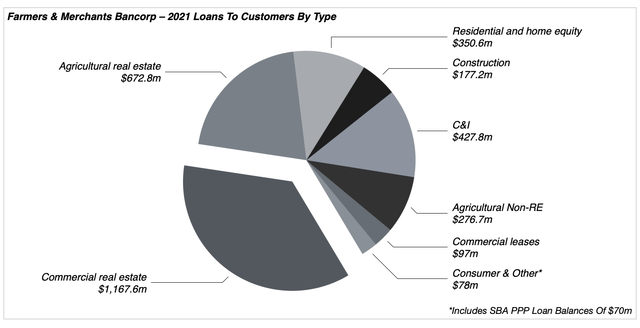

Data Source: Farmers & Merchants Bancorp 2021 Form 10-K

One of F&M’s distinguishing features is in the composition of its loan book. The bank is the 14th largest bank lender to agriculture in the country, and at last count, around 30% of its loans outstanding were to various agricultural borrowers (which includes both agricultural real estate as well as agricultural production and equipment financing, etc.). Total assets stood at a little over $5.1B at the end of last year.

A Class Act

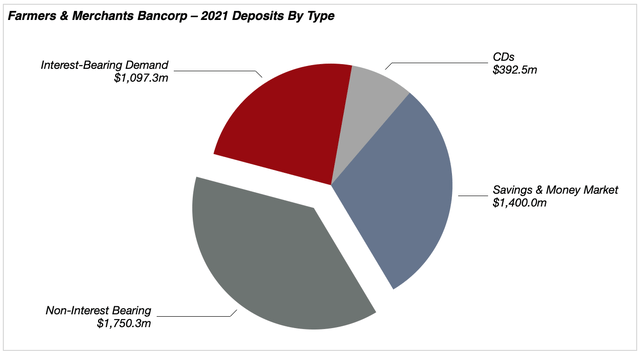

F&M has just about everything you’d want in a community lender. For one, and as per the image below, the bank has a solid core deposit franchise, with non-interest-bearing deposits currently funding around one-third of its asset base. Combined with its loan mix (i.e., a relatively lower skew to lower-yielding loans like residential mortgages), this leads to handsome net interest margins, even as the lower interest rate environment has reduced yields on earning assets.

Data Source: Farmers & Merchants Bancorp 2021 Form 10-K

On top of that, the bank is a very efficient operator. Operating expenses have typically landed in the low-50s area as a percentage of the top line, which compares favorably to its peer group.

Combined, those points make for a profitable lender. That is attractive in itself, but banks that display a greater degree of ‘core’ profitability also have more scope to absorb credit losses during downturns – a nice thing to have given the nature of the industry.

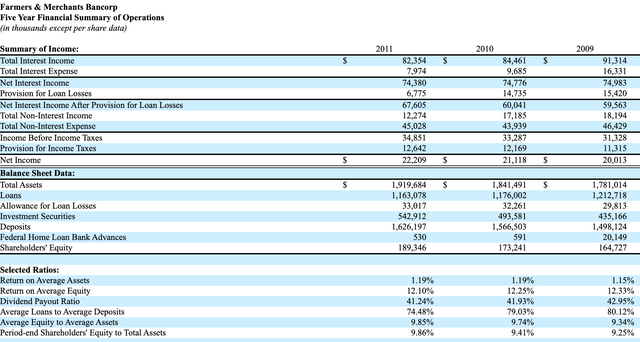

On the subject of credit quality, F&M again appears to score very highly. Granted, community lenders can often outperform here versus the larger banks, but the point stands nonetheless. Even during the financial crisis, the bank saw non-performing loans peak at well below 100bps, barely causing a dent to net income as it went on to post ROTE in the 12% area.

Data Source: Farmers & Merchants Bancorp 2011 Form 10-K

Strong across-the-cycle profitability is something I feel is very easy to overlook, especially without a ‘normal’ downturn for so long (COVID being a bit unique I guess), but it should support a higher valuation in my view.

Like most banks dependent on interest income, F&M has experienced downward pressure on its revenue these past ten or so years due to the lower rate environment, though tangible book value per share (“TBVPS”) CAGR of 9% in that time looks very solid. All said, this bank looks like a class act, and from a business perspective there’s really not much to dislike.

Reasonably Placed Heading Into 2022

Unlike the peer group, provisioning hasn’t really been a big part of the story here recently. F&M was already well-placed heading into the downturn – with typically pristine credit quality and its loan loss allowance above 2% – while the severe downside scenario that seemed likely at one point never materialized due to the stimulus measures.

With that, provision expensing was light here in 2020, and unlike many banks, F&M didn’t record a credit in 2021. Lower levels of provisioning still helped, however, with net income rising 13% last year to $66.3m ($84 per share). Core earnings growth was slightly weaker, although full-year pre-provision operating profit (“PPOP”) still grew an impressive 9% (to $90.2m), and part of that ‘weakness’ was related to the bank’s ongoing expansion into the Bay Area, with operating expenses rising 11% last year partly as a result. Core loan growth (i.e., ex-PPP balances) was likewise impressive, increasing around 10%, while TBVPS was up the same amount to $568.

Looking ahead, PPP loans falling off the balance sheet will be a slight drag, with only around $2.6m in fees left to be accreted into interest income in FY22 (versus around $9m last year). On the flip side, loan growth has picked up, with period-end loan balances up around 7% in Q4 versus Q2, and interest rates are also rising. The bank doesn’t provide much color on its rate sensitivity (except to confirm that it is indeed asset sensitive), but between its strong core deposit base, low loan-to-deposit ratio and cash balance (~13% of earning assets), I’m hoping for a decent bump to interest income as rates rise.

As Good A Time As Any

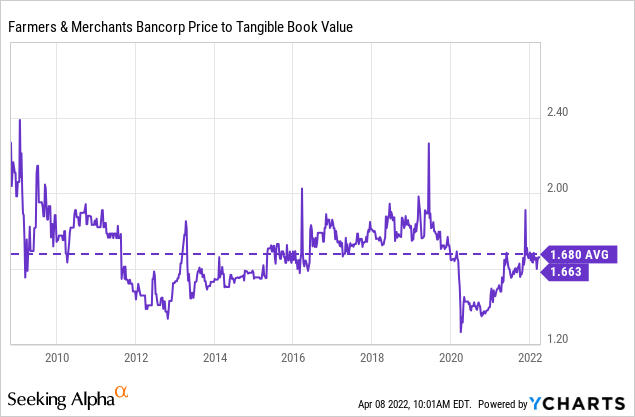

FMCB currently trades around the $950 mark, equal to just under 1.7x tangible book value and 11x FY21 EPS.

Calling this bank cheap might look like a hard sell, though with its ROTE averaging 15% since 2018, plus its historically strong performance across the cycle, I do feel these shares can support a significantly higher valuation. Indeed, this is as good a time as any to buy outside of a recession, especially now that interest rates are actually rising. Even ‘more of the same’ can be good for 10%-plus annualized returns, with historical PPOP running in the high single-digit range plus low single-digits from the dividend and periodic buybacks. Given the stability of the bank’s earnings, I think that makes FMCB an interesting pick for conservative-minded investors who don’t mind wandering off the beaten track a little. Buy.

Be the first to comment