Tzido

Investment Thesis

Farfetch (NYSE:FTCH) reported Q2 results that were decidedly middle of the road. And yet its shares took off? Why?

Investors were assuaged that the bulk of the headwinds that the company has had to navigate in H1 2022 will not be likely to repeat in H2 2022.

What’s more, investors are now coming around to the fact that with its valuation still down substantially more than 80% from its previous highs, perhaps, the worst case is now priced in.

As Farfetch eyes up 2023, Farfetch believes that China, the biggest luxury market in the world, will become a tailwind.

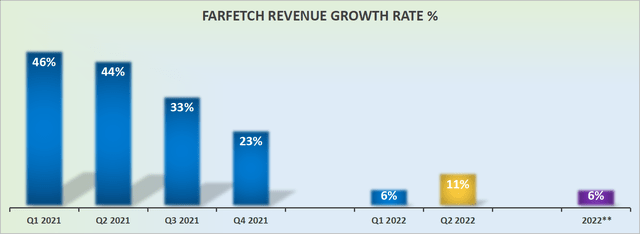

Revenue Growth Rates Guided Against Improving Comparables

The first half of 2022 was largely expected to be tough, consequently the fact that against this background, Farfetch still managed to eke out double-digit topline growth was very welcomed by investors.

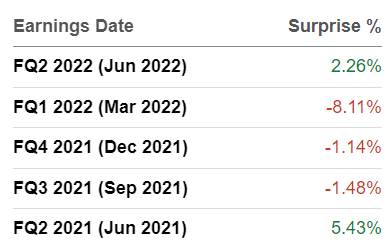

FTCH surprise revenue

What’s more, as you can see above, Farfetch’s Q2 topline revenue posted a notable departure from its recent revenue misses.

Indeed, as you can see above, Q1 2022 was particularly challenging for Farfetch as it had to embrace both the unwinding of its Russia business, as well as China’s lockdowns.

What’s to Expect For H2 2022 and 2023?

Farfetch makes a full and impassioned argument that Q2 is likely to be the trough in its recent performance. Farfetch believes that it can turn around its operations so that in 2023 it will be able to post a 20% CAGR, or as Farfetch declares,

We have the organic growth that you are seeing in the business outside of macro factors, again, full price growth of 20% excluding Russia and China. We will lapse the stoppage in Russia. And I believe China will turn into a strong tailwind.

Farfetch believes that it will come around to comping against Q1 2022 when it lost its Russian market setting itself up for meaningful improvements in early 2023. And then, Farfetch asserts that China will no longer be a headwind, but a tailwind.

Furthermore, Farfetch continues to move higher with its brand take rate, reaching 32% in Q2, the highest level as a public company.

Meanwhile, on the other side of its business, Farfetch continues to boost of 90% customer retention. Given that we are embracing a cost of living crisis in many parts of the world, this is undoubtedly a positive metric for shareholders to base their bullishness upon.

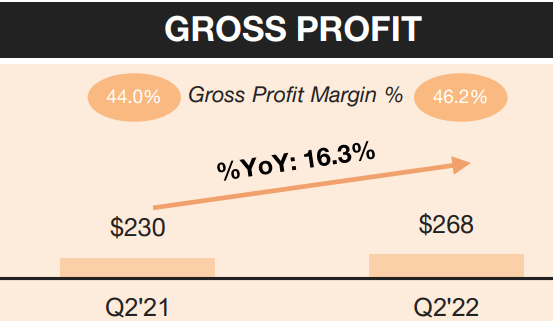

FTCH Q2 2022 presentation

The meaningful cutting back of investments, plus reduced headcount, together with a resolute move towards getting more of its merchandise to transact without concession, has led to its gross margin expanding 220 basis y/y, as seen above.

Given that this was a business that many investors wanted absolutely nothing to do with, this all of a sudden doesn’t seem all that bad. There’s the ”unofficial guidance” of 20% CAGR next year, strong brand retention, plus an improving gross margin profile. This doesn’t strike me as a company that deserves to be left for dead.

Valuation — Less than 2x Sales

Farfetch argues that after reporting a negative 8% EBITDA in Q1, and a negative 5% EBITDA in Q2, it can improve its profitability so that it will end 2022 at breakeven.

This would imply that the second half of 2022 would see at least $36 million of EBITDA, meaning that Farfetch would at least match the same bottom line profitability as last year’s H2 2021.

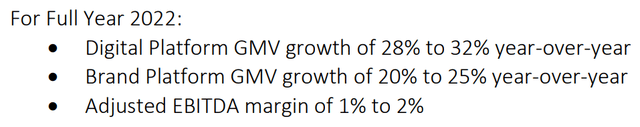

That being said, approximately 6 months ago Farfetch was guiding for very strong GMV growth on both its Digital and Brand platforms.

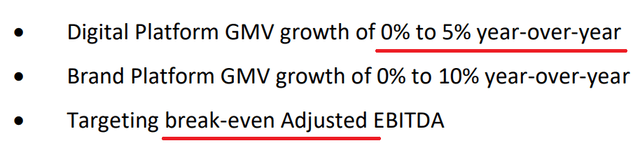

And today’s guidance is as such:

This shows a management team that struggles to guide for more than 6 months at a time. Will this time be different?

On the other hand, since that guidance was given 6 months ago, the stock is today already down more than 40%, including the jump of +50% last week.

So, I believe we could say that this management had to navigate a very challenging 2022, but that the stock has already moved ahead and priced in the worst-case scenario.

The Bottom Line

I make the case that Farfetch has a path to profitability that is not far-fetched. It has a valuation that is not far-fetched. It’s a stock that has been left for dead, but in fact, has a plan for a near-term turnaround.

A lot of the issues facing this company haven’t gone away, such as its rapidly increasing share count. Nevertheless, when all is said and done, I’m asserting this stock with a tepid buy rating.

Ultimately, this leading online luxury fashion marketplace may now be too cheaply valued and offers an attractive investment opportunity at approximately $12.

Be the first to comment