Ethan Miller/Getty Images News

Faraday Future (NASDAQ:FFIE) tried to present a new paradigm for the EV industry with its ultra-engineered flagship with a retail price only affordable by a few. Like many other EV companies, the company went public last year on the back of fervent investor demand for the new generation of EV manufacturers. The EV cohort of 2021 included a vast array of companies targeting different parts of what is still rising consumer demand for EVs as households seek to take advantage of greater federal support for their purchases, fast-expanding charging infrastructure, and longer battery range.

The transition away from the internal combustion engine is a real and fast ramping macro trend that is still very much in a very early stage in North America. This framed the enthusiasm toward companies in the space and led to Faraday Future being able to raise close to $1 billion in gross proceeds when it went public last year. The recent collapse of Electric Last Mile has opened up a new paradigm in the EV investment space. In this, the concerns voiced by bears that the rush to go public by a large number of EV companies last year represented a suboptimal allocation of capital and was only a result of unique market conditions stemming from excess liquidity. Indeed, these companies are now failing and face the real prospect of bankruptcy as capital market conditions deteriorate.

A Difficult Macro Backdrop To Raise Cash

Faraday Future is still pre-revenue as the company is set to start production and delivery of its flagship FF 91 during the third quarter of 2022. At a starting retail price point of $180,000 excluding federal or state tax credits, the car would be competing in the high-end luxury market. The non-EV comparatives would be the Bentley Bentayga, Lamborghini Urus, and Mercedes-Maybach.

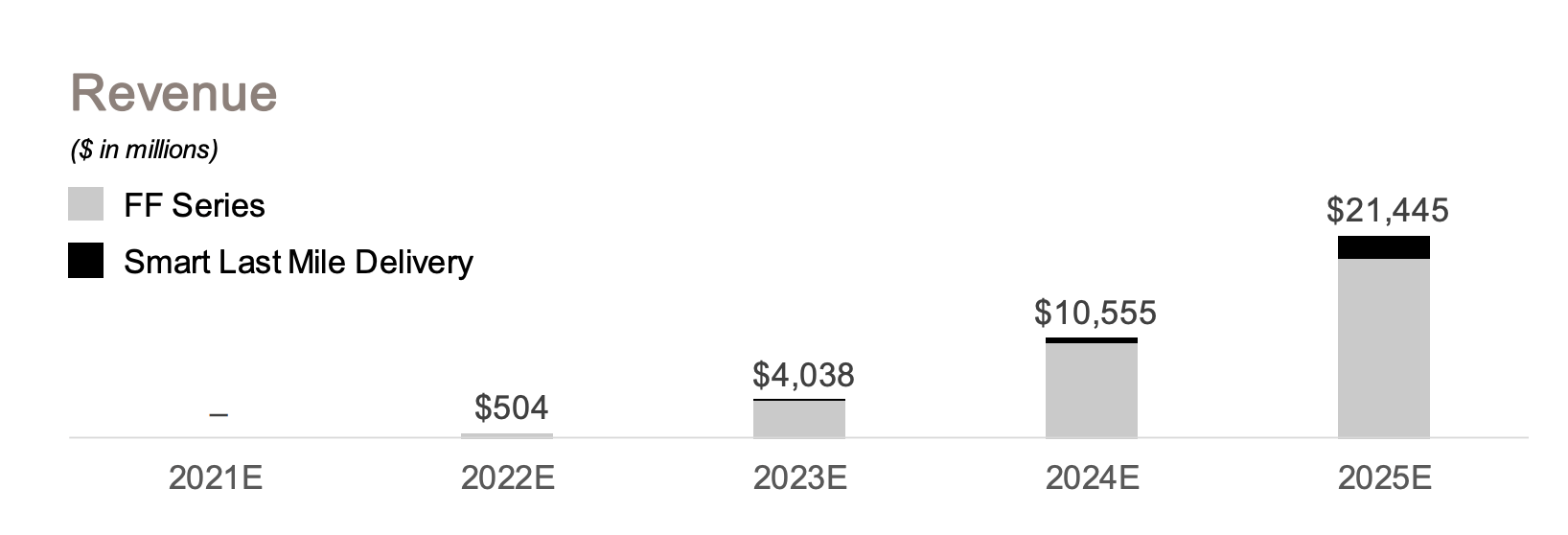

The company provided reservation figures of around 14,000 and initial financial guidance for revenue of at least $504 million in fiscal 2022. However, Faraday Future has since admitted in a filing with the SEC that it materially inflated this figure.

Faraday Future

Actual reservations are 97% smaller at 401. The larger figure included free to make indications of interest whilst actual reservations required a $5,000 refundable fee. Further, indications of interest have actually shrunk. This was down from 64,124 reservations received just after Faraday unveiled the FF 91 at CES 2017.

Assuming the company is able to produce and deliver all 401 cars during its third quarter, we should expect revenue of at least $72 million for the year. This comes against recently released financials that showed a net loss increase to $153 million during the first quarter of Faraday’s fiscal 2022, up from a $76 million loss in the comparable year-ago period. The company ended the quarter with cash and equivalents of $276 million, down consecutively from $505 million in the previous quarter.

Negative free cash outflow at $166.8 million was an increase from a $21 million outflow in the year-ago quarter. Whilst an increase is expected as Faraday gears up to ramp production next quarter, the company also blamed price pressure from rising material costs and issues with logistics for the increase. Also important to note is total current liabilities of $242.8 million are 88% of Faraday’s cash reserves. Hence, assuming cash burn the company’s runway is unlikely to exceed two quarters.

The SEC subpoena complicates the situation as it will likely create significant bottlenecks for the company tapping the capital markets to expand its runway. The SEC started a formal probe after a review identified inaccurate statements made by management.

Venture Forward Into Uncertainty

It’s becoming increasingly clear that the rising tide of automobile electrification will not lift all the boats. An unfortunate mix of high cash burn, an egregious management team under regulatory scrutiny, and a looming recession have plunged Faraday’s future into deep uncertainty. Faraday’s investors are likely asking whether the company will be the next EV manufacturer to collapse in the coming summer of chaos. Perhaps this was always going to be the outcome with an accumulated deficit that was at $3 billion as of the end of its last quarter. The focus on the high-end luxury market is also going to be difficult as this market segment is more likely to stick to strong established brands.

Faraday Future is set to launch the FF 91 next quarter, perhaps providing some traction with some consumers of high-end luxury EVs who are yet to receive fully electric alternatives for their current cars. The competition is going to heat up and Faraday faces a difficult battle of gaining market share in a niche that is inherently exclusionary. The next few months will be a trudge as management struggle to ramp up production, grow reservations, respond to the SEC investigation, and raise more cash.

Be the first to comment