Chris Hondros/Getty Images News

In challenging economic times, investors may want to seek out companies and business models that are counter-cyclical. I believe pawn stores are a business model that could potentially thrive in this environment. Recently, I wrote a bullish article on FirstCash Financial (FCFS), the largest player in the space. In this article, I will cover EZCORP, Inc. (NASDAQ:EZPW), a sizeable pure-play pawn store competitor to FCFS, and also provide more thoughts on the pawn business model.

Company Overview

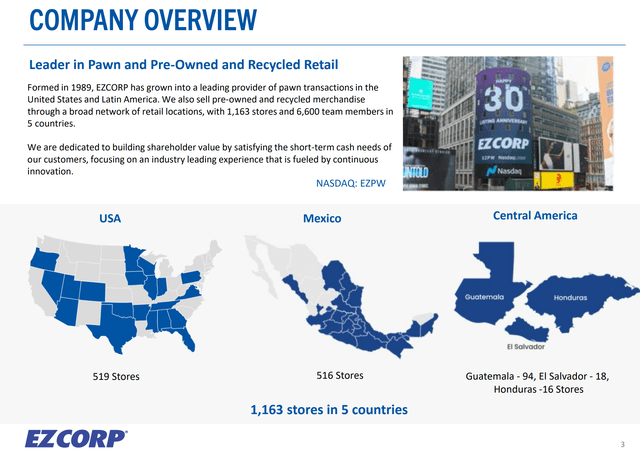

EZCORP, Inc. is a leading pawn store operator in the United States and Latin America. EZCORP has 1,163 stores across 5 countries, with the vast majority in the U.S. and Mexico (Figure 1).

Figure 1 – EZCORP Overview (EZPW investor presentation)

What Is Pawn?

Pawn stores are local retail stores that buy and sell pre-owned consumer products like electronics, jewelry, gaming devices, musical instruments, and tools. In many instances, pawn stores act as a secured lender to unbanked/underbanked/credit constrained consumers by providing small ticket non-recourse loans that are backed by the pawned asset.

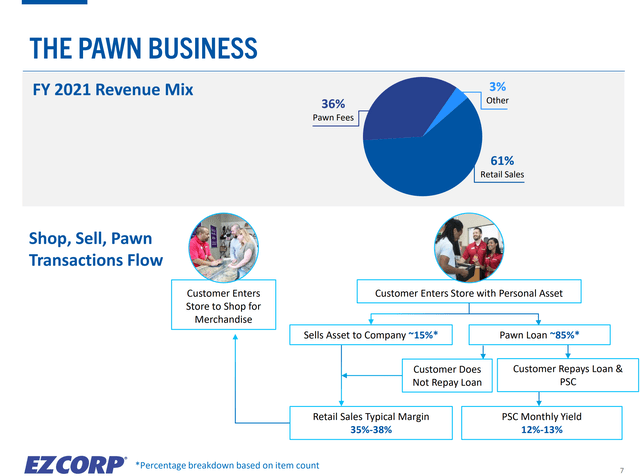

For EZCORP, A typical customer enters the pawn store with their personal asset. About 15% of the time, the customer sells the item directly to the store. and receives cash. The asset then enters the pawn store’s merchandise inventory, and is put on display at a 35-38% mark up.

For the other 85% of customers, they get a pawn loan collateralized with their asset. Pawn loans have 12-13% monthly yields. Credit losses in the pawn business are typically low, as the pawn store only lends a fraction of the market value of the asset. If the customer defaults (i.e. doesn’t pay back the loan), the pawn store takes possession of the asset and it enters the store’s inventory, where it gets resold at the 35-38% mark up. Figure 2 shows an overview of EZCORP’s pawn business.

Note, this basic business model is very similar to the one I described in my FirstCash Financial article. The only difference between EZCORP’s business model and the one described for FCFS is the propensity of customers to sell directly to the pawn store (15% for EZCORP vs. ~25-30% for FCFS), and the retail mark up the company typically charges (35-38% for EZCORP vs. 35-45% for FCFS).

Figure 1 – Pawn business model (EZPW investor presentation)

Pawn Is Counter-Cyclical

Historically, the pawn business has performed well across most economic cycles, especially downturns. The following is an excerpt from my FCFS article, which explains why:

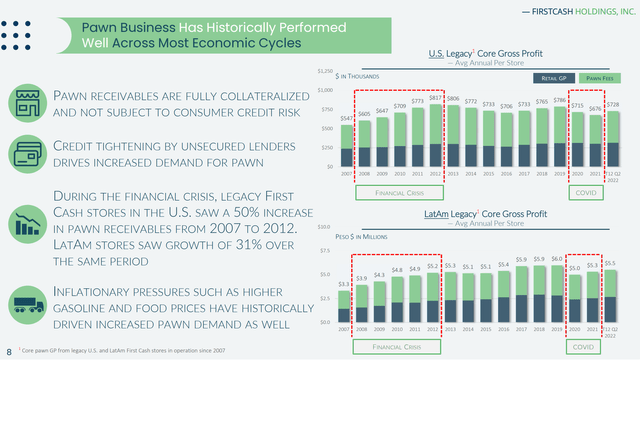

In particular, the pawn business is countercyclical, as financially stretched consumers tend to utilize pawn services more during tough economic conditions. U.S. FirstCash Holdings stores actually saw a 50% increase in pawn receivables from 2007 to 2012 during the “Great Financial Crisis” (“GFC”), and receivables declined during COVID, as financially stretched consumers were buoyed by government stimulus cheques (Figure 2).

Figure 2 – Pawn is counter-cyclical (FCFS investor presentation)

EZCORP Pawn Loan Utilization Increasing

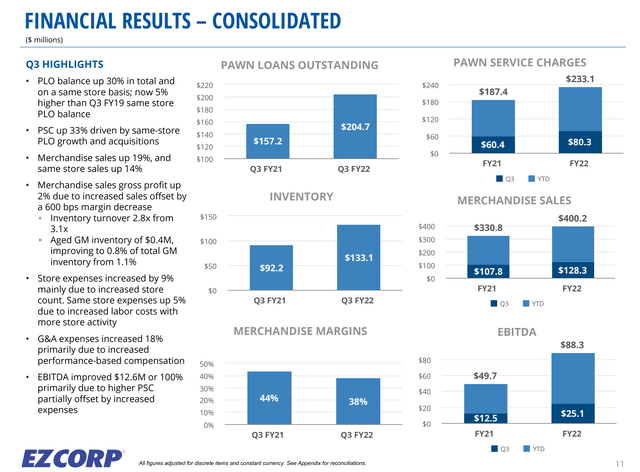

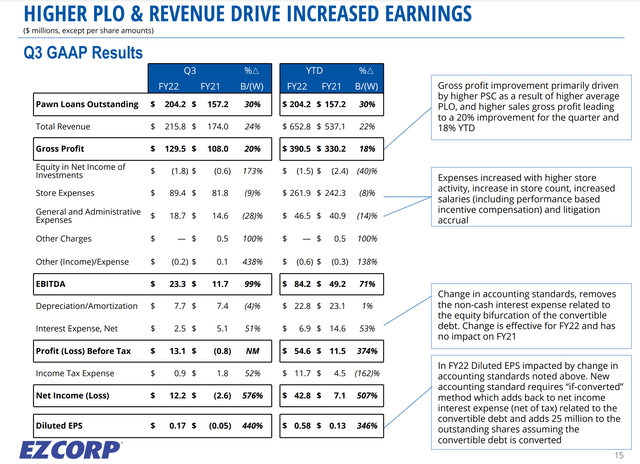

As COVID-pandemic government stimulus measures have ended and persistent inflation is eating into stretched household budgets, I expect pawn store utilization to increase in the coming quarters. Already, we can see EZCORP’s pawn loans balance increasing 30% YoY to $205 million as of June 30, 2022 (Figure 3).

Figure 3 – EZPW Q3 Financial Highlights (EZPW Q3/22 investor presentation)

Business Model Generates High Yield & Low Losses

The most attractive aspect of the pawn loan business model is the high cash yields these loans generate. Unlike payday lending, which has interest rate caps in 18 states and are banned in 12 other states, the pawn loan business model do not have interest rate caps.

From Figure 3 above, we see that YTD, EZCORP has generated $233 million in pawn service charges on $190 million in average pawn loans outstanding (average between Q3/22 loan balance of $205 million and Q4/21 loan balance of $176 million), which equates to annual yields of over 160%. This is comparable to yields generated by FirstCash Financial’s pawn business.

Another aspect of the pawn loan business that is underappreciated is the relatively low loan loss ratio. In other forms of lending to risky customers (for example payday lending), the lender must charge high interest rates to compensate for the heightened probability of loan losses. However, for pawn loans, the lender lends only a fraction of the market value of the item. If the customer defaults, the pawn store takes possession and resells the item with a retail mark up of 35-40%.

But Suffers Heavy Store Infrastructure Costs

The challenge with the pawn loans business model though, is that there is not an easy way to drive loan volumes. Pawning off your valuables at pennies on the dollar is often a last ditch effort most people would avoid if possible. This means in good economic times, pawn stores may suffer from a high SG&A drag, as its assets are underutilized.

For EZCORP, although the pawn business generate high cash returns of 160%+ yields, after deducting store and corporate expenses, EZCORP only has a modest YTD Net Profit of $43 million or $0.58/share EPS on net margins of 6.6% (Figure 4).

Figure 4 – EZPW Q3 Financial Summary (EZPW Q3/22 investor presentation)

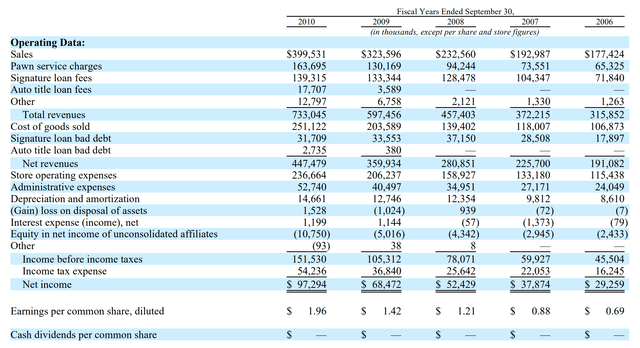

We expect net margins to rise as the economy worsens though, as loan volume goes up and the fixed store costs are spread over more loans. For context, in the years leading up to the GFC, EZPW’s net margins grew steadily from 9.3% in 2006 to 11.5% in 2008 and 13.3% in 2010 as stretched consumers utilized more of the company’s services (Figure 5).

Figure 5 – EZPW’s net margins grow during recessions (EZPW 2010 10K Report)

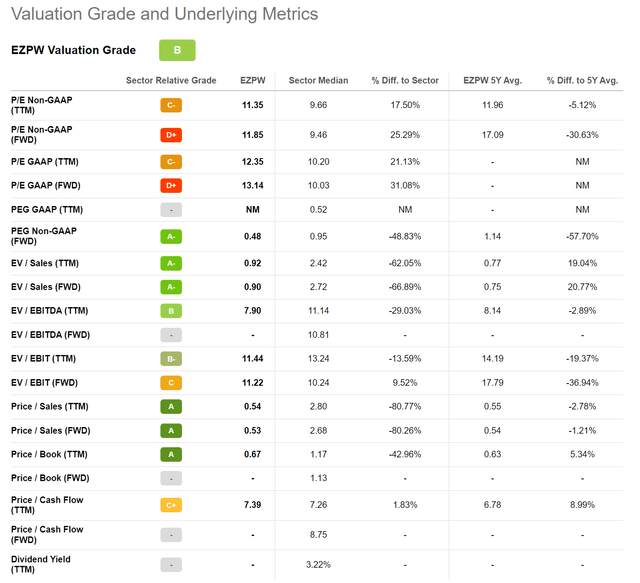

Valuation Is At A Premium

Valuation-wise, EZCORP trades at a slight premium to the financials sector, with non-GAAP forward P/E multiple of 11.9x vs. 9.5x (Figure 6). We think this premium is warranted as financial companies like banks currently have depressed valuation multiples due to economic uncertainty while EZCORP benefits from a weak economy, as mentioned above.

Figure 6 – EZPW Valuation (Seeking Alpha)

EZCORP is also trading at a discounted valuation compared to its pawn peer, FCFS, which has a 16.0x forward P/E multiple. In some respects, EZCORP is preferable to FCFS, as it is a pawn pure-play, whereas FCFS has a nascent lease-to-own (“LTO”) business that is susceptible to a slowing economy.

Risks To EZCORP

Although consumers’ utilization of pawn loans increase during tough economic environments, their ability and willingness to spend on goods may decrease, counteracting some of the benefits of higher pawn volumes. This risk would show up in the merchandise gross margin line and inventory turnover ratio, i.e. EZCORP may not be able to charge as high a markup on pawned merchandise or sell the merchandise as quickly.

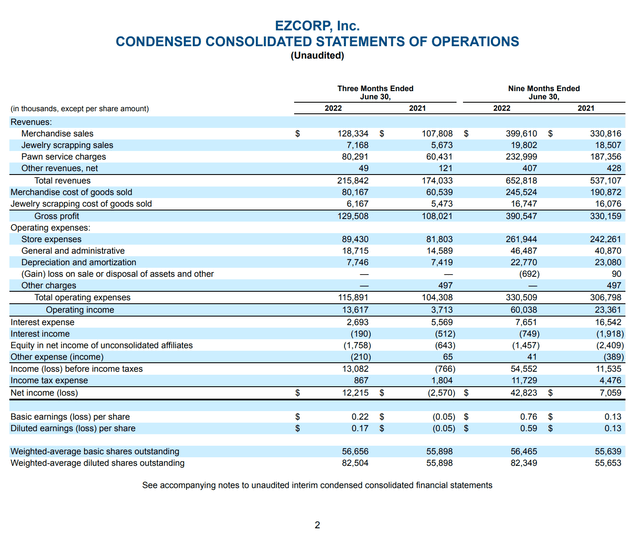

From EZPW’s latest 10Q report, we can observe merchandise gross margin decreasing, with Q3/22 GM of 37.5% vs. 38.6% YTD and 43.9% in Q3/21 (Figure 7). So far, the negative impact has been minimal, as merchandise gross profit has actually increased 1.7% YoY to $48.1 million, while pawn service charges have increased 32.8% YoY to $80.3 million as pawn loan volumes picked up. Net-net, worsening economic conditions have been a large tailwind to EZPW. However, investors should monitor the inventory turnover and merchandise gross margin line in future quarters, as a prolonged period of economic weakness will hurt the resale of pawned merchandise.

Figure 7 – EZPW Q3/2022 Financials (EZPW Q3/2022 10Q Report)

Another risk for EZCORP is that volatile precious metals price could hurt jewelry scrapping margins. When pawn stores take possession of pawned jewelry, sometimes it is sold for its precious metal value, or ‘scrapping’. Pawn stores can also offer ‘cash for gold’ promotions, and resell the gold collected.

If precious metal prices move suddenly against the pawn store operator, they may pay out a higher ‘cash value’ than what they can sell the precious metals for. For EZCORP, this was not an issue in the latest quarter, as jewelry scrapping margins in Q3/2022 were healthy at 13.9% vs. 15.7% YTD. However, if we look at Q3/2021, we see the scrapping margin was only 3.5%. This is because in Q3/2021 (April to June 2021), gold prices spiked from ~$1,700 to over $1,900, then collapsed back to $1,760 by the end of the quarter (Figure 8). EZCORP was likely caught paying top dollars for jewelry that quickly depreciated in gold value.

Figure 8 – Volatile precious metal prices could impact jewelry scrap margins (tradingeconomics.com)

Finally, we should mention that EZCORP has moderate levels of financial debt. As of June 30, 2022, EZCORP has $313 million of Long Term Debt and $222 million of cash, against $98 million in LTM EBITDA. This translates to 0.9x LTM Net Debt / EBITDA. Debt may hinder management’s ability to react to changing economic conditions.

Conclusion

In challenging economic times, investors may want to seek out companies and business models that are counter-cyclical. I believe pawn store operators such as EZCORP stand to benefit from the current economic slowdown and are worth speculative buys.

Be the first to comment