Win McNamee

Although oil prices have been decreasing since June after a rapid appreciation, caused mostly by Russia’s invasion of Ukraine, Exxon Mobil Corporation’s (NYSE:XOM) share price continues to accelerate to this day. The stock is now trading at its all-time high levels. While the oil bears are expecting this growth of Exxon’s stock to end mostly due to the demand destruction that should result from a hawkish policy of the Federal Reserve, the latest developments suggest that additional supply disruptions could prevent this scenario from occurring in the foreseeable future, creating a possibility of a further appreciation of the company’s shares.

In addition, as the embargo on Russian oil is about to kick in during December, we could expect oil prices to trade at the current relatively high levels for a while. This would help Exxon to seize the opportunities from the upcoming supply shocks and create additional shareholder value along the way.

Ignore The Fed, It’s All About Supply Disruptions

In my latest article on Exxon written nearly a month ago, I stated that Russia’s decision to mobilize its male population for the war in Ukraine is going to have negative consequences for the country’s oil industry and the overall global oil market, since such a decision could create additional supply disruptions of oil. This take goes against the popular belief, which states that as long as the Federal Reserve continues to execute its hawkish monetary policy and engages in a quantitative tightening, we’re going to enter a recession that will lead to demand destruction and subsequent depreciation of oil prices and Exxon’s shares. So far, those who believe in the demand destruction argument have been wrong, and there’s an indication that they would continue to be wrong in the foreseeable future.

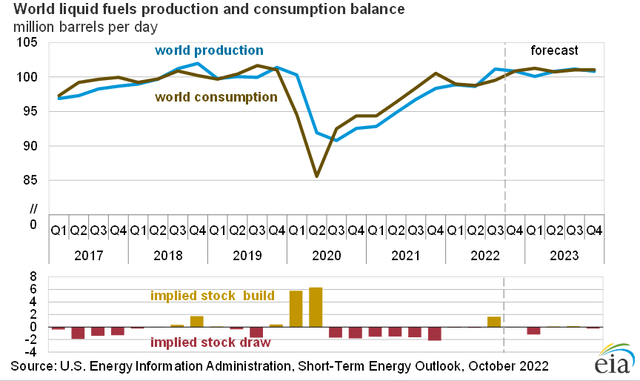

First of all, recently released economic data shows that the U.S. economy continues to grow Y/Y. This is a sign that even if we’re going to enter a recession, it’s not going to happen in the coming months. At the same time, in its October report, the EIA stated that it believes the Brent crude oil spot prices mostly to be in the range of $93 per barrel in Q4’22 and $95 per barrel in Q1’23. On top of that, the agency expects the global consumption of liquid fuels in 2023 to be 101.03 million barrels per day, above the global production of 100.73 million barrels per day. This indicates that significant demand destruction due to the aggressive Fed is unlikely to materialize anytime soon.

World Liquid Fuels Production And Consumption Balance (U.S. Energy Information Administration)

What we do know instead is that as the demand increases, the supply is more than likely to be tight going forward. First of all, the latest decision of OPEC+ to cut the production by 2 million barrels of oil per day, which accounts for ~2% of the global daily oil supply, is more than likely to at least keep the oil prices at the current relatively high levels.

At the same time, we also know that in December, the EU’s embargo on Russian oil is about to kick in, while in February the imports of Russian oil products to the union would be banned as well. During normal conditions, it would’ve been easy for Russia to change the markets and begin to sell its liquids to other customers. After all, that’s exactly what the country has been doing in recent months when it increased the exports of its oil to India and China. However, it’s highly unlikely that Russia would be able to do so in the following months.

First of all, one of the main reasons for an embargo is the need to deplete Russia’s war chest in order to prevent it from financing its war efforts in Ukraine. Therefore, in addition to prohibiting the imports of Russian liquids to the European markets, the EU along with the UK also agreed to implement a ship insurance ban under which its companies won’t insure tankers that transfer Russian oil by the end of this year.

This is going to hurt Russia’s ability to sell its oil to non-European actors, since it has a vulnerable export supply chain along with an underdeveloped tanker fleet. 80% of its oil exports are done via sea, mostly by Western companies whose governments are about to sanction Russian oil. Without the ability to replace Western tankers with its own fleet, it’s more than likely that we’re going to see additional disruptions of oil supplies in the following months, which would more than likely keep the oil prices at the current relatively high levels.

What’s also important to note is that the G7 nations plan to implement a price cap on Russian oil, under which mostly non-European states would receive an exemption from the insurance sanctions and continue to import the Russian oil normally if they purchase it at a certain lower price. This is done in order to ease the effects of sanctions on the oil market and ensure that the developing nations don’t suffer from the European embargo.

The problem is that Russia itself is unlikely to agree to such a price cap and instead could decide not to sell its liquids at all at significant discounts. In such a scenario, the supply shock could be even greater and would strengthen my supply-disruption argument even more. After the Russian invasion of Ukraine in February, Russia’s oil production has already decreased and there are reasons to believe that the output would be lower in the future, especially since most of the oil servicing firms such as Halliburton (HAL) have already sold their operations in Russia.

What’s Next For Exxon Mobil?

Considering the latest developments, there is every reason to believe that the supply disruptions could continue to outweigh the demand destruction, which is a positive thing for Exxon and its shareholders. Even if oil prices starts to decrease for some reason, the decline is unlikely to be significant, as the White House has already outlined its desire to replenish the strategic petroleum reserve in the future, creating a possible support level for oil prices.

However, even without that replenishment, I believe that the current supply disruptions are enough to keep the market tight and the prices at relatively high levels. On top of that, as OPEC+ and Russia decrease their production, Exxon is able to increase them without creating a scenario where there’s an oversupply of oil. In its Q2 earnings report, Exxon stated that its oil production has increased to 3.73 million barrels per day, up from 3.58 million barrels per day a year ago, and with the latest new offshore discoveries in Guyana, it’s more than likely that the company would be able to ramp up production even more in the future.

Considering this, it’s safe to say that the current geopolitical environment greatly favors Exxon. It has an opportunity to continue to generate record returns in the foreseeable future by increasing its production and decreasing its breakeven price at the same time.

That’s why I expect the company to deliver a strong Q3 earnings report tomorrow and a positive outlook for the future given the latest and the upcoming geopolitical developments. The street already expects the company to generate a record $102.96 billion in revenues during the third quarter, which represents a growth of ~40% Y/Y, and given the developments described above, the business has every chance to achieve that target.

As for Exxon’s fair value, back in June and August, I made two separate discounted cash flow (“DCF”) models. The first model showed Exxon’s fair value to be $99.15 per share, while the second model showed the company’s fair value to be $104.77 per share. The increase in fair value is attributed to the improvement of the top-line growth assumptions. As I was stating at the beginning of summer, the market hasn’t fully realized how big of an impact the European sanctions against Russian oil would have on the overall oil market.

Considering that OPEC+ decided to create an additional supply shock, while the sanctions against Russian oil are about to kick in beginning in less than two months, there’s a real possibility that the top-line growth assumptions would receive an upward revision, which would also improve all the other metrics in the model and lead to a greater valuation. I plan to update my model after the Q3 numbers come out tomorrow, but considering the latest and upcoming developments, we could already assume that Exxon’s stock could continue to appreciate in this environment. The oil market should remain tight, while the consumption is forecasted to increase, undermining the demand-destruction argument for now.

Be the first to comment