onurdongel

On Friday, October 28, 2022, oil and gas supermajor Exxon Mobil Corporation (NYSE:XOM) announced its third quarter 2022 earnings results. To say that these results were impressive would be a dramatic understatement. Exxon Mobil beat the revenue and earnings estimates that were presented by its analysts. In fact, the company reported the highest quarterly net income ever in its history. This was driven not only by the high prices for crude oil and natural gas, which were actually down a bit compared to the second quarter but also by the company growing its production relative to the year-ago quarter. The market clearly liked this earnings report as it drove the stock price up following the announcement. Despite this and the strong capital appreciation that the company’s stock has delivered over the past twelve months, Exxon Mobil still appears to be dramatically undervalued. Thus, it might not be too late to buy into the company and earn yourself further profits.

As my regular readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into the analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from ExxonMobil’s third-quarter 2022 earnings report:

- Exxon Mobil brought in total revenues of $112.070 billion in the third quarter of 2022. This represents an impressive 51.89% increase over the $73.786 billion that the company brought in during the prior-year quarter.

- The company reported an operating income of $21.696 billion in the reporting period. This compares very favorably to the $8.154 billion that the company reported in the year-ago period.

- Exxon Mobil produced an average of 3.716 million barrels of oil equivalent per day during the current quarter. This represents a 1.39% increase over the 3.665 million barrels of oil equivalent that the company produced per day on average during the equivalent period of last year.

- The company reported a free cash flow of $22.047 billion during the most recent quarter. This represents a dramatic increase over the $9.037 billion that the company reported last year.

- Exxon Mobil reported a net income attributable to the common shareholders of $19.660 billion in the third quarter of 2022. This represents a 191.26% increase over the $6.750 billion that the company reported in the third quarter of 2021. It is also the highest quarterly net income that the company has ever had.

It seems certain that the first thing that anyone reviewing these highlights will notice is that Exxon Mobil managed to show year-over-year improvement in terms of every measure of financial performance. This is not exactly unexpected. After all, anyone that drives a car can testify to the fact that oil prices are substantially higher than they were last year.

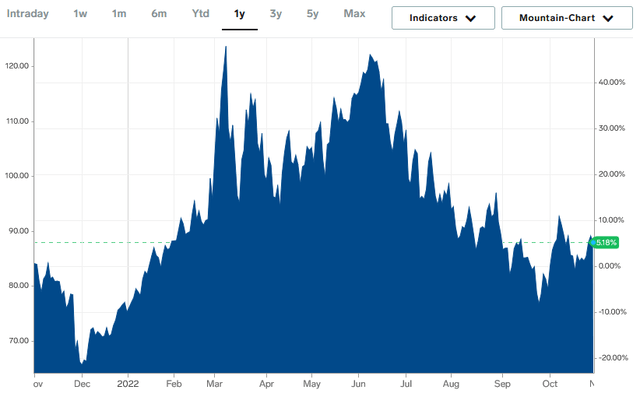

As we can see, the price of West Texas Intermediate crude oil is up by 5.18% over the past twelve months. However, we can also see that oil prices were declining over most of the third quarter, so during much of the quarter, Exxon Mobil would have received higher prices for its oil than it is getting today. The same is true of natural gas, which has generally given better pricing performance over the past year than crude oil. We can see this reflected in the company’s realized prices during the quarter when compared to the third quarter of last year:

|

Q3 2022 |

Q3 2021 |

|

|

Crude Oil ($/bbl) |

$91.69 |

$67.62 |

|

Natural Gas ($/mcf) |

$8.38 |

$3.33 |

It should be fairly obvious how this would cause ExxonMobil’s financial performance to improve. After all, if the company received more money for each unit of product that it sells then it will bring in more revenue all else being equal. This, therefore, means that it has more money available to cover its expenses and make its way down to the bottom line. However, all else is rarely equal in the energy industry. As noted in the introduction, Exxon Mobil had a higher production during the most recent quarter than it had during the equivalent period of last year. Thus, not only did the company receive more money for each unit of product that it sold but it also had more products to sell and generate revenue from. These two factors thus helped to boost the company’s results relative to last year.

It is somewhat unlikely that ExxonMobil’s fourth quarter will be as good as this one, although it will still likely be better than the fourth quarter of 2021. The biggest reason for this is that we will probably not see crude oil prices return to their third-quarter levels in the near term. We have begun to see rising supplies of crude oil, which has been pushing prices down somewhat. However, as I pointed out recently, the problem facing the United States right now is not the supply of crude oil but its refining capacity. To put it simply, the United States lacks sufficient refinery capacity to meet the demand for gasoline and especially diesel fuel. This is evident in the fact that much of the Northeast has less than a month of diesel consumption in storage, which is an incredibly low level for this time of year. This will likely keep prices for refined products somewhat elevated for a while.

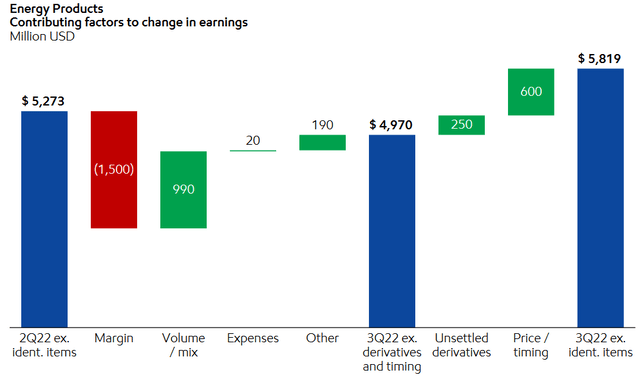

This shortage of refined products could benefit Exxon Mobil over the next few quarters due to the company being more than just an exploration and production company. Exxon Mobil also is one of the largest refiners in the country. In the third quarter, Exxon Mobil reported its highest-ever refining throughput in North America as it was attempting to take advantage of this shortage and refine as much oil as it possibly could. Unfortunately, though, the company’s refining margin was lower than in the second quarter. This reduced the business unit’s earnings by approximately $1.5 billion quarter-over-quarter. Exxon Mobil was able to make up for this with volumes and timing. As I have pointed out in various previous articles, refineries are frequently able to boost their profitability when crude oil prices decline quickly due to the fact that oil prices tend to move more rapidly than gasoline prices. We see that concept highlighted in ExxonMobil’s earnings as overall the company’s refinery and energy products business delivered a $5.819 billion profit compared to $5.273 billion in the second quarter:

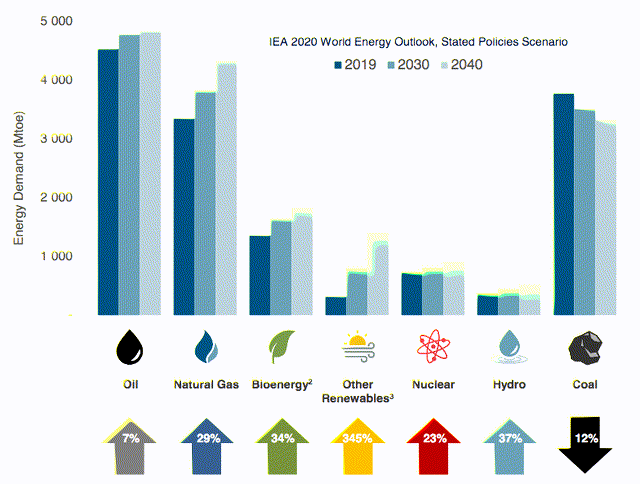

It is therefore uncertain exactly how well the company will perform over the next quarter or two as it will largely depend on whether or not a strong performance in the refinery unit can offset the likely weaker crude oil prices. However, the long-term outlook for both oil and natural gas prices is quite strong as the demand for both substances is likely to grow more quickly than the supply of them. This is something that may seem surprising considering the efforts of many national governments to reduce the consumption of crude oil or natural gas within their borders. However, according to the International Energy Agency, the global demand for crude oil will rise by 7% and the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2020 World Energy Outlook

The biggest cause for the growth in natural gas consumption is the efforts that many nations have put forward to reduce carbon emissions to fight climate change. One common strategy that many have been using is to retire old coal-fired power plants and replace them with renewable energy sources. However, renewable energy lacks the reliability to meet the needs of modern society. After all, wind power does not generate any energy when the air is still and solar power does not work when the sun is not shining. Thus, renewable plants are often supplemented with natural gas turbines because natural gas is reliable enough to satisfy the needs of society as well as burns cleaner than any other fossil fuel. Exxon Mobil noted specifically in its earnings report that the demand for liquefied natural gas is increasing globally due to several nations increasing their imports of natural gas from overseas for this reason.

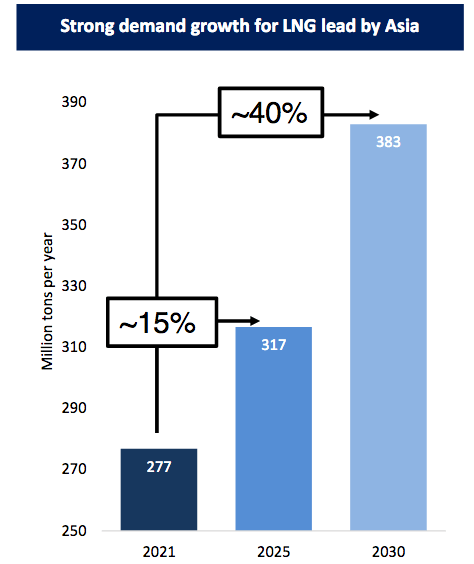

Exxon Mobil has been moving to capitalize on this growing international demand for natural gas. As the only way to ship natural gas overseas is to convert it into a liquid, the company has been constructing liquefaction plants around the world to perform this task. One of these plants started operation immediately following the end of the third quarter. This plant is the Mozambique Coral South Floating LNG plant, which is the first floating liquefied natural gas project in Africa. The plant is designed to produce about 3.4 million tons of liquefied natural gas per year using the gas produced in Mozambique’s incredibly resource-rich Area-4 Block. Exxon Mobil owns 25% of this project alongside Italy’s Eni (E) so we can expect that it will receive a proportional share of the cash flow from it. This project could indeed prove to be quite profitable due to its positioning. Mozambique is very well positioned to ship liquefied natural gas to Asia by crossing the Indian Ocean as well as to Europe through the Suez Canal. This is nice because these are the two areas that are expected to greatly increase their imports of liquefied natural gas over the coming years. As I mentioned in a previous article, Asia alone is expected to increase its imports of liquefied natural gas by 40% by 2030:

Golar LNG

Europe, meanwhile, has been actively looking for a replacement for Russian natural gas due to the political fallout from the situation in Ukraine. This project could therefore result in some incremental growth for Exxon Mobil now that it has begun producing liquefied natural gas.

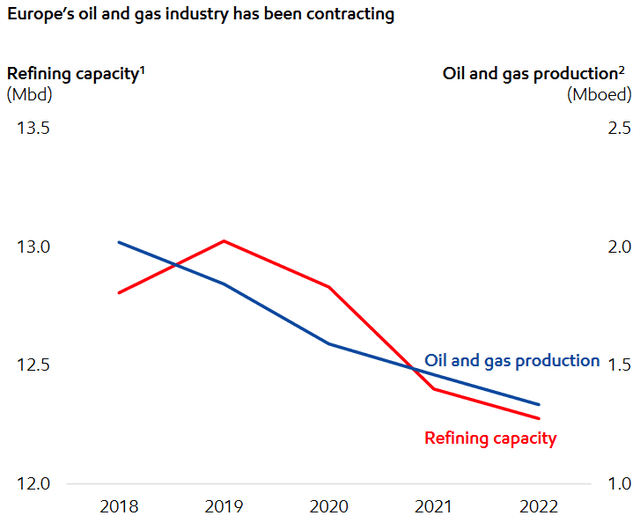

We could also see growing demand from Europe for other products that Exxon Mobil produces. These include refined products. This is largely due to European policy meant to reduce carbon emissions. As a result of European “green” policies, oil and gas production has fallen by 700,000 barrels of oil equivalent and refining capacity has fallen by 500,000 barrels of oil equivalent per day since 2018:

The overall demand for fossil fuel energy is not down nearly that much in the European Union, however. This is one of the biggest reasons for the current energy crisis in the nation that is threatening to leave many people without heat this winter. The end result will likely be growing demand for imports from friendly nations, such as the United States. As we have already seen though, refining capacity in the United States is already stretched to its limits. Thus, the law of supply and demand would point to rising prices for refined products (and likely crude oil). This would obviously benefit Exxon Mobil over the next several years since American refining capacity will not grow sufficiently to meet the needs of both Europe and the United States given the current policy in the United States.

Over the past twelve months, ExxonMobil’s stock price is up by 72.13% as of the time of writing. However, there are signs that the stock is still significantly undervalued. One metric that we can use to see this is the price-to-earnings growth ratio. This ratio is a modified form of the traditional price-to-earnings ratio that takes a company’s forward earnings per share growth into account. Generally, a price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its forward earnings per share growth and vice versa.

According to Zacks Investment Research, Exxon Mobil will grow its earnings per share at a 24.49% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 0.34 at the current price. As this figure is well below 1.0, it is a very clear sign that the stock could be undervalued relative to the company’s forward earnings per share growth. However, as I have pointed out in numerous previous articles, pretty much everything in the traditional energy industry is dramatically undervalued today. Thus, it may make some sense to compare ExxonMobil’s valuation against that of some of its peers in order to see which company offers the most attractive relative valuation:

|

Company |

PEG Ratio |

|

Exxon Mobil |

0.34 |

|

Chevron (CVX) |

0.70 |

|

ConocoPhillips (COP) |

0.47 |

|

TotalEnergies (TTE) |

0.49 |

|

BP (BP) |

0.64 |

|

Shell (SHEL) |

0.54 |

As we can clearly see, Exxon Mobil appears to be the most attractive of the supermajor energy companies by a considerable margin. In fact, the fair valuation of the stock using this method is $325.59, which would represent a phenomenal gain over today’s price. Please keep in mind that nearly every stock in every sector outside of energy has a price-to-earnings growth ratio well above 1.0 and that will clearly show how undervalued the energy sector as a whole and Exxon Mobil in particular are.

In conclusion, Exxon Mobil posted very solid results that continue to show how the company is a proven winner in the energy space. Although the company might deliver slightly weaker results in the next few quarters, the long-term fundamentals remain incredibly strong and Exxon Mobil will likely deliver growth over the coming years. Despite these good things though, the stock continues to look considerably undervalued relative to its earnings growth so it could still be worth purchasing.

Be the first to comment