Omer Messinger/Getty Images News

In 2020, Exxon Mobil (NYSE:XOM) was left for dead. Not only were oil prices and demand being held artificially low, but the dividend yield had ballooned as anti-fossil-fuel pressures had become so great even the storied Dow Jones Industrials Average booted Exxon Mobil after 92 years! On Friday, Exxon Mobil reported record-breaking earnings (and raised its dividend for the 19th year in a row) as the share price continues its dramatic year-to-date climb.

In this report, we review the company’s disciplined business strategy, cash flows, valuation, and big risks (especially the “woke mob” risk), as well as considering how a focus on dividend growth first helps many investors see beyond short-term market noise and fearmongering. We conclude with our strong opinion on investing in Exxon Mobil now, as well as where we see the best contrarian dividend opportunities going forward.

Exxon Mobil

Disciplined Business Strategy:

Exxon Mobil is an integrated oil and gas company. More specifically, it’s one of the world’s largest publicly traded energy providers and chemical manufacturers. It divides its business into three segments, including:

-

Upstream: this includes exploration, development, production, natural gas marketing, and research activities.

-

Downstream: this includes refining, marketing and selling of different petroleum products, including gasoline, jet fuel, heating oil, diesel, and propane.

-

Chemical: this business supplies petrochemicals (compounds derived from oil and gas) that are used to make packaging, plastics, tires, batteries, household detergents, motor oils, adhesives, and synthetic fibers, to name a few.

Exxon Mobil is unique as compared to many of its peers because it has remained steadfast in its commitment to oil and gas, instead of bowing harder to calls for increased investment in renewables. That’s not to say Exxon Mobil has turned its back on renewables altogether (it hasn’t), it’s just been less distracted by unrealistic calls to end fossil fuel immediately. In our opinion, Exxon Mobil continues to be a better steward of shareholder capital than peers, as we will explain in this report.

For example, during the depths of the pandemic (when demand and oil prices were plummeting), Exxon Mobil continued to push forward with its growth plans, and is now benefiting from higher oil prices and industry supply that is not keeping up with demand. Specifically, as per CEO Darren Woods, on the second quarter earnings call:

“While the market has clearly been a factor, our results reflect our focus on the fundamentals as well as plans and investments we put in motion several years ago and stuck with through the depths of the pandemic.”

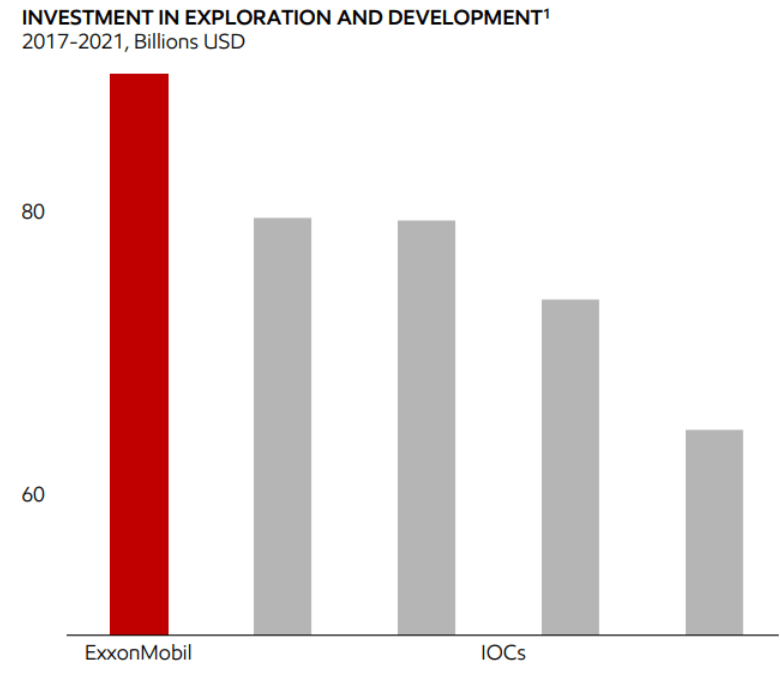

For perspective, Exxon Mobil leads all of its peers in oil and gas investment, as you can see in the following graphic.

Q2 Earnings Presentation

Strong Cash Flows

Exxon Mobil is a capital intensive business (i.e., it requires large amounts of investment), and it has continued to deliver very strong cash flow this year, especially as the price of oil has gained. For example, on Friday Exxon reported that it:

“Grew earnings and cash flow from operating activities to $19.7 billion (U.S. GAAP) and $24.4 billion, respectively, as strong volume performance, including record refining volumes, rigorous cost control and higher natural gas realizations more than offset lower crude realizations, and weaker industry refining margins.”

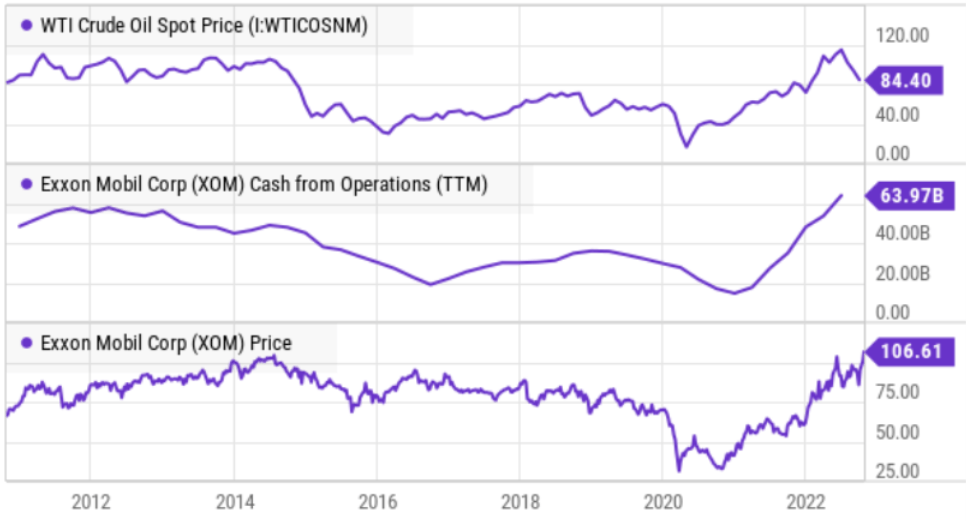

And for more perspective, you can see in the following chart that Exxon Mobil has been delivering its highest cash flow from operations in over a decade.

YCharts

And as you can also see in the chart above, Exxon Mobil’s cash flows from operations closely follow the price of oil. And its stock price does, too. This year’s gain in the price of oil has been a windfall for Exxon Mobil.

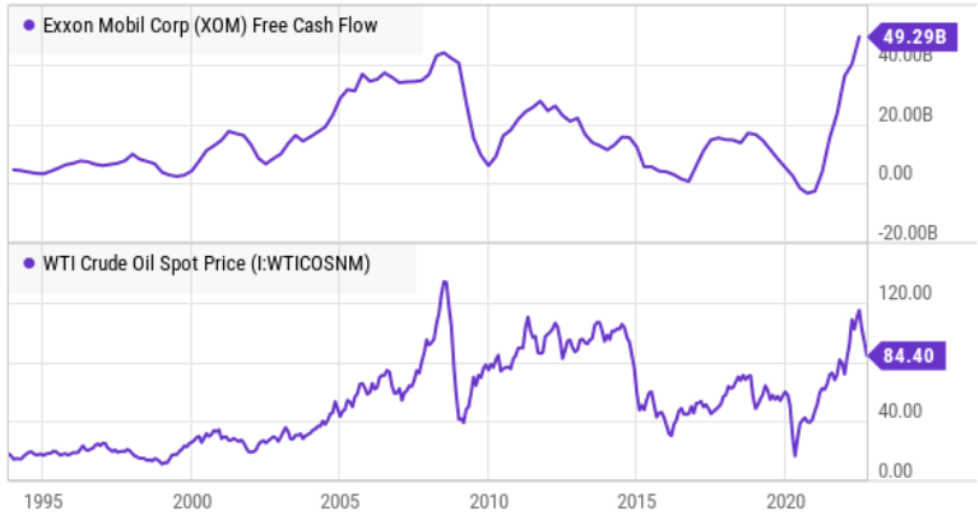

Free Cash Flow (or basically cash flow from operations minus capital expenditures) is an important non-GAAP metric for Exxon Mobil investors to follow because it is an indication of how much cash flow the company has left over to make new investments, pay down debt, buy back shares and pay dividends. And as Exxon reported Friday, free cash flow for Q3 was $22B (and its debt-to-capital ratio is now 19%, just below the low end of the company’s target range). For more perspective, here is a look at Exxon Mobil’s recent free cash flow (as compared to the price of oil), and as you can see free cash flow has spiked (a very good thing).

YCharts

For perspective, Exxon Mobil pays out about $3.64 per share each year in dividends versus $11.53 per share in free cash flow (i.e., the dividend is very well covered), plus it’s recently been buying back shares, and it has plenty of free cash flow left over to continue financing growth for its capital-intensive business.

Dividend Safety:

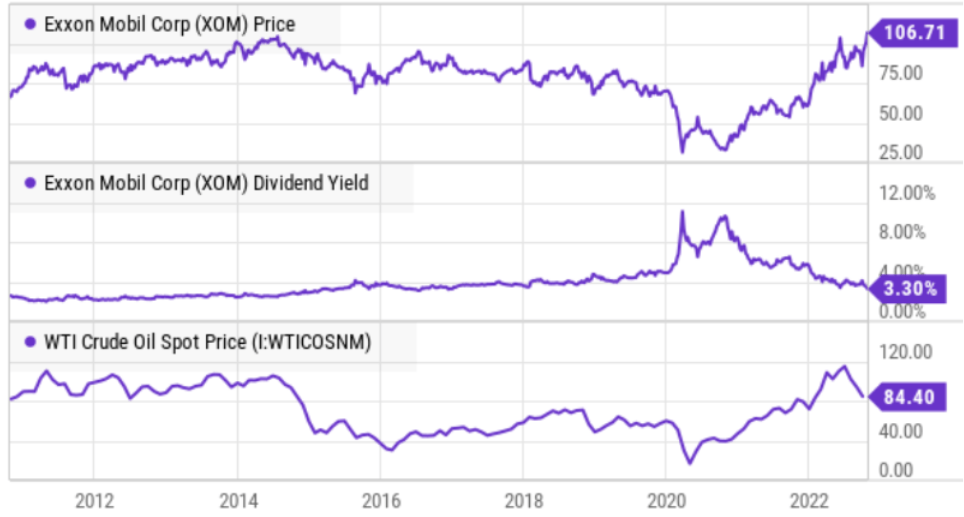

The steady growing dividend is the main reason a lot of investors own Exxon Mobil. For example, the shares currently yields 3.3% (decent by historical standards), and the dividend payment has been increased every year for the last 19 years.

YCharts

What’s more, the dividend has grown at an average annual rate of 6.0% over the last 39 years. Further, as we saw earlier, Exxon Mobil’s dividend is extremely well covered by free cash flow, with lots of free cash flow left over to buyback shares and fund growth.

As a side note, Exxon Mobil currently offers three ways for shareholders to receive dividends (direct deposit, check or dividend reinvestment). And considering the healthy dividend, dividend reinvestment has been very powerful for Exxon Mobil over the decades.

Valuation

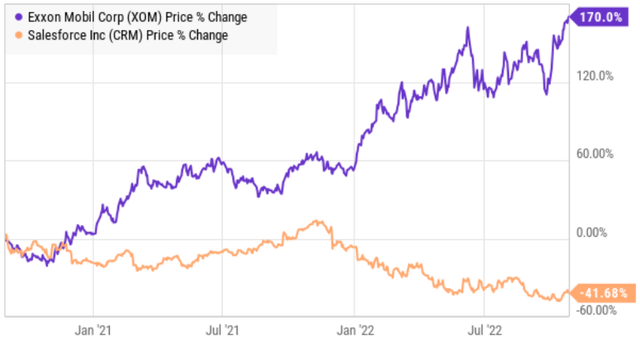

Exxon Mobil was left for dead by many investors during the pandemic as demand dropped and oil prices fell below zero. For example, Exxon even got kicked out of the Dow Jones Industrials Average after being a stalwart member for 92 years! It was replaced by Salesforce (CRM) on August 31, 2020. And here is a look at how that worked out (i.e., Exxon shares skyrocketed while Salesforce tanked as the Dow Jones people apparently didn’t get the “buy low, sell high” memo).

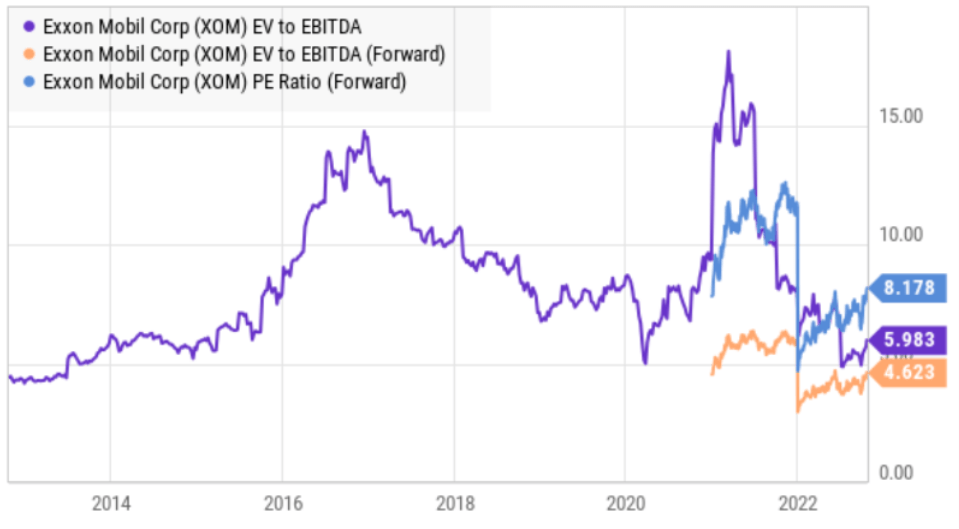

And despite the recent share price gains, Exxon Mobil still trades at only around 4.6 times enterprise value to forward EBITDA. This is extremely inexpensive for a business with such financial strength and powerful cash flows.

YCharts

It also trades at just over 8 times forward earnings. Or said differently, it offers an incredible 12.2% forward earnings yield (the inverse of P/E ratio).

Considering the financial strength (Exxon is rated AA- by S&P) and compelling valuation multiples, Exxon Mobil would still be attractive if oil fell dramatically lower (because they’d still have the cash flow to cover the dividend and fund growth). And if the price of oil keeps rising—Exxon Mobil will likely be an incredible winner.

Risk Factors:

Of course there are also significant risks to Exxon’s business that need to be considered. For example:

-

Volatile Oil and Gas Prices: are a significant risk factor for Exxon Mobil considering its cash flow and profits depend so heavily on it. However, the good news is that the company is financially very strong, and it can weather volatility better than other energy companies. We will have more to say about the long-term future demand and price of oil in a later section of this report.

-

Capital Intensive Business: As mentioned, Exxon Mobil’s business is very capital intensive, meaning they need a lot of cash flow to fund growth (i.e., property, plant and equipment are required and they are very expensive). However, as mentioned, Exxon Mobil is in a strong financial position with a ton of cash flows. The company was able to keep investing during the covid slowdown (when others backed off), and this has allowed Exxon to be a profit leader now that prices and demand have recovered.

-

Political, Government and Social Factors: are a major risk for Exxon Mobil. For example, the company can be negatively affected by increases in taxes, changes in environmental regulations, actions by policymakers, litigation and potential greenhouse gas restrictions. Exxon Mobil announced earlier this year that it aspires to be “net zero” or be greenhouse gas emission neutral for its operations by 2025, however this doesn’t account for the emissions produced when its fuels, for example, are used by customers. We’ll have more to say about social pressures and risks in the next section.

Despite The Woke Mob:

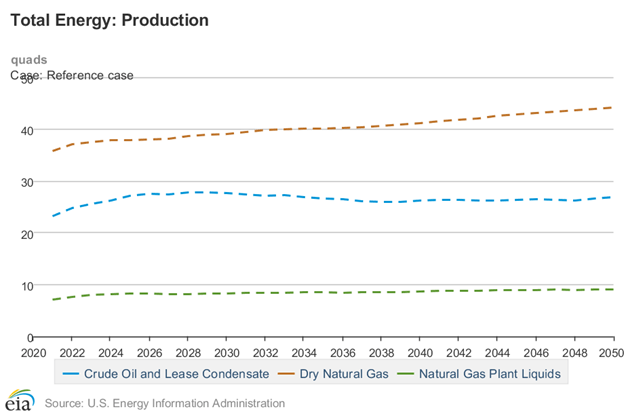

To the chagrin of those that would like to see fossil fuel production ended immediately, the U.S. EIA projects production will increase for the next three decades, as you can see in the following oil and gas forecast.

US EIA

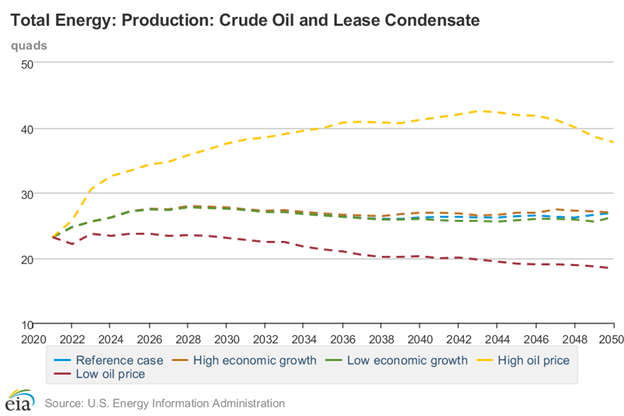

This increase is a good thing for energy producers (such as Exxon Mobil), especially if the price of energy increases, as it has recently, and as you can see in the following high-price and low-price scenarios for oil.

US EIA

Certainly reducing pollution and protecting the environment are good things, but fossil fuel remains a vital component of the economy, powering our lives and providing jobs (and the alternatives are still much more costly).

And despite the importance of fossil fuels, there are extremely vocal social and political factions (i.e. the “woke mob”) that continue to villainize it. Here are a few recent examples:

These pressures are absolutely a risk for Exxon Mobil. Nonetheless, Exxon Mobil has remained steadfast in its commitment, as Morningstar sector strategist, Allen Good, recent wrote:

“While many of its peers have announced intentions to divert investment to renewables to achieve long-term carbon intensity reduction targets, ExxonMobil remains committed to oil and gas… It is also investing in low-carbon technologies, but each of these efforts is measured and keeps oil and gas production at the core. While this strategy is unlikely to win praise from environmentally oriented investors, we think it’s likely to prove more successful and probably holds less risk.”

Conclusion:

We have owned Exxon Mobil, and benefitted from its dramatic recent gains, as we wrote about over a year ago in this article: Exxon Mobil: Despite Woke Mob, 6% Yield Tempting. To the contrary, if you’d have panicked and given in to the pressures of the woke mob (like the Dow Jones Industrials Average people did, dumping Exxon from their index after 92 years, almost exactly at the bottom), you’d have missed out.

Despite the strong gains, we believe Exxon Mobil remains a highly attractive investment opportunity for long-term investors. We also acknowledge that short-term fear has created some new contrarian big-dividend opportunities (such as BlackRock (BTZ) (BIT) and PIMCO (PDI) closed-end funds) as we wrote about in detail in this report: 5 Top Big-Dividend Contrarian Opportunities.

However, at the end of the day, you need to invest in what is right for you. Disciplined, goal-focused, long-term investing is a winning strategy, as Exxon Mobil has proven once again.

Be the first to comment