CHUNYIP WONG

Shares of Exxon Mobil (NYSE:XOM) soared 5% on Friday after the company reported record profits for the second-quarter due to strong product demand and pricing in petroleum markets. Profits in Exxon Mobil’s production business surged, with pricing factors providing an earnings boost of $8.1B quarter over quarter. Exxon Mobil’s free cash flow also soared which could result in generous capital returns for shareholders. The risk profile continues to be favorable and the stock may push for new highs in the short term!

Strong earnings release due to favorable market conditions

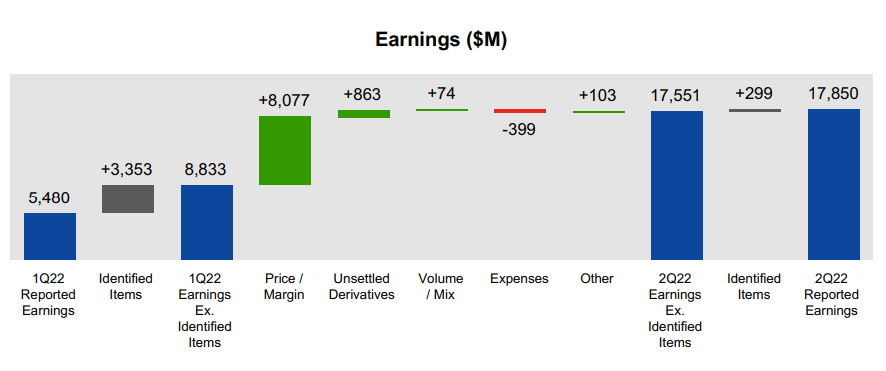

Exxon Mobil generated $17.9B in profits in the second-quarter, showing an increase of a massive $12.4B compared to the quarter-earlier period. Pricing is what made all the difference for Exxon Mobil as average realized prices for crude and natural gas increased strongly from Q1’22 to Q2’22: in the US, Exxon Mobil’s crude pricing grew 15% quarter over quarter to $107.78 a barrel while natural gas pricing surged 35% to $6.49 per kcf. Due to pricing factors alone, Exxon Mobil’s profits soared $8.1B in the second-quarter.

Exxon Mobil: Q2’22 Factor Analysis

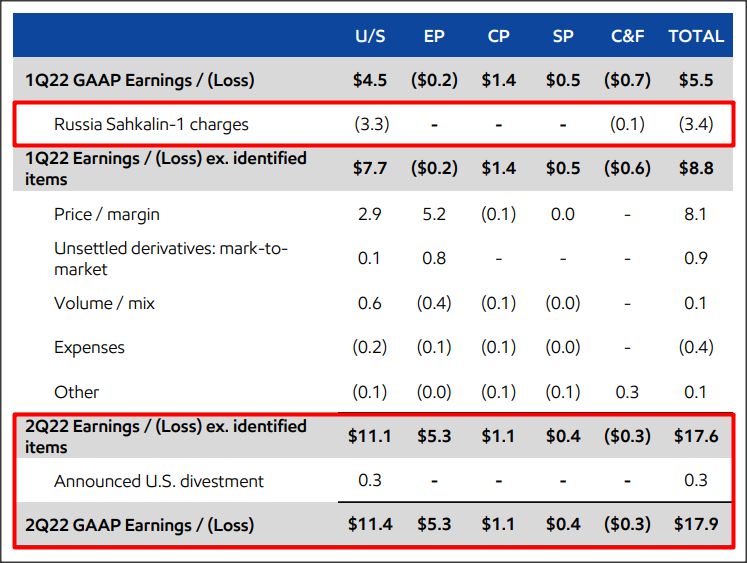

Exxon Mobil’s production business generated the majority of profits for the energy company in Q2’22: $11.4B. Compared to Q1’22, Exxon Mobil’s profits increased $6.9B, of which $2.9B came from improved pricing. Exxon Mobil’s profits in the first-quarter would have been higher, however, if the company didn’t decide to shut down its Sakhalin-1 project in the Okhotsk Sea which resulted in a $3.3B impairment. Exxon Mobil announced that it plans to withdraw from Russia in March, after the country invaded Ukraine. Exxon Mobil had about $4B of oil and gas assets in the country before its decision to exit the Russian market.

Exxon Mobil: Q2’22 Earnings Reconciliation

Exxon Mobil did extremely well regarding free cash flow with Q2’22 FCF soaring 56% quarter over quarter to a record $16.9B. Operating cash flow, fueled almost exclusively by pricing factors, increased 35% quarter over quarter to $20.0B. Investment activity and asset sales remained on a normal level and didn’t impact free cash flow more than usual.

|

FY 2022 |

FY 2021 |

||||

|

$B |

Quarter 2 |

Quarter 1 |

Quarter 4 |

Quarter 3 |

Quarter 2 |

|

Cash Flow from Operating Activities |

$20.0 |

$14.8 |

$17.1 |

$12.1 |

$9.7 |

|

Proceeds from Asset Sales |

$0.9 |

$0.3 |

$2.6 |

$0.0 |

$0.3 |

|

Cash Flow from Operations and Asset Sales |

$20.9 |

$15.1 |

$19.7 |

$12.1 |

$9.9 |

|

PP&E Adds / Investments & Advances |

($4.0) |

($4.3) |

($4.6) |

($3.1) |

($3.0) |

|

Free Cash Flow |

$16.9 |

$10.8 |

$15.1 |

$9.0 |

$6.9 |

(Source: Author)

Exxon Mobil’s strong Q2 performance in the production business brought the firm’s year to date free cash flow to $27.7B which is about 63% of my low-case FCF estimate for FY 2022. I expect Exxon Mobil to generate between $44B and $46B in free cash flow this year, a target that I believe is realistic and achievable if petroleum prices remain in the $90-100 a barrel price range in the second half of the year.

Exxon Mobil’s operating-cash-flow-to-free-cash-flow conversion improved as well, from 73% in Q1’22 to 85% in Q2’22. The improved conversion ratio means that every dollar in operating cash flow resulted in an additional 12 cents in free cash flow in the second-quarter and the reason for the improved conversion also lies in pricing factors.

Over the last year, Exxon Mobil’s average operating-cash-flow-to-free-cash-flow conversion was 81%, meaning for every dollar generated in operating cash flow, Exxon Mobil saw 81 cents showing up as free cash flow.

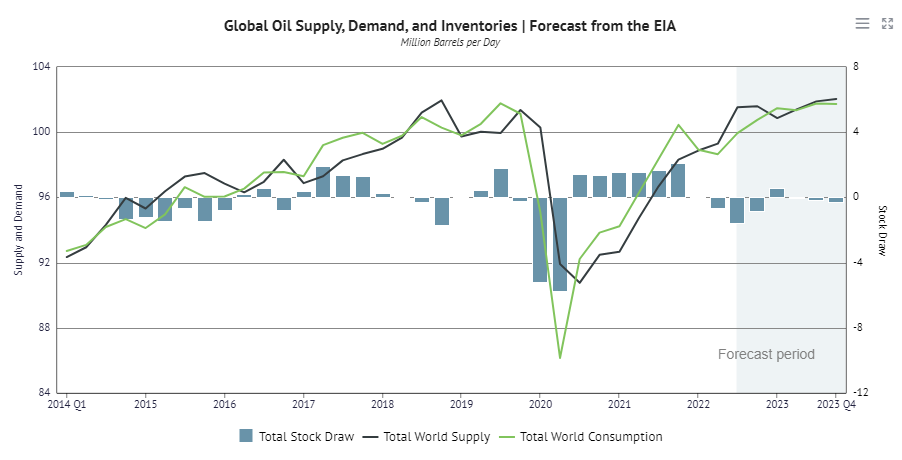

I believe that market prices will remain high for the foreseeable future, largely because of robust forecasts for energy supply and demand. Forecasts from the EIA show that demand and supply will remain fairly balanced in the second half of FY 2022 and for FY 2023, which generally supports a positive FCF outlook for Exxon Mobil. The International Energy Agency said in June, that global oil supply may even struggle to meet demand in 2023 due to a resurgent economy in China. If pricing remains strong, Exxon Mobil’s shares have potential to revalue higher.

Knoema: Global Oil Supply, Demand Forecast

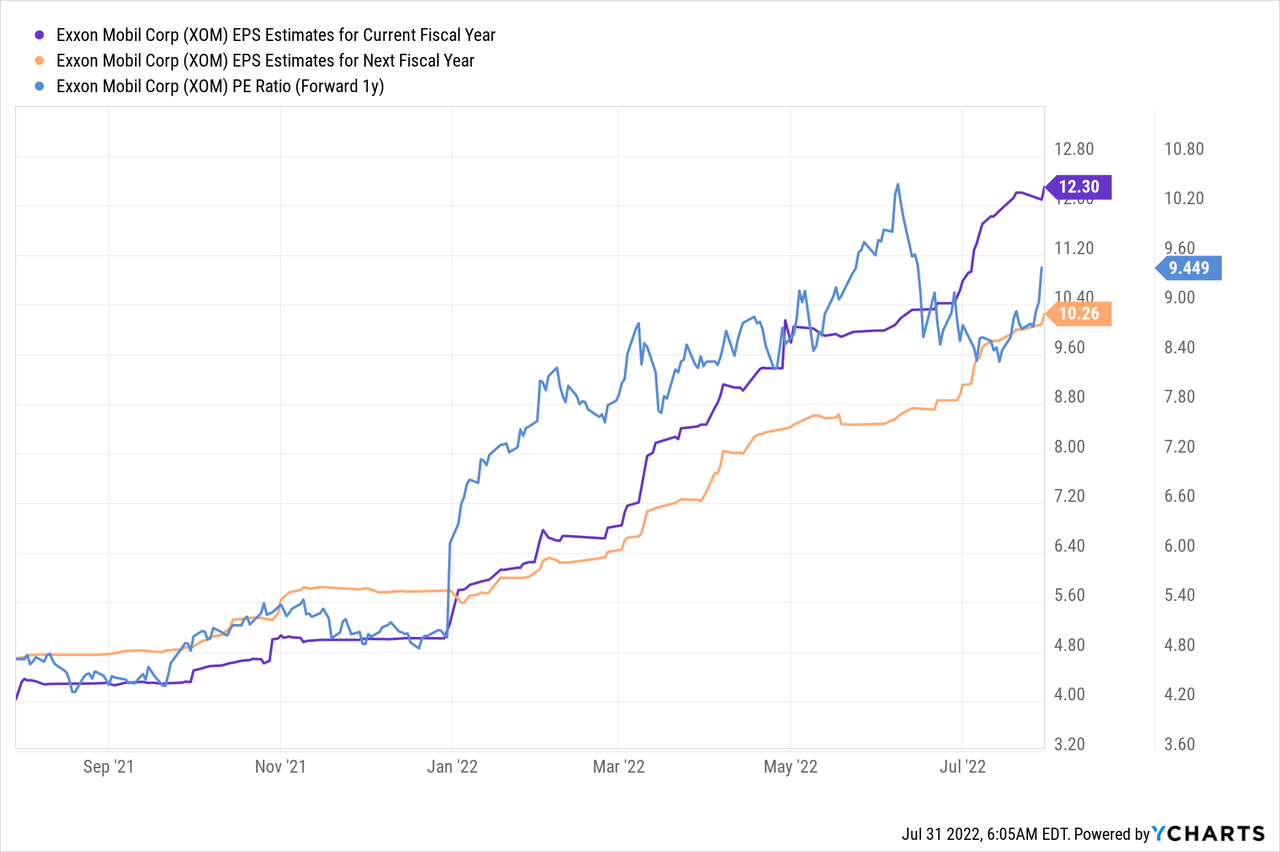

Estimates are rising, attractive P-E ratio

Earnings estimates are rising for Exxon Mobil and the stock, based on current expectations, is cheap. The P-E ratio for Exxon Mobil is 9.5 X based off of EPS predictions of $10.26 in FY 2023.

Capital returns

Exxon Mobil distributed 45% of its Q2’22 free cash flow to shareholders, a total of $7.6B. Of those distributions, $3.7B (49%) were dividends and $3.9B were buybacks (51%). Exxon Mobil announced a $30B buyback in April that will be completed by the end of FY 2023 and the company could buy back even more shares if product pricing remains strong. The dividend is set to rise as well.

Risks with Exxon Mobil

The big risk for Exxon Mobil is that petroleum and natural gas prices may decline in the second half of the year which would weigh heavily on the firm’s earnings and free cash flow prospects. Weaker end-market pricing and falling petroleum demand, which is likely to occur in a recession, are major risks for Exxon Mobil and its valuation. A decline in free cash flow will likely result in a lower valuation factor for Exxon Mobil.

Final thoughts

Pricing for petroleum and gas is still strong which is why I don’t see a winter for the energy industry coming. The risk profile for shares of Exxon Mobil remains favorable since the energy outlook for FY 2023 doesn’t show a drop-off in demand just yet. Although petroleum prices have fallen off of their 2022 highs, Exxon Mobil is still benefiting from prices around the $100 a barrel level. The company is flush with cash and set to return a lot of it to shareholders until the end of FY 2023. Because Exxon Mobil’s shares are still cheap based off of P-E, I believe there is more upside waiting for shareholders!

Be the first to comment