Sundry Photography/iStock Editorial via Getty Images

Williams-Sonoma, Inc. (NYSE:WSM) has been an exceptional business over the past few decades with consistent top line growth and tremendous earnings growth. Gains in market share account for much of this growth but leaning into the digital-first model while also expanding rapidly into higher margin white space opportunities has recently been the main driver of earnings.

It seems likely to me that Williams-Sonoma will continue to grow and gain share over time. What is less certain is how the business will fare in an upcoming economic downturn that seems imminent. Analysts have been revising earnings expectations lower for home furnishing businesses and Restoration Hardware (RH) already lowered FY 2022 guidance while the CEO expressed extreme trepidation when discussing economic outlook in the Q1 earnings call.

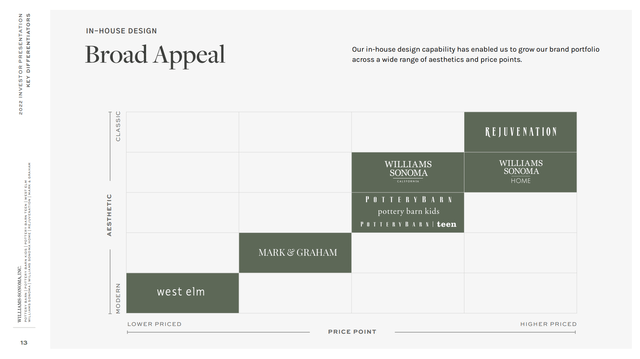

It’s no secret that the industry is in for a downturn and Williams-Sonoma’s common stock has been dragged down alongside other businesses in the industry. But I think there are reasons to believe that Williams-Sonoma is better positioned than its industry peers to weather the upcoming economic uncertainty. First, it has a variety of target markets due to its diverse portfolio of brands. This makes it less reliant on any one income group and better able to weather a recession. Second, also due to its many brands, it could benefit more than its competitors from a shift back from services to goods as hardline goods become disinflationary and stickier services inflation remains elevated. Finally, its B2B segment seems to be more of a secular grower than the cyclical core business segment that targets retail customers. This should help smooth out earnings even if retail customers pull back on spending.

Diverse Portfolio of Brands

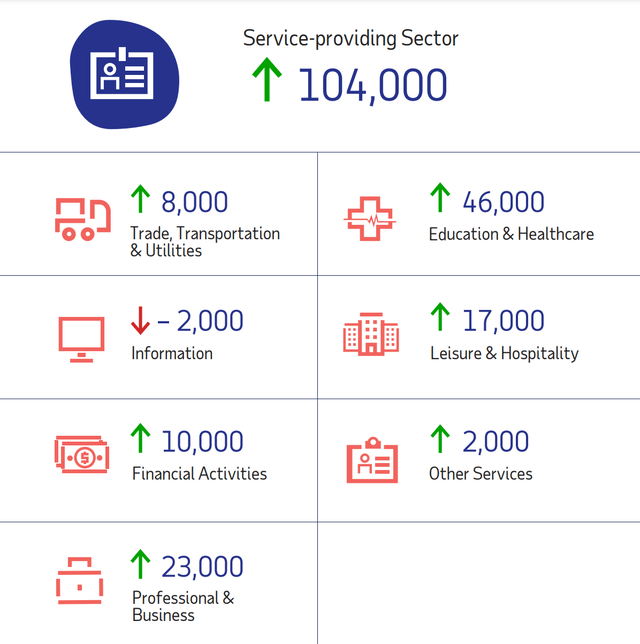

Recessions hurt everyone. People lose jobs, asset prices drop which lowers everyone’s net worth, and both of these lead to people spending less on discretionary goods. However, each recession is different and this leads to unique dynamics that cause any number of unique outcomes. Recently, we’ve seen many high-earning tech positions get cut, while at the same time, lower-earning hospitality industry employment is rising.

May 2022 National Employment Report (ADP National Employment Report – May 2022)

This could lead to more of a slowdown in luxury goods spending while employees at tech companies start to save more just in case. On the flip side, if the economic slowdown gets worse and unemployment in even the hospitality sector rises, spending on affordable items could drop while wealthier consumers with a greater capacity to borrow could spend relatively more. In either of these scenarios, Williams-Sonoma will not be immune to a slowdown in sales but its range of target customers gives it a better chance than its competitors to weather different economic scenarios.

The Different Williams Sonoma Brands (Williams Sonoma, Inc. 2022 Investor Presentation)

Williams-Sonoma also owns brands that sell different types of goods. Furniture is the main driver of the business but the Williams-Sonoma brand sells kitchen and home products, and Mark and Graham sells luggage and bags for traveling. Again, depending on different economic dynamics, these brands can help smooth earnings if there is an industry-wide slowdown in furniture sales.

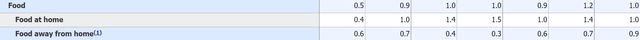

As an example, the June CPI reading showed a deceleration of food at home inflation but an acceleration of food away from home. If this trend continues, people may decide to cook and eat at home to save more, leading to stronger sales for the Williams-Sonoma brand.

June CPI Food Inflation (U.S. Bureau of Labor Statistics)

B2B Segment

The B2B segment is the most exciting part of the business in my opinion. It grew over 50% year-over-year last quarter to almost $250 million in sales and management is guiding for $1.5 billion in sales by 2024. Williams-Sonoma can take market share so rapidly in this segment because of the variety of brands and products I mentioned above. This B2B furnishings market will continue to grow over time and Williams-Sonoma is competitively advantaged to capture the most market share.

Of course, this is a huge driver of long-term growth, but in the short term, it will continue to grow even when compared to tough 2021 comps. As CEO Laura Alber explained on the Q2 2022 earnings call, the B2B segment targets an entirely different customer than the core business. If corporate earnings remain relatively strong compared to consumer earnings/balance sheets, this segment could offset a slowdown in the core retail segment of the business.

Valuation and Comparison to Peers

In a previous article, I compared Wayfair (W) to Restoration Hardware when I proposed a potential pair trade to take advantage of valuation and macro discrepancies between the two companies. Here I’ll compare Williams-Sonoma to Restoration Hardware to make the case that Williams-Sonoma is relatively cheap.

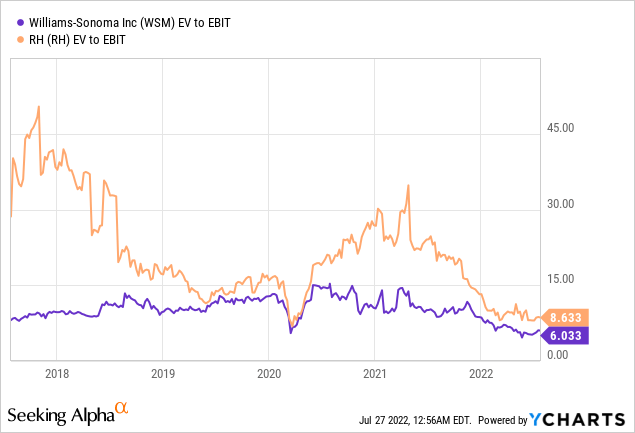

At first glance, it seems the market believes that Williams-Sonoma is in a better position than Restoration Hardware. Williams-Sonoma is down 15% year-to-date while Restoration Hardware is down 48%. But at a closer glance, Restoration Hardware’s steep sell-off has more to do with the fact that it got ahead of itself valuation-wise.

Through 2019 and into 2020, both stocks traded at about the same EV/EBIT multiple, but into 2021, Restoration Hardware traded closer to 20x EBIT whereas Williams-Sonoma stayed closer to 15x. Now that recession fears have brought this industry down to Earth, both trade at an upper-single-digit multiple. An appropriate multiple is likely somewhere in between these two extremes, say 10x EBIT.

But picking an earnings multiple is the less consequential part. What will largely determine how these stocks move in the next few quarters is the earnings part of the equation. Due to the reasons I went over above (a more diverse portfolio of brands and goods, a rapidly growing B2B segment that is higher margin than the core retail segment), I would bet that Williams-Sonoma will see stronger earnings and fewer lowered earnings revisions than its industry peers such as Restoration Hardware or Wayfair.

If I’m wrong about this short-term scenario, I’m still confident owning the stock because I think Williams-Sonoma is a long-term growth story that will gain market share and maintain its high operating margin. I see no reason to seriously doubt management’s 2024 goal of $10 billion of revenue with an operating margin in line with 2021 (~17%). This guidance implies $1.7 billion of EBIT in 2024. Even with the current 7x trough EBIT multiple it trades at today, Williams-Sonoma’s enterprise value would be ~$12 billion in that scenario, compared to ~$10 billion today. This type of earnings growth will bail investors out over time even if the next few quarters are ugly. On top of this, Williams-Sonoma has no debt and is repurchasing shares by the fistful. This should also help put a floor on downside for investors with a long-term holding period.

Final Thoughts

I think Williams-Sonoma is better positioned than its peers to weather an economic downturn. Its variety of brands/goods that target different income groups along with its almost secularly growing B2B segment will help smooth earnings over the next few quarters as economic growth slows. And at 7x 2021 EBIT, Williams-Sonoma is cheap if I’m right about it maintaining 2021 earnings.

Those factors aren’t just short-term advantages; they are competitive advantages that will fuel long-term growth and I’m confident that they will help Williams-Sonoma achieve its 2024 goal of $10 billion in revenue along with a ~17% operating margin. So, even if the next few quarters are ugly, it seems to me that shareholders with long-term holding periods have limited downside.

Be the first to comment