PM Images

What This Article Is All About

If it’s not clear enough from the title, we’re going to look at the upcoming Exxon Mobil (NYSE:XOM) dividend changes. Specifically, these are charts and graphs that I’ve been looking at to make an educated guess regarding the expected dividend increase.

Even if I’m wildly wrong, the visuals plus analysis will help XOM investors better understand the cash flowing from the business to those who own the stock. There’s value in thinking about the thinking. I strongly feel that a ton of great data, perhaps even wisdom, can be gleaned from good pictures.

Will There Be An Increase?

It’s possibly I’m putting the cart before the horse. There is the potential that XOM will not increase the dividend. That probability is close to 0% but it could happen in 2022. As a brief reminder:

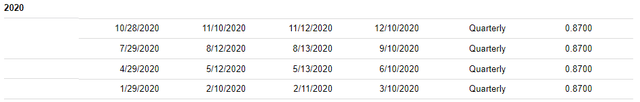

XOM Dividend $0.87 for 4 Quarters (Seeking Alpha)

Yes, of course I do understand that 2020 was unique. My point is that it’s never an absolute certainty we will see an increase.

Just remember what we learned back in October 2021:

For much of the last two years, Exxon was forced to borrow heavily to keep the payout intact as the pandemic-induced oil crash drained the driller’s cash.

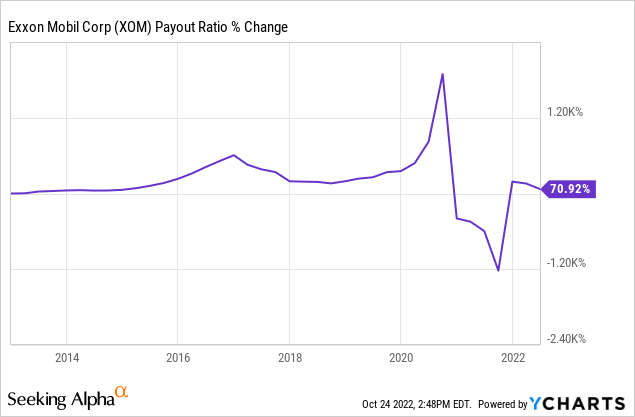

And, the payout ratio can go totally nuts as a result of financial pain. It got squeezed a bit in 2015 and 2016, for example, and it got pretty bad in 2020, just using the straight line numbers.

In any case, here’s a picture that captures the variance over time. The payout ratio is not nearly as smooth as the actual cash that’s landing in brokerage accounts.

All of that said, with the incredible surge in energy prices, I’d be shocked if we didn’t see at least a moderate increase in the very near future. So, it’s fun and useful to make some educated guesses.

Dividend Increase Expected Very Soon

I think we’ll see an increase announced on Wednesday, October 26th.

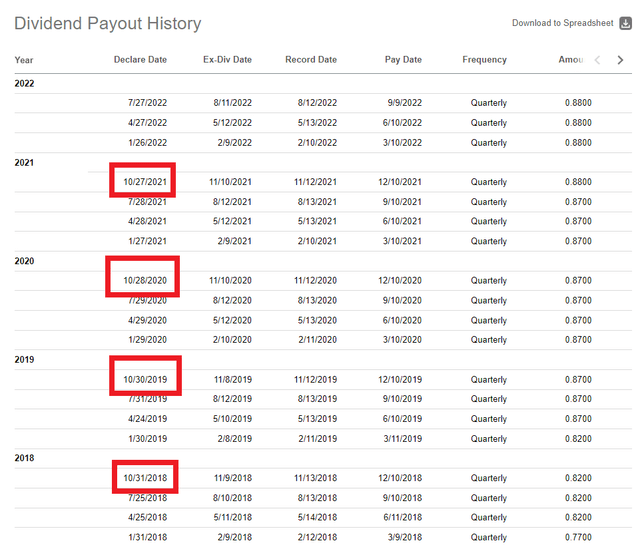

XOM Dividend Increase History (Wednesday Announcements) (Seeking Alpha & Author)

- 10/31/2018 = Wednesday

- 10/30/2019 = Wednesday

- 10/28/2020 = Wednesday

- 10/27/2021 = Wednesday

I think this is clear enough. We can move on.

What XOM Says (Plus An Extrapolation)

Currently, XOM is paying out $0.88 per quarter. That’s enough for a yield of right around 3.3% as I write this up. Given the very long streak of increases, I enjoy seeing this data, directly from the XOM web site:

ExxonMobil’s dividend payments to shareholders have grown at an average annual rate of 6.0% over the last 39 years.

I’m particularly interested in the 6.0% average increase. It’s a point of great pride, and it also roughly tells us that long-term holders can roughly expect about 9.3% gains over the longer view, when adding the increases together.

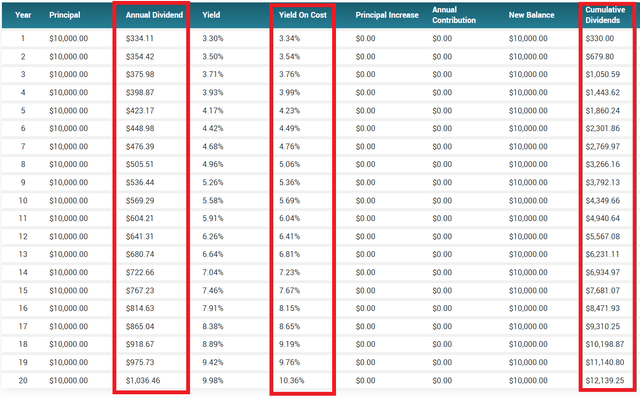

Assuming $10K to start, and no additional investments and no capital gains, here’s how those dividends would add up over time from our current starting point here in late October 2022.

XOM Dividends Going Forward at 6% (MarketBeat Dividend Calculator)

It would take about 13 years for the dividend to double. In about 18 years the dividend would totally cover the initial cost of XOM stock. By the 20th year, XOM bought right now would have a Yield On Cost of over 10%.

Remember, this is too simplistic. We’re leaving a lot out, including dividend reinvestment, any added or subtracted principal, and the general variance associated with dividend announcements. That doesn’t even start to touch the wide variance in the energy business; booms and busts.

Adding it up, and keeping it light and fun, a dividend increase of 6%, would take the dividend from $0.88 to $0.93, or $3.72 annualized. That would take XOM’s yield from 3.3% to 3.5%, in case you’re wondering.

Yes, But What’s XOM Thinking About?

Here is some color from CEO Darren Woods from back in late July, 2022.

We returned $7.6 billion to shareholders during the quarter in the form of dividends and share repurchases. The increase in distribution reflects the confidence we have in our strategy, performance we are seeing across our businesses and renewed strength of our balance sheet.

But, here is some nuanced language from that same earnings call:

- “…as you know, our first priority is to continue to invest in the business.”

- “…strike the right balance in terms of share repurchases and dividends.”

- “…being efficient as we look to return capital to shareholders.”

- “…share repurchase program has a secondary benefit of reducing the nominal size of our dividend.”

Wait, there’s more:

As we look at the dividend, I’d say there’s a number of things that we continue to evaluate. I mean clearly, we think it’s pretty critical that we have a competitive dividend. And today, we think we do have a competitive dividend. [Emphasis: Author]

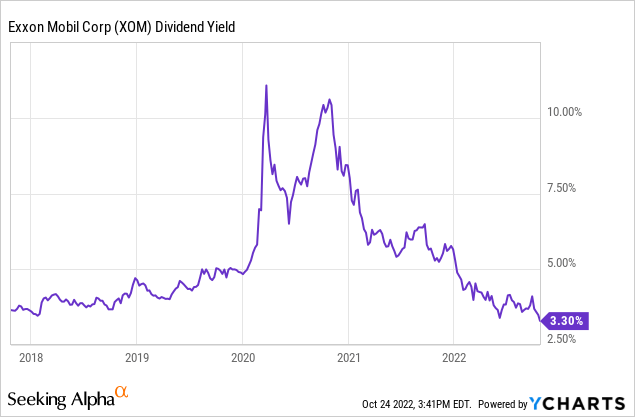

In late July, XOM’s yield was moving around 4%. It’s down around 3.3% now, as I’ve pointed out. Here’s another view of XOM’s yield, over five years.

To get XOM up to 4% from here, we’d need to see an increase to $1.06 or more per quarter, which is around $4.26 annualized. That’s an increase of $0.18 per quarter, or somewhere right around 20% according to my fast math. I don’t think we’ll see anything close to that, but hey, anything is possible.

I will also add this, for the sake of completion. XOM’s highest four dividend increases over the last 20 years are as follows, in high to low order:

- 2012 = 18%

- 2008 = 13%

- 2013 = 13%

- 2006 = 12%

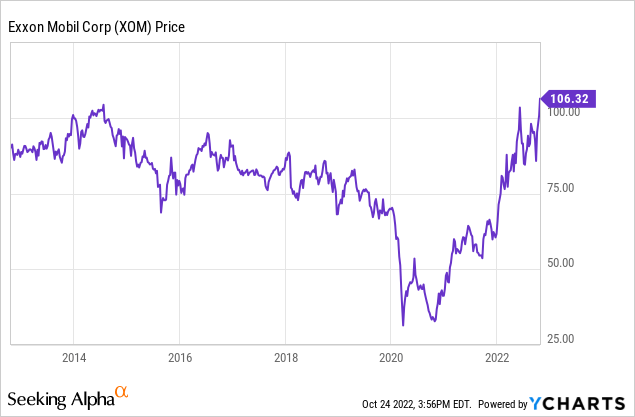

Again, it’s extremely unlikely that we’ll see a monster increase, getting us up to 4% or higher. XOM’s price is too high right now, even with a piles and piles of extra cash. It’s not me, it’s the math doing the talking. After all, the yield is simply calculated by taking the dividend and dividing it by XOM’s price, which is high right now:

Please note that I’m not saying XOM is cheap, or expensive in relation to the value of the business. I’m merely pointing out that we’re back up near high prices again, which almost every XOM investor understands.

To come back full circle, CEO Darren Woods seems far more interested in using XOM’s extra cash to grow the company and shoring up the balance sheet. For better or worse, depending on your perspective, management has signaled that a moderate dividend increase is coming, not a tsunami wave.

That Ship Has Sailed

I’ll pour a little salt into the wound. I’m sorry new investors, but the time to grab a very high starting yield is now… in the past. The starting yield not likely to get back to levels seen in 2020 or 2021 any time soon. Here’s the steep mountain the yield would have to climb back up:

XOM High Yield Gone (Seeking Alpha)

Furthermore, that would be bad news for most investors because any wonderful increase in XOM’s dividend wouldn’t likely come from yearly dividend bumps, or “dividend growth” as per the discussion above.

Of course, anything is possible, but the most likely a big increase in XOM’s yield change would come from a rather precipitous fall in XOM’s price. Except for diehard income investors, many shareholders would not welcome the capital losses, even if only on paper.

Wrap Up

I’m thinking we’re going to see an increase between 6% and 10%. For fun, my exact guess will land at 8%, which gives us $0.95 per quarter, or $3.80 per year. That’s probably too aggressive, but I’ve got my fingers crossed.

Given the price appreciation, and the moderated starting yield, I’m giving XOM a Hold. It’s a solid company, and a good stock but the time for really big gains, and a high starting yield have come and gone.

I don’t see XOM as a Sell although some income investors might wish to trim their holdings down a bit, and grab other beaten down dividend growth and income stocks, perhaps such as Altria (MO). It’s beaten down and the yield is fantastic at well over 8% right now, as I write this up.

Be the first to comment