KanawatTH/iStock via Getty Images

In a world where most of the infrastructure behind processes, applications, and agreements relies on centralized entities, smart contracts are a novel concept that fosters trust and removes the need for an intermediary between parties. We believe that these attributes give smart contracts the ability to carve a path forward toward a new digital framework that disrupts industries like financial services, software, and many others.

Smart contracts act as the foundational layer for coding utility, applications, and programmable functions into the blockchain. The use cases and benefits that this programmability provides smart contracts may seem improbable, whether it is accessing banking apps that pay users high annual interest rates, being able to buy a house in a matter of clicks, or facilitating universal healthcare profiles. But their growth potential is real, and today they power a rich ecosystem of applications and on-chain utility. In this piece, we explore how smart contracts work and how their applications can revolutionize the digital economy.

Key Takeaways

- Smart contracts can act as the software layer for efficient and secure decentralized applications (dapps).

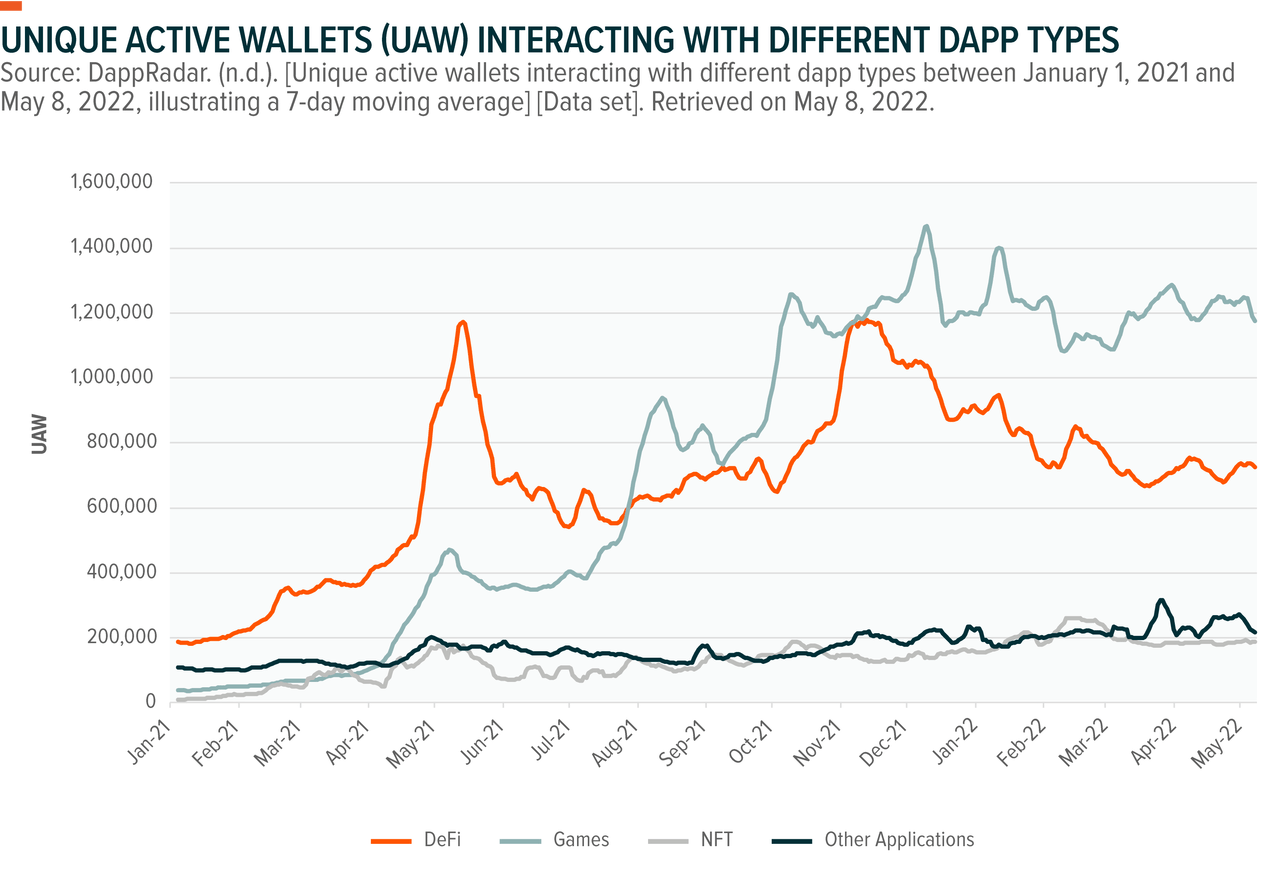

- Dapps add specific utilities to the blockchain, beyond peer-to-peer transfers. The number of digital wallets interacting with dapps has increased from roughly 300,000 to 2,200,000 within the last year and a half.1

- Smart contract technology is in its infancy, but we believe that it has the potential to disrupt traditional sectors and open the gates to user-owned economies. They could redefine the paradigm of the way applications are deployed in a digital ecosystem.

Smart Contracts Expand Blockchain Technology’s Use Cases

American computer scientist Nick Szabo introduced smart contracts around 1994. His idea was to build code that would allow contract execution without the need for outside trusted intermediaries. In October 2008, Satoshi Nakamoto, a pseudonym for an individual or perhaps a group of individuals, created Bitcoin, the first successful blockchain application powered by pre-defined rules around its operations, functionality, and utility.

While the Bitcoin network provided the first framework for a distributed cryptocurrency network, a Russian developer named Vitalik Buterin took the baton and expanded programmability by leveraging the smart contract concept. In essence, Buterin created the base layer for programmable money that revolutionized how people think about, create, and deploy blockchain utility. In 2013, he introduced Ethereum, a novel, general-purpose blockchain ecosystem with smart contract integration that would allow for the creation of any programmable condition, including monetary transactions. Ethereum allows users and developers to bring utility to the blockchain, expanding its use well beyond a peer-to-peer currency.

At their core, smart contracts are programs that automate the execution of an agreement so that all participants can be immediately sure of the outcome without any intermediary’s involvement or time delay. These contracts can be deployed to the network by any user and the rules and conditions embedded in their code dictates how they run.

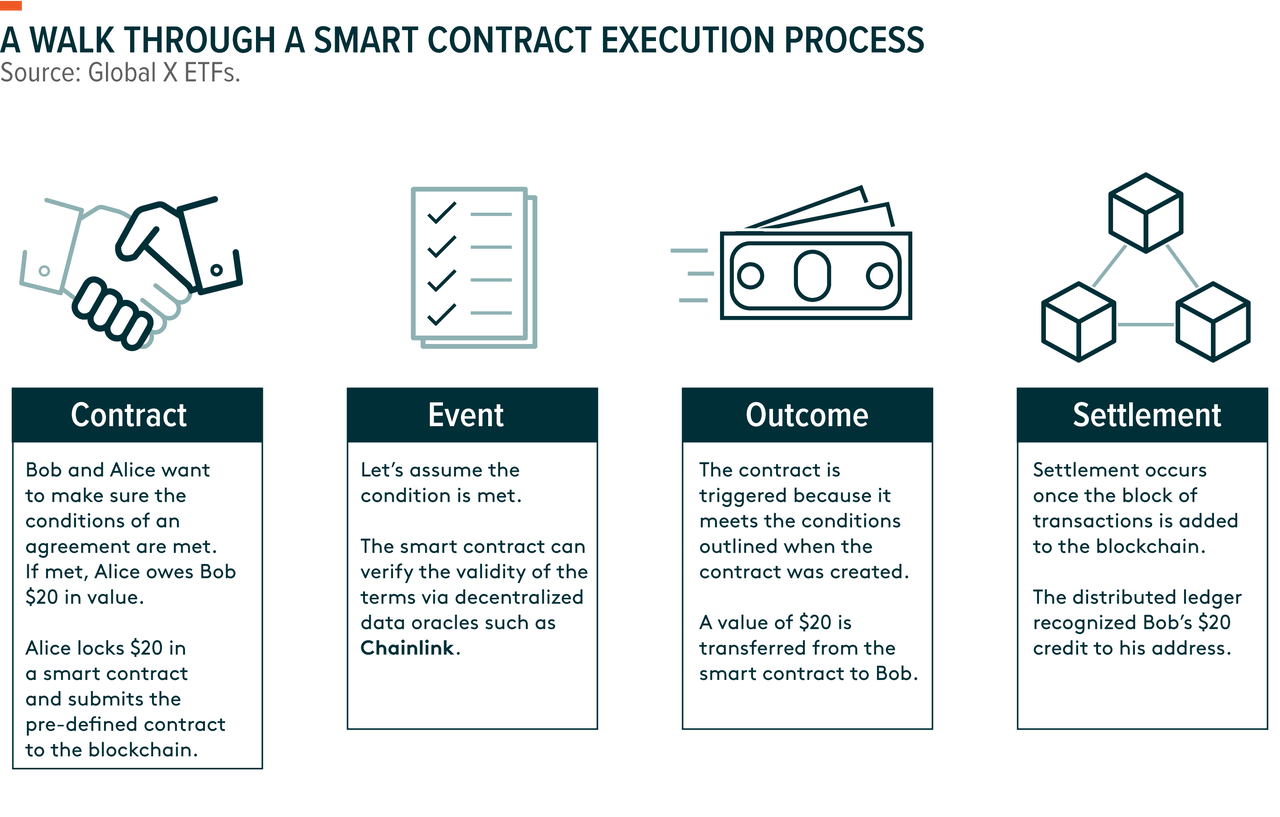

To illustrate smart contracts in action, let us assume two individuals want to make sure the conditions of an agreement are met. Historically, the participants would have to trust an outside third party to execute the terms agreed upon. Smart contracts offer a solution that ensures execution while eliminating the middlemen. In the example illustrated below, we highlight the mechanics of a smart contract using a scenario between Bob and Alice.

This scenario between Bob and Alice is a basic example, but it gets to the essence of smart contracts. A smart contract is a collection of code and data that resides on a distributed ledger network and is meant to execute pre-defined conditions. The main attributes of smart contracts hosted by blockchain ecosystems are:

- Trustless and reliable: Smart contracts always execute as programmed. No third-party risk means users can be certain of the expected outcome as per the pre-defined code.

- Enhanced security: The code lives within the immutable ledger distributed across the entire network, significantly limiting any single point of failure. After the contract is deployed, the blockchain provides integrity and security.

- Lower costs: The absence of third parties removes overhead costs, bringing efficiency to smart contracts.

- Speed: Transaction finality is almost instant, depending on the blockchains’ block times and rules.

Smart contracts provide a more efficient and enhanced mechanism of agreement, transaction, and general value transfer. In addition, because smart contracts can execute any special-purpose task, they comprise the foundation of a dapp movement that we view as potentially transformative.

Dapps: Where Smart Contracts and User Interface Intersect

Visually, dapps resemble any regular application. They have a user interface hosted on the web that makes calls to the backend, just like any app that we may interact with daily. The difference is that a dapp’s backend is powered by smart contracts running on a decentralized network of computers versus a central entity. This feature enhances resiliency because the code’s execution does not depend on a single point of failure, while also adding transparency since anyone can access the open-source code.

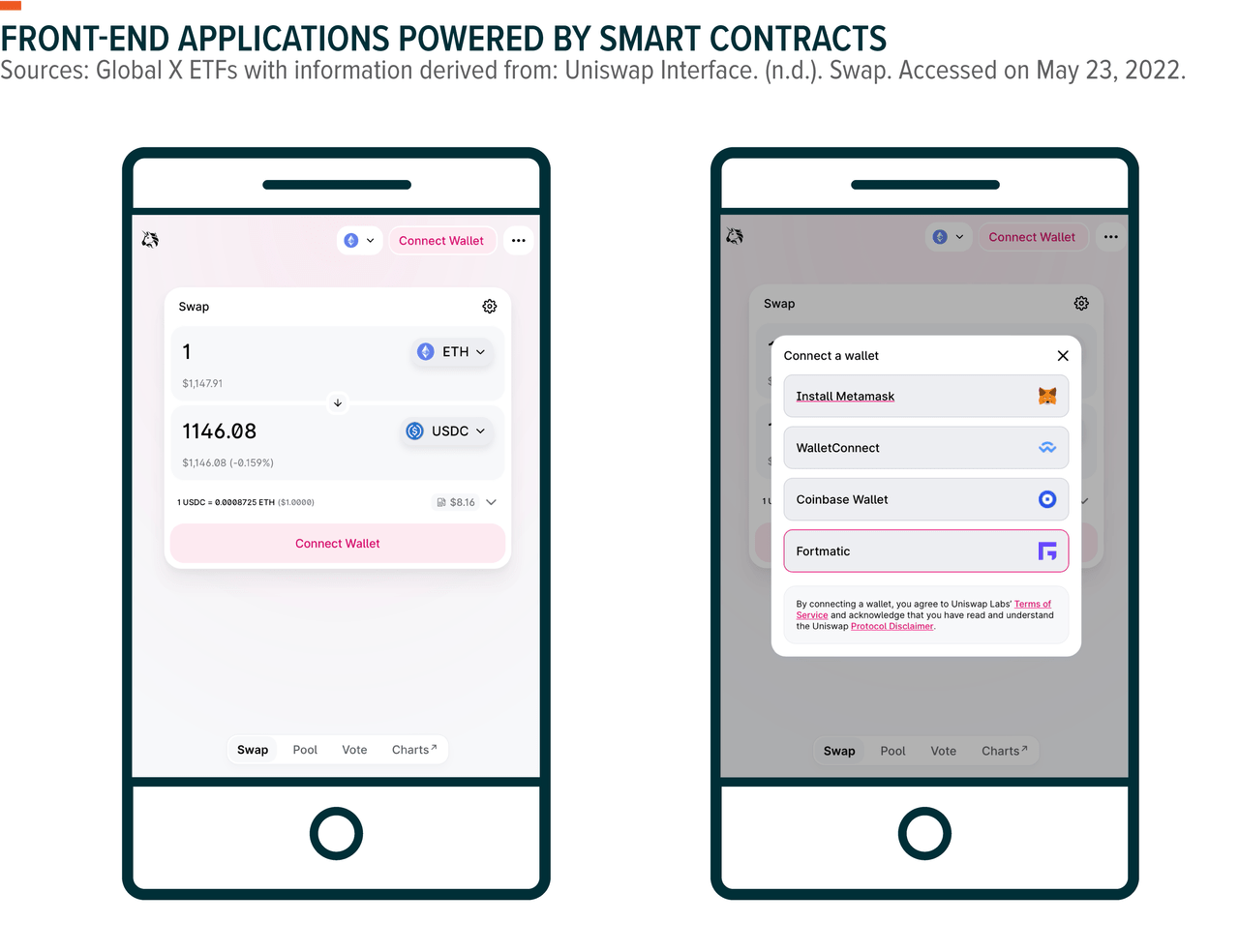

Uniswap, one of the largest dapps, is shown below. It was built to facilitate a truly open and decentralized cryptocurrency trading platform where liquidity is provided by users. On the front end, Uniswap is a simple application with minimal complexities and a simple user interface (UI). On the backend, Uniswap is built out of smart contract code pertaining to liquidity rules and market-making concepts, allowing for an open-source exchange that powers peer-to-peer trading activity between market participants.

Because smart contracts live within the distributed blocks of transactions, they are completely programmable. Any developer can attach an intuitive and simplified front-end display.

Dapps come in different shapes and sizes, with financial services applications, non-fungible trading (NFT) trading, and gaming being some of the most prominent categories.

Today, roughly 152,000 smart contracts power about 11,000 dapps. Roughly 1.7 million unique users engage with these dapps daily, executing about 28.5 million transactions with an estimated total incoming value of $6.6 billion per day.2

A powerful feature of dapps that often goes under the radar is their ability to interact with each other. Dapps can act as building blocks that users can combine, adapt, or build on. The word crypto enthusiasts use to refer to this characteristic is composability. Composability accelerates innovation because users can leverage the work of others to build the missing components for a project rather than develop everything from scratch. For example, any Ethereum dapp can use Uniswap’s smart contracts to execute token exchanges.

As dapps benefit from the robustness of distributed ledger networks and the programming flexibility and low cost of smart contracts, we believe that they could redefine the paradigm of how applications are developed, paving the way towards a user-owned Web3 ecosystem.

Smart Contracts and Their Applications Have the Potential to Disrupt Multiple Sectors

The Continued “Software-ization” of Finance

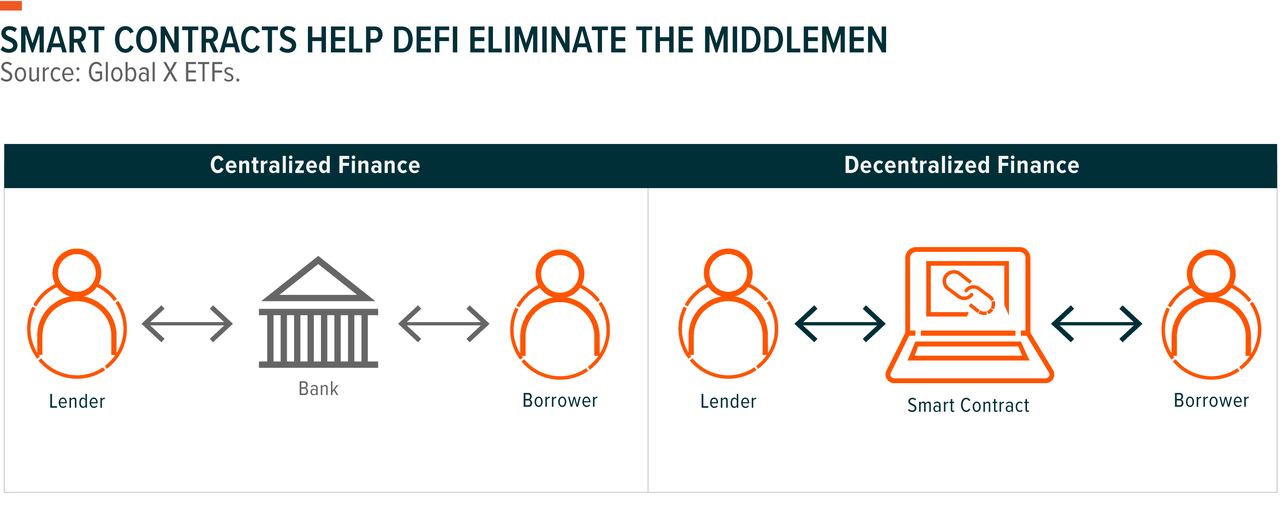

Financial services applications are an ideal fit for smart contracts. Technology continues to disrupt the traditional financial services industry and give further rise to fintech, where the two intersect. Smart contract code and dapp composability could accelerate the pace of development of software dedicated to finance. Today, intuitive banking apps replace the need to go to branch offices, and contactless payments eliminate the need to carry cash. Smart contracts could be the next step toward making finance even more software-centric, as they power decentralized finance applications (DeFi). DeFi benefits from smart contracts’ speed, low cost, and peer-to-peer nature while drawing on a democratized supply of liquidity because anyone with an internet connection can participate.

DeFi has seen a massive inflow of applications and value. Today, the total DeFi market cap sits at around $39 billion and includes thousands of applications.3 Compared with the financial services market cap of over $3 trillion, we believe DeFi has enough room for growth.4 And speaking of growth, multiple categories exist today, with decentralized exchanges, money markets, stablecoins, derivative products, insurance, and asset management among the most prominent.

A lending and borrowing dapp such as Aave is a great example of a potential disruptor. Its decentralized nature and efficiency could replace retail banks as it is able to provide lending and borrowing services with no middlemen included. Aave is a decentralized, non-custodial liquidity and money marketplace for borrowing and lending cryptocurrencies with over $10.3 billion in total value locked.5 Through Aave, a market participant can get an instantaneous asset-backed loan on their digital assets. The interesting thing about Aave is that users lend the liquidity needed to issue loans in exchange for fee-derived yield, and these activities are solely powered and guaranteed by a smart contract’s code.

The Monetization of Gaming and E-Sports

Gaming dapps is one of the areas that exploded in popularity in 2021. One of the reasons for the growth is the value proposition that tokenized in-game economies pose, as users can receive fungible or non-fungible tokens from playing games, hence monetizing their gaming time. Additionally, the blockchain infrastructure behind games has also evolved, giving games very cheap transaction fees. Axie Infinity was the game that brought play-and-earn gaming into the spotlight during the summer of 2021. It received intensive media coverage as gamers in low-income nations such as the Philippines were earning enough money to provide income for their families.6

The total gaming market is estimated to reach $257 billion by 2025.7 Today, play-and-earn applications have a total market cap of around $6.9 billion which highlights the infancy of the technology in such a growing sector.8 Due to the rise of e-sports, in-game tokenomics, and Web3’s ability to monetize digital value, we expect the space to continue to grab attention from traditional gamers and developers.

The Decentralization of the Internet & A Shift Towards Web3

Smart contracts and their ability to interact with the blockchain can enable a shift toward a user-owned internet where users no longer simply contribute content and data—they can own and monetize it too. Currently, creative content as well as data collected online is generally centralized under corporate entities that control, monetize, and leverage private and user-generated data. The centralization of such critical content can become a challenge and a point of failure. With blockchain technology and decentralized applications, users have the power to gain control, security, and value from their digital data.

An early example of decentralized web monetization is Brave’s open-source web browser, which aims to disrupt data monarchies. Today, most of the internet’s advertising revenue generated by consumer activity goes to private corporations controlling this user-generated data. Because these companies manage massive data pools, they can leverage the data that they collect in exchange for marketing revenue. Google is a prime example. The Brave browser rewards users with shared revenue via native BAT (Basic Attention Token) tokens for ad view, giving users the power to monetize their attention.

This space is still in its early stages, but it is developing quickly and revealing the disruptive potential of a user-owned internet that includes platforms for social media, marketplaces, content streaming, and data storage. Aave recently launched a decentralized social media base layer dapp called Lens Protocol. Its purpose is to serve as a composable and decentralized social layer from which developers can build social applications, allowing users to store data on-chain and own their content.

The Tokenization of Everything

Smart contracts allow for the tokenization of everything, including real estate, experiences, ownership rights to real-world assets, intellectual property, content creation, and credentials. These tokens can be split into non-fungible tokens (NFTs) and fungible tokens. NFTs differ from fungible tokens in that they are not identical to each other and thus include an immutable record that links a unique asset to a specific address.

NFTs can represent the deed to a property, verifiable credentials, a sports contract, unique tickets, and exclusive passes. An NFT could also represent a medical record. Luxury items and the counterfeit market offer another use case. Manufacturers and consumers could validate the authenticity of goods through blockchain technology via unique digital identities powered by smart contracts.

Tokenization adds liquidity, security, and validity to ownership, whether it is digital data or any real-world asset. Dapps such as decentralized exchanges can power the trading activity and liquidity of these tokenized assets, introducing a powerful new digital economy. Also, any dapp will be able to leverage these tokenized assets while allowing their composability ethos to build an ecosystem of novel utility through “digital backpacks” composed of rich data.

Other Areas of Disruption

The beauty of smart contracts is that their programmable logic can be used to trigger disruption to traditional sectors and power many other applications. These include supply chain enhancements, on-chain data access and storage, financial auditing, cybersecurity, insurance, governance and voting systems, healthcare, and much more.

A Novel Infrastructure Starts to Carve Its Path

Smart contracts and their ability to power dapps can create an infrastructure for more efficient financial systems, and the backbone of Web3, a user-owned internet. We expect smart contract utility to increase as the benefits of the growing dapp ecosystem, and its ongoing technological upgrades proliferate faster and become more well-known. In particular, dapps’ composability traits that enable them to interact with each other can expand their functionality and accelerate the rate of innovation in the space. And in the process, we expect them to enrich the internet experience for users.

Related ETFs

BKCH: The Global X Blockchain ETF (BKCH) seeks to invest in companies positioned to benefit from the increased adoption of blockchain technology, including companies in digital asset mining, blockchain & digital asset transactions, blockchain applications, blockchain & digital asset hardware, and blockchain & digital asset integration.

Click the fund name above to view the fund’s current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

FOOTNOTES

1. DappRadar. (n.d.). The world’s Dapp store: Discover, track & trade everything DeFi, NFT and gaming [Data set]. Retrieved on May 23, 2022 from DappRadar – The World’s Dapp Store | Blockchain Dapps Ranked

2. DappRadar. (n.d.). Industry overview. Accessed on June 24, 2022 from Dapps Industry Overview | DappRadar

3. CoinGecko. (n.d.). Decentralized finance (DeFi): Top 100 DeFi coins by market capitalization. Retrieved on June 24, 2022 from Top DeFi Coins by Market Capitalization – CoinGecko

4. Statista Research Department. (2022, May 31). Market capitalization of financial services, big tech and fintech industries worldwide in 2010 and 2018. Statista. Market cap: financial services vs big tech vs fintech | Statista

5. DeFi Llama. (n.d.) Aave: TVL and stats. Retrieved on June 24, 2022 from DefiLlama

6. Nunley, C. (2021, June 27). Tech: People in the Philippines are earning cryptocurrency during the pandemic by playing a video game. CNBC. People in the Philippines are earning cryptocurrency during the pandemic by playing a video game

7. Dobrilova, T. (2022, June 2). How much is the gaming industry worth in 2022? [+25 powerful stats] [Blog post]. TechJury. How Much Is the Gaming Industry Worth in 2022? [+25 Stats]

8. CoinGecko. (n.d.). Play to earn: Top play to earn coins by market capitalization. Retrieved on June 24, 2022 from Top Play To Earn Coins by Market Cap | CoinGecko

GLOSSARY

Terms are listed in the order in which they appear.

Decentralized applications (dapps): Decentralized applications built on top of smart contract platforms. Dapps use the infrastructure of distributed ledger networks and are composable with each other.

Chainlink: A decentralized oracle network

Distributed Ledger: A book or collection of accounts that can be shared across a network of multiple sites, geographies, or institutions. A blockchain is the most common type of distributed ledger and all network participants maintain a copy of the ledger.

User interfaces (UI): The means by which a user may interact with digital products or services.

Uniswap: Open-source and decentralized exchange.

Non-fungible tokens (NFTs): NFTs differ from fungible tokens in that they are not identical to each other, and thus include an immutable record that shows that a specific asset is owned by only one address in a blockchain. NFTs can represent digital content and digitize any real-world asset, thus adding liquidity and innovative avenues of exploration.

Composability: Refers to the ability to interact, build on, and improve on open-source applications and layers, including like-kind assets.

Decentralized finance applications (DeFi): Decentralized applications (see above) that offer financial instruments without the need for intermediaries. DeFi dapps are powered by smart contracts. DeFi allows users to participate in money market activities such as lending and borrowing via decentralized avenues

Aave: Open-source liquidity platform for lending and borrowing against cryptocurrencies.

Total Value Locked (TVL): The overall value of cryptocurrencies in their platforms. The term refers to the monetary value deposited in applications and serves as a reliable gauge of sentiment and growth. Locking assets within protocols indicate growth, utility, and user conviction.

Axie Infinity: A game built on the Ethereum ecosystem in which players purchase NFTs of monster-like characters called Axie’s and then pit them against each other in battles. Players are rewarded with fungible tokens for playing, which can be traded at an exchange.

Brave: Open-source web browser focused on privacy and rewards users for advertising attention.

Lens Protocol: A decentralized social media base layer.

Investing involves risk, including the possible loss of principal. The investable universe of companies in which BKCH may invest may be limited. Narrowly focused investments typically exhibit higher volatility. Investments in blockchain companies may be subject to the following risks: the technology is new and many of its uses may be untested; theft, loss or destruction of key(s) to access the blockchain; intense competition and rapid product obsolescence; cybersecurity incidents; lack of liquid markets; slow adoption rates; lack of regulation; third party product defects or vulnerabilities; reliance on the Internet; and line of business risk. Blockchain technology may never develop optimized transactional processes that lead to realized economic returns for any company in which the Fund invests. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. BKCH is non-diversified.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Carefully consider the funds’ investment objectives, risks, and charges and expenses. This and other information can be found in the funds’ full or summary prospectuses, which may be obtained at globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC or Mirae Asset Global Investments. Global X Funds are not sponsored, endorsed, issued, sold or promoted by Solactive AG, nor does Solactive AG make any representations regarding the advisability of investing in the Global X Funds. Neither SIDCO, Global X nor Mirae Asset Global Investments are affiliated with Solactive AG.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment