oliver de la haye/iStock via Getty Images

Investment Thesis

Expeditors International (NASDAQ:EXPD) had good Q3 earnings but now does not have enough potential upside for me. Freight rates have already peaked, and the rising potential for protectionist measures, especially in the U.S., could pose a headwind to long-term global trade growth.

Expeditors International

Expeditors International is a global logistics company headquartered in Seattle, Washington. They are among the most significant ten global freight forwarders in a fragmented industry. The Company employs trained professionals in 176 district offices and numerous branch locations on six continents. An integrated information management system links employees to a seamless worldwide network. EXPD’s core focus is on Asia-North America trade lanes, though it’s also been gradually expanding its presence on crucial intra-China and European freight lanes. EXPD’s most important geographic markets are China (32% of revenue), the United States (27%), Europe (15%), and South Asia (10%).

As a global forwarder, the company contracts with airlines and ocean carriers for cargo space and then fills that capacity with customers’ freight. This allows EXPD to collect a spread between the going rates for wholesale and retail freight transport. It also gives customers better pricing than they would get if they purchased freight service directly from air or ocean carriers. Services include the consolidation or forwarding of air and ocean freight, customs brokerage, vendor consolidation, cargo insurance, time-definite transportation, order management, warehousing and distribution, and customized logistics solutions.

EXPD is an asset-light transporter, meaning it does not own transportation equipment such as trucks, aircraft, or container ships. However, demand for EXPD’s services is generally tied to global economic activity, particularly cross-border industrial inputs and finished goods flows. This presents a cyclical risk, as slowdowns in economic growth or protectionist measures can cause customers to reduce the volume of goods moved with EXPD. At the same time, the fixed costs of its logistics workforce and warehouses remain.

It is expected that freight capacity constraints will dissipate in 2023 while high inflation hurts global shipping volumes, driving down air and ocean freight rates. In addition, the post-pandemic restocking efforts will be primarily complete by the end of this year. Customers will revert to ordering just in time instead of just in case.

EXPD has annual sales above $19B with 19K employees. They are 96.2% owned by institutions with 5.9% short float. Their free cash flow yield per share is 8.5%. The buyback yield per share is 5.4%. Return on equity is 43.6% with 38.1% return on invested capital. The price-to-book ratio is high, in my opinion, at 4.4. A Piotroski F Score of 6 shows some strength.

Third Quarter Results

EXPD reported third-quarter 2022 results on November 8th. Quarterly earnings of $2.54 per share beat consensus estimates of $1.94 by 30.9%. Total revenues of $4.36B were above the estimates of $4.21B and rose 1% year over year. Airfreight tonnage and ocean container volumes decreased by 13% and 10%, respectively.

Jeffrey S. Musser, President and Chief Executive Officer of Expeditors International, stated in their third-quarter press release.

“We continued to perform at a very high level, generating another strong quarter of financial performance and cash flow. We accomplished this despite uncertain economic conditions that resulted in declines in tonnage and volumes, reductions in both buy and sell rates, and an overall rebalancing of capacity in the logistics freight markets. These conditions have continued in recent weeks, and we believe that inflation, high energy costs, and government fiscal and monetary measures will continue to exert pressure on global supply chains. Additionally, many shippers are now looking to shrink retail inventories that were overstocked earlier in the year in reaction to COVID-related supply chain disruptions.

“Based on what we currently see, these changing conditions that involve decelerating demand and an overall decline in rates are likely to continue for the remainder of 2022 and into 2023. Just as we quickly adapted to unprecedented operating conditions spurred by the pandemic, we are adjusting for this new operating environment and continue to make focused efforts to control costs. Most critically, we remain fully engaged with our customers to accommodate their needs for capacity and services, while looking forward to when the economy eventually reverses course and demand starts to increase again.”

Bradley S. Powell, Senior Vice President and Chief Financial Officer, added the following.

“As we have commented previously, we did not expect the unprecedented COVID-related operating conditions to persist long-term. We believe we are now seeing a changing environment. While many concurrent disruptions continue to plague our industry, including the quarantines in China, the conflict in Ukraine, and the shortage of labor and certain equipment, conditions are starting to ease. We now believe we are seeing a shift towards slowing volumes and falling rates. We have been here before and know which levers to pull to enhance our efficiencies and control costs. We are ready to further align ourselves with a post-COVID environment of higher inflation and tapered demand. We do not know how long these new conditions will last. We will continue to invest appropriately for the long-term in our people, processes, and technology, and we believe we will be fully capable of meeting the eventual upturn in demand.”

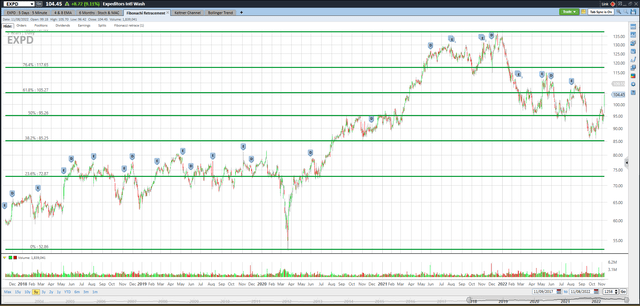

Fibonacci Retracement Levels

I’ve added the green Fibonacci lines, using the high and low of the past five years for EXPD. It’s interesting to note how the market pauses or bounces off these Fibonacci lines. They can be one clue as to where the stock price may be headed. The price is currently at the 61.8% Fibonacci retracement level but could go lower. I don’t see enough upside potential for me to buy EXPD based on the reasons in this article.

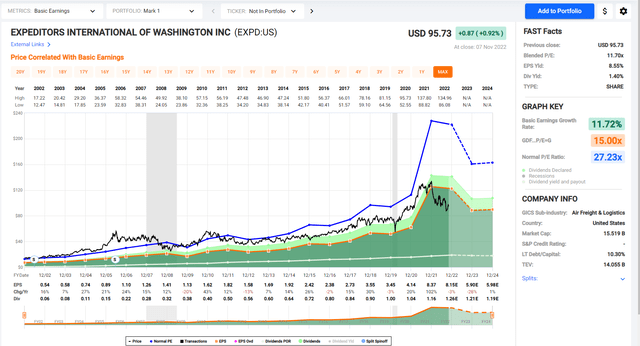

Trend in Earnings Per Share, P/E Ratio, and Net Operating Margin

The black line shows EXPD’s stock price for the past twenty years. Look at the chart of numbers below the graph to see EXPD’s volatile earnings were $3.45 in 2019, $4.14 in 2020, and $8.37 in 2021, and they are projected to earn $8.15 in 2022 and $5.90 in 2023.

The P/E ratio for EXPD is currently above 11, but the average ratio over the past ten years is 21. I don’t think the P/E will rally back to 21 anytime soon. If EXPD earns $5.90 in 2023, the market would have to assign a P/E ratio of 18 to get a stock price of $106.20. That’s only $2 higher than the November 8th trading price of $104.20.

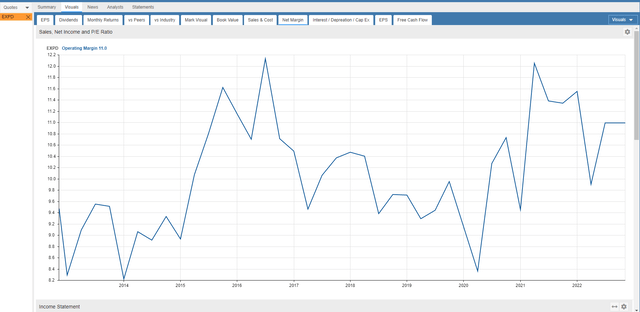

The net operating margin trend ranged between 8% and 12% for the past decade. This metric has improved since 2013 but is now near the top of the range at 11%.

Takeaway

Expeditors International has some strengths but does not have enough potential upside for me since EXPD’s stock price has already rallied on good third-quarter results. More attractive risk-to-reward investments are available elsewhere.

Be the first to comment