Mike Coppola/Getty Images Entertainment

Investment Thesis

I believe the reopening rally got ahead of itself for many travel businesses. Expedia’s (NASDAQ:EXPE) stock repeatedly broke all-time highs throughout 2021 and early 2022 even as the underlying business was slow to recover. Now that the stock has dropped by over half, I think it may be a good time to analyze the business in more detail.

List of Expedia’s Properties (Expedia Annual Report 2022)

The company has some strength. Through its many properties, Expedia is broadly diversified across most key markets in the travel industry. The core business also seems to have stabilized from the effects of the pandemic.

Unfortunately, there is high uncertainty regarding the business’s operations more than a few months into the future. I simply don’t believe the most likely business outcomes show enough growth to make the business obviously undervalued. The business also has taken on more debt, diluted its shares, and stopped returning cash to shareholders as a result of the pandemic.

For these reasons I’m not interested in investing in Expedia right now. But I believe this uncertainty may create a good buying opportunity in the next couple of quarters. I’m going to be watching a few key metrics over the next few months to assess if Expedia becomes a good value investment.

Metric #1: Booking Trends

There are some promising signs for a comeback in travel. Expedia’s last earnings call was upbeat, with management indicating that lodging bookings for February, March, and April were up even over 2019 levels. The company is doubling down on Vrbo, which it says was the number one downloaded app in the first quarter of this year.

According Expedia’s latest 10-Q filing, quarterly gross bookings are up significantly, almost 60% year over year. The last quarter’s revenue margin also strengthened by 1.1 percentage points. These reflect a strong improvement in travel trends so far this year.

Yet all of Expedia’s headline numbers are still down over their 2019 levels. Lodging, which management spent the most time focusing on, appears to be the most resilient segment. But the company’s air travel, advertising, and media segments are all well off their 2019 levels.

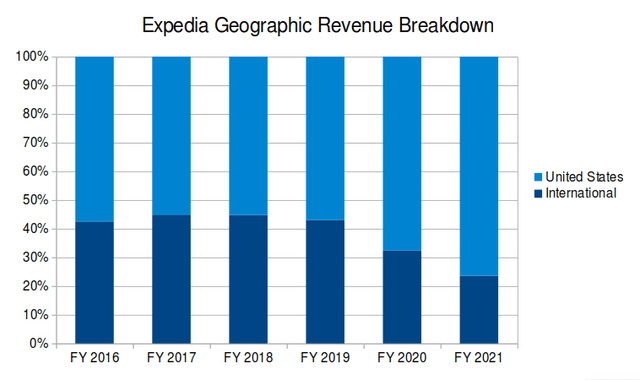

Created by author using data from Expedia’s 10-K filings

The international travel segment is also struggling. Revenue from outside the United States has historically made up 40% to 45% of revenue, but in 2021 that number was down to just 24%. I’m hoping to see a rebound in this and other segments as pandemic restrictions continue to be lifted. I think these booking trends and the business’s overall revenue mix will be a bullish sign if they start to shift back towards historical averages.

Metric #2: Air Travel

Another key indicator I’m watching is airline travel. This is connected to overall travel trends, and I expect strong demand for flights to correlate with increased demand for travel. This is especially relevant for Expedia since air revenue has been down so much more than its other segments. Revenue generated from Expedia’s air segment was down over 70% from 2019 to 2021, compared to just under 24% for its lodging segment.

Even as worries of a recession intensify, I think most indicators for airfare have remained unusually strong. TSA passenger throughput numbers have seen solid growth year over year, although most numbers are still down from their 2019 levels. International air travel has also started a strong rebound, even surpassing its 2019 levels in some areas.

What I’m specifically looking for are signs of continued, sustained strength in air travel into the late summer, fall, and winter as indications that the travel business is still in high demand. For some more detailed data I’ll be looking at both earnings and forward guidance from major carriers such as Southwest Airlines (LUV), Delta Air Lines (DAL), and United Airlines (UAL).

Metric #3: Business Travel

Another major part of the business I’m looking at is Expedia’s B2B segment. Business travel is another core business segment that has been slow to rebound from the pandemic. On its last earnings call Expedia’s CEO called the segment “underrated by the markets” and said that he expects it to outgrow the consumer business on a percentage basis over the next several years. I also agree that this is a huge opportunity for Expedia, and I like the way the company is creating more accessible B2B options for its partners.

At the same time, I’m unsure how quickly the demand may bounce back. Some data points point to a slower recovery. For example, the American Hotel and Lodging Association released a report in April saying they expect 2022 business travel revenue to be down by almost one quarter compared to 2019. I’ll be watching out for this segment’s results on Expedia’s upcoming quarterly reports.

Expedia’s Financial Position

During the pandemic Expedia had to undertake some drastic measures in order to stay financially stable. The business cut its dividend, possibly for good. Share buybacks have been suspended indefinitely. Since the last report before the pandemic, Expedia’s shares outstanding have increased by over 12%. Full-time employees have been cut by over 40%. Expedia also had to dramatically increase its debt position. Over the year of 2020 Expedia took on over 3.7 billion dollars in additional net debt.

While all of this has a negative impact for existing shareholders, I don’t think it is as bad as it may seem. This level of share dilution isn’t as extreme as other travel businesses. Carnival (CCL), for example, had to almost double its shares outstanding to stay afloat. Expedia also used the opportunity to pay off its high interest debt. Most of the new debt issued is very low interest. Specifically, one billion is in 0% interest convertible notes, and another billion is in 2.95% notes not due until 2031.

More directly, it appears to me that this crisis is subsiding. Over the past couple of quarters, the business has started the process of deleveraging. The company has paid back $1.9 billion in debt over the past year. On its last earnings call, the company’s CFO discussed this process:

Remember that there’s 2 primary ways that we can get that [Debt to EBITDA] ratio down. One is paying down debt, which is something that we are actively thinking about and second growing into it from an EBITDA standpoint. We do expect EBITDA to be robust as we get into this year as we get more fully recovered. And if trends continue, and we’re certainly going to look at proving our ratios in this area to open up some more options for EBITDA.

But even as the business’s cash flows normalize, I believe the company will still be dealing with the financial consequences of the pandemic for some time. For prospective investors, it means it may be a while before Expedia has significant free cash flow to return to shareholders.

Final Verdict

It’s tricky to value a business like Expedia in this environment. Traditional valuation methods like comparables or discounted free cash flow models depend on forward projections for revenue and earnings. I’m not sure these forward projections are useful in an environment with such high uncertainty.

The average analyst projection sees Expedia recovering to its 2019 levels sometime in the next two years. For me, I want to see some more concrete progress towards this goal as well as reduced uncertainty surrounding general travel demand.

As I see it, Expedia’s shares are back to trading at near their pre-pandemic levels. Unfortunately, this is with more shares outstanding, higher debt, and a much more uncertain travel environment. Because of this, I’ll pass on Expedia’s stock right now. But I am watching it closely, since I believe it may present a good value investment opportunity once the company’s recovery trajectory becomes more clear.

Be the first to comment