Hispanolistic

UserTesting, Inc. (NYSE:USER) is a software as a service (SaaS) provider that takes the form of a platform. It gives businesses the ability to see and hear the experiences of customers as those customers interact with products, designs, applications, processes, concepts, or brands. In order for businesses to acquire a profound comprehension of what it is actually like to be a customer, they need to continually interact with, listen to, and observe their customers in person. This is made possible by the platform known as UserTesting, which allows businesses to observe and watch real people who have opted in as they interact with products or services in order to obtain an authentic perspective. This enables USER’s customers to have improved experiences, which in turn drives growth, increases customer loyalty, and increases market share.

Company Presentation

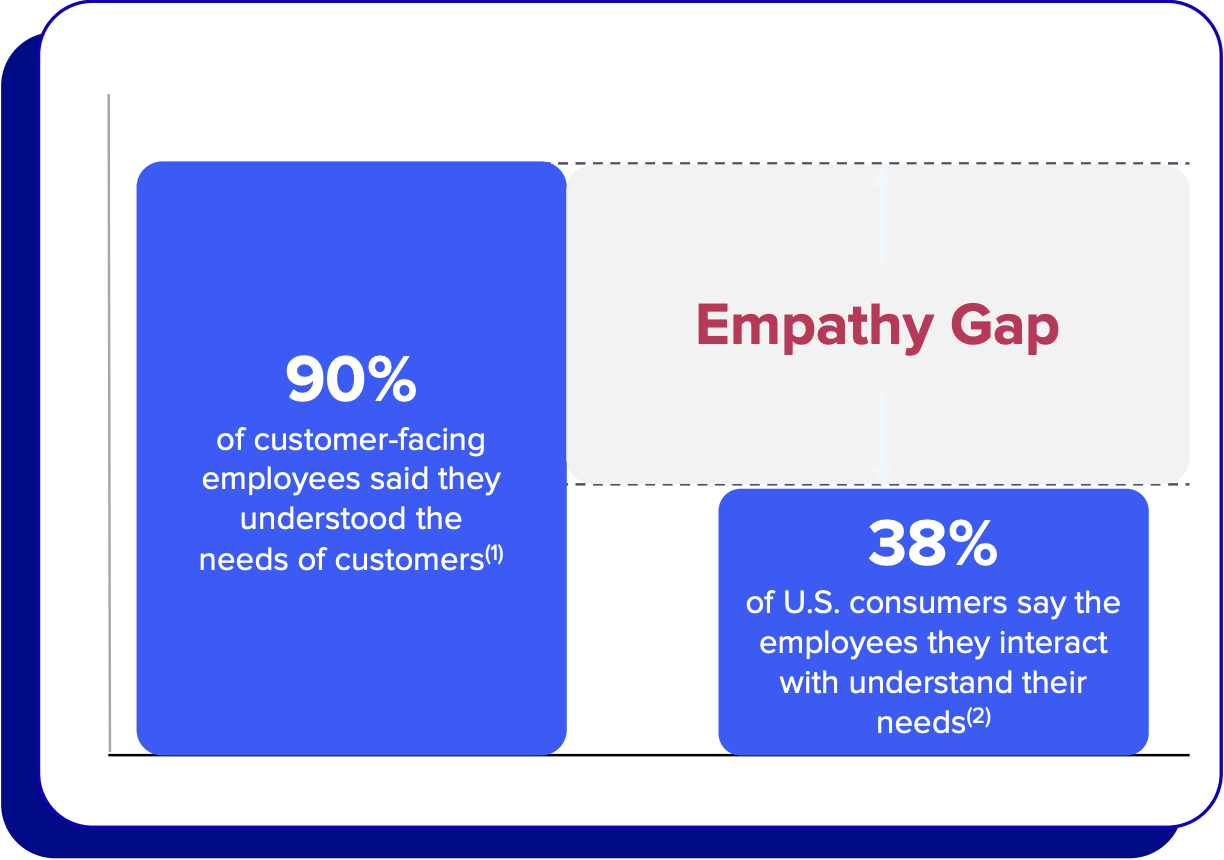

USER’s system examines different points of view using machine learning and brings important insights to companies in record time and on a massive scale. By harnessing the potential of video to drive alignment and action, this aids businesses in saving time and money while also improving the quality of their choices about the customer experience. Companies are attempting to find new ways to set themselves apart in a competitive market by providing superior customer service and innovative products. To do this, businesses are investing billions on data analytics. The distance between an organization’s view of its customer-centricity and the view of its customers remains wide despite these efforts. The “empathy gap” is the chasm between businesses and their customers, which often results in subpar service for the end user.

Company Presentation

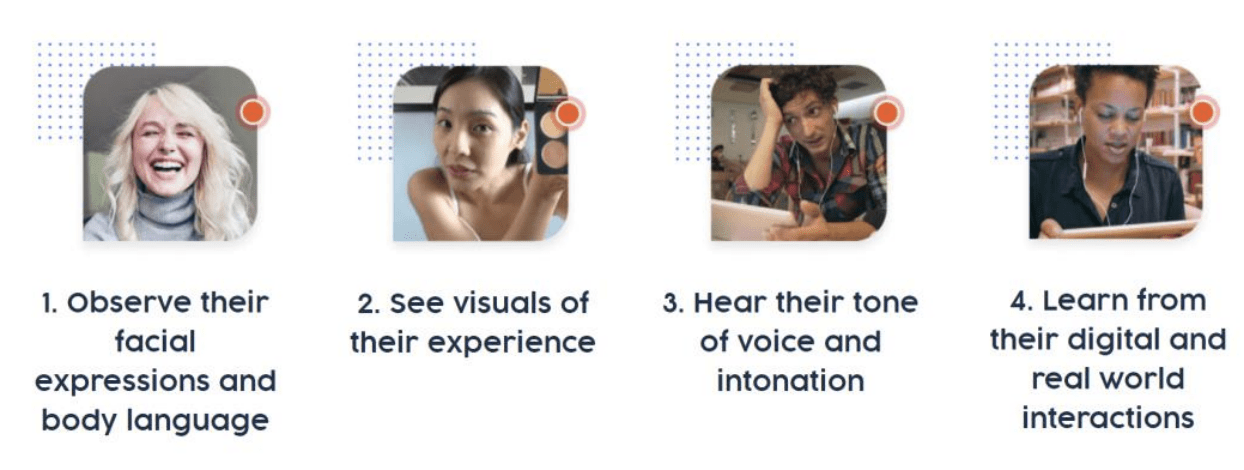

The power of the UserTesting Human Insight Platform is the ability to capture and analyse Customer Experience Narratives (CxNs):

CxNs are digitally recorded video narratives from targeted, opt-in audiences from our unique UserTesting Contributor Network or an organisation’s own network. These video-based recordings capture the perspectives and experiences of these audiences in narrative form. Our technology enables our contributors or customers of an organisation to record their screen or actions on camera as they consider and engage with products, designs, processes, concepts, or brands. As a result, we capture a broad array of human signals needed to truly understand a human experience, including: intonation and tone of voice, facial expressions, body language, visuals, and actions (both digital and real world), all overlaid with a person’s thoughts spoken out loud as they go through an experience.

Company Presentation

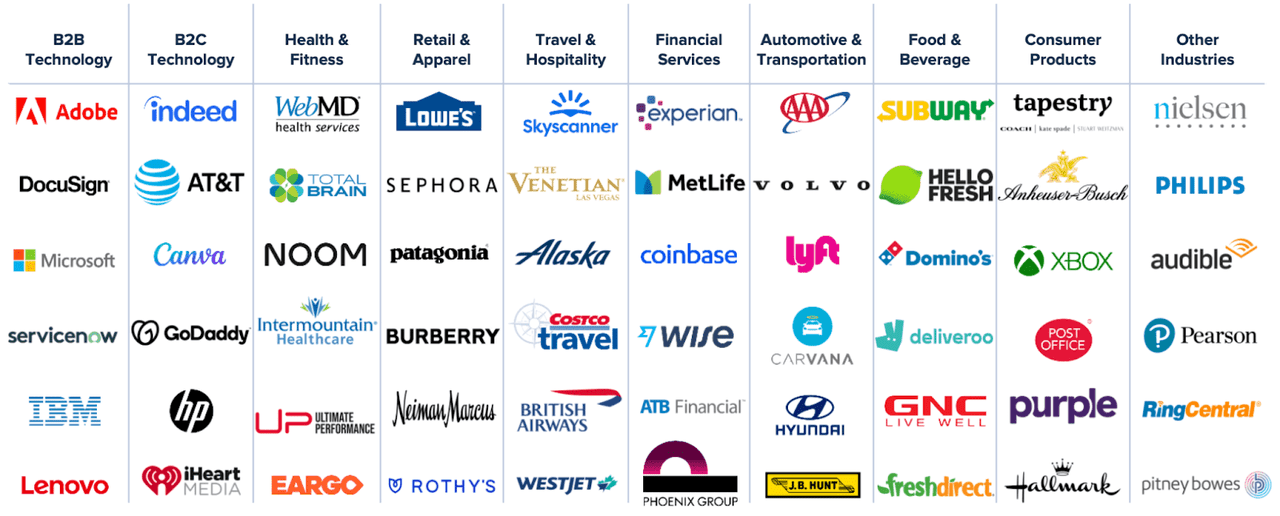

This rich and immersive format gives businesses a bird’s eye view of their clients’ reactions to the products and services they have developed and provided. USER had over 2,300 clients as of December 31, 2021, including more than half of the top 100 most valuable companies in the world, according to Forbes, and more than 300 significant customers with at least $100,000 in annual recurring revenue (ARR).

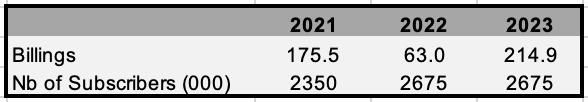

FactSet, Analyst Est

It is important to contextualize the role in which USER plays within organizations. Much is priced in due to the sentiment around cost cutting from companies and the consolidation in software platforms used for BAU. This has been the bear case against USER since the IPO and has caused the subsequent drop in share price.

Yes, I mean, we co-exist often with some type of tool for doing quantitative analysis, kind of a survey type tool. We often coexist with some kind of analytics or measurement tool, so folks want to know what people are clicking on and their apps and things like that. Those are often even used by different teams in an organization. Our tool is primarily used by a design research team, a UX research team, to really get feedback on how people interact with a UI that might not even be in production. We see a lot of prototype testing on our platform. Again, what you’re just not going to be able to do with production analytics, or, for example, you can’t survey your customer base about a UI they’ve never seen before. We don’t see a lot of displacement risks from a consolidation standpoint. I think for us, it’s really just around companies continuing to invest in those teams that are supporting the UX research efforts that are going on in their product organizations

Andy MacMillan, CEO, Q2 Earnings Call.

Company Presentation

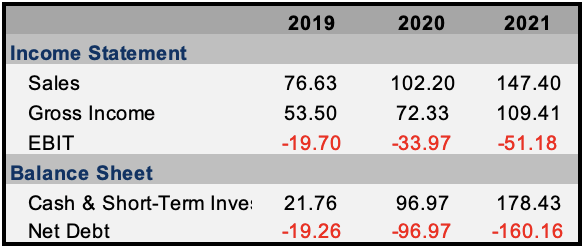

Financial Breakdown

When one looks at the income sheet, it’s easy to get the impression that USER is just another technology firm that’s losing money. Despite the fact that this is true, it does not represent the opportunity that is currently available. Consequently, the company’s profitability will inevitably be constrained in the short term, but this stage of the business’s development will pave the way for expansion in the longer run. The balance sheet for USER is solid, exhibiting a substantial negative net debt position well in advance of the initial public offering. This affords the management team the flexibility to restructure and adjust their strategy in response to the macro environment as they deem appropriate.

Company Report

On a relative basis USER’s 73.8% drop in price since the IPO has brought the valuation down to earth as such. This however has to be effectively judged as to whether there is much more room to continually grow given USER’s market penetration. As is evident with the growth in Gross Margin, the profitability can be achieved within a few years as forecast by management. This comes on the back of significant restructuring to facilitate the macro environment.

CEO Andy MacMillan when asked if the slowdown in sales guidance is due to a reduction in ARPU or slowdown in the small business segment:

I would say as far as ARPU versus customer acquisition, I think it’s less driven by an ARPU issue. What we mentioned on the call is that I think the SMB segment—and one of the unique things about our business is, we sell in every segment, we sell to really, really small companies, all the way to the biggest enterprises in the world. I think is typically true of economic cycles. It’s a lot more dynamic at the lower end of the market with smaller companies who might restrict spending as a matter of life and death for their company to survive. I think in that segment, SMB, kind of small business in particular, we think there will be tougher logo acquisition for acquisition of all kinds of software products, and so that’s why we reduced our investment in that team as part of our restructuring. That’s where we see the bigger impact as opposed to kind of a degradation of our ARPU.

Andy MacMillan, CEO, Q2 Earnings call.

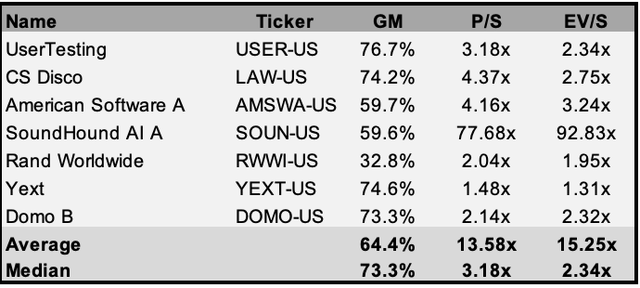

USER boasts an EV/Sales and P/S ratio equal to the median valuation of its chosen peer group. Given the depressed levels of the stock and the negative sentiment that is priced in, the short term distribution is skewed to the upside.

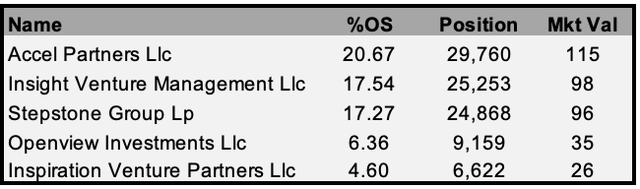

Ownership

The ownership structure of USER, in my view, presents the largest risk. This is due to the nature of the institutional investors who own the shares. As seen below, ~65% of the outstanding shares that were issued in the IPO are held by Venture Capital firms. The significant risk that can facilitate another leg down in the stock price is the sell down of any of the below positions. This can occur due to the realized gains owing to the IPO.

Final Thoughts

USER is a good example of a well-built company that has developed software that is essential for businesses to use in order to carry out user testing. This software has been adopted by some of the largest companies in the world, notwithstanding the fact that the company is unable to post a profit. In order to ensure that the allocation of USER into a portfolio is done in an effective manner, it is essential to construct a risk return model while also maintaining reasonable expectations regarding the macro environment. In light of the information presented and the way things are currently standing, USER does not strike me as an attractive investment opportunity when set alongside other possibilities.

Be the first to comment