Florent Molinier

One of the biggest problems facing many people in America today is the incredibly high rate of inflation. This has gotten to the point that many people have been forced to take on second jobs or look for extra sources of income in order to keep themselves fed and the bills paid. Fortunately, as investors, we have other methods that we can use to increase our incomes. One of these methods is to purchase shares of a closed-end fund that specializes in the generation of income. These funds provide investors with an easy way to gain access to a professionally managed portfolio of assets that can, in most cases, pay out a higher yield than pretty much anything else in the market.

In this article, we will discuss the Eaton Vance Tax-Managed Global Diversified Equity Income Fund (NYSE:EXG), which is one closed-end fund (“CEF”) that investors can use for this purpose. As of the time of writing, the fund boasts an impressive 8.48% distribution yield, which is certainly enough to turn most peoples’ heads. I have written about this fund before, but a year has passed since that time, so many things have changed. This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund’s finances as we attempt to determine if it could be a reasonable purchase today.

About The Fund

According to the fund’s webpage, the Eaton Vance Tax-Managed Global Diversified Equity Income Fund has the stated objective of providing investors with a high level of current income and gains. The fund has a secondary objective of earning long-term capital appreciation. This is somewhat unusual for an equity fund as many of them focus on total return. After all, equities are a total return instrument since we seek to both earn income through dividends as well as benefit from capital gains. This fund does deliver a total return to a point since it does have a secondary objective of capital appreciation but we do not, in general, typically think of equities as an income vehicle.

The fund’s strategy does convert them somewhat to that purpose, however. As the name of the fund implies, the Eaton Vance Tax-Managed Global Diversified Equity Income Fund invests its assets into a portfolio of common equities from both domestic and foreign issuers, attempting to emphasize dividend-paying stocks. The fund then writes call options on both domestic and foreign indices in order to generate premium income. This is very similar to the strategy used by many other Eaton Vance funds, although this one does not mention anything about being an option-income fund in its official name.

The fact that this is an option-income fund may be concerning to some investors because of the fact that many of us have heard about the risks inherent in options strategies. Naturally, though, some strategies are safer than others. The real risk lies in writing naked call options, which is when the investor sells an option against some asset that he does not own. This can cause potentially unlimited losses since the investor will have to buy the asset at any price if the option is exercised. That is, unfortunately, what this fund is doing. As just stated, the fund is writing options against domestic and foreign indices but it does not actually own the option. The fund’s management does try to construct a portfolio that should somewhat resemble the performance of the index, but there is no guarantee that it will be successful. Thus, this strategy could be somewhat risky for the fund and by extension for its investors. The fund does attempt to repurchase the options when the losses get too large but once again, there is no guarantee of success at this. Therefore, we might be exposed to greater risk than most potential purchasers realize.

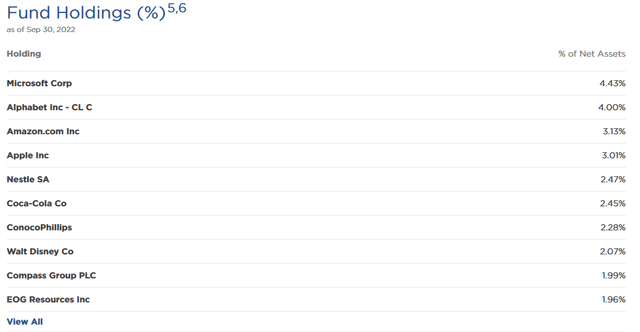

The largest positions in the fund look quite similar to most other Eaton Vance Funds, although there are a few differences. Here they are:

A few of these are companies that would not ordinarily be found in income-focused funds. For example, Alphabet (GOOG, GOOGL) and Amazon (AMZN) are interesting picks because they pay no dividends. In addition, Microsoft (MSFT) and Apple (AAPL) pay such a low yield that they may as well be non-dividend stocks. The high weightings of these stocks thus might be a drag on the fund’s income since it could dump them and replace them with just about any other dividend-payer and increase its income.

With that said, though, these companies did deliver very strong capital gains over most of the past decade, so they probably helped the fund maintain sufficient performance to satisfy investors. Unfortunately, things have changed in the past year, as all four of these stocks have underperformed the market by quite a lot:

|

Company |

YTD Return |

|

Microsoft |

-24.89 |

|

Alphabet |

-33.32% |

|

Amazon |

-40.85% |

|

Apple |

-16.69% |

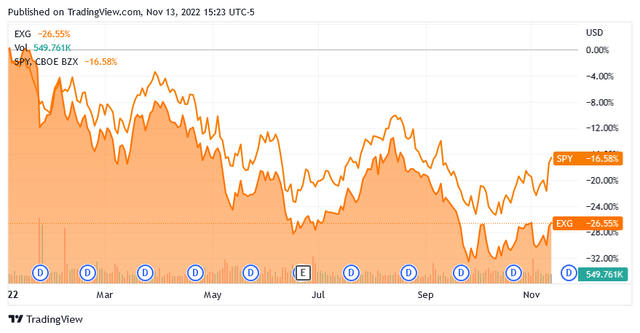

In comparison, the S&P 500 index (SPY) is only down 16.58% over the same period. The high weightings here may be one reason why the fund is underperforming the market year-to-date:

These four technology stocks, Nestle (OTCPK:NSRGY), and Walt Disney Co. (DIS) are the only stocks that were among the fund’s largest positions over the past year. Since we last looked at the fund, Meta Platforms (META), Bank of New York Mellon (BK), adidas (OTCQX:ADDYY), and ASML Holding (ASML) were replaced by Coca-Cola (KO), ConocoPhillips (COP), Compass Group (OTCPK:CMPGF), and EOG Resources (EOG). I cannot say that these were bad changes. In particular, the two energy companies are quite nice to see, as energy is the only sector of the S&P 500 that is up year-to-date as of the time of writing. That is certainly a better performance than several of the replaced companies managed to deliver over the same time period!

The fact that quite a few of the largest positions have changed significantly over the past year may lead one to expect that the Eaton Vance Tax-Managed Global Diversified Equity Income Fund has a fairly high turnover. This could be concerning, since a high turnover creates a drag on the performance of a fund. This is because it costs money to trade stocks or other assets, which are paid by the investors in a fund. Thus, management must generate sufficient returns to both cover these extra expenses and still deliver the returns that investors expect, which is a tall order that few fund managers are able to achieve on a consistent basis.

This is one of the reasons why index funds have become so popular as they tend to do minimal trading and have very low expenses. This does not necessarily mean that a fund with a high turnover will underperform but it does make things more difficult for management. Interestingly, though, the Eaton Vance Tax-Managed Global Diversified Equity Income Fund does not have a particularly high turnover rate despite the significant changes that we have seen in the fund’s holdings over the past year. In fact, it only has a 44.00% annual turnover, which is quite low for a closed-end equity fund.

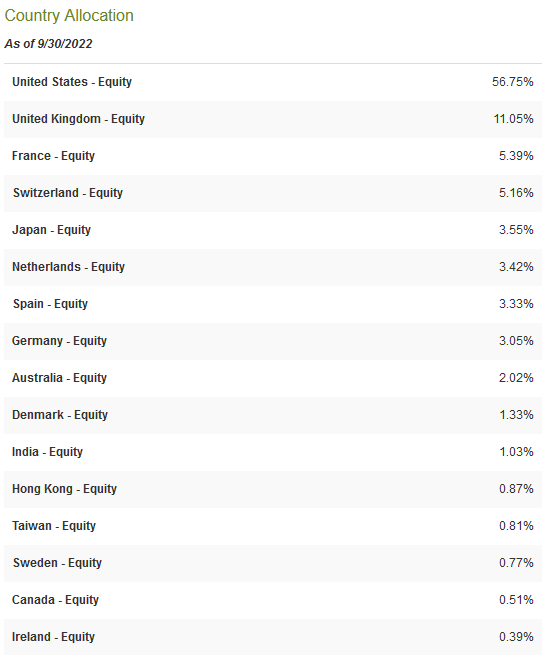

The name and the description of the fund both suggest that it purchases both American and foreign stocks. However, only two of the companies on the largest positions list are foreign firms. This may lead one to believe that the fund is primarily an American equity fund that just holds a few foreign stocks as an afterthought. A look at the rest of the portfolio reveals a different story, however. In fact, only 56.75% of the fund is invested in American companies:

CEF Connect

This is a somewhat more internationally diversified portfolio than what some other global equity funds possess. In particular, many global funds have a 60% to 70% weighting towards the United States. However, the United States only accounts for a bit less than 25% of the global gross domestic product so the fund is still overweighted to that country given its actual representation in the global economy. As such, it may be a good idea to have some money invested in an international fund to achieve international diversification across your portfolio.

The reason that international diversification is important is because of the protection that it provides us against regime risk. Regime risk is the risk that some government or other authority will take some action that proves to have an adverse impact on a company that we are invested in. We saw a great example of that back in 2021 when the incoming Biden Administration unilaterally canceled the permits for the construction of the Keystone XL pipeline and caused all the money invested by TC Energy (TRP) into the project to be wasted. The only way to protect ourselves against this risk is to ensure that only a relatively small percentage of our portfolios is exposed to any given country. This fund does that to a certain extent but as already stated, it is important to invest some money into an international fund to increase foreign exposure and achieve true diversification.

Distribution Analysis

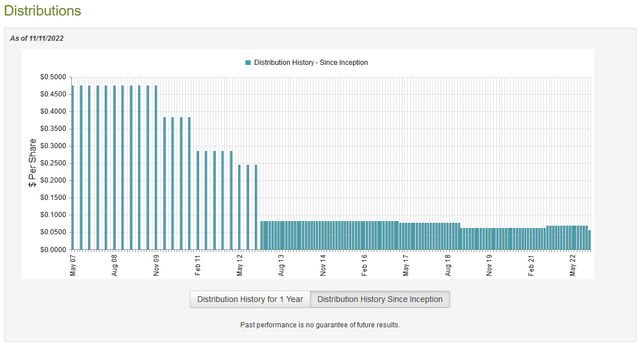

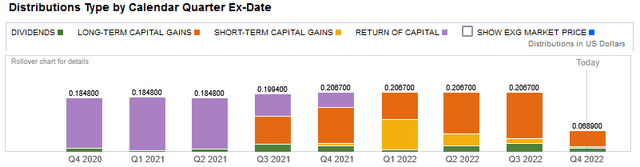

As stated earlier in the article, the primary objective of the Eaton Vance Tax-Managed Global Diversified Equity Income Fund is to provide its investors with a high level of current income and gains. As such, we might expect that the fund boasts a fairly high distribution yield. This is indeed the case as it currently pays a monthly distribution of $0.0553 per share ($0.6636 per share annually), which gives it an 8.48% yield at the current price. The fund has not been incredibly consistent about this distribution over its history and in fact, it cut it for the most recent month:

This cut is certainly not something that we like to see, particularly as the fund’s track record has generally pointed to declining payouts over the years. The reason for the latest cut was probably the poor performance of the market year-to-date, particularly the large technology stocks. Regardless of the reason, it is unlikely to appeal to those investors that are seeking a safe and secure income to use to pay their bills. Another thing that may be concerning is that throughout 2021, nearly all the fund’s distributions were considered to be a return of capital. However, all the distributions this year have been either realized gains or dividend income:

The return of capital distributions may be concerning to more conservative investors because this can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. However, there are other things that can cause a distribution to be classified as a return of capital, such as the distribution of unrealized capital gains or money received from certain options strategies. These are both things that this fund may be doing. As such, it is important that we investigate exactly how the fund is financing its distributions in order to determine how sustainable they are likely to be.

Unfortunately, we do not have a particularly recent report to consult for this purpose. The fund’s most recent financial report corresponds to the six-month period ending April 30, 2022. As such, it will not give us any real insight into how well the fund performed over the past half-year, which was a period of time that saw a number of interest rate hikes and generally declining markets. It may give us some insight into how the fund was financing the return of capital distributions last year, though.

During the six-month period, the Eaton Vance Tax-Managed Global Diversified Equity Income Fund received $25,969,751 in dividends and $121 in securities lending income from the investments in its portfolio. This gives the fund a total income of $25,969,872 during the six-month period. It paid its expenses out of this amount, leaving it with $9,985,879 available for investors. This was nowhere close to enough to cover the $126,109,784 that it actually paid out during the period.

This is certainly concerning, but the fund does have other ways to obtain the money that it needs to cover its distribution. One of these ways is through capital gains. Unfortunately, it failed miserably at this, as it had net realized capital gains of $170,759,570, but this was offset by $509,169,486 net unrealized losses. After accounting for all inflows and outflows, the fund’s assets declined by $444,032,757 during the period. This clearly indicates that the fund failed to cover its distribution, which may be one of the reasons why it just cut the distribution. With that said, it did have enough income and net realized gains to cover the payout, but this is something that we want to keep an eye on since the more that the fund loses, the harder it will be for it to generate the gains needed to cover the payout.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Eaton Vance Tax-Managed Global Diversified Equity Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of the fund’s assets minus any outstanding debt. It is, therefore, the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the fund’s net asset value. This is because such a scenario implies that we are obtaining the fund’s assets for less than they are actually worth. This is, fortunately, the case with this fund. As of November 11, 2022 (the most recent date for which data is currently available), the Eaton Vance Tax-Managed Global Diversified Equity Income Fund had a net asset value of $8.21 per share. However, the fund’s shares currently trade for $7.83 per share. This gives the fund a discount of 4.63% at the current price. This is a much larger discount than the 0.13% one that the fund has averaged over the past month so the current price appears to be quite reasonable.

Conclusion

In conclusion, the Eaton Vance Tax-Managed Global Diversified Equity Income Fund has long been a fairly popular play among income investors. Unfortunately, it has an outsized position to a handful of low-yielding and underperforming technology companies that has proven to be a significant drag on its performance over the past several months. However, apart from that, the fund does appear to have a reasonably diversified portfolio for a global fund, although it could be better.

The biggest problem here is that EXG has insufficient income to cover its distribution now that the market has turned, and so it was forced to cut the distribution. This could easily be resolved by putting money into sectors that have reasonably good performance and yields such as energy and healthcare. Fortunately, the price is very reasonable right now but I would not buy EXG until it resolves its issues with its portfolio.

Be the first to comment